- Japan

- /

- Construction

- /

- TSE:1942

Kandenko (TSE:1942): Evaluating Valuation After a Sustained Uptrend in Share Price

Reviewed by Simply Wall St

Price-to-Earnings of 17.5x: Is it justified?

KandenkoLtd is currently trading at a price-to-earnings (P/E) ratio of 17.5x, which makes it more expensive than the Japanese construction industry average of 12.7x and also higher than the fair estimated P/E ratio of 16.3x.

The P/E ratio compares a company's current share price to its per-share earnings. It is commonly used to gauge whether a stock is fairly valued, undervalued, or overvalued compared to peers or the wider industry. For capital goods companies such as KandenkoLtd, this metric offers insight into how the market is pricing in earnings growth and underlying profitability.

Given KandenkoLtd's higher P/E versus industry and fair benchmarks, the market appears to be expecting stronger growth or a higher quality of earnings than most peers. Investors should consider whether such optimism is warranted by the company's forward earnings prospects and recent financial performance, or if expectations have run ahead of fundamentals.

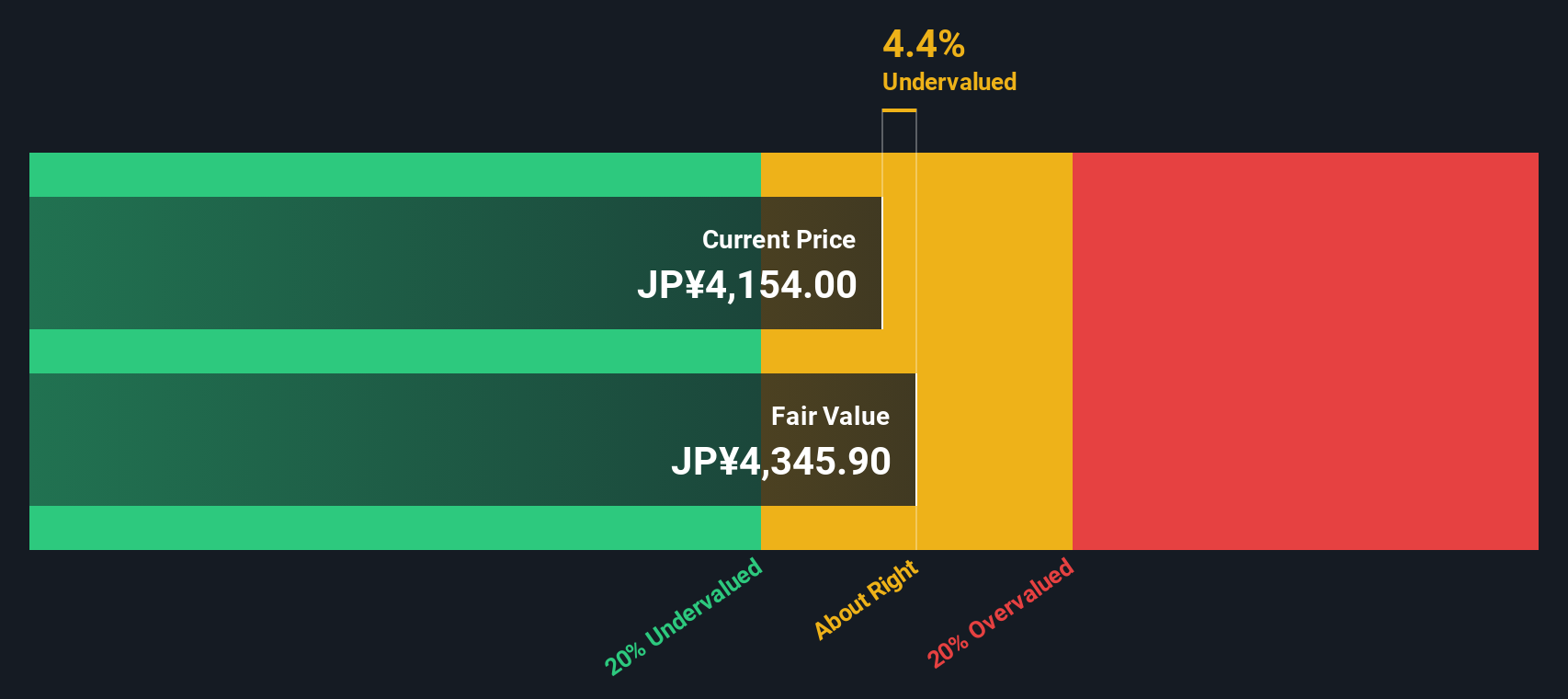

Result: Fair Value of ¥4,360 (OVERVALUED)

See our latest analysis for KandenkoLtd.However, potential shortfalls in expected earnings growth or broader market volatility could challenge the optimism reflected in KandenkoLtd’s current valuation.

Find out about the key risks to this KandenkoLtd narrative.Another View: What Does the DCF Model Indicate?

Looking at KandenkoLtd through the lens of our SWS DCF model presents a different perspective. This method currently suggests the shares are undervalued, which challenges the higher valuation implied by earnings multiples. Which approach has it right, and what could shift the balance?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own KandenkoLtd Narrative

If you see the story differently or prefer to conduct your own research, you can easily form a personal view in just a few minutes, starting today. Do it your way

A great starting point for your KandenkoLtd research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More High-Potential Opportunities?

Don't let your next smart investment slip by. Power up your watchlist with fresh ideas from across the market, handpicked to help you move ahead.

- Zero in on under-the-radar opportunities by scanning for penny stocks with strong financials with solid financials and growth potential that many investors overlook.

- Tap into the AI revolution by finding AI penny stocks leading innovations in automation, analytics, and intelligent software.

- Maximize your returns by focusing on dividend stocks with yields > 3% that offer attractive yields and reliable income for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KandenkoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1942

KandenkoLtd

Engages in electrical and piping work, and other facility construction work in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives