- Japan

- /

- Construction

- /

- TSE:1888

These 4 Measures Indicate That Wakachiku Construction (TSE:1888) Is Using Debt Safely

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Wakachiku Construction Co., Ltd. (TSE:1888) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Wakachiku Construction

What Is Wakachiku Construction's Net Debt?

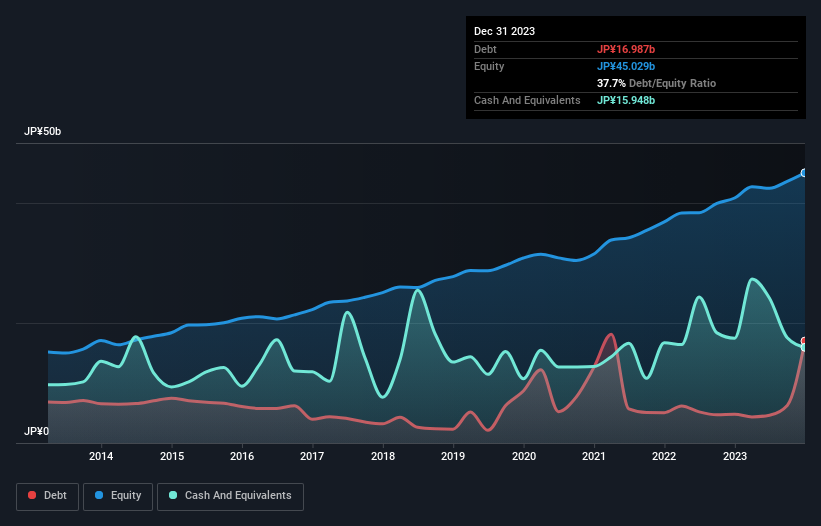

The image below, which you can click on for greater detail, shows that at December 2023 Wakachiku Construction had debt of JP¥17.0b, up from JP¥4.80b in one year. However, it also had JP¥15.9b in cash, and so its net debt is JP¥1.04b.

How Strong Is Wakachiku Construction's Balance Sheet?

According to the last reported balance sheet, Wakachiku Construction had liabilities of JP¥46.3b due within 12 months, and liabilities of JP¥5.91b due beyond 12 months. Offsetting these obligations, it had cash of JP¥15.9b as well as receivables valued at JP¥47.5b due within 12 months. So it can boast JP¥11.2b more liquid assets than total liabilities.

This surplus suggests that Wakachiku Construction is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Wakachiku Construction has net debt of just 0.15 times EBITDA, suggesting it could ramp leverage without breaking a sweat. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. On the other hand, Wakachiku Construction saw its EBIT drop by 6.7% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. There's no doubt that we learn most about debt from the balance sheet. But it is Wakachiku Construction's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Wakachiku Construction generated free cash flow amounting to a very robust 94% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

Wakachiku Construction's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its EBIT growth rate does undermine this impression a bit. Considering this range of factors, it seems to us that Wakachiku Construction is quite prudent with its debt, and the risks seem well managed. So we're not worried about the use of a little leverage on the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 1 warning sign for Wakachiku Construction that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Wakachiku Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1888

Wakachiku Construction

Engages in construction and real estate businesses.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives