Nitto Boseki Co., Ltd. (TSE:3110) Stocks Pounded By 33% But Not Lagging Industry On Growth Or Pricing

Nitto Boseki Co., Ltd. (TSE:3110) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 26%, which is great even in a bull market.

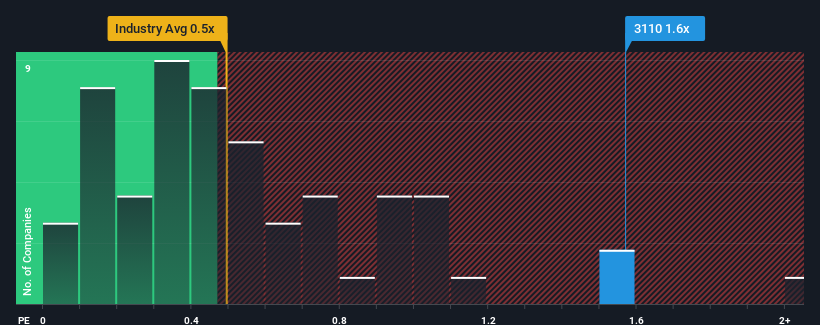

In spite of the heavy fall in price, when almost half of the companies in Japan's Building industry have price-to-sales ratios (or "P/S") below 0.5x, you may still consider Nitto Boseki as a stock probably not worth researching with its 1.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Nitto Boseki

What Does Nitto Boseki's Recent Performance Look Like?

Nitto Boseki certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Nitto Boseki will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Nitto Boseki's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The latest three year period has also seen a 24% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 9.0% during the coming year according to the nine analysts following the company. That's shaping up to be materially higher than the 5.2% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Nitto Boseki's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Despite the recent share price weakness, Nitto Boseki's P/S remains higher than most other companies in the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Nitto Boseki's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You always need to take note of risks, for example - Nitto Boseki has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Boseki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3110

Nitto Boseki

Engages in the manufacture, processing, and sale of textile products and textile-related industrial goods, rock wool and building materials, glass fiber products, and specialty chemicals and medical products in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives