- Japan

- /

- Construction

- /

- TSE:1941

Chudenko (TSE:1941): Examining Valuation After Upgraded Earnings Outlook and Higher Interim Dividend

Reviewed by Simply Wall St

Chudenko (TSE:1941) just updated its earnings outlook for the fiscal year ending March 2026 and announced a higher interim dividend compared to last year. This provides investors with clear signals about the company’s direction.

See our latest analysis for Chudenko.

Chudenko’s upbeat guidance and higher interim dividend have caught the market’s attention, with the stock delivering a 30.2% share price return year-to-date and a remarkable 132.5% total shareholder return over three years. This momentum appears to be building as a result of these positive signals, reflecting renewed confidence in the business and its long-term growth potential.

If strong company momentum like this stands out to you, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares up strongly and Chudenko signaling further growth, investors are left to consider whether the current momentum leaves any value on the table or if the market has already priced in the company’s future prospects.

Price-to-Earnings of 10.9x: Is it justified?

Compared to the industry, Chudenko's shares trade at a price-to-earnings (P/E) ratio of 10.9x based on the last close. This is below both its industry and peer averages, suggesting the market may currently be underestimating its earnings power relative to other construction companies.

The price-to-earnings ratio measures how much investors are paying for each yen of earnings. In capital goods sectors, this metric often highlights market expectations for future growth or profitability and is a widely used yardstick for value.

Chudenko's P/E stands at 10.9x, which is notably lower than the JP Construction industry's 12.3x and well below the peer average of 16.1x. This positions Chudenko as good value relative to both and could signal room for the price to move higher if its earnings stay robust or continue to rise.

While there is not enough data to establish a fair value P/E ratio for Chudenko, the current discount to peers is significant and suggests potential for re-rating.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10.9x (UNDERVALUED)

However, stagnant revenue or unexpected shifts in the construction sector could easily dampen Chudenko's outlook. Investors should remain vigilant.

Find out about the key risks to this Chudenko narrative.

Another View: SWS DCF Model Offers a Different Perspective

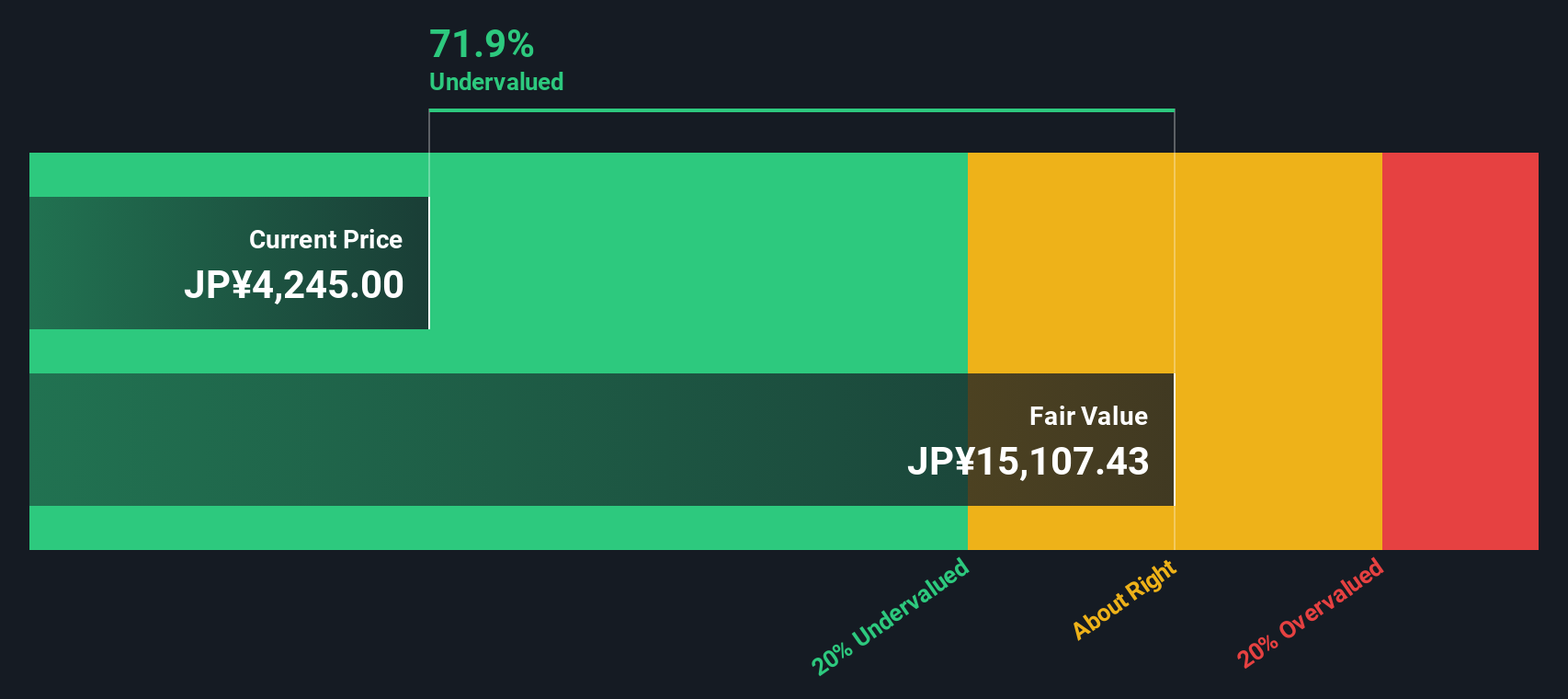

While Chudenko looks undervalued using its price-to-earnings ratio, our SWS DCF model paints an even starker picture. The stock trades at a hefty 71.5% discount to our fair value estimate, highlighting a potentially overlooked opportunity. But does this divergence signal upside or a hidden risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Chudenko for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Chudenko Narrative

If you want to take an independent approach or have your own perspective on Chudenko, you can quickly create your own analysis in just a few minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Chudenko.

Looking for more investment ideas?

Make your next smart move by searching the market’s brightest spots. These hand-picked stock ideas could open up new long-term opportunities for your portfolio.

- Uncover high-potential brands in fast-growing healthcare technology by checking out these 31 healthcare AI stocks, which are transforming patient care with AI-powered innovation.

- Capture reliable income streams by seeking out these 15 dividend stocks with yields > 3% and watch your investments work harder with consistent yields above 3%.

- Position yourself at the forefront of digital finance by selecting these 82 cryptocurrency and blockchain stocks, which are driving advancements in blockchain adoption and cryptocurrency integration.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1941

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives