- Japan

- /

- Food and Staples Retail

- /

- TSE:9869

3 Undiscovered Gems With Potential On None Exchange

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of geopolitical developments and economic shifts, major indices like the S&P 500 have reached record highs, buoyed by optimism surrounding trade policies and advancements in artificial intelligence. Amid this backdrop, small-cap stocks have been somewhat overshadowed by their larger counterparts, despite potential opportunities within this segment for discerning investors seeking growth in under-the-radar companies. In the current market environment, a good stock often exhibits resilience and adaptability to changing economic conditions while operating within sectors poised for innovation or recovery. These characteristics can be particularly appealing when exploring lesser-known stocks that may offer unique value propositions not yet fully recognized by broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tien Phong Plastic | 40.41% | 4.32% | 8.11% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Danang Port | 23.72% | 10.58% | 9.22% | ★★★★★☆ |

| An Phat Bioplastics | 62.46% | 9.85% | 4.38% | ★★★★★☆ |

| Krishana Phoschem | 109.80% | 43.94% | 26.30% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

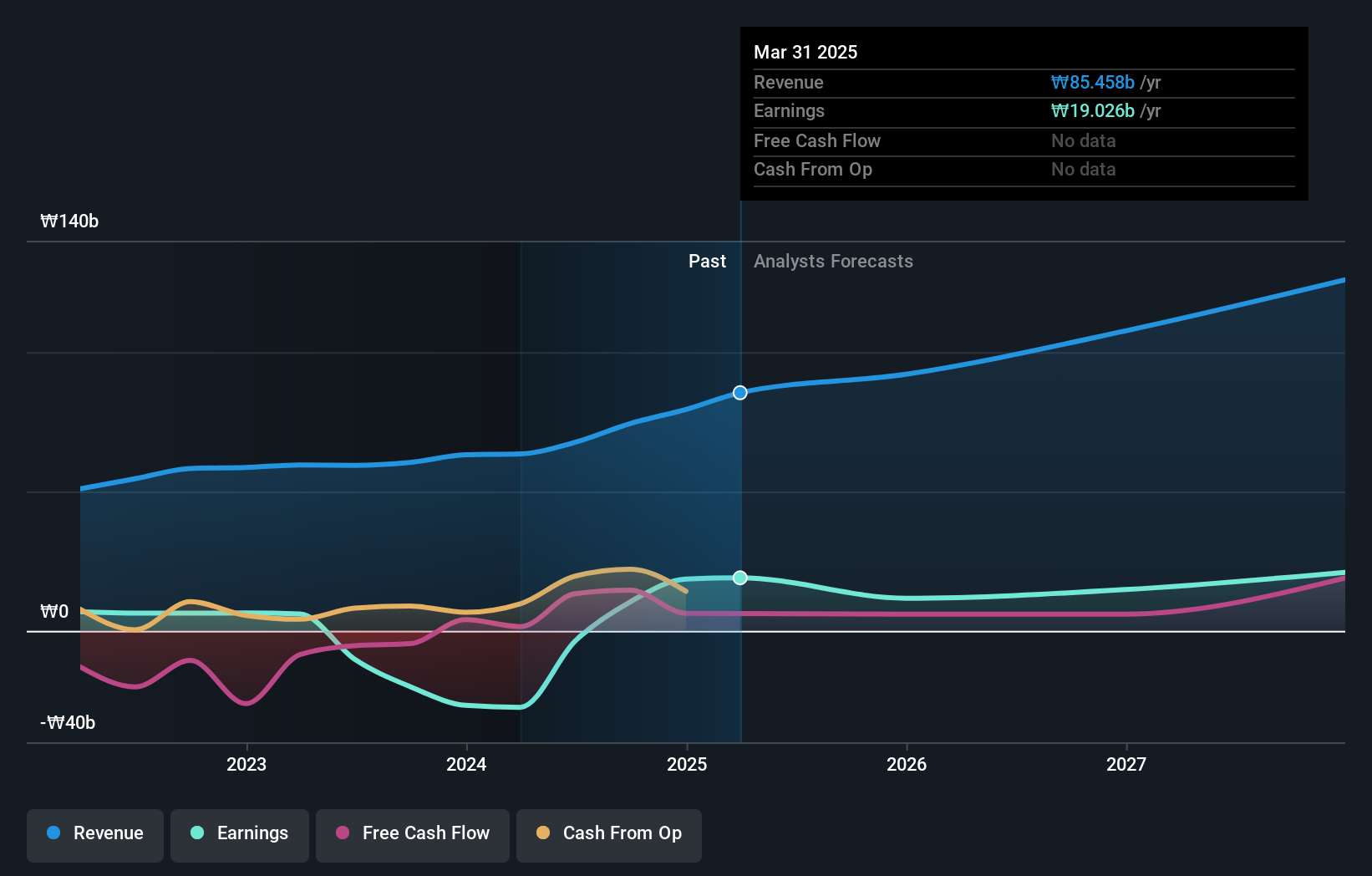

EMRO (KOSDAQ:A058970)

Simply Wall St Value Rating: ★★★★★★

Overview: EMRO, Incorporated offers supply chain management software solutions both in South Korea and internationally, with a market capitalization of approximately ₩804.73 billion.

Operations: EMRO's revenue primarily comes from cattle sales, totaling approximately ₩74.43 billion.

EMRO, a promising player in the tech industry, has recently turned profitable, setting it apart from the broader Software sector which saw a 3.8% earnings dip. With no debt on its books for over five years and high-quality past earnings, EMRO stands on solid ground. The company’s free cash flow turned positive this year at US$14.57 million as of September 2024, indicating robust financial health despite significant capital expenditures of US$4.94 million in January 2025. Earnings are projected to grow annually by 6%, suggesting potential for sustained future growth within its market niche.

- Delve into the full analysis health report here for a deeper understanding of EMRO.

Understand EMRO's track record by examining our Past report.

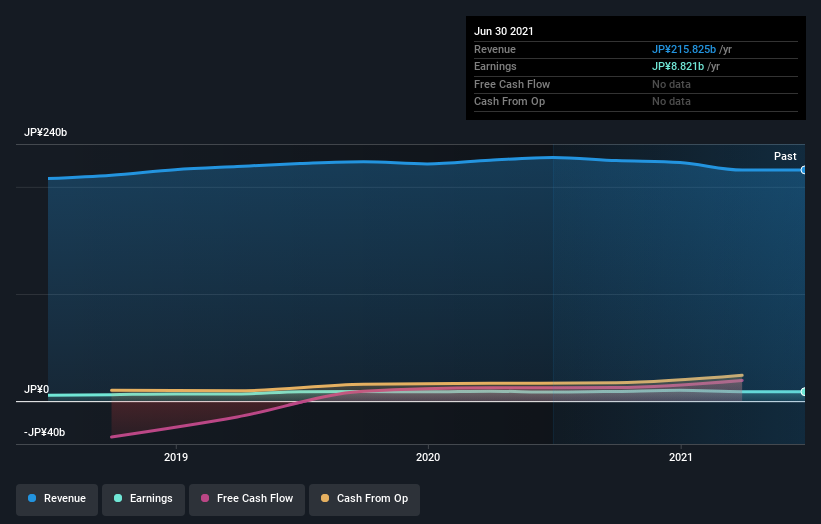

Toenec (TSE:1946)

Simply Wall St Value Rating: ★★★★★★

Overview: Toenec Corporation is an integrated facility company involved in the construction and enhancement of social infrastructure across the energy, environment, and information technology sectors in Japan, with a market cap of ¥93.17 billion.

Operations: Toenec generates revenue primarily from its Equipment Engineering Business, excluding energy, which accounts for ¥242.16 billion, and the Energy Business segment contributing ¥12.65 billion.

Earnings for Toenec have surged by 43.8% over the past year, outpacing the construction industry's growth of 20.7%. Despite a 15.8% annual decline in earnings over five years, recent performance highlights its potential as an undervalued player, trading at 73.5% below estimated fair value. The company's interest payments are well-covered with EBIT at a robust 10.7 times coverage, indicating financial stability and sound debt management with a net debt to equity ratio of just 3.6%. This suggests that Toenec is positioned for potential growth amid its current valuation gap and strong earnings momentum.

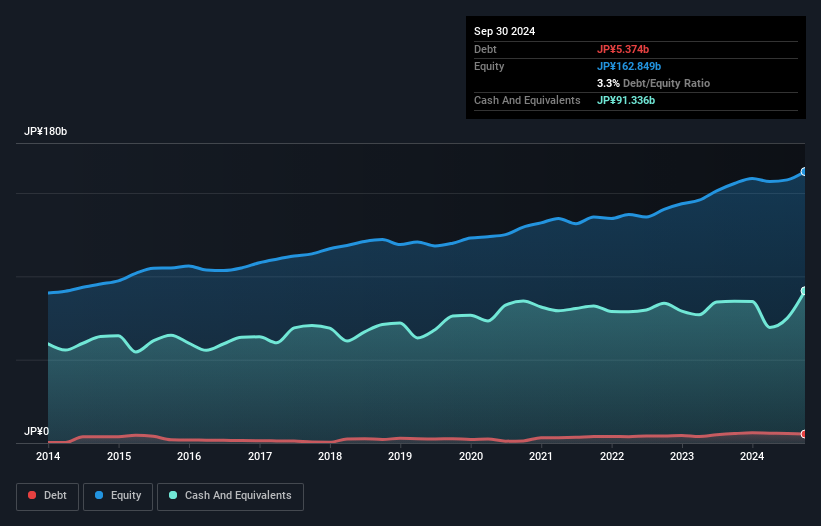

Kato Sangyo (TSE:9869)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kato Sangyo Co., Ltd. operates as a general food wholesaler both in Japan and internationally, with a market capitalization of ¥135.21 billion.

Operations: Kato Sangyo generates revenue primarily from its Room Temperature Distribution Business, which accounts for ¥717.02 billion, followed by the Liquor Logistic Business at ¥245.21 billion. The Low Temperature Logistic Business contributes ¥114.36 billion to the overall revenue stream.

Kato Sangyo, a small cap player in the consumer retailing sector, is showcasing promising financial health. The company is trading at 87.2% below its estimated fair value, suggesting potential undervaluation. Earnings have surged by 20.5% over the past year, outpacing the industry average of 11.5%. However, a notable ¥4.6 billion one-off gain has skewed recent results, which investors should consider when evaluating earnings quality. Despite an increase in debt to equity from 2.1 to 3.3 over five years, Kato Sangyo's cash exceeds total debt and interest coverage remains robust, indicating solid financial footing for future growth prospects.

- Click to explore a detailed breakdown of our findings in Kato Sangyo's health report.

Gain insights into Kato Sangyo's past trends and performance with our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 4684 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kato Sangyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9869

Kato Sangyo

Engages in the general food wholesaling business in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives