- Japan

- /

- Construction

- /

- TSE:1979

Taikisha (TSE:1979): Evaluating Valuation After Upgraded Earnings Forecast and Strong Half-Year Results

Reviewed by Simply Wall St

Taikisha (TSE:1979) has drawn attention after reporting higher profits and substantial growth in both sales and operating income for the first half of its fiscal year, together with a forecast upgrade.

See our latest analysis for Taikisha.

Boosted by a robust set of results and an upgraded outlook, Taikisha’s share price has climbed steadily, with a 13.9% return over the past month and a 29.3% gain year-to-date. Looking at the longer term, momentum is clearly behind the stock. The company delivered a 33.5% total shareholder return over the past year and more than doubled investor wealth over three years.

If Taikisha’s momentum has you rethinking your portfolio, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With shares rallying after stellar results and a brighter outlook, investors are now asking whether the market is underestimating Taikisha’s growth potential, or if all that optimism is already reflected in the current share price.

Price-to-Earnings of 15.7x: Is it justified?

Taikisha’s current share price translates to a price-to-earnings (P/E) ratio of 15.7x, which provides a snapshot of the market’s expectations for the company’s earnings power. This is an important lens for investors to gauge whether the stock is valued appropriately versus the sector and its peers.

The price-to-earnings ratio measures how much investors are willing to pay for one unit of the company's earnings, often reflecting both growth expectations and perceived risk. For a capital goods firm like Taikisha, the P/E can shine a light on whether the business’s profit outlook justifies its valuation, especially in a sector where earnings volatility and growth rates can fluctuate significantly.

At 15.7x, Taikisha is valued below its peer average (18x), suggesting stronger value relative to similar companies. However, compared to the JP Construction industry average (12.3x), Taikisha’s P/E is notably higher, which could mean the stock comes at a premium. Furthermore, its P/E exceeds the estimated Fair Price-to-Earnings Ratio of 13.1x. This indicates the market might be factoring in higher future growth or less risk than the fundamentals support.

Explore the SWS fair ratio for Taikisha

Result: Price-to-Earnings of 15.7x (ABOUT RIGHT)

However, weaker-than-expected earnings or a pullback from current highs could quickly reverse sentiment and prompt investors to reassess Taikisha’s outlook.

Find out about the key risks to this Taikisha narrative.

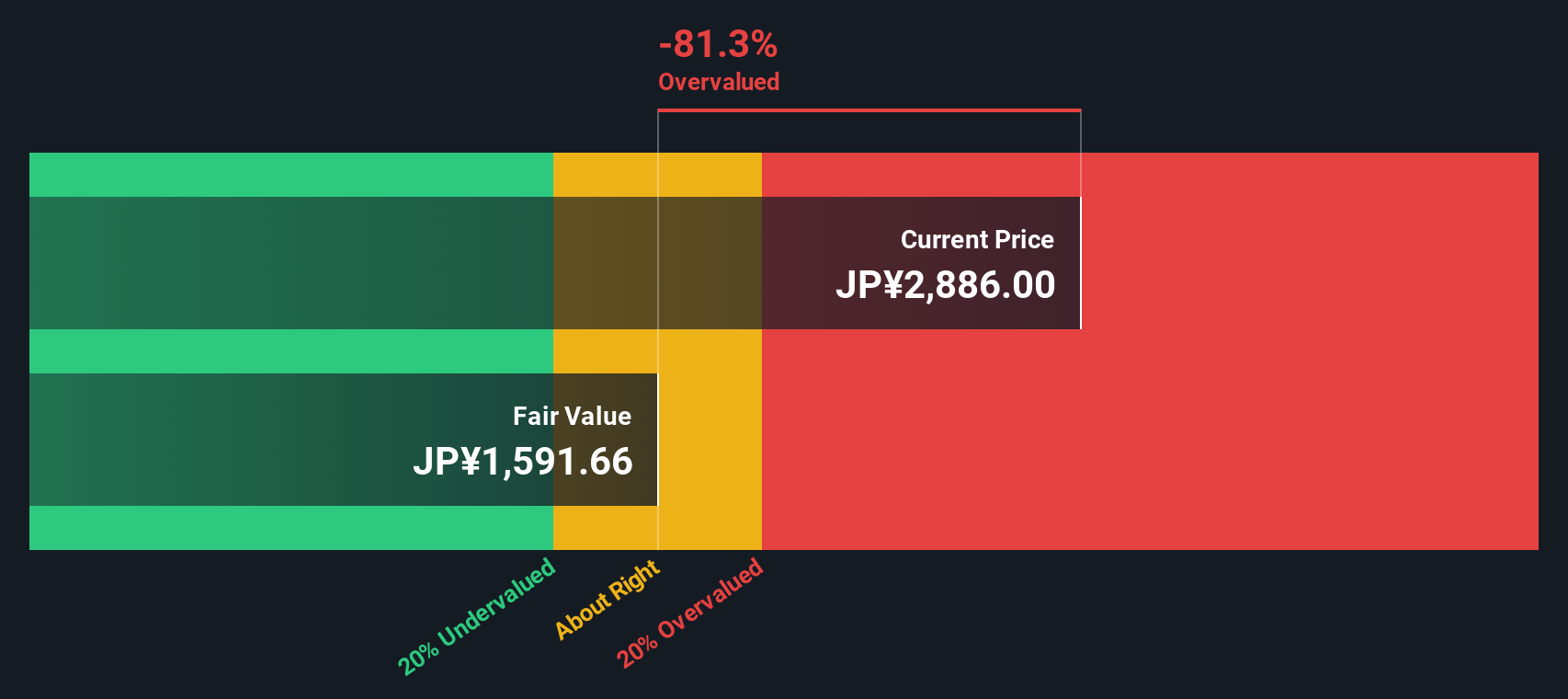

Another View: Discounted Cash Flow Model Suggests Overvaluation

While Taikisha’s valuation looks fairly reasonable based on its price-to-earnings ratio, our DCF model tells a different story. The SWS DCF model estimates fair value at ¥1,747.6, which is much lower than the current share price of ¥3,180. This suggests the stock could be overvalued from a cash flow perspective. Does this highlight caution for investors, or is the market seeing something our model is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taikisha for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taikisha Narrative

If you see things differently or want to dig deeper into the data yourself, you can build your own perspective in just a few minutes. Do it your way.

A great starting point for your Taikisha research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Seize your advantage today by checking out more smart investment ideas designed to elevate your portfolio beyond the ordinary.

- Access reliable income streams and check out these 14 dividend stocks with yields > 3% with yields above 3% for income-focused investors who want stable returns.

- Position yourself for the future by tapping into cutting-edge innovation and reviewing these 27 quantum computing stocks that are pioneering quantum computing breakthroughs.

- Capitalize on tech-driven healthcare advancements and explore these 32 healthcare AI stocks set to shape tomorrow’s medical landscape with AI-powered solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taikisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1979

Taikisha

Engages in the environmental systems and painting systems businesses in Japan.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives