- Japan

- /

- Trade Distributors

- /

- TSE:2768

Has Sojitz’s 290% Rise Set Up Opportunity After Latest Earnings Surprise?

Reviewed by Simply Wall St

Wondering whether it’s time to make a move on Sojitz stock? You are not alone. Over the last few years, Sojitz has quietly moved from being a steady performer to a clear darling for those who love to see growth charts tick steadily upward. In fact, if you had invested in Sojitz five years ago, your position would be up over 290% today, an eye-popping figure in any market climate. Even just this year, Sojitz is up 23.6% year-to-date, with particularly strong momentum showing in the last month, notching a 7.1% gain even after a modest 0.8% pullback in the most recent week.

What’s driving these moves? Beyond global shifts in commodity markets and evolving demand in Sojitz’s key sectors, investors seem to be recalibrating the company’s risk and growth outlook. It’s a stock that’s capturing attention as international trade flows and supply chain strategies shift. While the past doesn’t guarantee future returns, the recent price behavior tells a story of renewed optimism and positioning for further growth.

But before making any decisions, let’s get to the heart of the matter: is Sojitz actually undervalued right now? According to our valuation framework, Sojitz scores a 3 out of 6, meaning it passes half of our key undervaluation checks. That’s promising, but how do those numbers really stack up, and what can we learn when we dig even deeper?

Let’s break down the main valuation approaches. Then I’ll share a perspective that many investors overlook, which might be an even better lens for judging Sojitz’s worth today.

Why Sojitz is lagging behind its peersApproach 1: Sojitz Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to the present using an appropriate rate. This method allows investors to gauge what a business might truly be worth based on the cash it can generate in the years ahead, regardless of market sentiment.

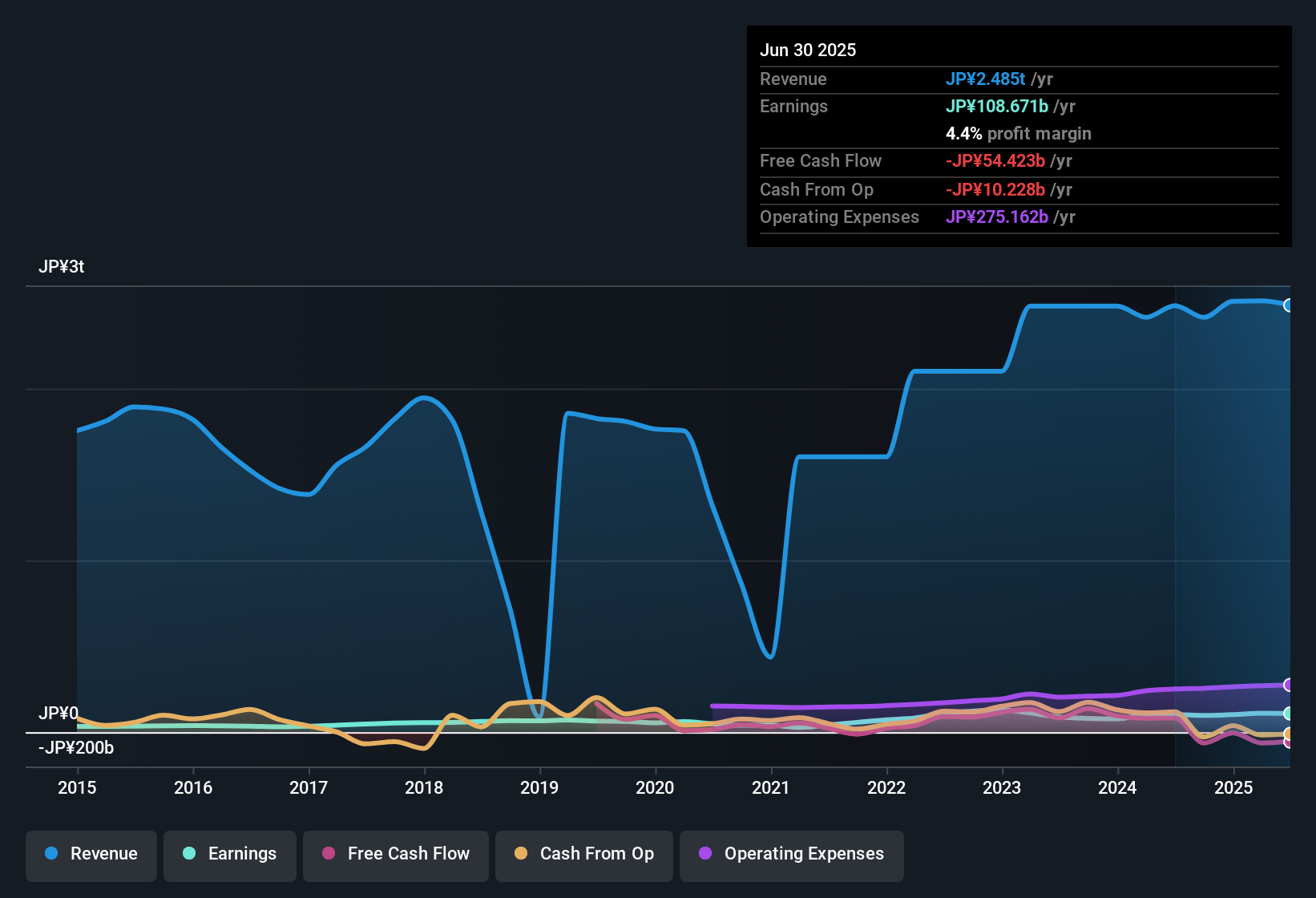

For Sojitz, the current free cash flow is negative at approximately ¥49.5 billion, reflecting some near-term challenges. Analyst estimates suggest that free cash flows are expected to remain negative over the next two years, but then swing sharply into positive territory, with projections reaching about ¥54 billion by 2030. While analysts provide guidance for the first five years, additional forecasts are extrapolated for the years following, helping create a longer-term picture of growth and value generation.

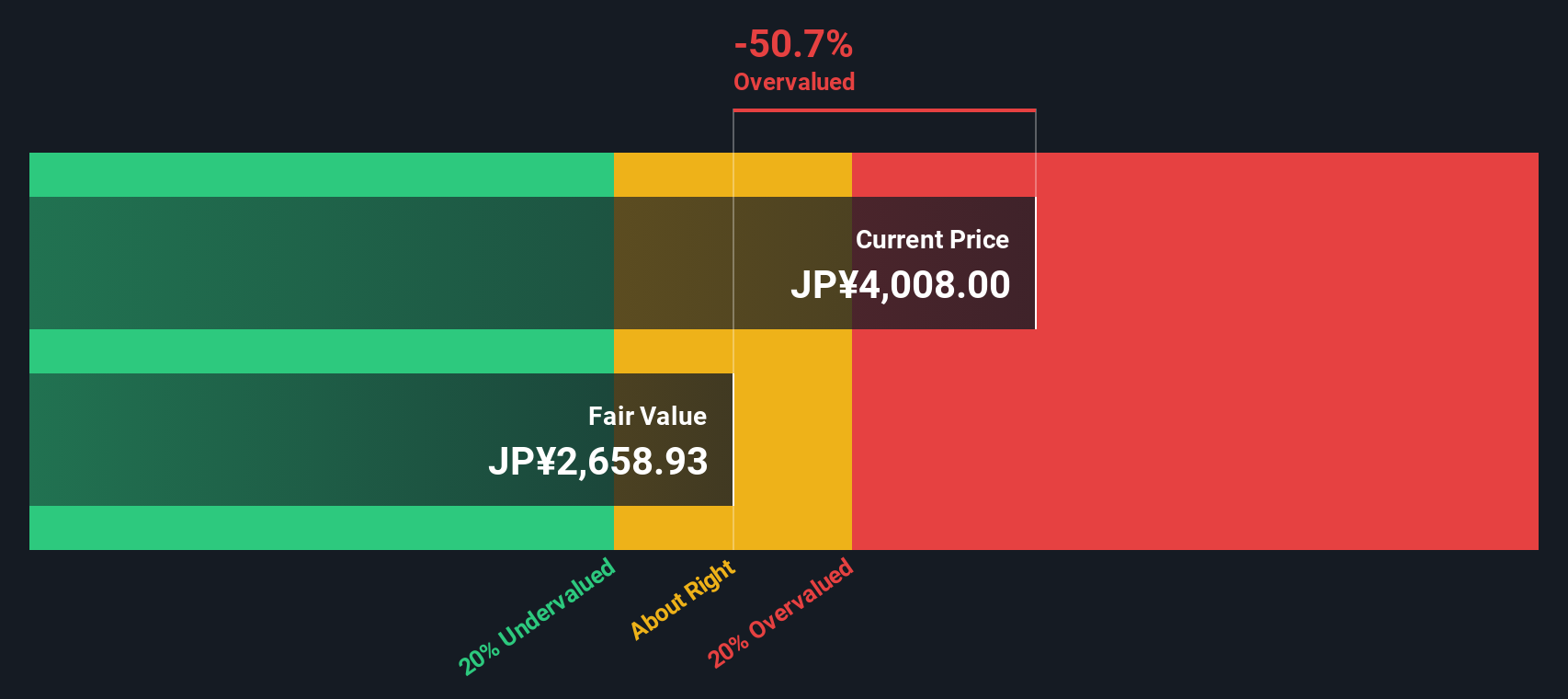

When all these cash flows are discounted to today’s value, the estimated intrinsic value comes out to ¥2,580 per share. However, given the current market price, the DCF model implies Sojitz is approximately 54.2% overvalued relative to these forecasts. This result highlights some caution because strong recent performance is visible in the share price, but cash flow projections suggest a premium is already baked in.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Sojitz.

Approach 2: Sojitz Price vs Earnings

For companies that are consistently profitable, the price-to-earnings (PE) ratio is one of the most useful ways to gauge valuation. It helps investors understand what the market is willing to pay today for a company’s earnings power. Growth expectations and risk both play key roles in what counts as a “normal” or “fair” PE ratio for any given stock. Higher growth companies or those with low-risk profiles often command a premium, while slower growth or riskier firms tend to trade at a discount.

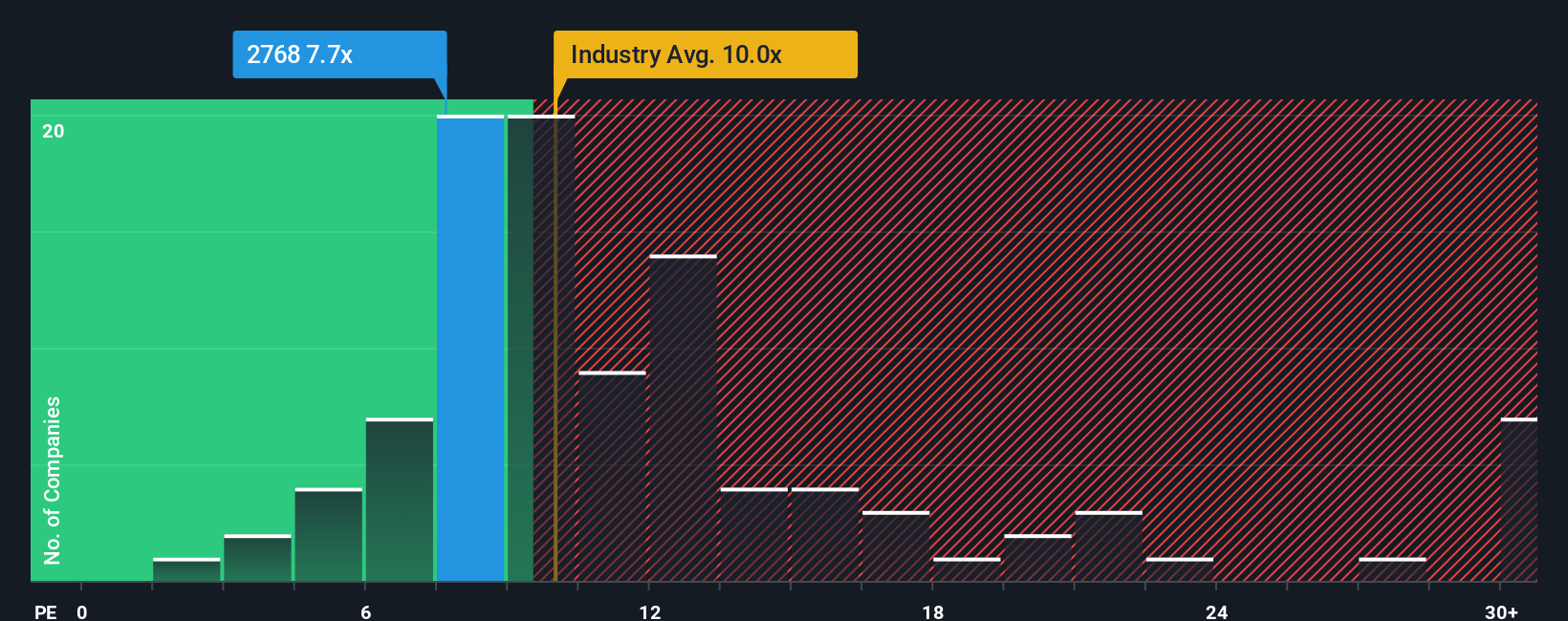

Sojitz currently trades at a PE ratio of 7.6x. This stands out as meaningfully below the peer average of 17.1x and also trails the industry average PE of 9.8x for trade distributors. At first glance, that might suggest an attractive entry point compared to peers.

However, looking beyond just straight comparisons, Simply Wall St’s proprietary “Fair Ratio” provides a more tailored benchmark. This fair PE ratio, set at 16.0x for Sojitz, factors in not only the company’s growth prospects and profitability but also how its risks, profit margins, and market cap stack up within the industry. Unlike basic averages, this approach accounts for influences peers may not share, giving a more well-rounded picture of valuation.

Since Sojitz’s actual PE ratio (7.6x) is notably below its Fair Ratio (16.0x), it appears the stock is currently undervalued based on its earnings potential and unique characteristics.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Sojitz Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, concise story you create about a company. It reflects your view on its future revenue, earnings, profit margins, and what you believe is a fair value for the stock. Narratives connect your vision for a company's business to a set of forecasts, which are then directly translated into a fair value, providing much more context than simple numerical comparisons.

On Simply Wall St's Community page, Narratives make this process easy and accessible to all investors, letting you share your perspective, see others', and stay on top of market-moving information as Narratives are updated in real time when new news or results are released. Narratives are designed specifically to help you make better, more flexible investment decisions. By comparing the Fair Value from your Narrative to the current market Price, you can decide exactly when a stock deserves to be bought or sold.

For Sojitz, some investors believe its expanding presence in global electrification and renewables will drive rapid future growth, supporting a Fair Value as high as ¥5,000 per share, while others see risks from commodities and global trade headwinds, assigning a more conservative Fair Value closer to ¥3,860. Narratives empower you to frame your own outlook confidently and dynamically.

Do you think there's more to the story for Sojitz? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2768

Sojitz

Operates as a general trading company that engages in various business activities worldwide.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives