- Japan

- /

- Construction

- /

- TSE:1961

Undiscovered Gems In Japan Featuring Sanki Engineering And Two Promising Small Caps

Reviewed by Simply Wall St

As Japan's stock markets have recently experienced gains, with the Nikkei 225 Index rising by 5.6% and the broader TOPIX Index up by 3.7%, optimism is fueled by China's stimulus measures and a dovish stance from the Bank of Japan. In this dynamic environment, investors may find opportunities in lesser-known stocks that exhibit strong fundamentals and potential for growth, such as Sanki Engineering and two promising small-cap companies.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.89% | 8.95% | 25.43% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.80% | 6.26% | 4.41% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| Mizuho MedyLtd | NA | 19.43% | 34.66% | ★★★★★★ |

| HeadwatersLtd | NA | 19.26% | 23.89% | ★★★★★★ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Sanki Engineering (TSE:1961)

Simply Wall St Value Rating: ★★★★★★

Overview: Sanki Engineering Co., Ltd. operates as a provider of diverse social infrastructure services both in Japan and internationally, with a market capitalization of approximately ¥1.28 trillion.

Operations: Sanki Engineering generates revenue primarily from its Building Equipment Business, which contributes ¥188.59 billion, followed by the Environmental Systems Business at ¥27.60 billion and the Machine System Business at ¥11.20 billion. The Real Estate Business adds a smaller portion with ¥2.50 billion in revenue.

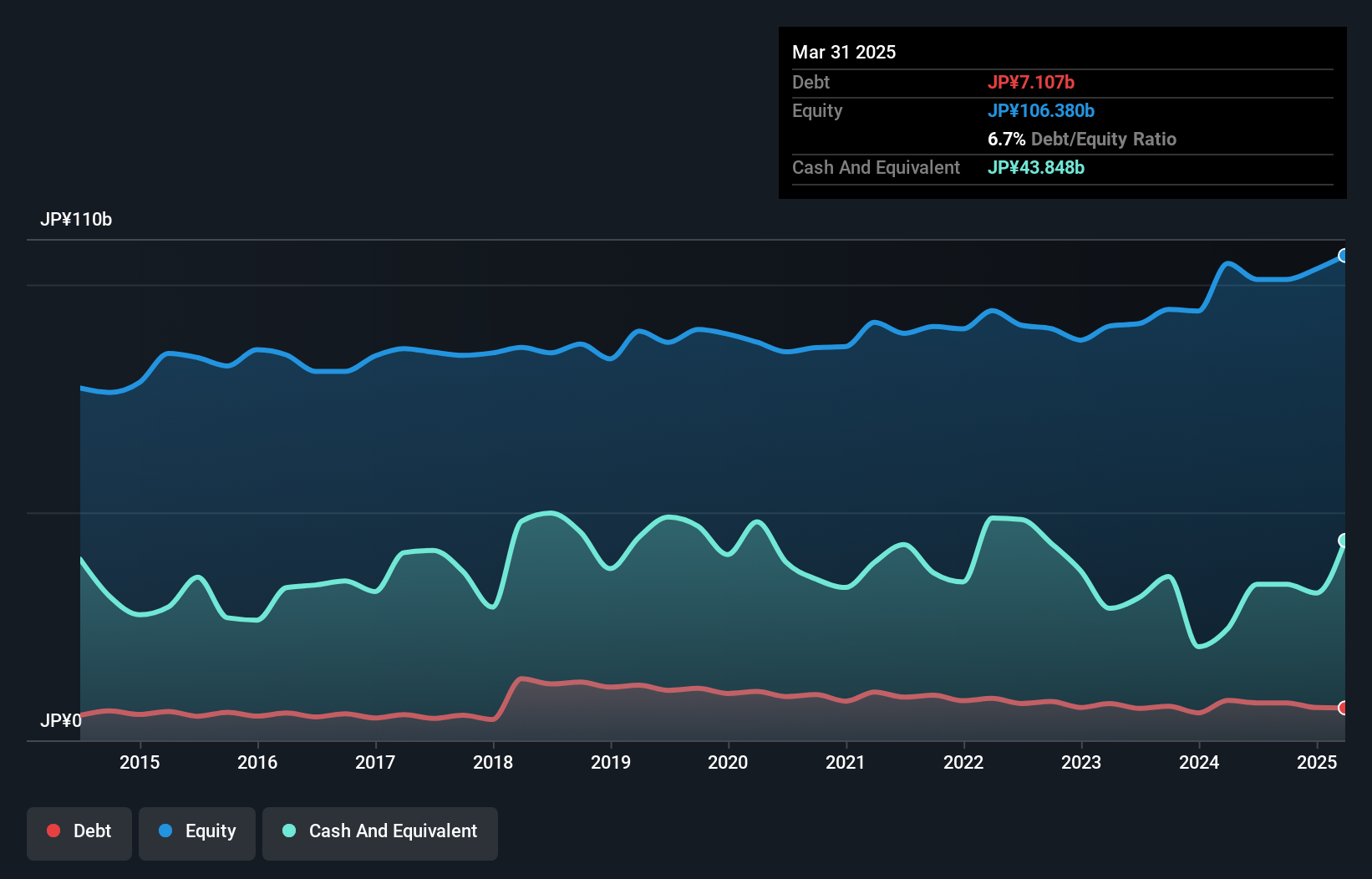

Sanki Engineering, a notable player in Japan's construction sector, has exhibited impressive earnings growth of 73.9% over the past year, outpacing the industry's 26.6%. Trading at nearly 40% below its estimated fair value suggests potential upside for investors. The company repurchased 118,000 shares for ¥262.59 million recently, part of a broader buyback plan aiming to enhance shareholder returns and capital efficiency. With a debt-to-equity ratio reduced from 12.6% to 7.8%, Sanki's financial health seems robust and promising for future growth prospects.

Techno Ryowa (TSE:1965)

Simply Wall St Value Rating: ★★★★★☆

Overview: Techno Ryowa Ltd. specializes in the design, construction, and maintenance of environmental control systems primarily in Japan, with a market cap of ¥43.78 billion.

Operations: Techno Ryowa Ltd. generates significant revenue from its Air Conditioning Hygiene Equipment Construction Business at ¥47.04 billion and General Building Equipment Work at ¥24.41 billion, with smaller contributions from the Electrical Equipment Construction Business and Cooling and Heating Equipment Sales Segment.

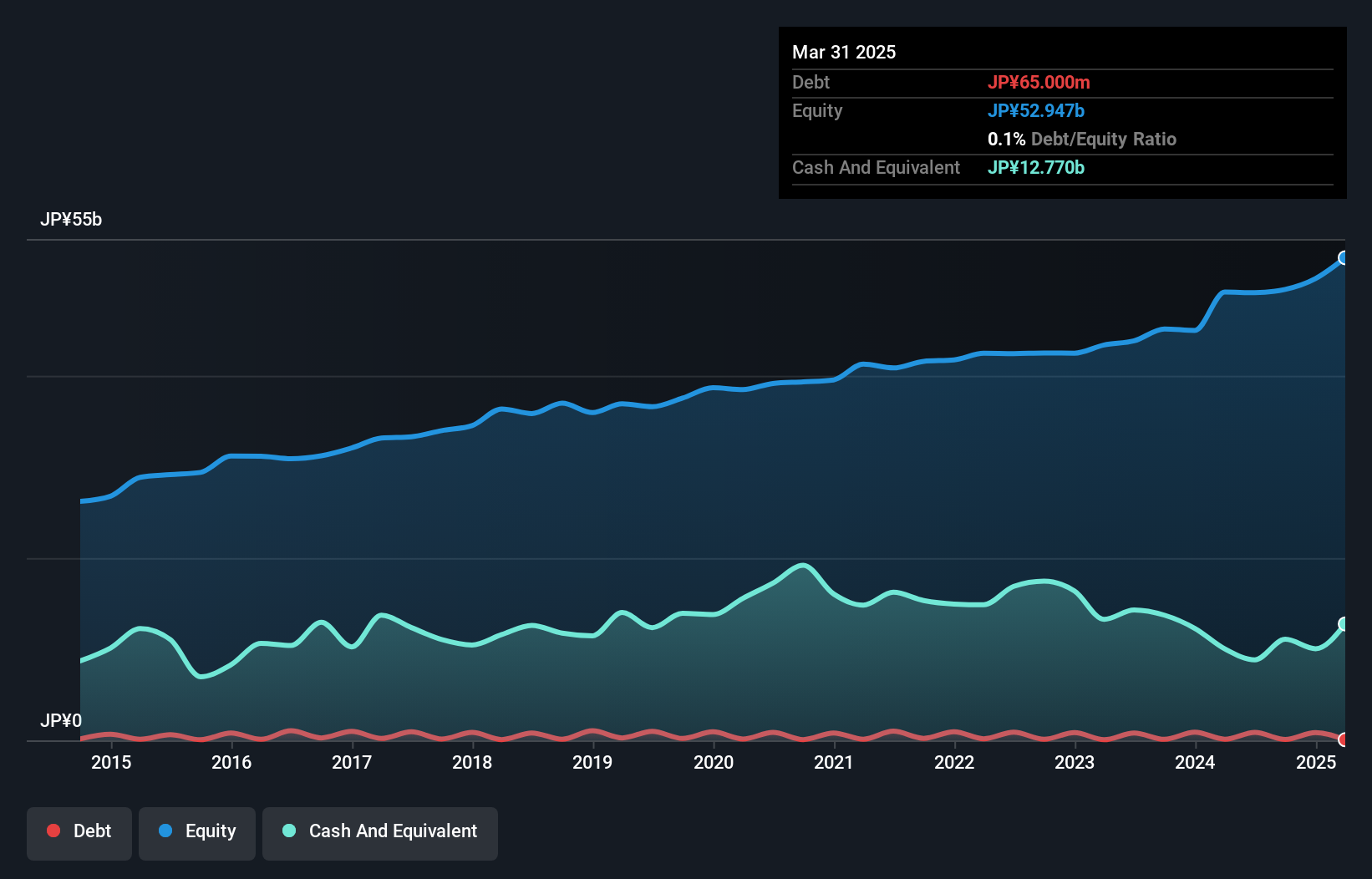

Techno Ryowa, a smaller player in Japan's construction sector, showcases impressive financial health with its earnings growth of 99% outpacing the industry's 26.6%. The company’s debt to equity ratio has improved from 2.7% to 1.8% over five years, highlighting effective debt management. Despite recent share price volatility, Techno Ryowa remains a value proposition with a Price-To-Earnings ratio of 9.5x compared to the JP market's average of 13.5x and was recently added to the S&P Global BMI Index on September 23, enhancing its visibility among investors.

- Unlock comprehensive insights into our analysis of Techno Ryowa stock in this health report.

Gain insights into Techno Ryowa's past trends and performance with our Past report.

MODEC (TSE:6269)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MODEC, Inc. is a general contractor specializing in the engineering, procurement, construction, and installation of floating production systems globally with a market cap of ¥236.68 billion.

Operations: MODEC generates revenue primarily through engineering, procurement, construction, and installation services for floating production systems. The company's financial performance includes a notable net profit margin trend over recent periods.

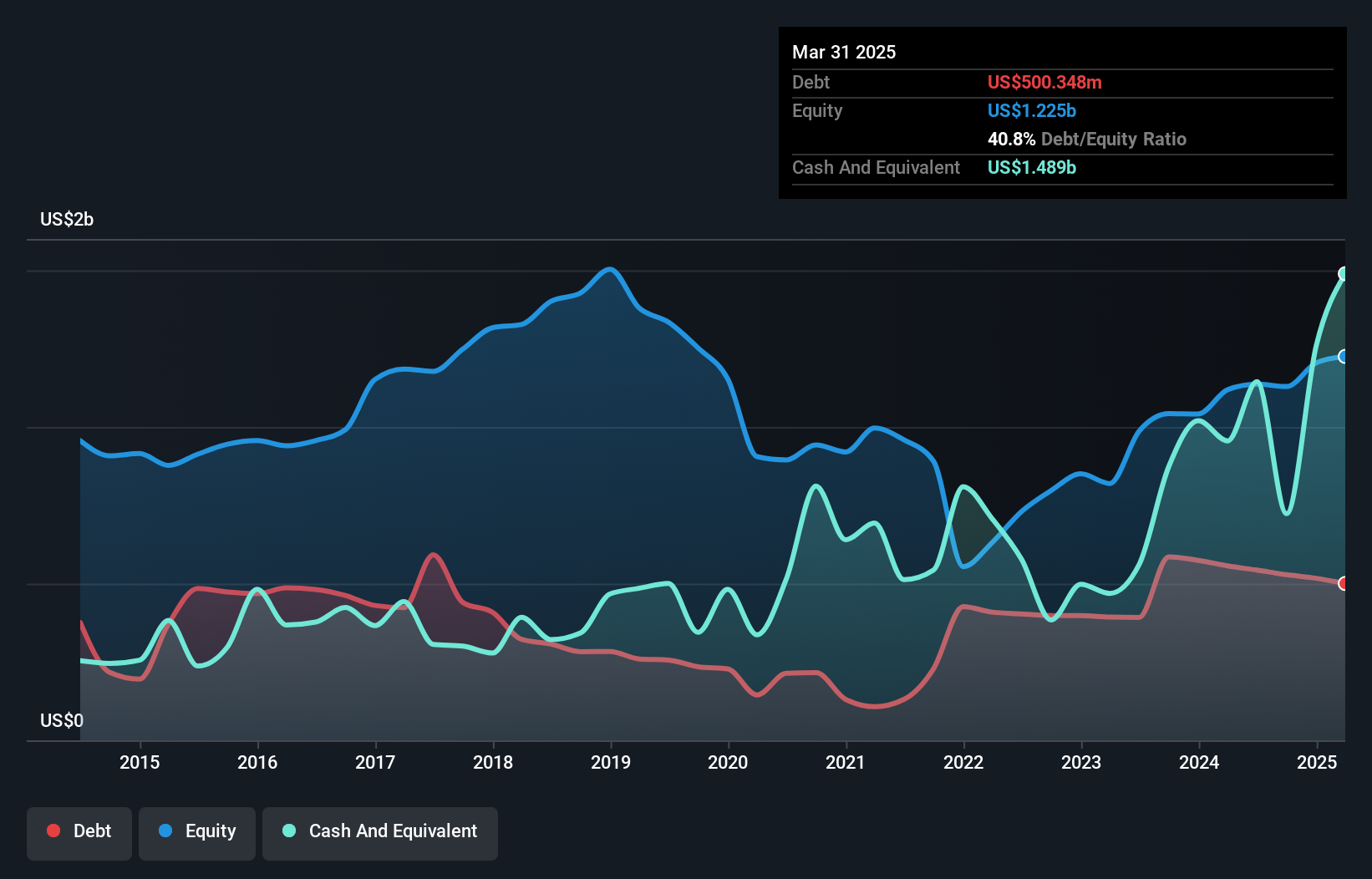

MODEC's recent performance highlights its potential as a promising investment. The company revised its 2024 earnings guidance, projecting revenue of US$4.3 million and operating profit of US$290,000, reflecting an upward adjustment from earlier forecasts. Earnings per share are now expected at US$2.93. Notably, MODEC announced a dividend increase to JPY 30 per share for the fiscal year 2024, up from JPY 10 previously. Despite a volatile share price recently, the firm's earnings grew by an impressive 375% last year.

- Click to explore a detailed breakdown of our findings in MODEC's health report.

Assess MODEC's past performance with our detailed historical performance reports.

Key Takeaways

- Explore the 738 names from our Japanese Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1961

Sanki Engineering

Provides various social infrastructure services in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026