- Japan

- /

- Construction

- /

- TSE:3443

Top Asian Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by trade uncertainties and economic fluctuations, Asian indices have shown resilience, with China's stimulus expectations and Japan's trade negotiations offering some optimism amidst broader challenges. In this environment, dividend stocks in Asia present an appealing opportunity for investors seeking steady income streams; these stocks often demonstrate stability and potential for growth even during volatile market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.83% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.38% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.05% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.03% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.81% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.55% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.60% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.05% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.44% | ★★★★★★ |

Click here to see the full list of 1207 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Able Engineering Holdings (SEHK:1627)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Able Engineering Holdings Limited is an investment holding company that operates a building construction business in Hong Kong with a market cap of HK$1.16 billion.

Operations: Able Engineering Holdings Limited generates revenue from its building construction business in Hong Kong, amounting to HK$6.43 billion.

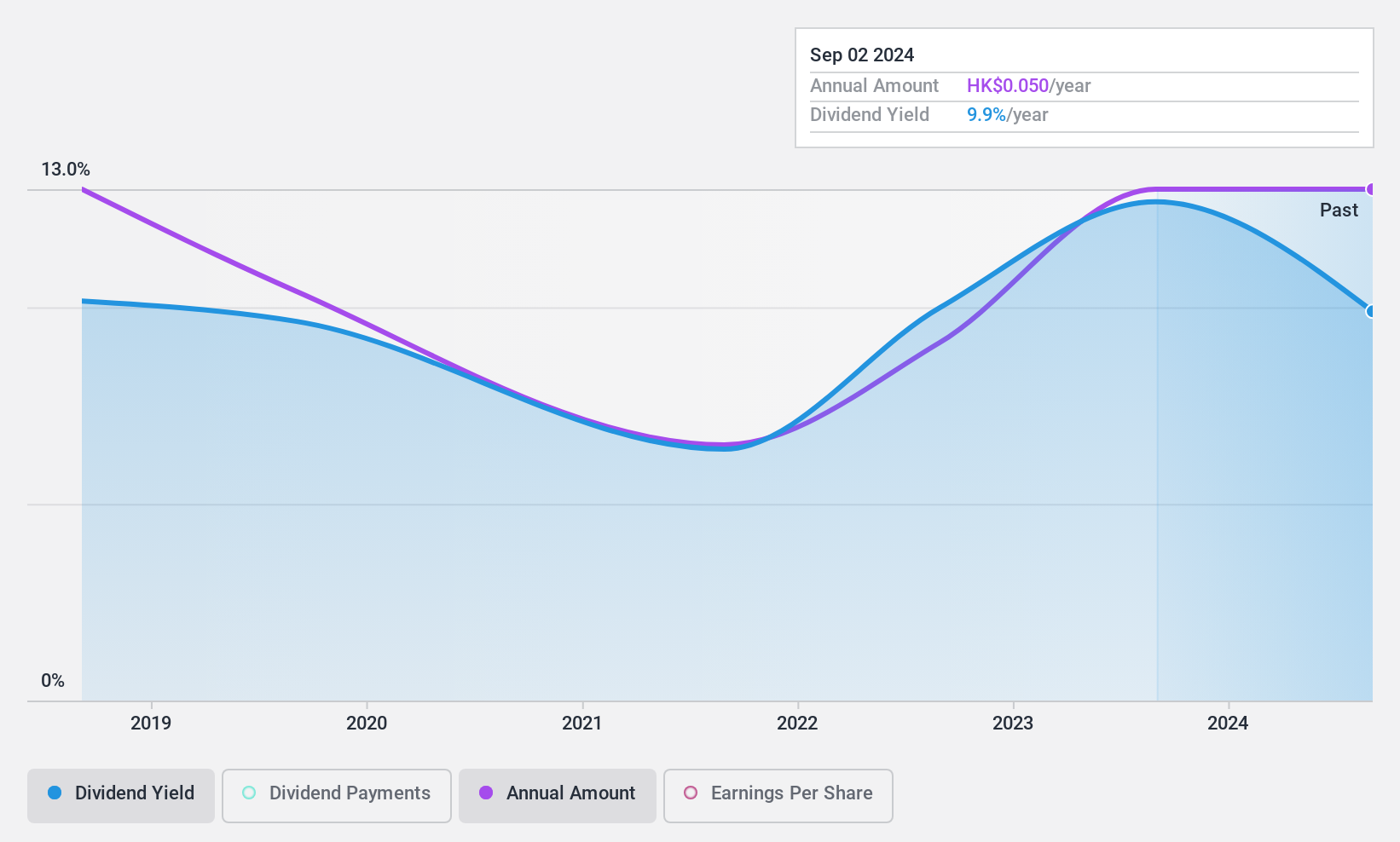

Dividend Yield: 8.6%

Able Engineering Holdings offers a dividend yield of 8.62%, ranking in the top 25% of Hong Kong's dividend payers. Despite this, its dividends have been unstable over the past seven years, with volatility and no growth in payments. The dividends are well-covered by earnings and cash flows, with payout ratios at 41.2% and 14.2%, respectively. Recently, Mr. Lau Chi Fai Daniel resigned as executive director to focus on group operations but remains involved with subsidiaries.

- Delve into the full analysis dividend report here for a deeper understanding of Able Engineering Holdings.

- The analysis detailed in our Able Engineering Holdings valuation report hints at an deflated share price compared to its estimated value.

Shanghai Foreign Service Holding Group (SHSE:600662)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanghai Foreign Service Holding Group Co., Ltd. operates as a comprehensive human resources service provider, with a market cap of approximately CN¥13.29 billion.

Operations: Shanghai Foreign Service Holding Group Co., Ltd. generates its revenue primarily from comprehensive human resources services.

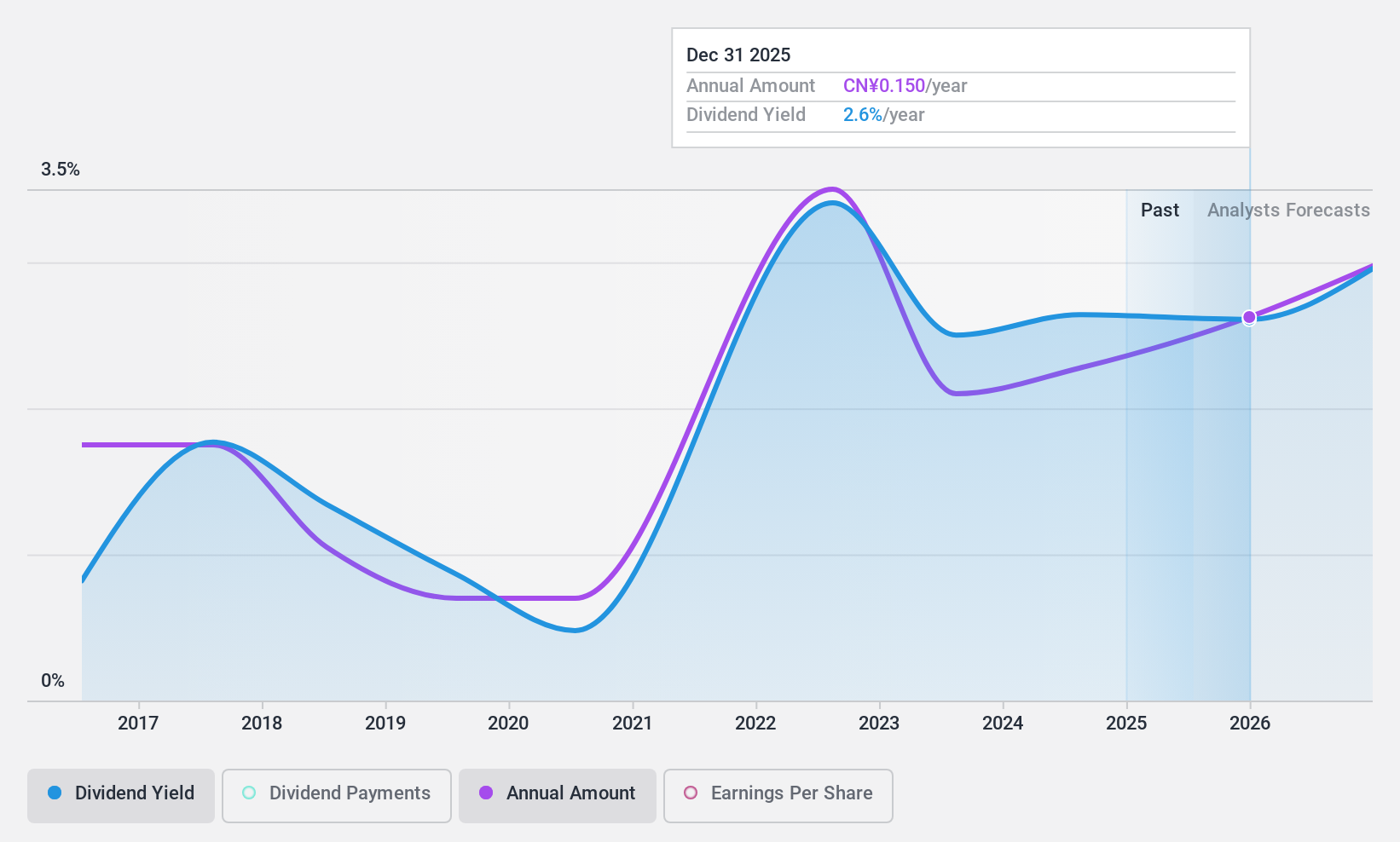

Dividend Yield: 4.1%

Shanghai Foreign Service Holding Group is trading at a significant discount, 32.8% below its estimated fair value, offering an appealing entry point for dividend investors. The company provides a competitive dividend yield of 4.12%, among the top 25% in China, supported by sustainable payout ratios of 50.1% from earnings and 48.1% from cash flows. However, its dividend history has been marked by volatility over the past decade despite recent growth in earnings and revenue performance improvements.

- Navigate through the intricacies of Shanghai Foreign Service Holding Group with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Shanghai Foreign Service Holding Group is trading behind its estimated value.

Kawada Technologies (TSE:3443)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kawada Technologies, Inc. operates in Japan's steel, civil engineering, architecture, and IT service sectors with a market cap of ¥52.63 billion.

Operations: Kawada Technologies, Inc. generates revenue primarily from its Steel Structure segment at ¥63.75 billion, followed by Civil Engineering at ¥40.25 billion, Architecture at ¥13.70 billion, and Solution Shon services at ¥7.83 billion.

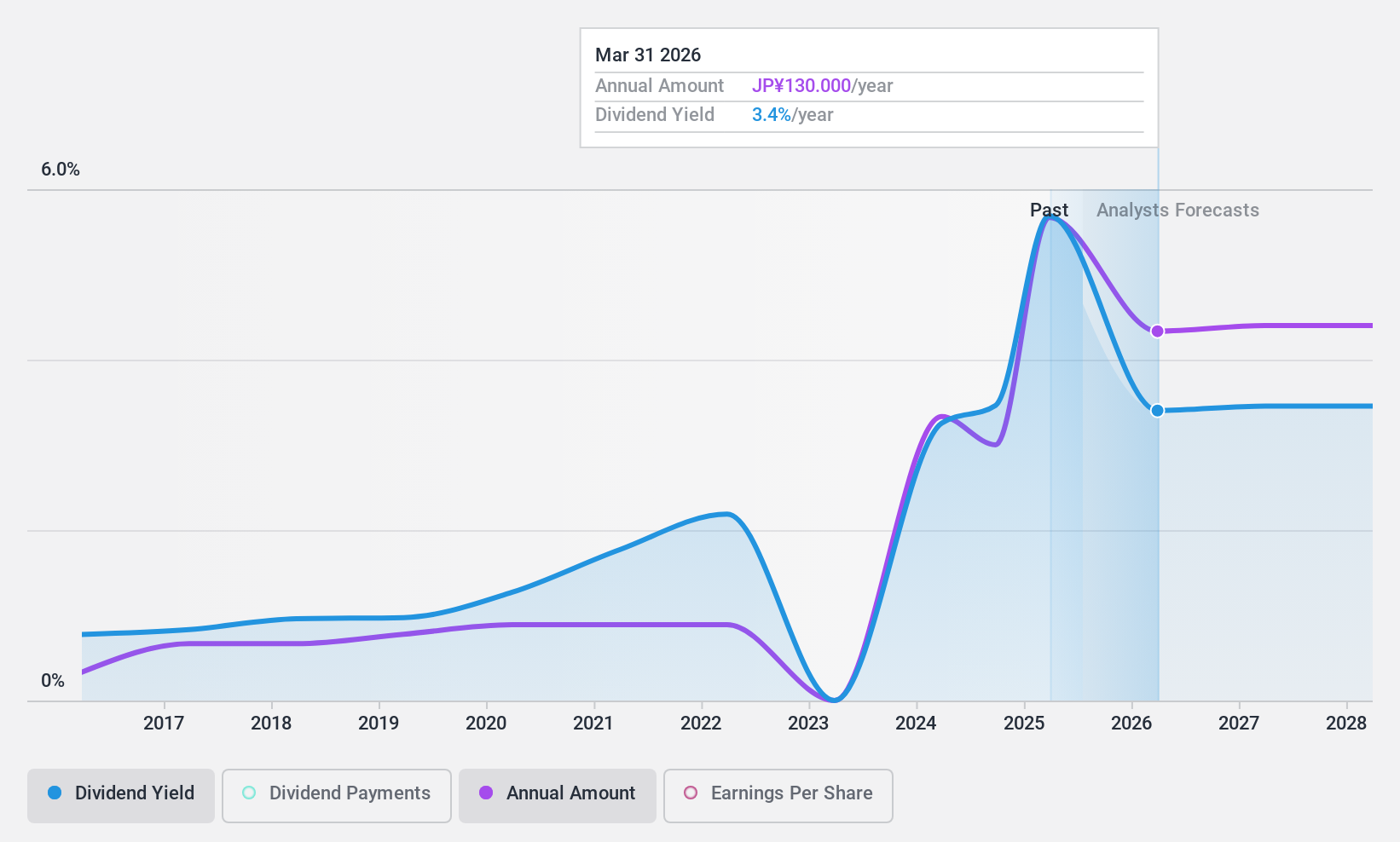

Dividend Yield: 5.5%

Kawada Technologies offers a dividend yield of 5.46%, ranking in Japan's top 25% of payers, but its dividends have been volatile over the past decade. Despite a low payout ratio of 26.2%, dividends are not covered by free cash flow, raising sustainability concerns. The company revised its dividend to ¥85 per share from ¥393, introducing an interim dividend for better shareholder profit distribution. It trades at good value compared to peers and industry standards.

- Click here to discover the nuances of Kawada Technologies with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Kawada Technologies' current price could be quite moderate.

Next Steps

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1204 more companies for you to explore.Click here to unveil our expertly curated list of 1207 Top Asian Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kawada Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3443

Kawada Technologies

Engages in the steel, civil engineering, architecture, and IT service sectors in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives