- Japan

- /

- Construction

- /

- TSE:1887

JDC (TSE:1887) Returns to Profit, Valuation Surges Above Sector Norms

Reviewed by Simply Wall St

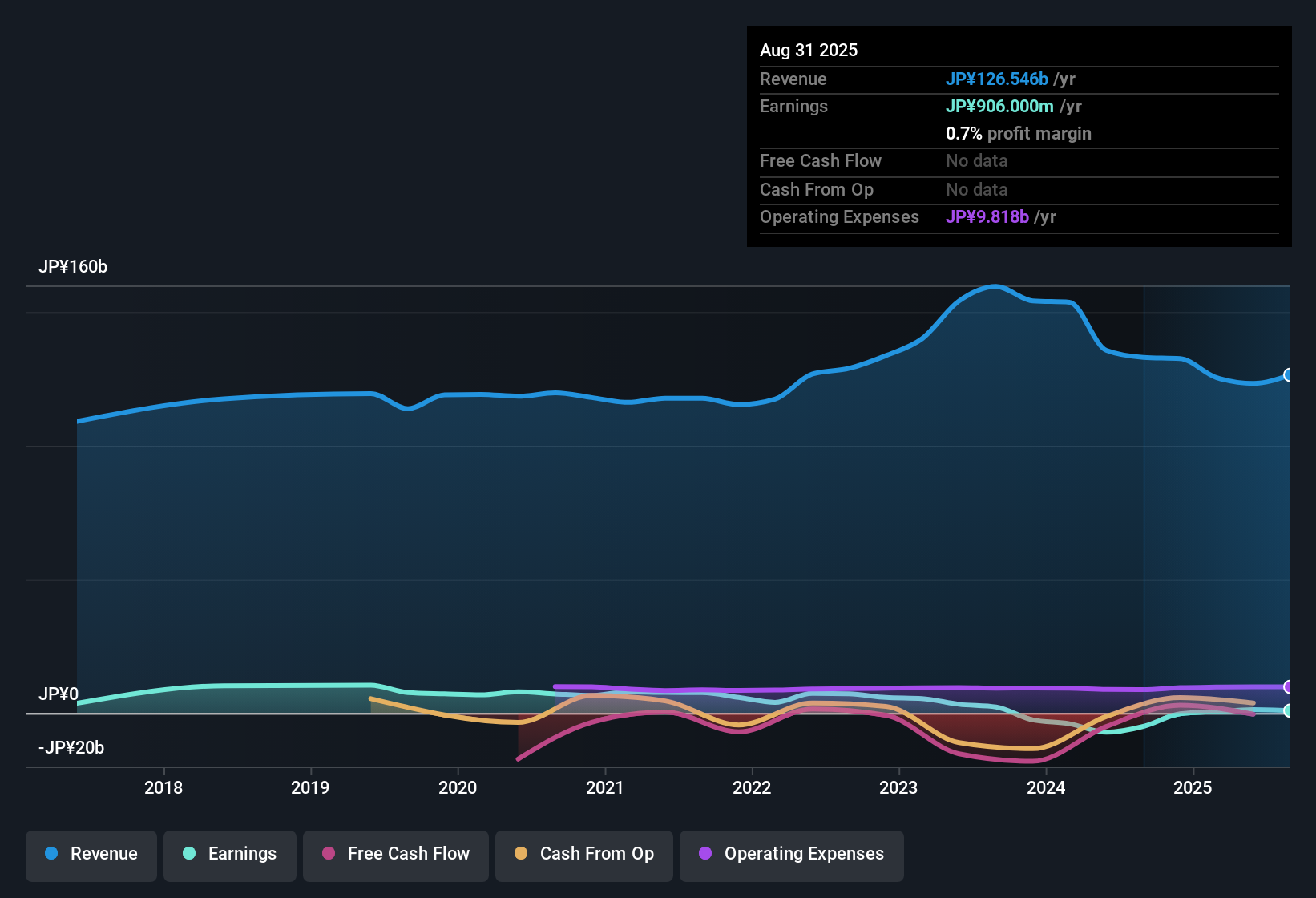

JDC (TSE:1887) returned to profitability over the past year after weathering five years of steep earnings declines averaging 47.9% annually. Its net profit margin also improved, according to the latest statements. Despite management emphasizing the quality of the turnaround, JDC now trades at a price-to-earnings ratio of 46.1x, which is far above both the Japanese construction industry average of 12.2x and direct peers at 10.6x. Shares are trading above the estimated fair value of ¥36.11. With ongoing questions around the sustainability of its dividend and the outlook for further earnings growth, investors are weighing the significance of this recent improvement against the stock's premium valuation and historical volatility.

See our full analysis for JDC.The next section puts these results side by side with the most common narratives shaping market sentiment, highlighting where the story matches up and where it might surprise investors.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Signals Upturn

- JDC’s latest filings confirm an improved net profit margin, underscoring a return to profitability after five consecutive years of steep annual declines averaging 47.9% per year.

- This development supports the bullish case that the turnaround in profitability is high quality and could mark the start of a new earnings phase for JDC.

- Bulls highlight that management has emphasized the improved margin as sustainable, a noteworthy point after such a prolonged period of earnings decline.

- This trend, following severe multi-year contractions, strengthens optimism about operational improvements driving future stability.

Dividend Fragility Remains a Core Risk

- Despite the profitability shift, the sustainability of JDC’s dividend is in question since management’s own commentary has not fully assured continued growth or stability in dividend distributions.

- This situation challenges the bearish concern that the upturn is superficial by indicating that, while profitability has returned, key risks highlighted in filings focus on the durability of growth and income.

- Bears point to continued uncertainty about whether the recent profit margin expansion can reliably fund payouts going forward.

- While historical declines amplify concern, the filing only partially addresses these risks, leaving the dividend outlook as a critical investor consideration.

Valuation Premium Widens Sector Gap

- Shares currently trade at ¥524.0, significantly above the DCF fair value of ¥36.11, with JDC’s price-to-earnings ratio of 46.1x far surpassing the Japanese construction industry average of 12.2x and peers at 10.6x.

- This figure creates tension with the prevailing view that premium multiples are justified solely by a return to profitability, as such a valuation puts increased pressure on JDC to sustain and rapidly expand its margin gains for the stock to justify its price.

- It is notable that, while a profitable period is positive, the stock’s premium relative to sector norms could heighten future volatility if the recovery stalls.

- The valuation disconnect reinforces how markedly investor expectations have stretched beyond recent fundamentals.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on JDC's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

JDC’s high valuation and uncertain dividend stability mean investors face elevated risk if earnings momentum falters or margin gains prove unsustainable.

If you want stocks trading closer to their fundamentals and not priced for perfection, discover better opportunities with these 875 undervalued stocks based on cash flows before the next shift in market sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1887

JDC

Provides civil engineering and construction works in Japan and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives