- Japan

- /

- Trade Distributors

- /

- TSE:2768

What Do Recent Price Swings Mean for Sojitz Shares in 2025?

Reviewed by Bailey Pemberton

Wondering what to do with Sojitz stock right now? You are not alone. Whether you are a long-term holder marveling at its remarkable 300%+ five-year run or someone eyeing the recent dip for an entry point, the decision is rarely obvious. Sojitz’s share price may have slipped by around 3% over the last week and month, but that barely dents the impressive 20% jump so far this year. Even after such a strong multi-year rally, there is plenty of debate about whether the market is fairly valuing Sojitz’s potential, or perhaps underestimating it despite fluctuating sentiment tied to broader market developments.

With a valuation score of 3 out of 6 based on major checklist items, Sojitz shows signs of being undervalued in half the categories monitored most closely. Is the recent pullback a genuine signal of increased risk, or could it be the start of another upward leg for the stock, especially given shifts in global trade and commodity markets that underpin Sojitz’s business?

Let’s dig deeper into the valuation itself and break down how Sojitz stacks up using classic valuation approaches. Before wrapping up, we will also consider a fresh angle on valuation that could change the way you look at this company’s true worth.

Why Sojitz is lagging behind its peers

Approach 1: Sojitz Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its expected future cash flows and discounting them back to what they are worth today. This approach helps investors assess whether a stock is undervalued or overvalued based on the business’s real ability to generate cash over the long run.

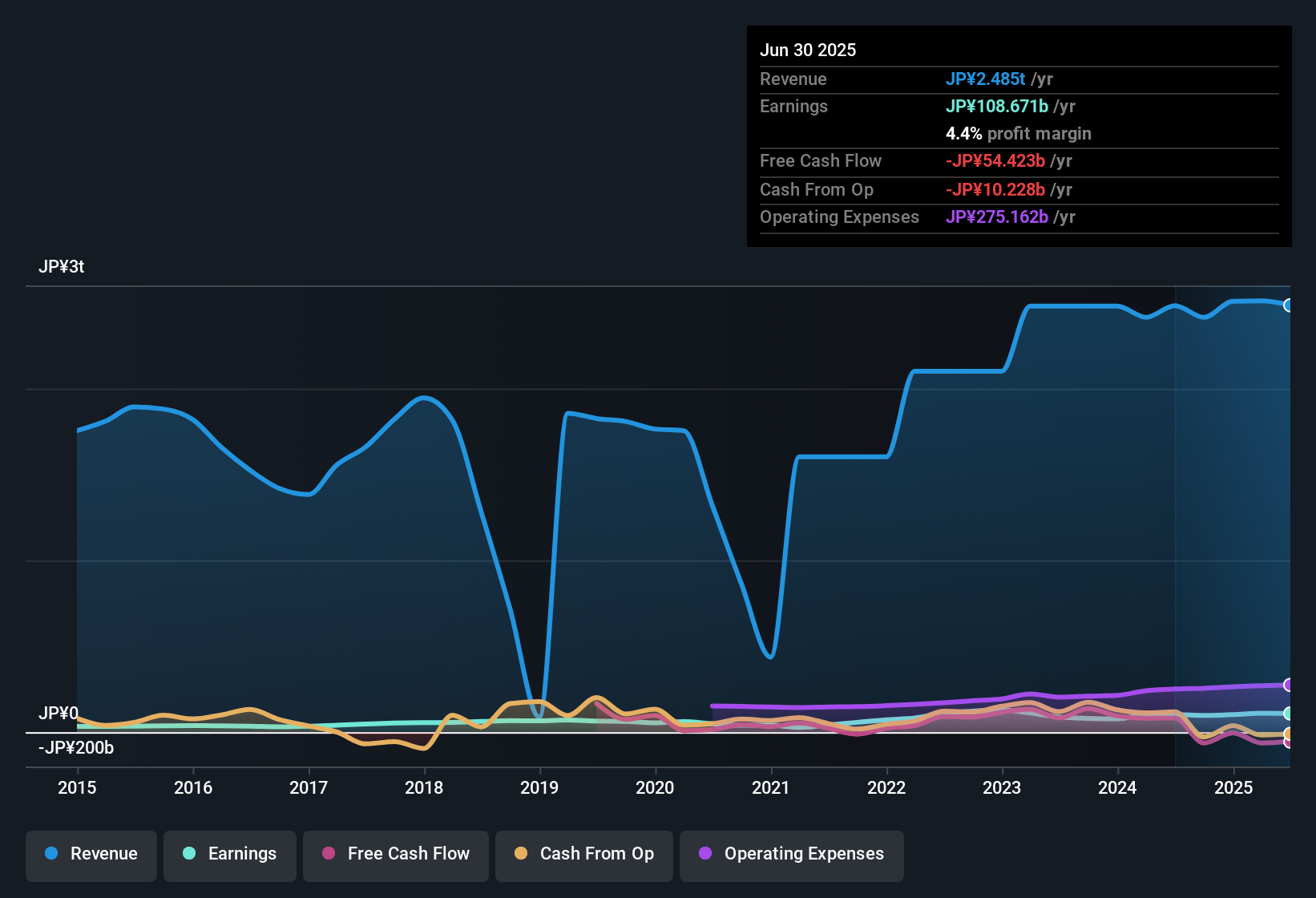

For Sojitz, the most recent Free Cash Flow (FCF) is negative at approximately ¥49.5 billion. Looking ahead, analysts predict fluctuating but steadily improving FCF figures, with projections turning positive and ultimately reaching ¥54 billion by 2030. These projections combine analyst forecasts for the next five years and extrapolations for the subsequent period.

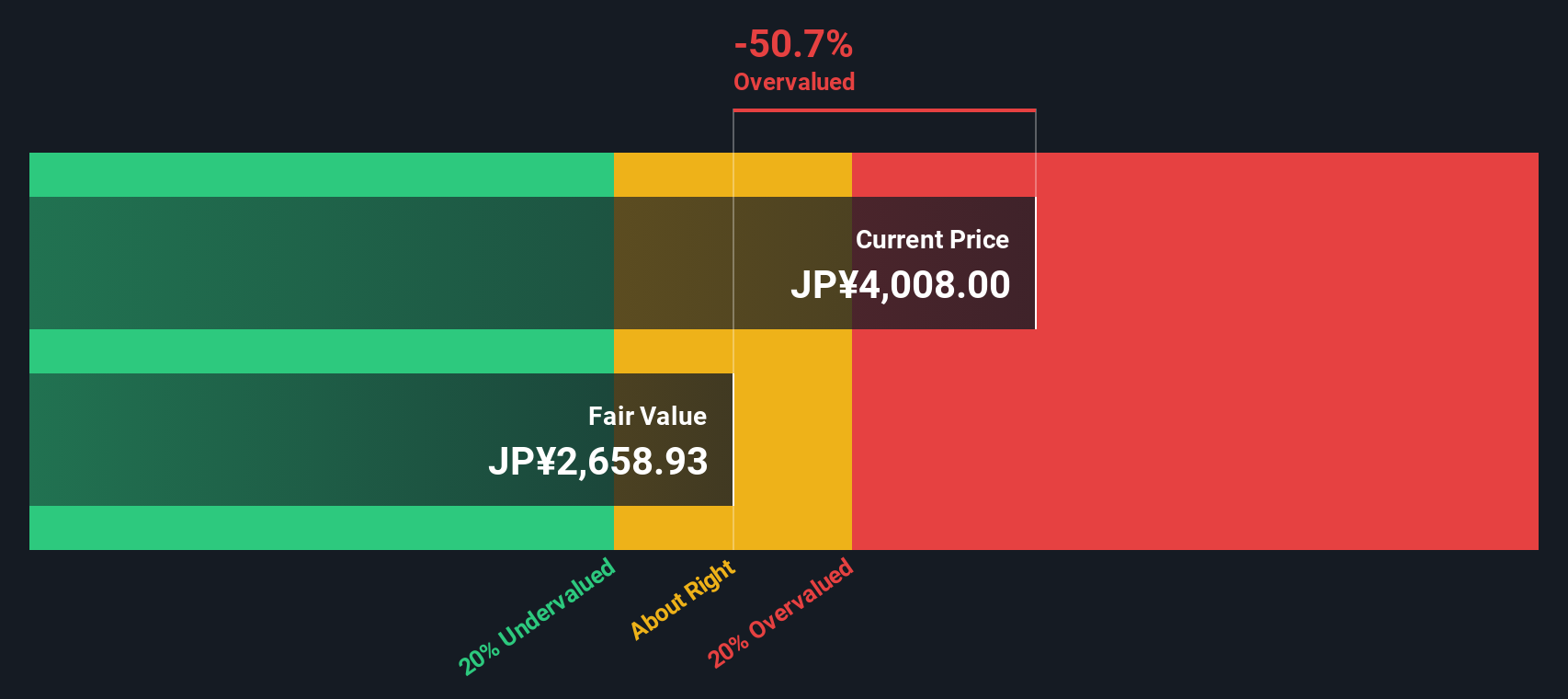

The DCF analysis calculates Sojitz’s intrinsic value at ¥2,608 per share. However, this is about 48.4% below the current market price, implying that the shares are significantly overvalued based on these future cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sojitz may be overvalued by 48.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Sojitz Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored metric for assessing profitable companies because it provides a snapshot of how much investors are willing to pay for a single yen of profits. It is simple, direct, and especially meaningful when analyzing businesses with consistent profitability like Sojitz.

Growth expectations and perceived risk play a big role in what constitutes a reasonable PE ratio. Companies with higher growth prospects or lower risk profiles tend to command elevated multiples, while those facing greater uncertainties often trade at a discount relative to peers and benchmarks.

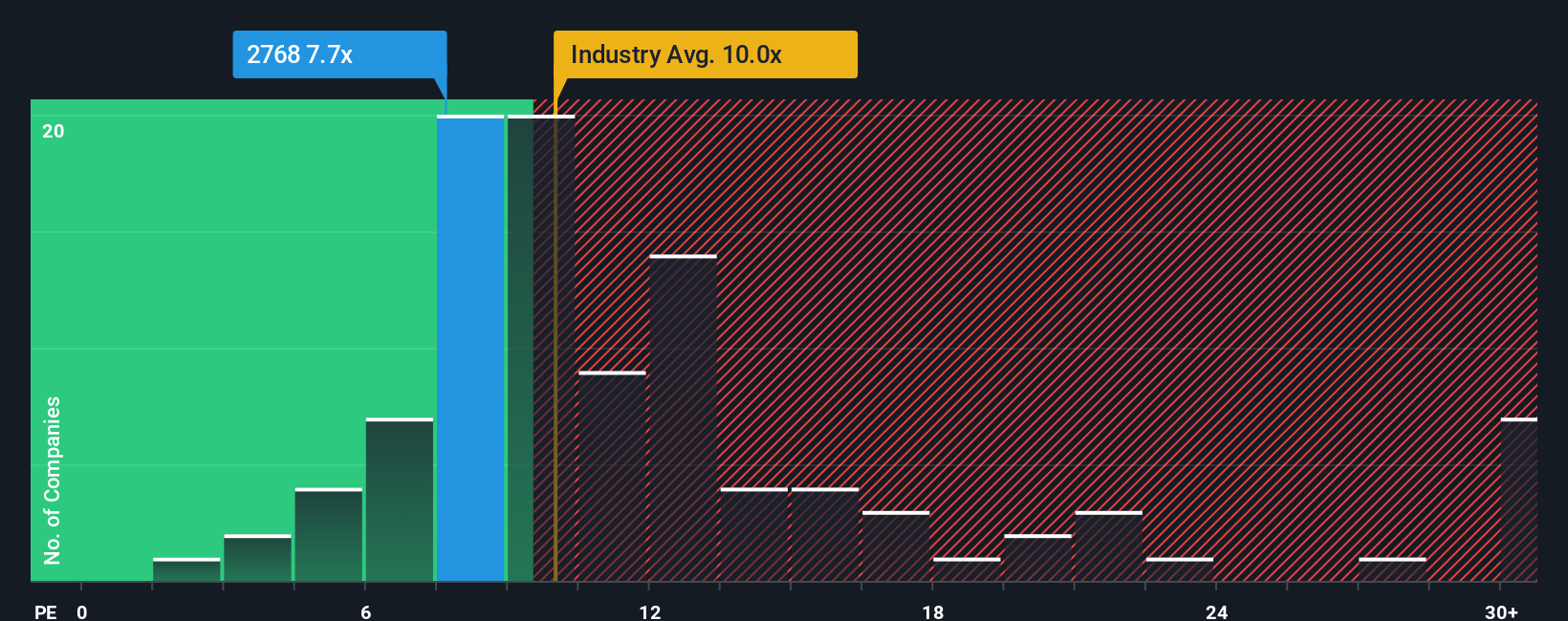

Currently, Sojitz sports a PE ratio of 7.4x. That is notably below both the Trade Distributors industry average of 9.8x and the average among similar peers at 15.9x. On the surface, this looks like a bargain, but static comparisons can miss nuances unique to Sojitz’s situation.

This is where the Simply Wall St "Fair Ratio" comes in. The Fair Ratio for Sojitz is 16.2x, representing the appropriate multiple when you take into account the company’s growth outlook, profit margins, market capitalization, industry specifics, and risk factors. This approach is more comprehensive than simply referencing peer or sector averages, since it tailors the valuation to Sojitz’s exact circumstances rather than painting with a broad brush.

Comparing the Fair Ratio (16.2x) to Sojitz’s current PE (7.4x), it appears the shares are trading at a significant discount and may be undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sojitz Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple, powerful tool that lets you create your own story about a company by connecting your view of its strategy or future with actual financial forecasts like expected revenue, earnings, and profit margins.

Narratives bridge the gap between a company’s story and its numbers by turning your expectations into a fair value, making analysis more personal and actionable. Available on Simply Wall St’s Community page, Narratives are used by millions of investors to see how shifting business trends, news, or earnings updates may instantly affect a company’s fair value and the case to buy or sell.

With Narratives, it is easy to compare your own thesis for Sojitz to both the current market price and to other investors. For example, the most optimistic current Narrative for Sojitz targets a fair value of ¥5,000 per share by forecasting robust renewables growth. The most cautious view puts fair value at ¥3,860 by highlighting commodity risks and margin pressures. Narratives help you stay agile as the market evolves and make smarter, more confident decisions backed by your unique perspective.

Do you think there's more to the story for Sojitz? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2768

Sojitz

Operates as a general trading company that engages in various business activities worldwide.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives