- Japan

- /

- Construction

- /

- TSE:1976

Doosan Bobcat And Two Other Solid Dividend Stocks To Consider

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets have experienced some turbulence, with major U.S. indices like the Nasdaq Composite and S&P MidCap 400 reaching highs before retreating. Amidst this backdrop of fluctuating growth stocks and cautious economic data, dividend stocks remain a steadfast option for investors seeking stability and income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.82% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.29% | ★★★★★☆ |

| Premier Financial (NasdaqGS:PFC) | 4.34% | ★★★★★☆ |

Click here to see the full list of 1991 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

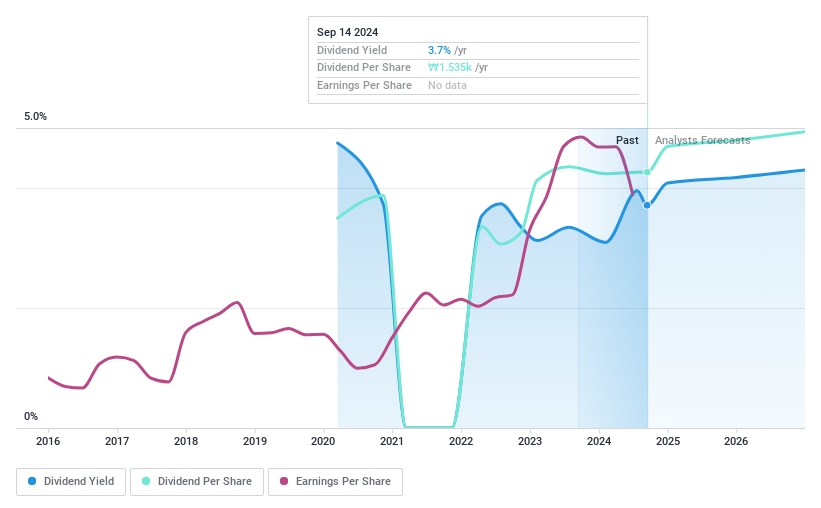

Doosan Bobcat (KOSE:A241560)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Doosan Bobcat Inc. designs, manufactures, markets, and distributes compact construction equipment across various industries globally, with a market cap of ₩4.04 trillion.

Operations: Doosan Bobcat Inc. generates revenue of $6.99 billion from its construction equipment segment, serving industries such as construction, landscaping, agriculture, grounds maintenance, utility, and mining across multiple regions worldwide.

Dividend Yield: 4%

Doosan Bobcat's dividend is well-covered by earnings and cash flows, with payout ratios of 31% and 25.6%, respectively. Despite being in the top 25% for yield in the KR market, its dividend history is unstable, having been paid for less than a decade with volatility. Recent financials show declining sales and net income, impacting earnings per share. The canceled acquisition by Doosan Robotics may influence future strategic direction but doesn't affect current dividend sustainability.

- Dive into the specifics of Doosan Bobcat here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Doosan Bobcat shares in the market.

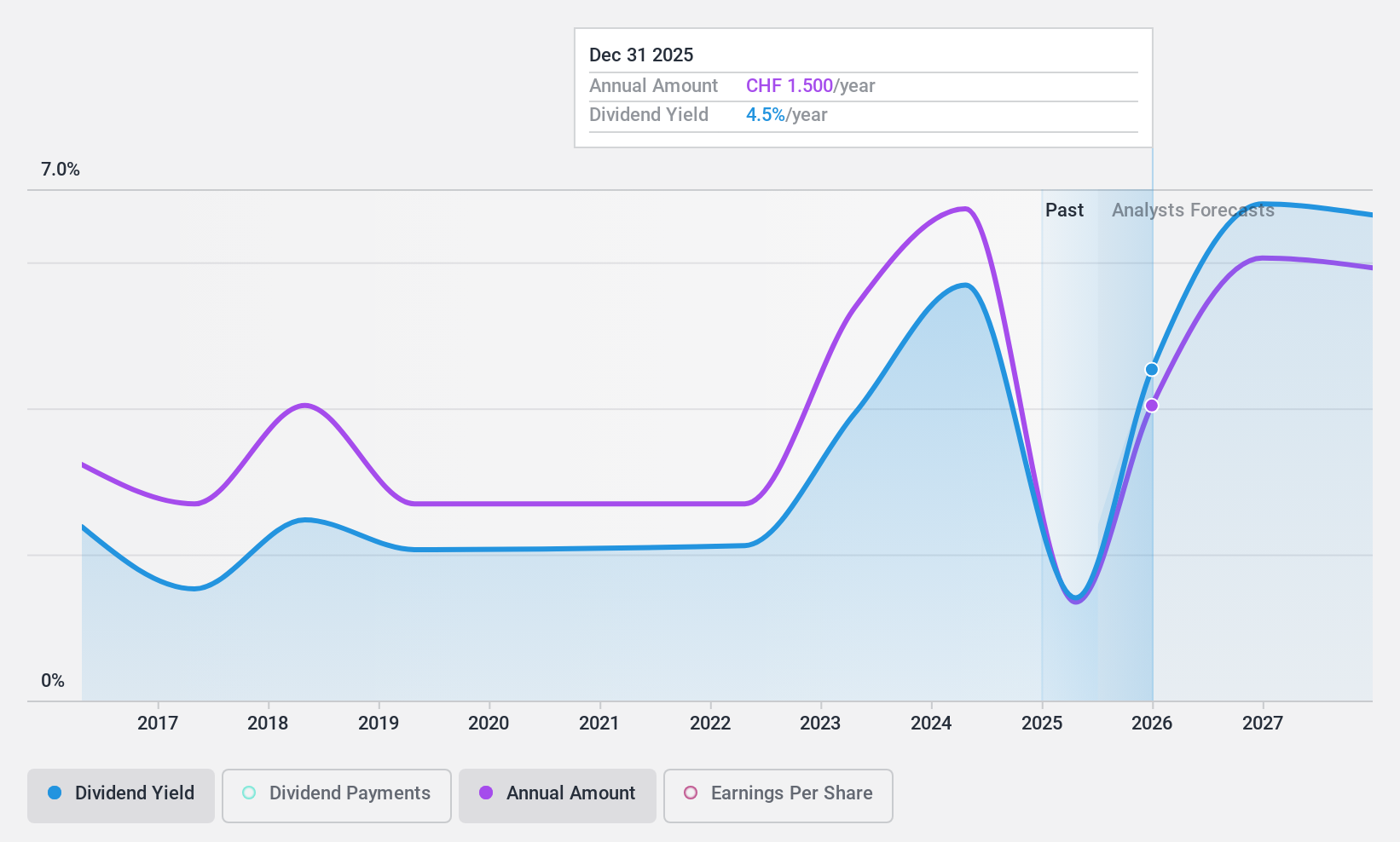

StarragTornos Group (SWX:STGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: StarragTornos Group AG specializes in the development, manufacturing, and distribution of precision machine tools for milling, turning, boring, grinding, and machining various materials with a market capitalization of CHF228.32 million.

Operations: Revenue Segments (in millions of CHF):

Dividend Yield: 6%

StarragTornos Group's dividend yield of 5.95% ranks it among the top 25% in Switzerland, though its history is marked by volatility and unreliability over the past decade. The payout ratio of 62.7% suggests dividends are covered by earnings but not by free cash flow, raising sustainability concerns. Recent executive changes include Markus Jäger as CFO, potentially impacting financial strategy amidst a backdrop of high share price volatility and significant shareholder dilution this year.

- Take a closer look at StarragTornos Group's potential here in our dividend report.

- The valuation report we've compiled suggests that StarragTornos Group's current price could be quite moderate.

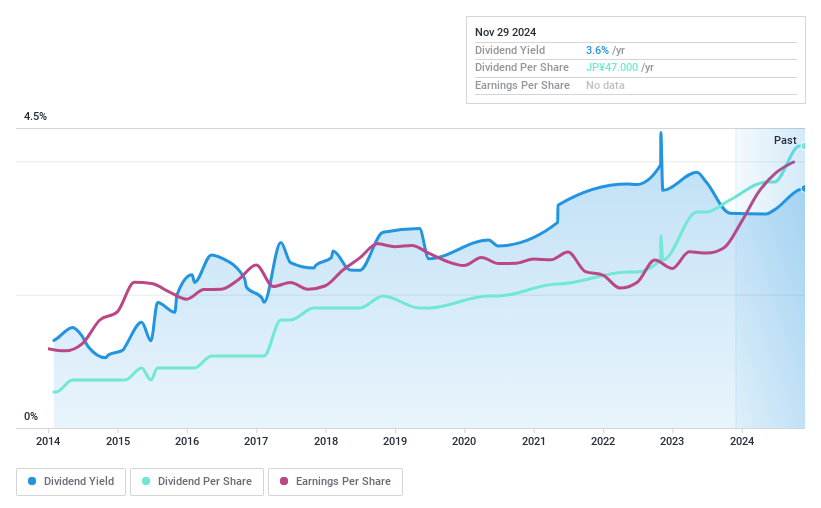

MEISEI INDUSTRIALLtd (TSE:1976)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MEISEI INDUSTRIAL Co., Ltd. is a construction works company operating in Japan and internationally, with a market cap of ¥65.09 billion.

Operations: MEISEI INDUSTRIAL Co., Ltd. generates revenue through its construction works operations both domestically in Japan and internationally.

Dividend Yield: 3.1%

MEISEI INDUSTRIAL Ltd.'s dividend yield of 3.07% is lower than the top 25% in Japan, with a stable and reliable history over the past decade. Despite a low payout ratio of 24%, dividends are not supported by free cash flow, raising sustainability concerns. The company has shown strong earnings growth at 45.2% over the past year and trades at a P/E ratio of 9.4x, below the market average, indicating potential value for investors.

- Click to explore a detailed breakdown of our findings in MEISEI INDUSTRIALLtd's dividend report.

- The analysis detailed in our MEISEI INDUSTRIALLtd valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Reveal the 1991 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1976

MEISEI INDUSTRIALLtd

Operates as a construction works company in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.