- Japan

- /

- Trade Distributors

- /

- TSE:3176

Three Undiscovered Gems for Savvy Investors

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a downturn, with smaller-cap indexes facing significant challenges as cautious Federal Reserve commentary and political uncertainties weigh on investor sentiment. Despite these headwinds, the U.S. economy has shown resilience with stronger-than-expected growth and retail sales figures, offering a mixed backdrop for investors seeking opportunities in less-explored stocks. In such an environment, identifying promising stocks often involves looking beyond immediate market fluctuations to find companies with strong fundamentals and growth potential that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

MEISEI INDUSTRIALLtd (TSE:1976)

Simply Wall St Value Rating: ★★★★★★

Overview: MEISEI INDUSTRIAL Co., Ltd. is a construction works company with operations in Japan and internationally, holding a market capitalization of ¥69.53 billion.

Operations: MEISEI INDUSTRIAL generates revenue primarily from its Construction Work segment, which accounts for ¥58.38 billion, and its Boiler Business segment, contributing ¥7.35 billion. The company has a market capitalization of ¥69.53 billion and operates both domestically in Japan and internationally.

MEISEI INDUSTRIAL, a company with a market presence that might not be on everyone's radar, has been making notable strides. Over the past year, its earnings surged by 45%, outpacing the Construction industry's growth of 21%. The firm boasts a price-to-earnings ratio of 10x, undercutting the JP market average of 13.4x. Recently, it repurchased approximately 1.27 million shares for ¥1.65 billion to enhance capital efficiency and shareholder returns. For the half-year ending September 2024, sales climbed to ¥31.58 billion from ¥26.58 billion last year, while net income rose to ¥2.94 billion from ¥2.23 billion previously.

Sanyo Trading (TSE:3176)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sanyo Trading Co., Ltd. operates in the rubber, chemical, green technology, industrial products, and life science sectors both in Japan and internationally through its subsidiaries, with a market capitalization of ¥45.93 billion.

Operations: Sanyo Trading's primary revenue streams include Mechanical Materials and Chemical Products, generating ¥54.19 billion and ¥46.67 billion, respectively. The Overseas Subsidiary segment also contributes significantly with ¥37.30 billion in revenue.

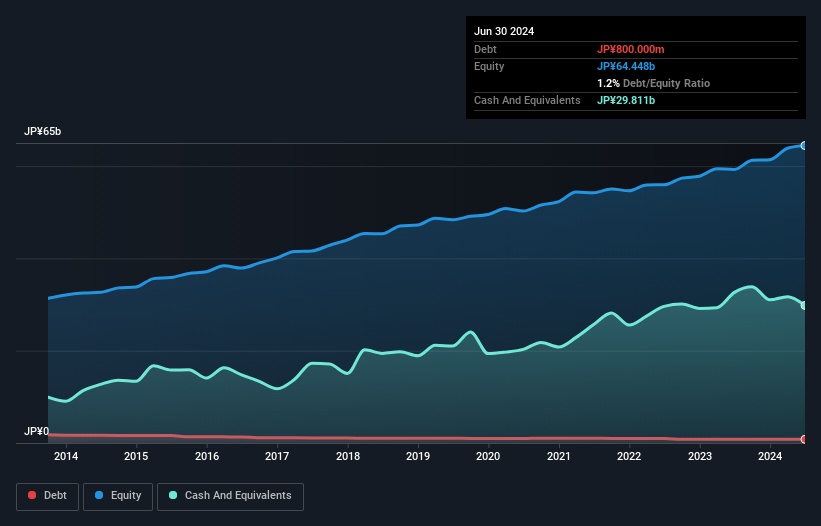

Sanyo Trading, a nimble player in the Trade Distributors sector, shows promise with its earnings growth of 7.8% over the past year, outpacing the industry average of 0.8%. The company is trading at a substantial discount, valued at 59.1% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. Despite an increase in its debt to equity ratio from 4.5 to 9.4 over five years, Sanyo maintains more cash than total debt and covers interest payments comfortably. With earnings forecasted to grow at 6.88% annually, it positions itself well for future expansion within its industry space.

- Take a closer look at Sanyo Trading's potential here in our health report.

Explore historical data to track Sanyo Trading's performance over time in our Past section.

Cresco (TSE:4674)

Simply Wall St Value Rating: ★★★★★★

Overview: Cresco Ltd., along with its subsidiaries, provides information technology services and digital solutions in Japan, with a market cap of ¥51.07 billion.

Operations: Cresco Ltd. generates revenue primarily from its IT Service Business, with significant contributions from the Finance segment at ¥16.15 billion and the Enterprise segment at ¥21.15 billion. The Digital Solution Business adds ¥3.83 billion to the overall revenue stream, while the Manufacturing segment contributes ¥14.50 billion.

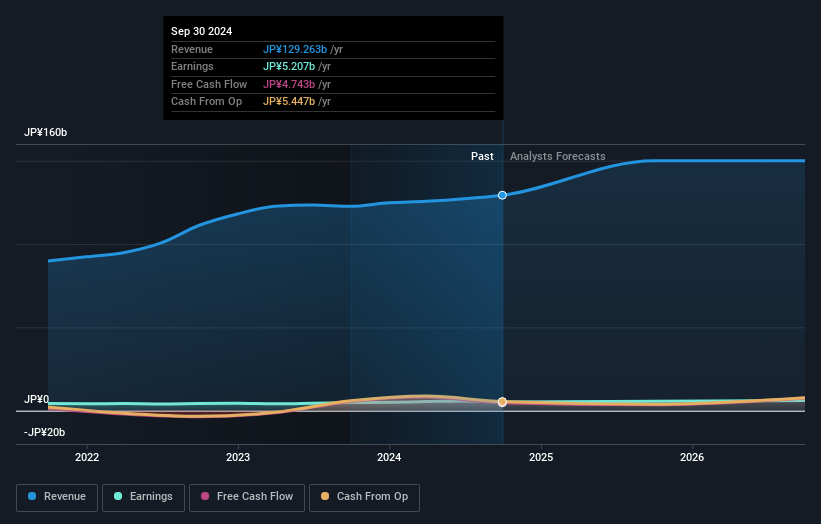

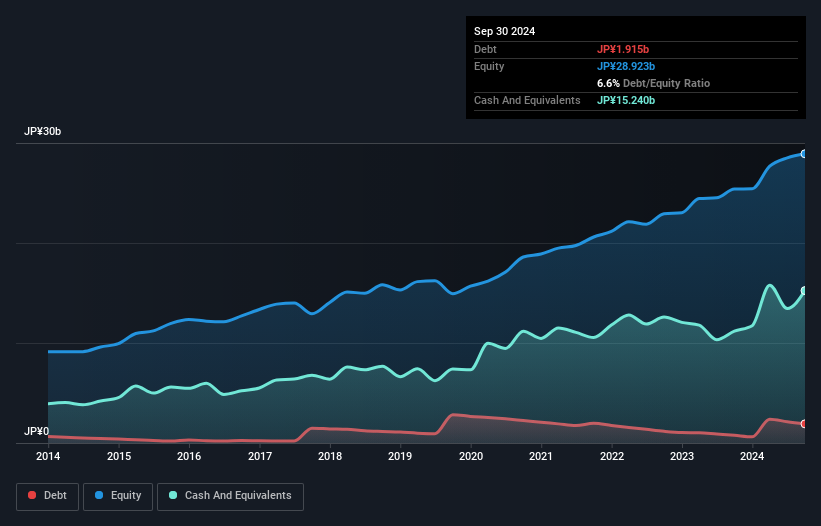

Cresco, a nimble player in its industry, has shown consistent earnings growth of 9.9% annually over the past five years. Despite not outpacing the broader Software industry's 12.7% growth last year, Cresco's financial health remains robust with a debt-to-equity ratio dropping from 19% to 6.6%. The company enjoys high-quality earnings and positive free cash flow, making it an attractive value proposition as it trades at nearly 59% below its estimated fair value. With more cash than total debt and strong interest coverage, Cresco seems well-positioned for future endeavors in the competitive landscape.

- Delve into the full analysis health report here for a deeper understanding of Cresco.

Understand Cresco's track record by examining our Past report.

Make It Happen

- Dive into all 4633 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3176

Sanyo Trading

Through its subsidiaries, engages in the rubber, chemical, green technology, industrial products, and life science businesses in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives