- Japan

- /

- Trade Distributors

- /

- TSE:2768

Sojitz (TSE:2768): Is There More Value Left After a Strong Three-Year Share Price Climb?

Reviewed by Kshitija Bhandaru

Sojitz (TSE:2768) shares have seen some interesting movement lately, with the stock finishing at ¥3,940 and minor gains over the past week. Investors might be weighing recent company performance in relation to longer-term growth trends.

See our latest analysis for Sojitz.

Sojitz has been quietly gaining momentum, with the share price seeing steady growth throughout the year and supported by improving total shareholder returns. The returns are up 18% over the past twelve months and have topped 100% across three years. The mood in the market suggests investors are starting to price in the company’s solid operational progress and renewed confidence in its outlook.

If you’re curious what else could be turning heads in the industrial space, take a look at standout auto and manufacturing names with our curated list: See the full list for free.

But with Sojitz stock up more than 100% over three years and recent gains still coming, investors are left wondering: is there still value left on the table, or has the market already priced in the future growth?

Most Popular Narrative: 10.4% Undervalued

The most widely followed narrative estimates Sojitz’s fair value at ¥4,397, about 10% above its last close of ¥3,940. Investor interest is growing as this new target suggests potential upside, hinging on Sojitz’s bets in transformative industries.

Expansion into high-growth sectors such as chemicals (for example, full acquisition of NIPPON A&L for lithium-ion battery materials and resins) and value chain moves into manufacturing are likely to strengthen Sojitz's presence in rapidly growing industries tied to global electrification. This could increase potential revenue and net margins over time.

Ready for a shock? The narrative behind this fair value leans on ambitious growth in emerging industries and a margin leap that is not fully priced in. What exact numbers are behind the bold outlook? The details might surprise you, so read on before everyone else catches up.

Result: Fair Value of ¥4,397 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, exposure to commodity cycles and rising costs means that even a strong growth story could quickly face setbacks if conditions shift against Sojitz.

Find out about the key risks to this Sojitz narrative.

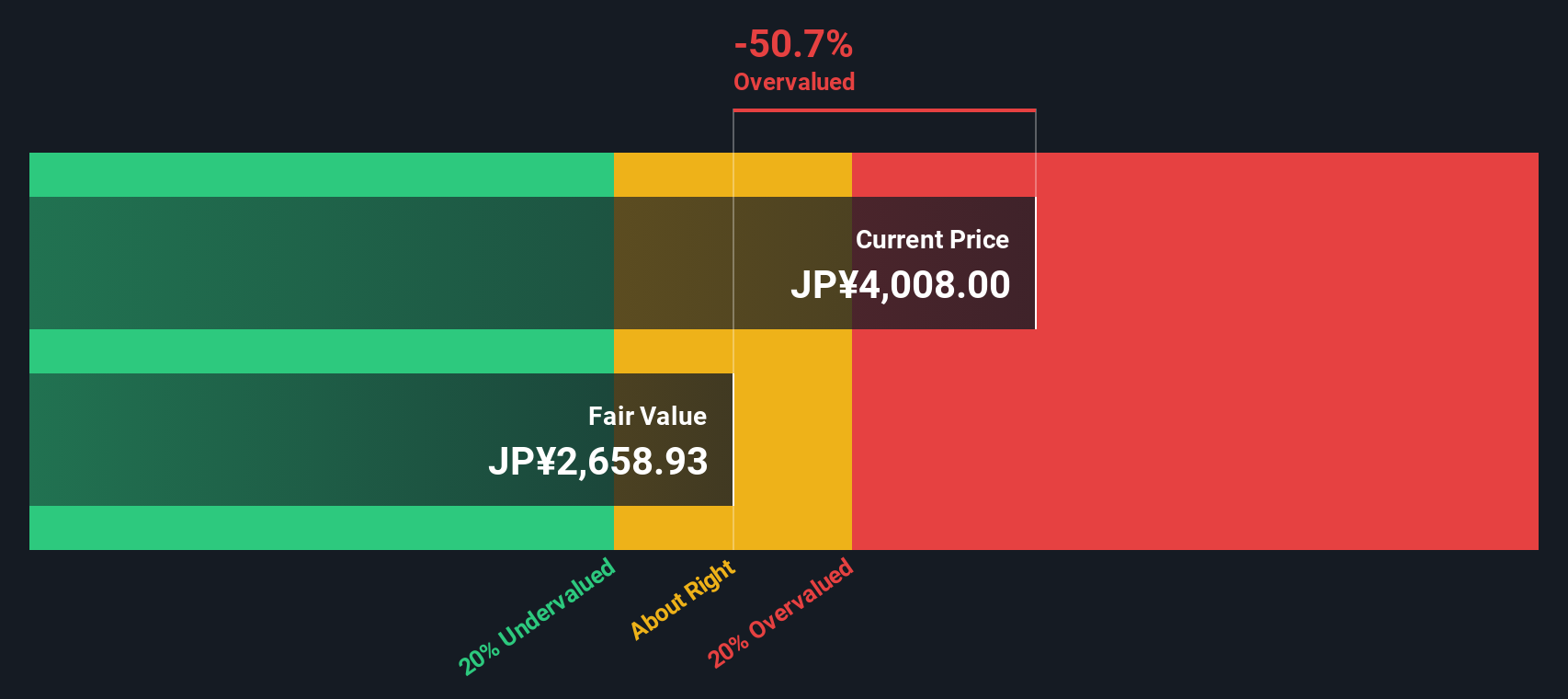

Another View: Discounted Cash Flow Model Questions the Upside

While the analyst consensus and market multiples suggest Sojitz is undervalued, our DCF model tells a more cautious story. It estimates fair value closer to ¥2,608, which is significantly below the current market price. The wide gap raises important questions about the assumptions driving both models, especially around future growth and risk.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sojitz for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sojitz Narrative

If you want to dig into the numbers for yourself or see how your outlook compares, it only takes a few minutes to build your own view. Do it your way

A great starting point for your Sojitz research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop your research short. Uncover more potential winners by branching out into different corners of the market using the Simply Wall Street Screener. If you wait, you might miss tomorrow’s breakout stock.

- Catch the momentum by scanning these 887 undervalued stocks based on cash flows for companies trading below their intrinsic value before the rest of the market catches on.

- Chase higher yields by targeting steady income streams when you review these 19 dividend stocks with yields > 3%, filled with stocks offering strong dividends above 3%.

- Leap ahead in tech by zeroing in on emerging innovations with these 24 AI penny stocks powering advances across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2768

Sojitz

Operates as a general trading company that engages in various business activities worldwide.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives