- Japan

- /

- Industrials

- /

- TSE:3105

Take Care Before Diving Into The Deep End On Nisshinbo Holdings Inc. (TSE:3105)

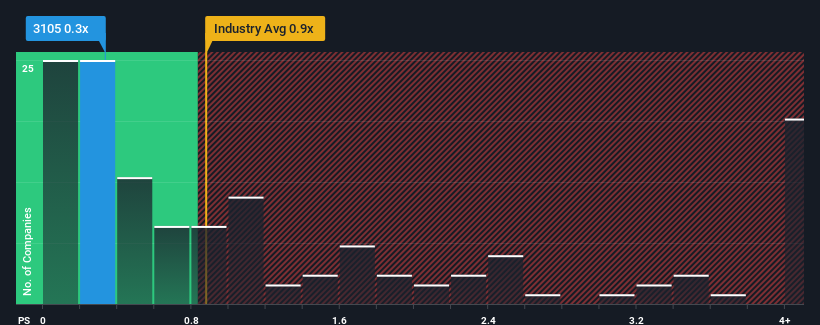

When close to half the companies operating in the Industrials industry in Japan have price-to-sales ratios (or "P/S") above 1.5x, you may consider Nisshinbo Holdings Inc. (TSE:3105) as an attractive investment with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Nisshinbo Holdings

How Has Nisshinbo Holdings Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Nisshinbo Holdings has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. Those who are bullish on Nisshinbo Holdings will be hoping that this isn't the case and the company continues to beat out the industry.

Keen to find out how analysts think Nisshinbo Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Nisshinbo Holdings would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 14% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 2.4% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 3.3% each year, which is not materially different.

With this in consideration, we find it intriguing that Nisshinbo Holdings' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Nisshinbo Holdings' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Nisshinbo Holdings that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nisshinbo Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3105

Nisshinbo Holdings

Operates wireless communication, microdevice, automobile brakes, precision instruments, chemicals, textiles, and real estate businesses in China and internationally.

Established dividend payer and good value.

Market Insights

Community Narratives