- Thailand

- /

- Oil and Gas

- /

- SET:PTTEP

Top Three Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets respond to the Trump administration's emerging policy changes, U.S. stocks have been buoyed by optimism around potential trade deals and AI investments, with major indices reaching record highs. In this dynamic environment, dividend stocks can offer a measure of stability and income for investors seeking reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.94% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.91% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.76% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

PTT Exploration and Production (SET:PTTEP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PTT Exploration and Production Public Company Limited, along with its subsidiaries, is involved in the exploration and production of petroleum both in Thailand and internationally, with a market cap of THB494.26 billion.

Operations: PTT Exploration and Production Public Company Limited generates revenue through its core activities in the exploration and production of petroleum across various regions.

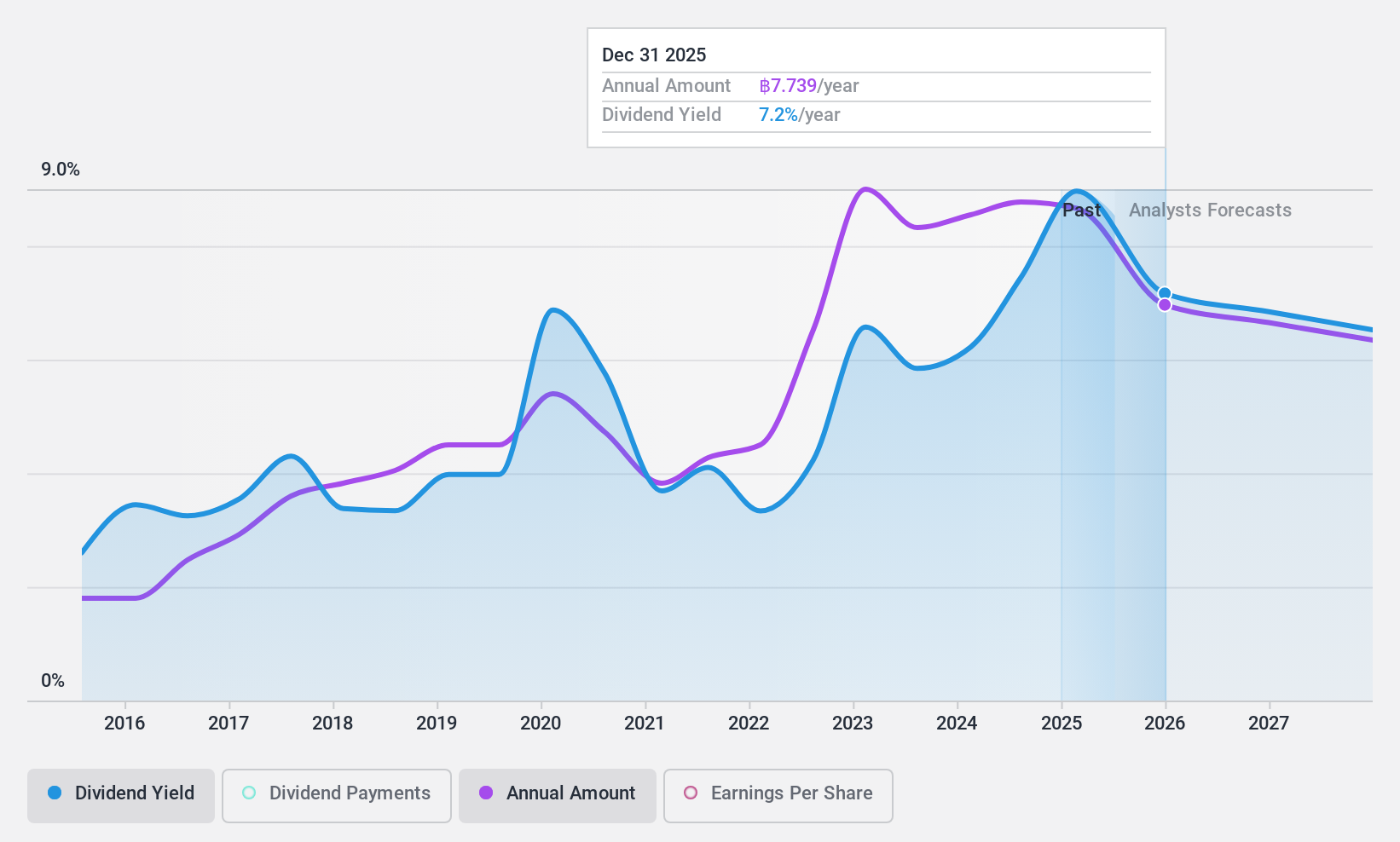

Dividend Yield: 7.2%

PTT Exploration and Production's dividend payments have been volatile over the past decade, with recent proposals indicating a decrease. Despite this instability, dividends are covered by earnings and cash flows, maintaining payout ratios of 53.9% and 49.7%, respectively. The stock trades below its estimated fair value and is considered good relative value compared to peers. Recent earnings showed modest growth in revenue and net income year-over-year, supporting its dividend sustainability for now.

- Click here to discover the nuances of PTT Exploration and Production with our detailed analytical dividend report.

- Our valuation report unveils the possibility PTT Exploration and Production's shares may be trading at a discount.

Techno Ryowa (TSE:1965)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Techno Ryowa Ltd. specializes in the design, construction, and maintenance of environmental control systems primarily in Japan, with a market cap of ¥49.24 billion.

Operations: Techno Ryowa Ltd.'s revenue is primarily derived from its Air Conditioning Sanitary Equipment Construction Business at ¥48.01 billion, followed by General Building Equipment Work at ¥25.11 billion, Electrical Equipment Construction Business at ¥2.62 billion, and Cooling and Heating Equipment Sales Segment at ¥1.20 billion.

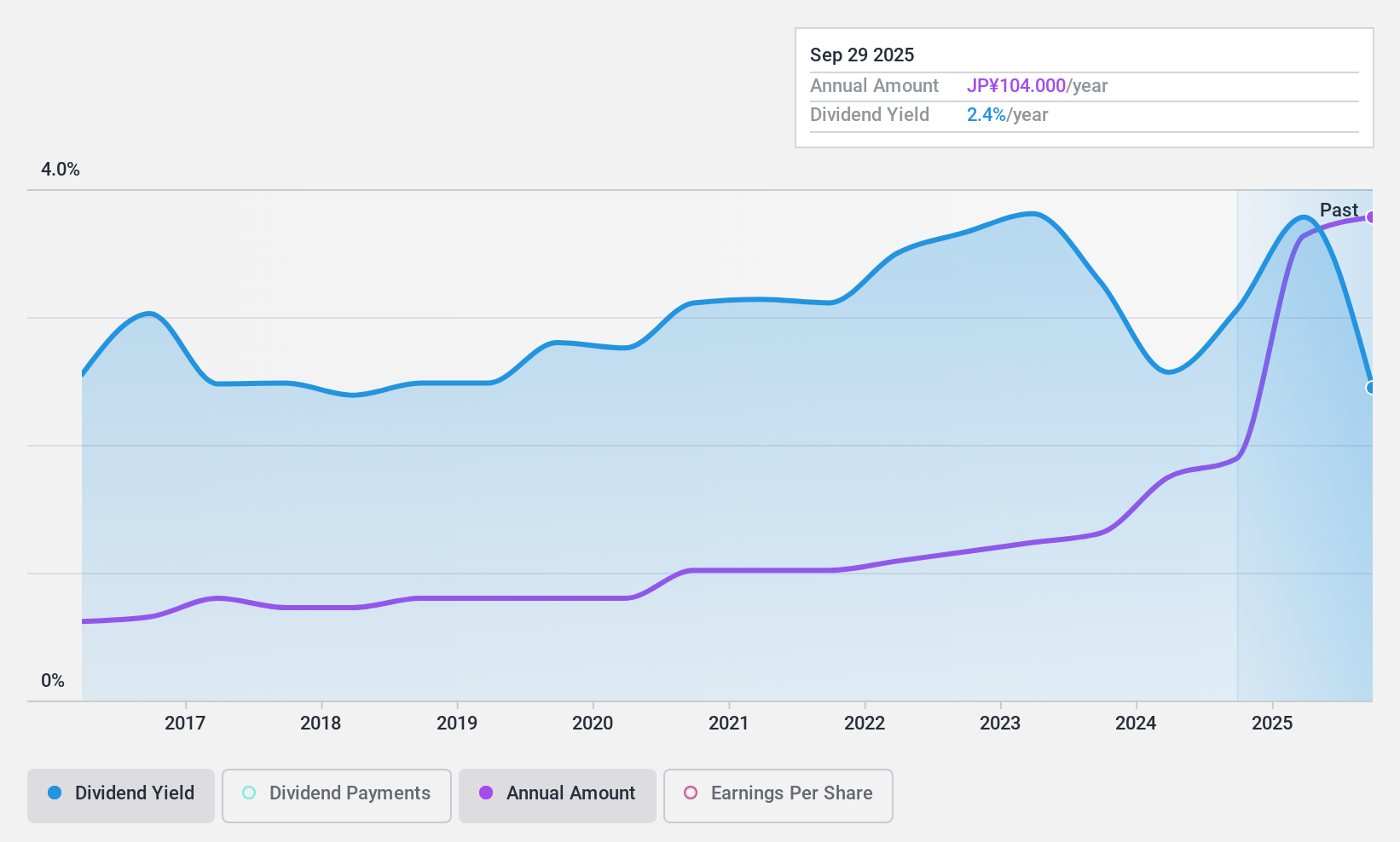

Dividend Yield: 3.9%

Techno Ryowa's dividend yield of 3.88% ranks in the top 25% of the JP market, though its payments have been volatile over the past decade. The payout ratio is modest at 35.1%, suggesting earnings coverage, but dividends are not supported by free cash flow. Despite recent earnings growth of 77.5%, financial sustainability concerns persist due to lack of free cash flows and historical payment instability, impacting long-term reliability for dividend investors.

- Dive into the specifics of Techno Ryowa here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Techno Ryowa shares in the market.

Itochu EnexLtd (TSE:8133)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Itochu Enex Co., Ltd. operates in the sale of petroleum products and liquefied petroleum gas (LPG) both in Japan and internationally, with a market cap of approximately ¥176.05 billion.

Operations: Itochu Enex Co., Ltd.'s revenue is primarily derived from its operations in the sale of petroleum products and liquefied petroleum gas (LPG) across domestic and international markets.

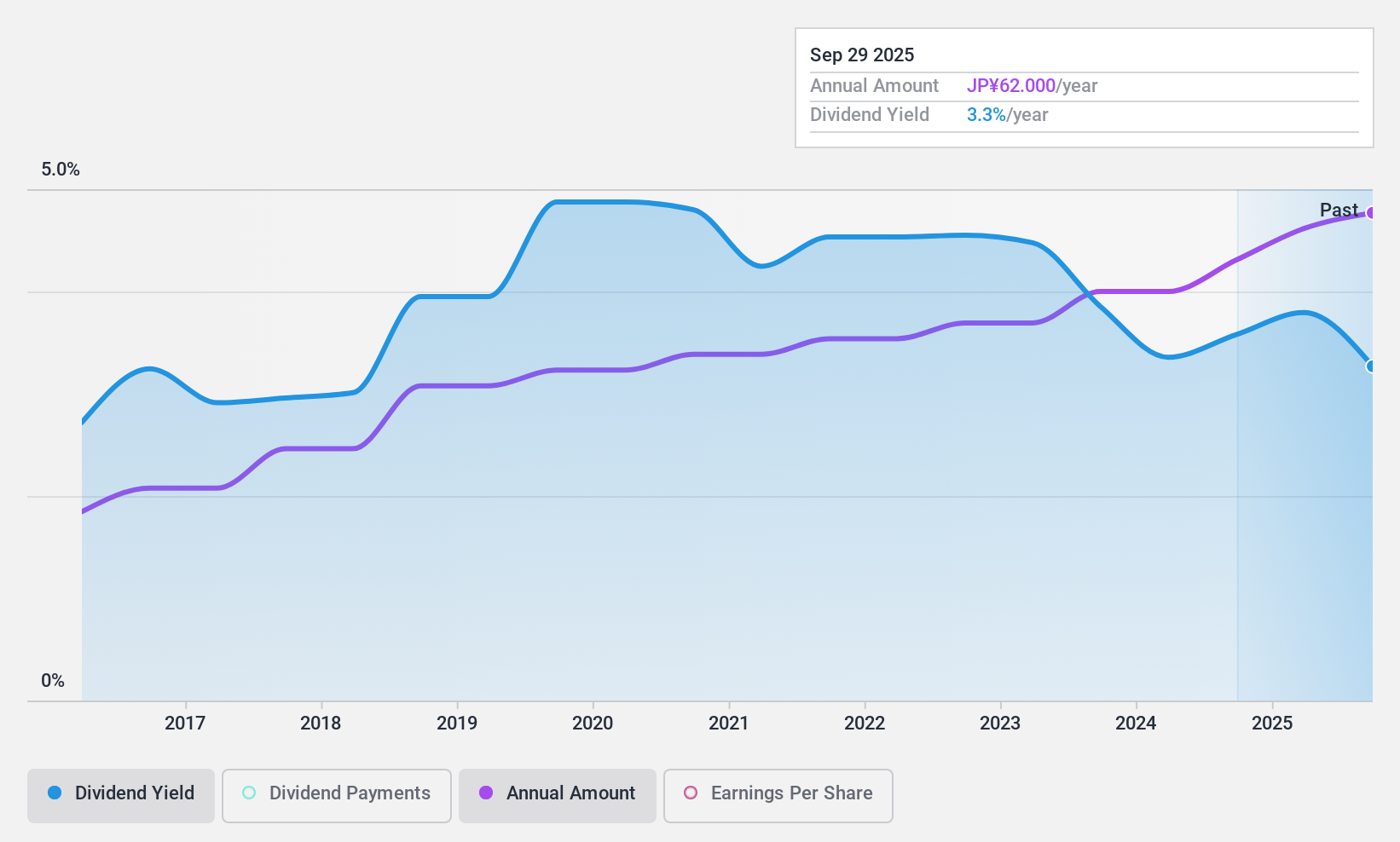

Dividend Yield: 3.5%

Itochu Enex's dividend yield of 3.51% falls short of the top 25% in the JP market, yet it offers stable and reliable payments, increasing over the past decade. The recent dividend hike to ¥28.00 per share underscores its growth trajectory. With a payout ratio of 47.6% and a cash payout ratio of 25.8%, dividends are well-supported by earnings and cash flows, enhancing sustainability for investors seeking consistent income streams amidst undervaluation concerns at current trading levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Itochu EnexLtd.

- Insights from our recent valuation report point to the potential undervaluation of Itochu EnexLtd shares in the market.

Seize The Opportunity

- Click here to access our complete index of 1938 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PTTEP

PTT Exploration and Production

Engages in the exploration, development, and production of petroleum in Thailand and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives