- Japan

- /

- Professional Services

- /

- TSE:2124

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets continue to experience gains, with indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, investors are closely monitoring the impact of geopolitical developments and economic policy changes. Amidst this backdrop of robust market performance and potential tariff concerns, dividend stocks remain an attractive option for those seeking steady income streams. A good dividend stock typically offers a reliable payout history and resilience in uncertain times, aligning well with current market dynamics.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

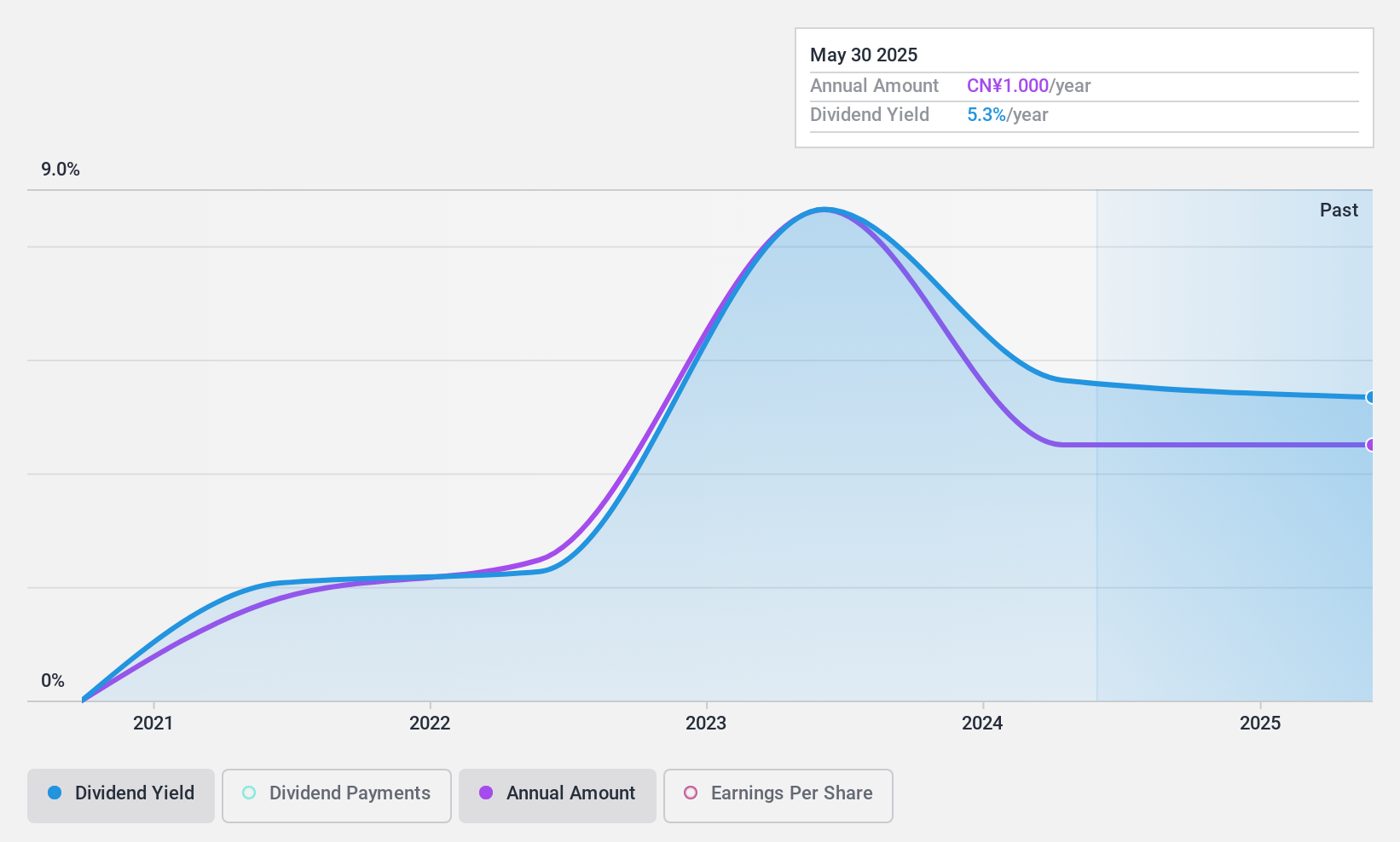

Zhejiang Jianye Chemical (SHSE:603948)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jianye Chemical Co., Ltd. is involved in the research, development, production, and sales of fine chemical products in China, with a market cap of CN¥3.16 billion.

Operations: Zhejiang Jianye Chemical Co., Ltd. generates its revenue from the research, development, production, and sales of fine chemical products in China.

Dividend Yield: 5.1%

Zhejiang Jianye Chemical's dividend payments are well-supported by both earnings and cash flows, with payout ratios of 66% and 48.5%, respectively. Despite a top-tier dividend yield of 5.14%, the company's short four-year history of paying dividends has been marked by volatility and unreliability, including annual drops exceeding 20%. Recent earnings show a decline in net income to CNY166.31 million from CNY240.05 million, potentially impacting future dividend stability.

- Click to explore a detailed breakdown of our findings in Zhejiang Jianye Chemical's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Zhejiang Jianye Chemical shares in the market.

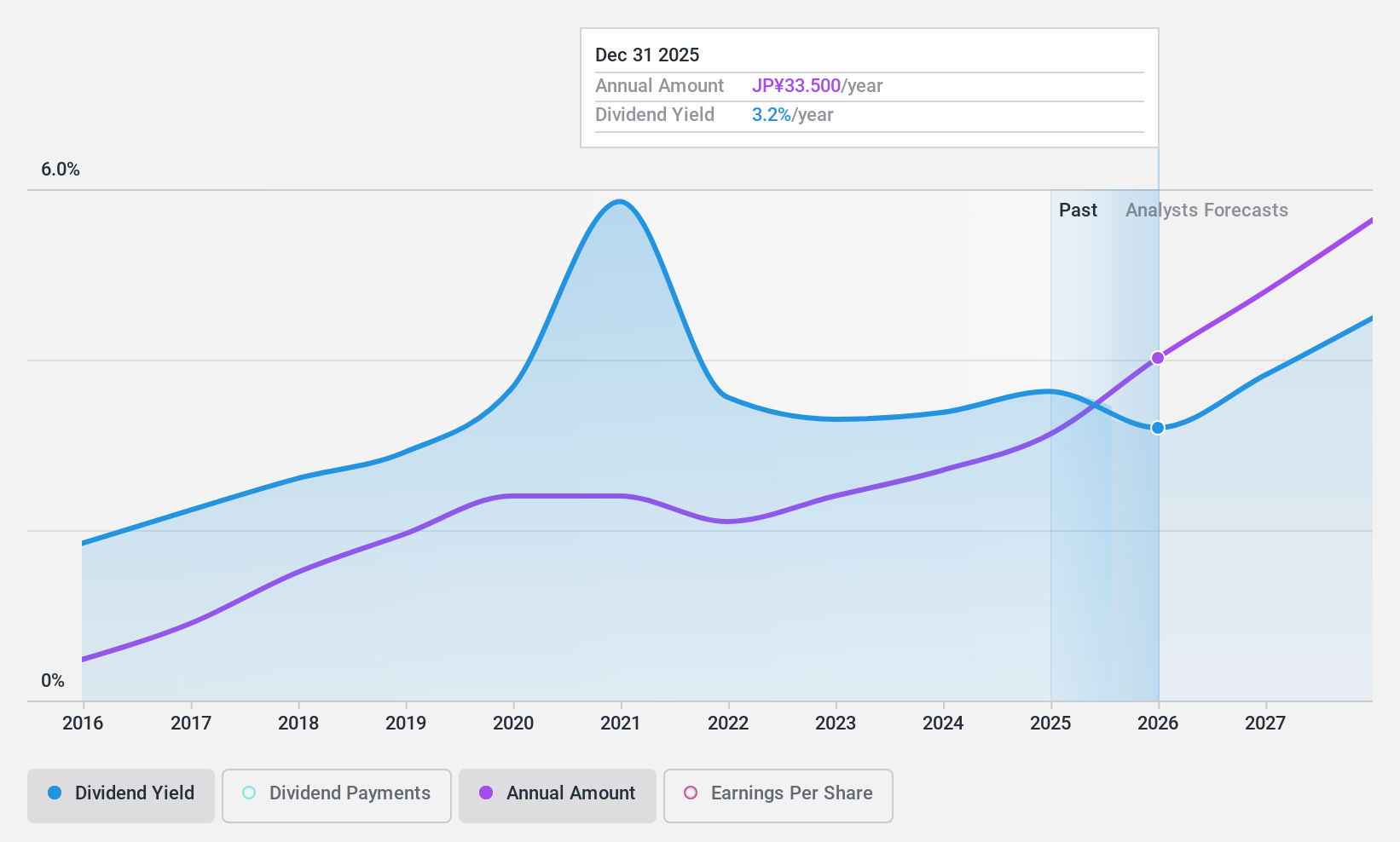

JAC Recruitment (TSE:2124)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JAC Recruitment Co., Ltd. operates as a recruitment consultancy business in Japan with a market cap of ¥113.22 billion.

Operations: JAC Recruitment Co., Ltd. generates its revenue primarily from the Domestic Recruitment Business at ¥33.46 billion and the Overseas Business at ¥3.74 billion, with an additional contribution from the Domestic Job Offer Advertising Business amounting to ¥390 million.

Dividend Yield: 3.6%

JAC Recruitment's dividend yield of 3.63% is slightly below the top 25% in Japan but remains attractive due to its stability and growth over the past decade. The dividend is well-supported by earnings and cash flows, with payout ratios of 60.7% and 61.5%, respectively, indicating sustainability. Additionally, the company recently completed a share buyback worth ¥1.49 billion, which may enhance shareholder value by reducing share count and potentially increasing future dividends per share.

- Click here and access our complete dividend analysis report to understand the dynamics of JAC Recruitment.

- According our valuation report, there's an indication that JAC Recruitment's share price might be on the cheaper side.

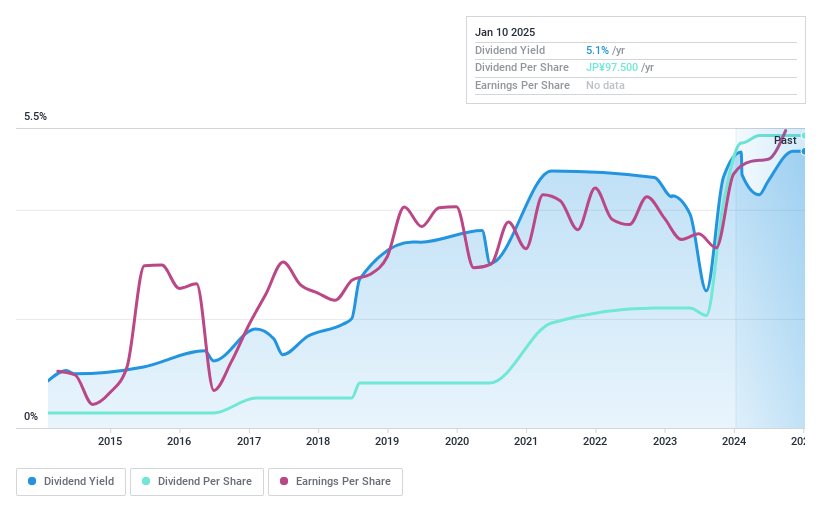

Miyaji Engineering GroupInc (TSE:3431)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Miyaji Engineering Group Inc., with a market cap of ¥51.05 billion, operates through its subsidiaries in the construction and civil engineering sectors in Japan.

Operations: Miyaji Engineering Group Inc. generates revenue from its segments MEC and MMB, with ¥42.46 billion and ¥32.21 billion respectively.

Dividend Yield: 5.1%

Miyaji Engineering Group's dividend yield of 5.06% is among the top 25% in Japan, yet its sustainability is questionable due to lack of free cash flow coverage and high non-cash earnings. Despite a reasonable payout ratio of 53.8%, dividends have been volatile over the past decade, with a recent decrease from ¥150 to ¥85 per share for Q2 2025. Earnings growth remains strong at 64.4%, providing some support for payouts.

- Dive into the specifics of Miyaji Engineering GroupInc here with our thorough dividend report.

- Upon reviewing our latest valuation report, Miyaji Engineering GroupInc's share price might be too optimistic.

Taking Advantage

- Navigate through the entire inventory of 1948 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2124

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives