- Japan

- /

- Construction

- /

- TSE:1949

Three Undiscovered Gems In Japan To Enhance Your Portfolio

Reviewed by Simply Wall St

Japan's stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% while the broader TOPIX Index fell by 1.0%. Despite currency headwinds and a revised lower GDP growth, certain small-cap stocks in Japan present unique opportunities for investors. Identifying good stocks often involves looking at companies that can navigate economic fluctuations effectively and offer potential for long-term growth. In this article, we explore three lesser-known Japanese stocks that could enhance your portfolio amidst these market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Togami Electric Mfg | 1.39% | 3.97% | 10.23% | ★★★★★★ |

| Totech | 16.86% | 5.13% | 11.52% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Techno Quartz | 18.64% | 16.15% | 22.17% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| Pharma Foods International | 191.14% | 33.83% | 23.46% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Sumitomo DensetsuLtd (TSE:1949)

Simply Wall St Value Rating: ★★★★★★

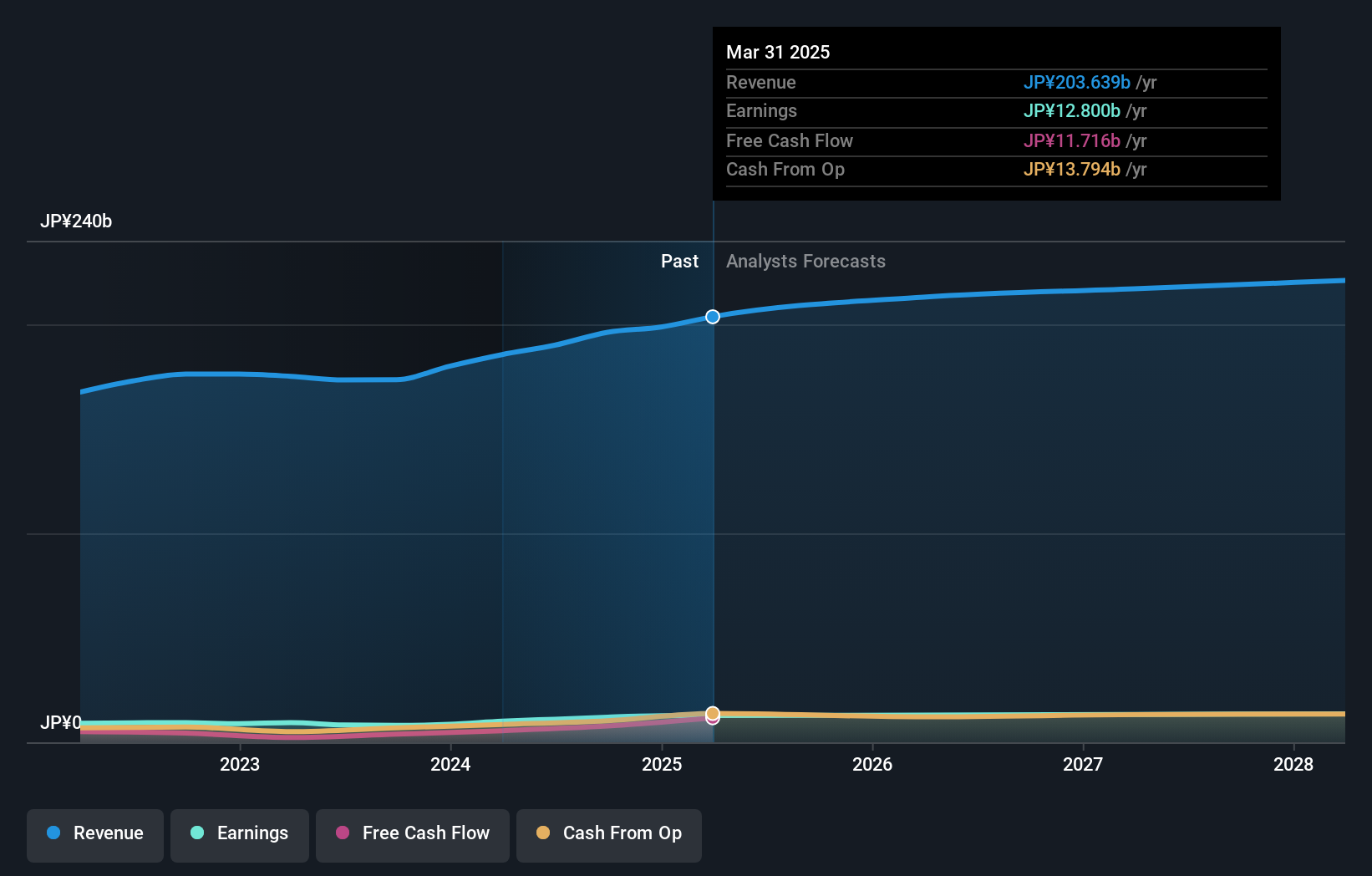

Overview: Sumitomo Densetsu Co., Ltd., along with its subsidiaries, operates as a construction company in Japan and several Southeast Asian countries, with a market cap of ¥137.02 billion.

Operations: Sumitomo Densetsu Co., Ltd. generates revenue primarily from its Utilities Engineering Service segment, which accounts for ¥182.44 billion. The company also reports minor revenue from other segments totaling ¥7.55 billion, with a segment adjustment of -¥0.66 billion.

Sumitomo Densetsu Ltd. has shown robust earnings growth of 33.5% over the past year, outpacing the construction industry's 25.5%. The company's price-to-earnings ratio stands at 12.4x, below Japan's market average of 13.2x, indicating potential value for investors. Additionally, its debt-to-equity ratio has improved from 3.8% to 2% over five years, suggesting better financial health. However, recent shareholder activism by Monex Asset Management was rejected in June's Extraordinary General Meeting.

- Unlock comprehensive insights into our analysis of Sumitomo DensetsuLtd stock in this health report.

GNI Group (TSE:2160)

Simply Wall St Value Rating: ★★★★★☆

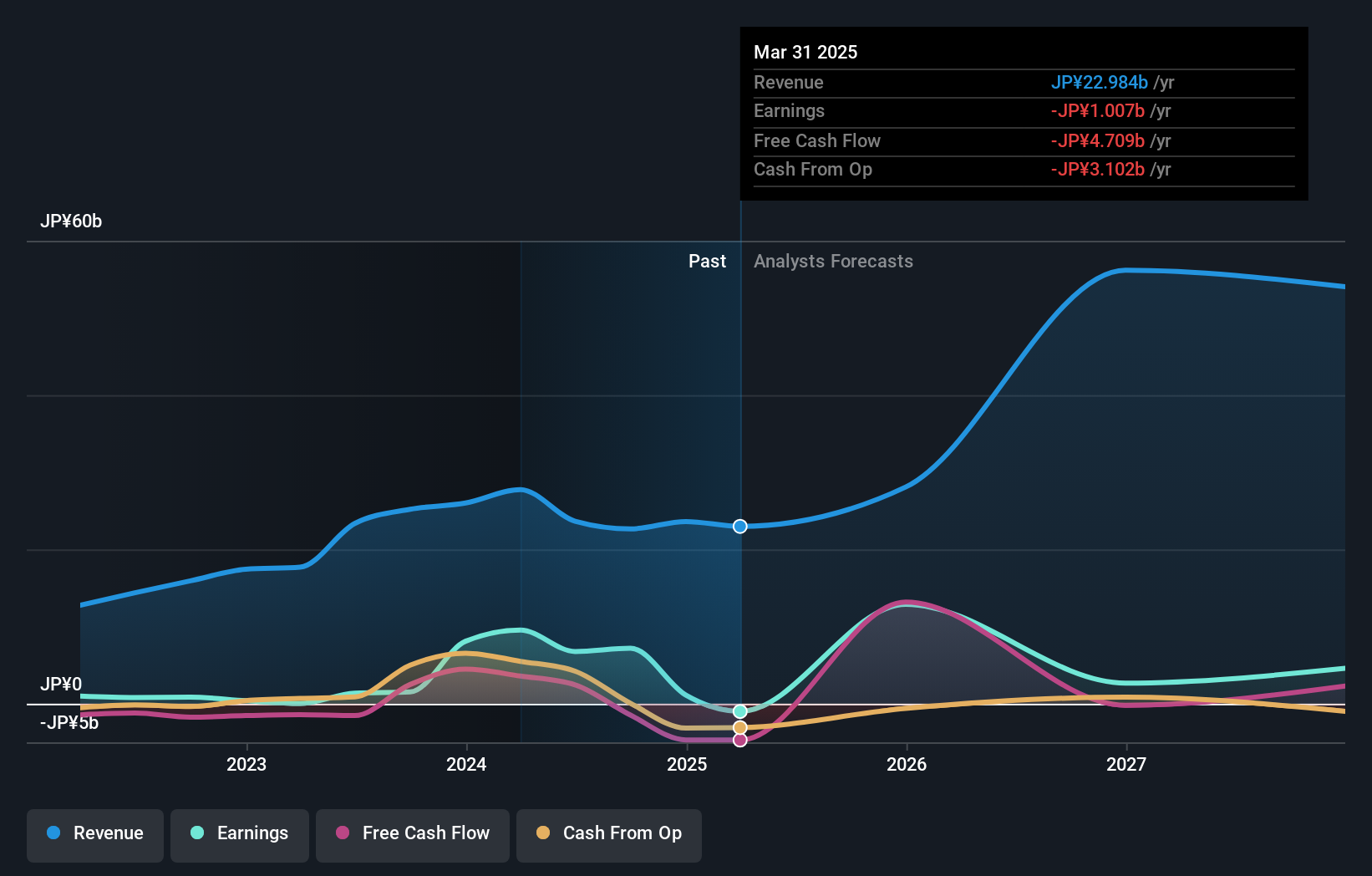

Overview: GNI Group Ltd. engages in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally with a market cap of ¥124.90 billion.

Operations: GNI Group Ltd. generates revenue primarily from its pharmaceutical segment, which accounts for ¥19.35 billion, and its medical device segment contributing ¥4.30 billion. The company has a market cap of ¥124.90 billion.

GNI Group's recent approval for Avatrombopag Maleate Tablets in China marks a significant milestone, adding to its portfolio alongside ETUARY and Nintedanib. The company has seen earnings growth of 393.9% over the past year, outpacing the biotechs industry at 172.6%. Despite high volatility in share price recently, GNI's debt-to-equity ratio improved from 16.8 to 13.8 over five years, and it holds more cash than total debt, indicating sound financial health.

- Click to explore a detailed breakdown of our findings in GNI Group's health report.

Gain insights into GNI Group's historical performance by reviewing our past performance report.

Access (TSE:4813)

Simply Wall St Value Rating: ★★★★★★

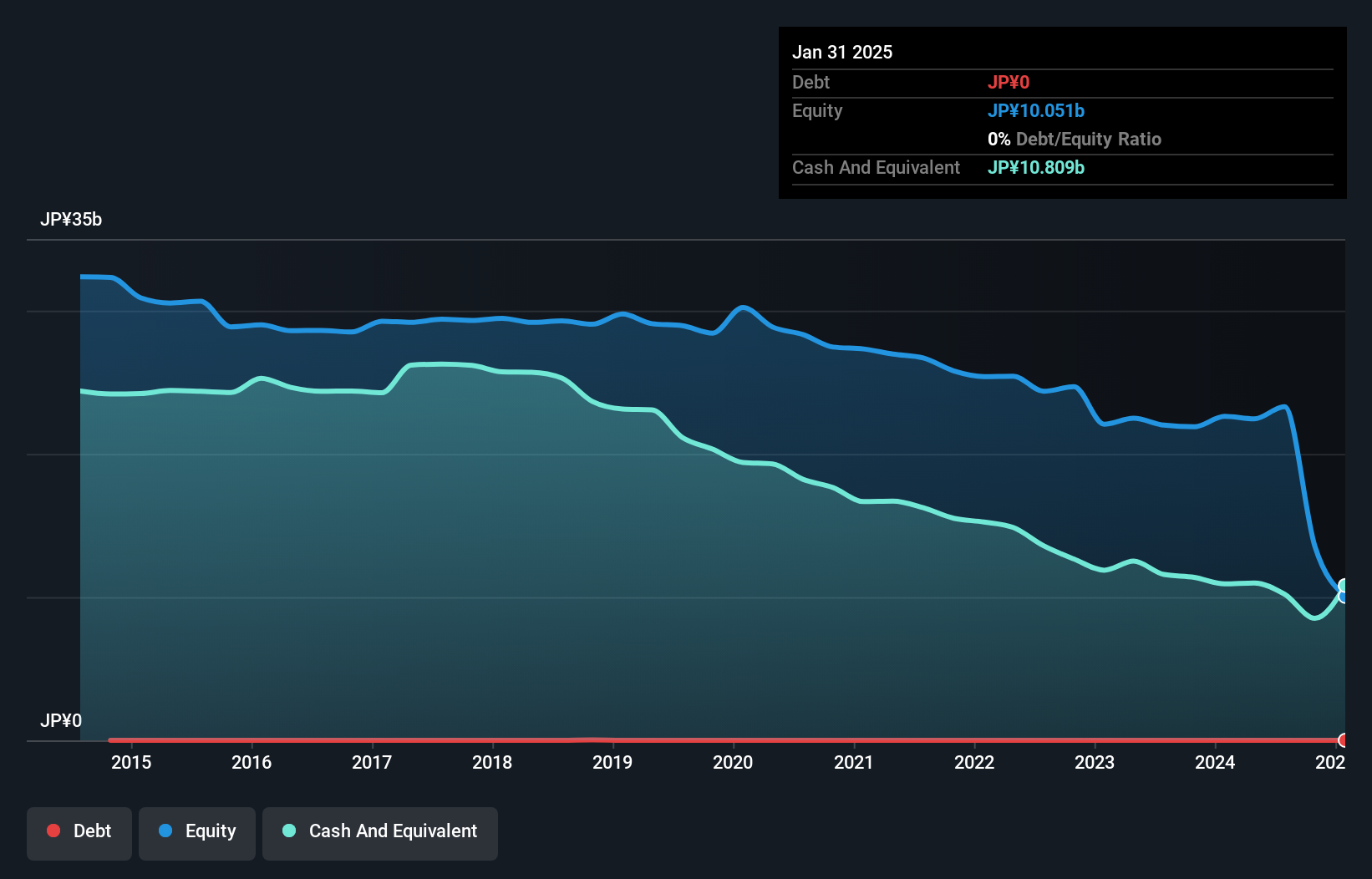

Overview: Access Co., Ltd. develops mobile and network software technologies for various industries globally, including telecom, consumer electronics, automotive, and energy infrastructure sectors, with a market cap of ¥65.51 billion.

Operations: Access Co., Ltd. generates revenue primarily from its IoT Business (¥5.54 billion), Network Business (¥10.37 billion), and Web Platform Business (¥2.07 billion). The company’s total revenue is significantly driven by the Network Business segment, contributing a substantial portion of the overall earnings.

Access Co., Ltd. has shown impressive progress, becoming profitable this year with no debt on its balance sheet. The company reported a levered free cash flow of -A$1.73 million as of July 2024, indicating some challenges in cash management. Despite highly volatile share prices over the past three months, Access boasts high-quality earnings and a net working capital increase to A$2.19 million in September 2024, suggesting improved operational efficiency.

Make It Happen

- Click this link to deep-dive into the 754 companies within our Japanese Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1949

Sumitomo DensetsuLtd

Operates as a construction company in Japan, Indonesia, Thailand, Cambodia, Myanmar, the Philippines, China, and Malaysia.

Flawless balance sheet with solid track record and pays a dividend.