The Market Doesn't Like What It Sees From Nippon Dry-Chemical Co., Ltd.'s (TSE:1909) Earnings Yet As Shares Tumble 26%

Nippon Dry-Chemical Co., Ltd. (TSE:1909) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 23%.

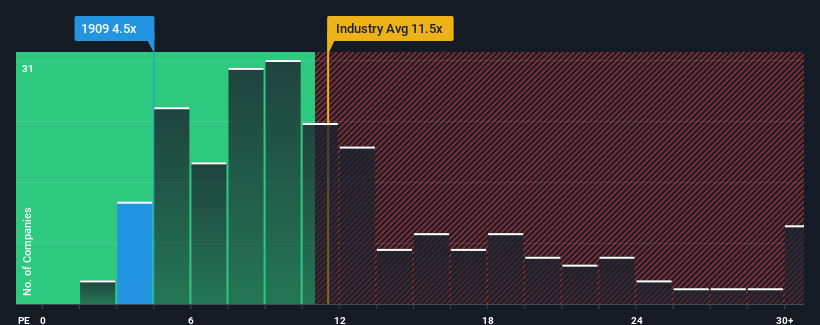

Even after such a large drop in price, Nippon Dry-Chemical may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.5x, since almost half of all companies in Japan have P/E ratios greater than 14x and even P/E's higher than 21x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's superior to most other companies of late, Nippon Dry-Chemical has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Nippon Dry-Chemical

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Nippon Dry-Chemical's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 31% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 49% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings growth is heading into negative territory, declining 7.0% over the next year. With the market predicted to deliver 9.8% growth , that's a disappointing outcome.

In light of this, it's understandable that Nippon Dry-Chemical's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Nippon Dry-Chemical's P/E looks about as weak as its stock price lately. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Nippon Dry-Chemical's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for Nippon Dry-Chemical you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

If you're looking to trade Nippon Dry-Chemical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nippon Dry-Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1909

Nippon Dry-Chemical

Engages in the design, manufacture, and sale of fire extinguishing equipment, fire engines, security systems, etc.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives