- Japan

- /

- Trade Distributors

- /

- TSE:3064

What MonotaRO (TSE:3064)'s Double-Digit September Sales Growth Means For Shareholders

Reviewed by Sasha Jovanovic

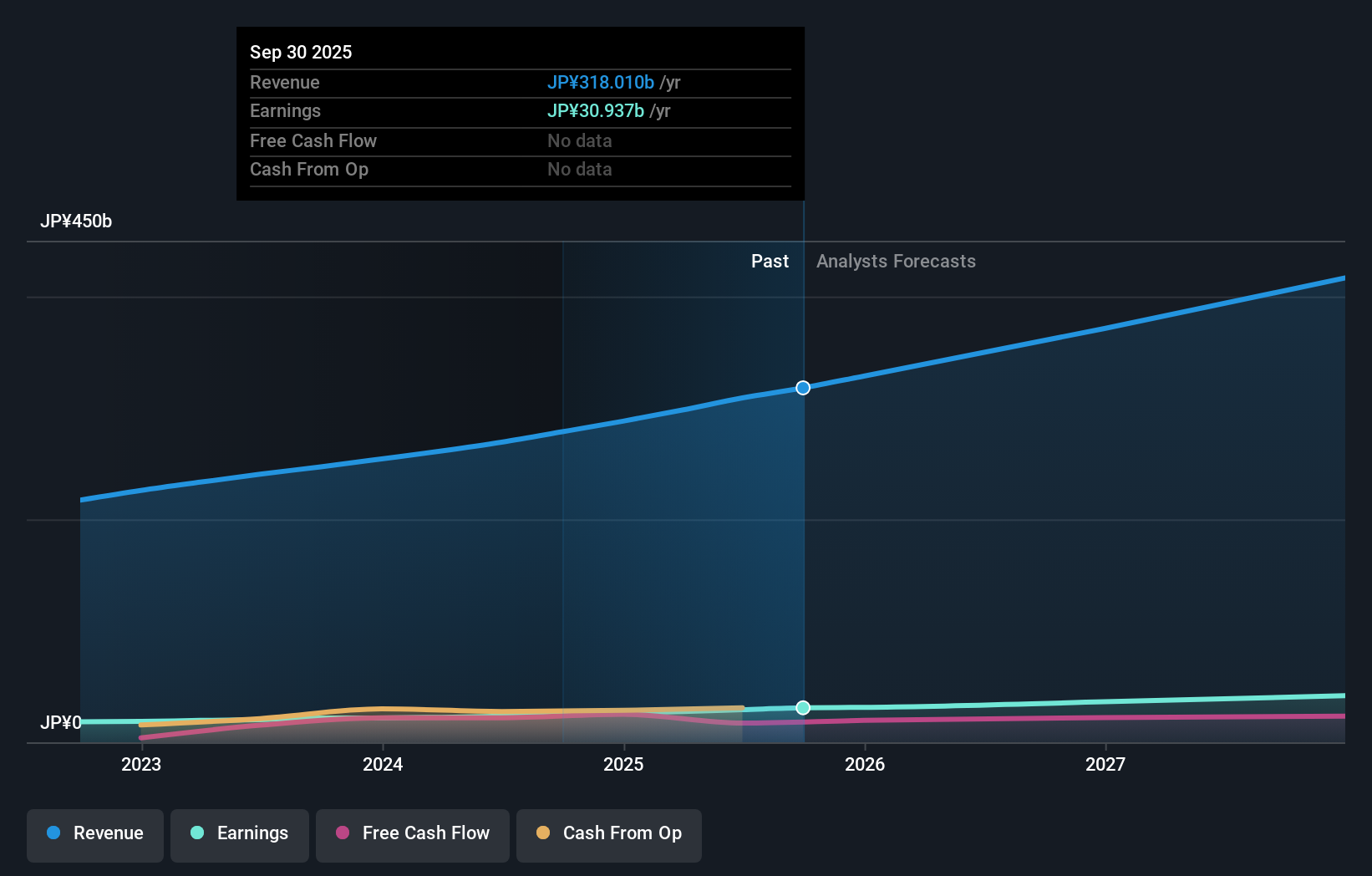

- MonotaRO announced that its September sales increased by 17%, reflecting higher demand and improved operational momentum reported earlier this week.

- This robust sales growth highlights the company's ability to capitalize on market opportunities and signals ongoing business strength.

- We'll explore how MonotaRO's strong sales performance in September contributes to its overall investment narrative and future market positioning.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is MonotaRO's Investment Narrative?

Owning MonotaRO means believing in the company’s capacity to deliver consistent growth above the market and trade distributors’ average, even as it navigates relatively high valuation multiples. The recent 17% sales increase for September could boost optimism around the near-term demand environment, especially with stronger operational momentum ahead of key Q3 results, but it may not fully offset concerns about lagging share price performance and the persistent risk of an earnings slowdown if growth doesn’t keep pace. With management continuing to increase dividends and complete buybacks, capital returns are firmly on the agenda, yet those positive signals come as the company’s shares are still trading below consensus fair value estimates. If the September sales momentum proves sustainable, it could alter investor sentiment and the market’s focus on growth catalysts, though risks around valuation and future revenue trends remain.

However, MonotaRO’s premium valuation versus peers is still something investors should be aware of. MonotaRO's shares have been on the rise but are still potentially undervalued by 26%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on MonotaRO - why the stock might be worth as much as 35% more than the current price!

Build Your Own MonotaRO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MonotaRO research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free MonotaRO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MonotaRO's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3064

MonotaRO

Operates an online MRO products store for factories in Japan and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives