- Japan

- /

- Real Estate

- /

- TSE:3252

Rasa And 2 Other Reliable Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

In the current global market landscape, U.S. stocks have experienced volatility due to AI competition fears and mixed corporate earnings, while European indices reached record highs influenced by strong earnings and the ECB's rate cuts. Amid these dynamic conditions, dividend stocks can offer a measure of stability and income potential for investors seeking reliable returns in an unpredictable environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.25% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

Click here to see the full list of 1952 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

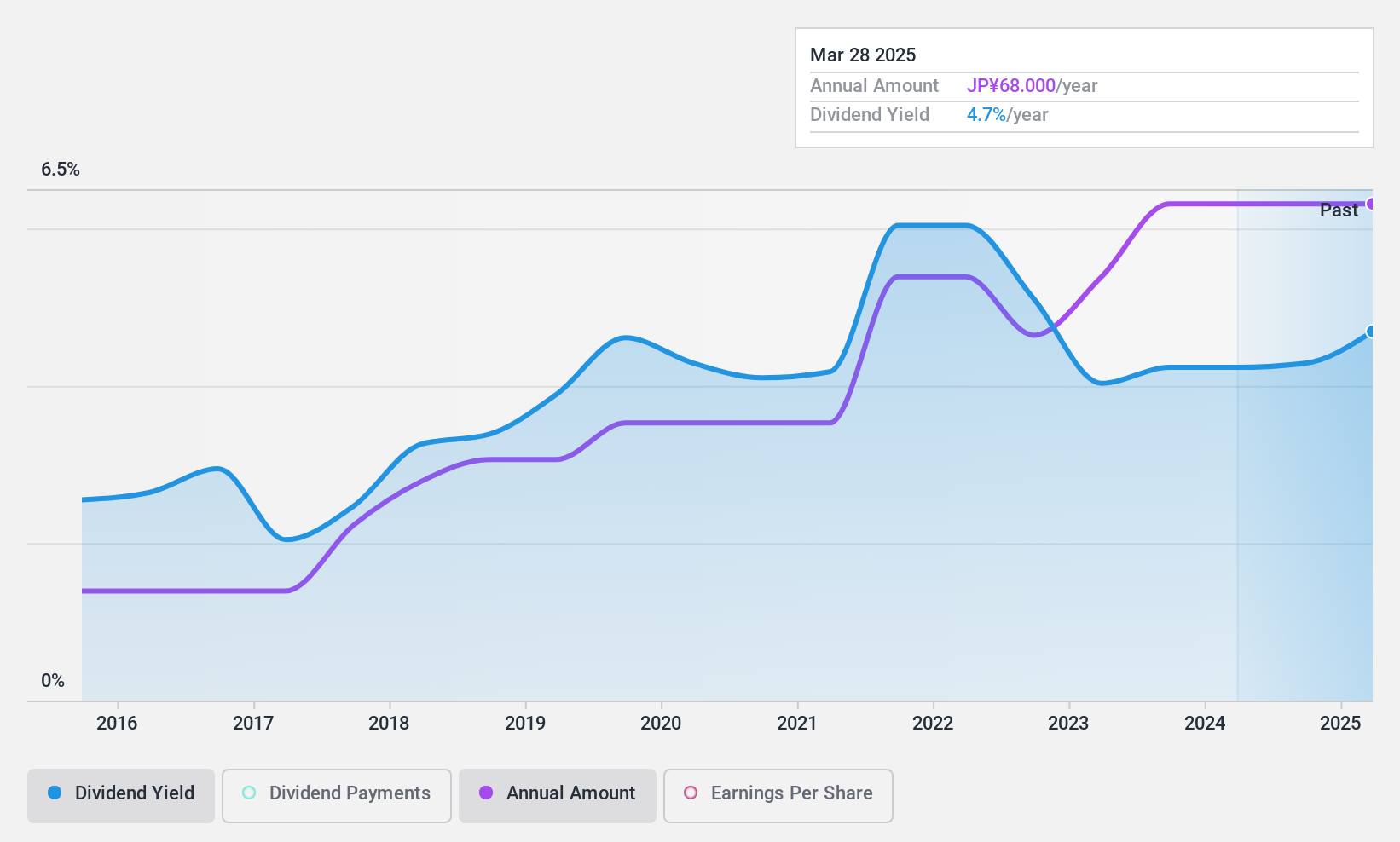

Rasa (TSE:3023)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rasa Corporation is a trading company that supplies resources, metallic materials, industrial machinery, construction equipment, and other products across Japan, China, Korea, Taiwan, and Australia with a market cap of ¥15.63 billion.

Operations: Rasa Corporation's revenue segments include Industrial Machinery / Construction Machinery Related (¥10.25 billion), Chemical Products Connection (¥5.90 billion), Resources / Metal Materials Related (¥5.75 billion), Plant/Equipment Construction Related (¥2.62 billion), Environmental Equipment Related (¥1.84 billion), and Real Estate Leasing Related (¥375 million).

Dividend Yield: 4.8%

Rasa offers a compelling dividend profile with stable and growing payments over the past decade. Its dividend yield of 4.76% ranks in the top 25% among JP market payers, supported by a low payout ratio of 39%, indicating strong earnings coverage. The cash payout ratio stands at 77.9%, suggesting adequate cash flow support. Additionally, Rasa's price-to-earnings ratio of 8.1x is attractive compared to the broader JP market average of 13.5x.

- Click to explore a detailed breakdown of our findings in Rasa's dividend report.

- The valuation report we've compiled suggests that Rasa's current price could be inflated.

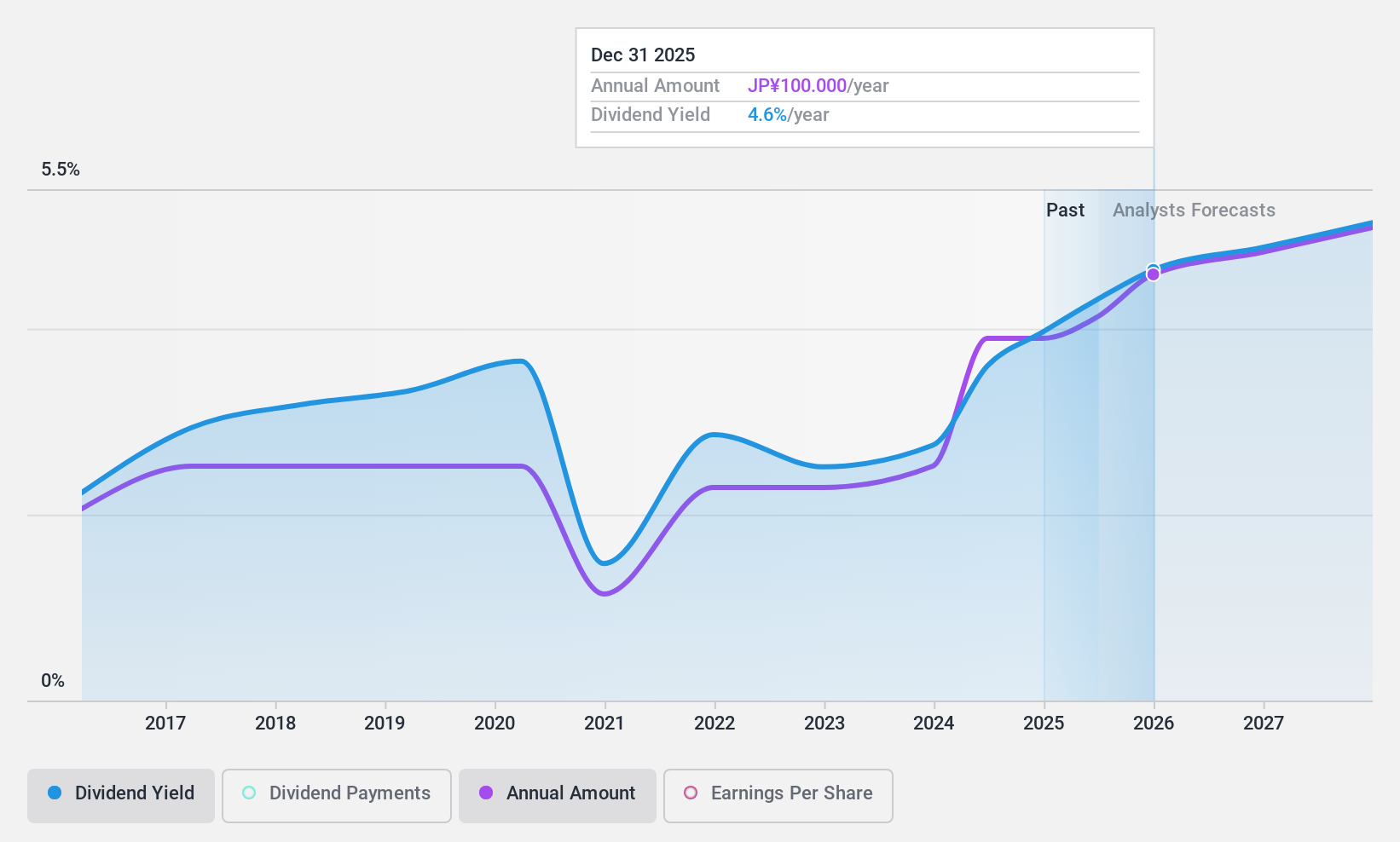

JINUSHILtd (TSE:3252)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JINUSHI Co., Ltd. operates in the real estate investment sector in Japan and has a market cap of ¥45.78 billion.

Operations: JINUSHI Co., Ltd. generates revenue of ¥52.23 billion from its real estate investment business in Japan.

Dividend Yield: 3.8%

JINUSHI Ltd.'s dividend yield of 3.81% is among the top 25% in the JP market, yet its payments have been volatile over the past decade. Despite a low payout ratio of 34.2%, dividends are not backed by free cash flow, raising sustainability concerns. Recent earnings guidance was revised upward, indicating potential growth with expected net sales of ¥56 billion and operating profit of ¥8.4 billion for fiscal year-end December 2024.

- Take a closer look at JINUSHILtd's potential here in our dividend report.

- Upon reviewing our latest valuation report, JINUSHILtd's share price might be too pessimistic.

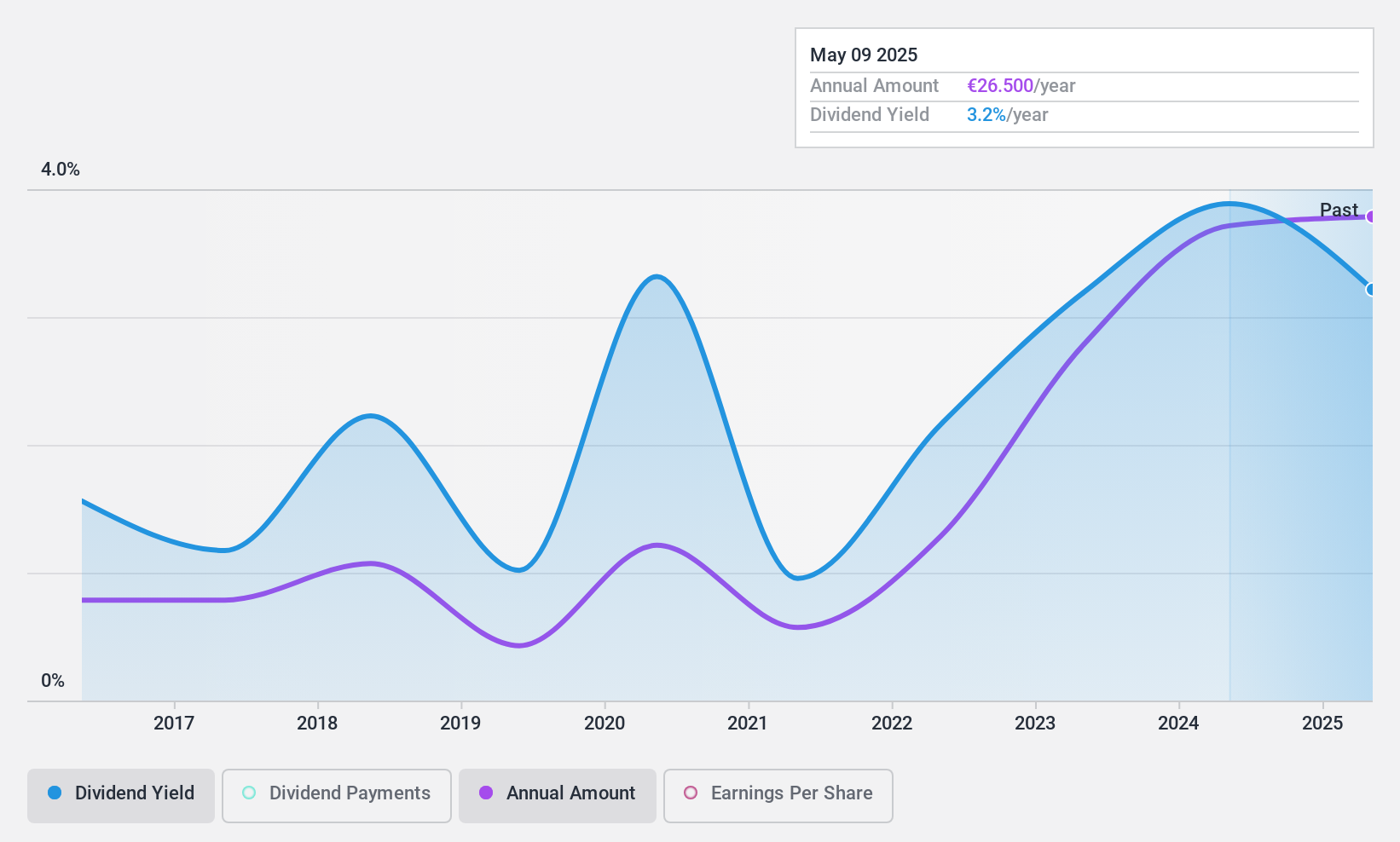

KSB SE KGaA (XTRA:KSB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KSB SE & Co. KGaA, along with its subsidiaries, manufactures and supplies pumps, valves, and related services globally, with a market cap of approximately €1.15 billion.

Operations: KSB SE & Co. KGaA generates revenue through its segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million).

Dividend Yield: 3.9%

KSB SE & Co. KGaA's dividend yield of 3.88% is below the top quartile in Germany, and past payments have been volatile, dropping over 20% annually at times. However, dividends are well covered by both earnings and free cash flow with low payout ratios of 29.9% and 24.2%, respectively. Recent guidance suggests EBIT could reach €245 million for FY2024, indicating potential financial strength despite its unstable dividend history over the last decade.

- Click here to discover the nuances of KSB SE KGaA with our detailed analytical dividend report.

- Our expertly prepared valuation report KSB SE KGaA implies its share price may be lower than expected.

Taking Advantage

- Navigate through the entire inventory of 1952 Top Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3252

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives