Japan's stock markets have seen modest gains recently, with the Nikkei 225 Index rising by 0.8% and the broader TOPIX Index up by 0.2%. Amid this backdrop, the Bank of Japan remains committed to normalizing its monetary policy as it gains confidence in achieving stable inflation. In light of these market conditions, dividend stocks can offer a reliable income stream and potential for capital appreciation. Here are three Japanese dividend stocks yielding up to 3.7% that may provide stability and growth opportunities for investors.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.16% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.08% | ★★★★★★ |

| Globeride (TSE:7990) | 4.17% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.78% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.78% | ★★★★★★ |

| Innotech (TSE:9880) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.51% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.41% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

Click here to see the full list of 447 stocks from our Top Japanese Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

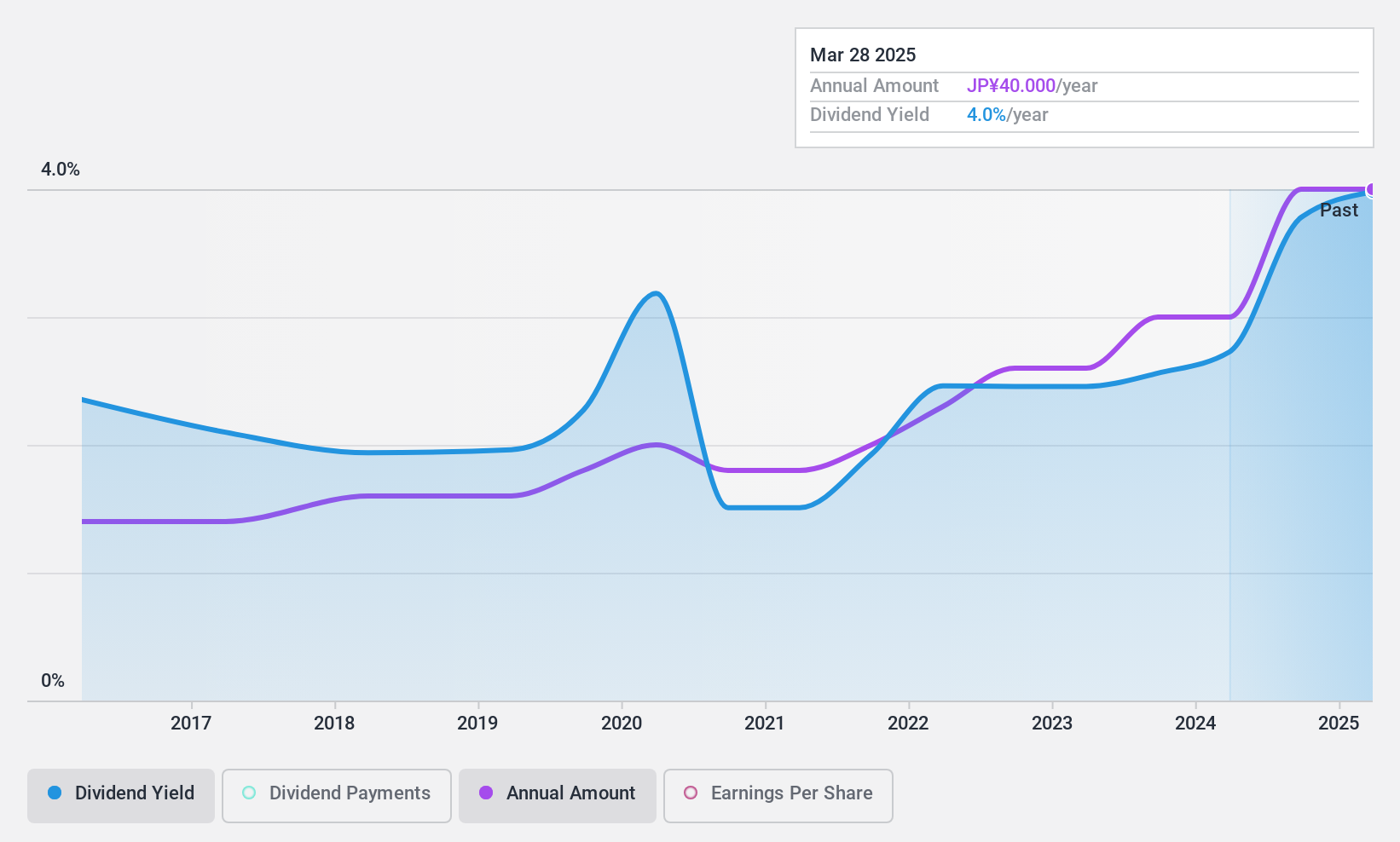

Shinnihon (TSE:1879)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shinnihon Corporation operates as a construction company in Japan with a market cap of ¥94.99 billion.

Operations: Shinnihon Corporation's revenue segments include Development at ¥63.72 billion and the Construction Business at ¥70.88 billion.

Dividend Yield: 3.3%

Shinnihon's dividend payments are well covered by both earnings (Payout Ratio: 25.7%) and cash flows (Cash Payout Ratio: 27%). Despite this, the company has had a volatile and unreliable dividend track record over the past decade. Trading at 60.2% below its estimated fair value, Shinnihon offers potential for capital appreciation but its current dividend yield of 3.26% is lower than the top quartile of Japanese dividend payers (3.71%).

- Get an in-depth perspective on Shinnihon's performance by reading our dividend report here.

- The analysis detailed in our Shinnihon valuation report hints at an deflated share price compared to its estimated value.

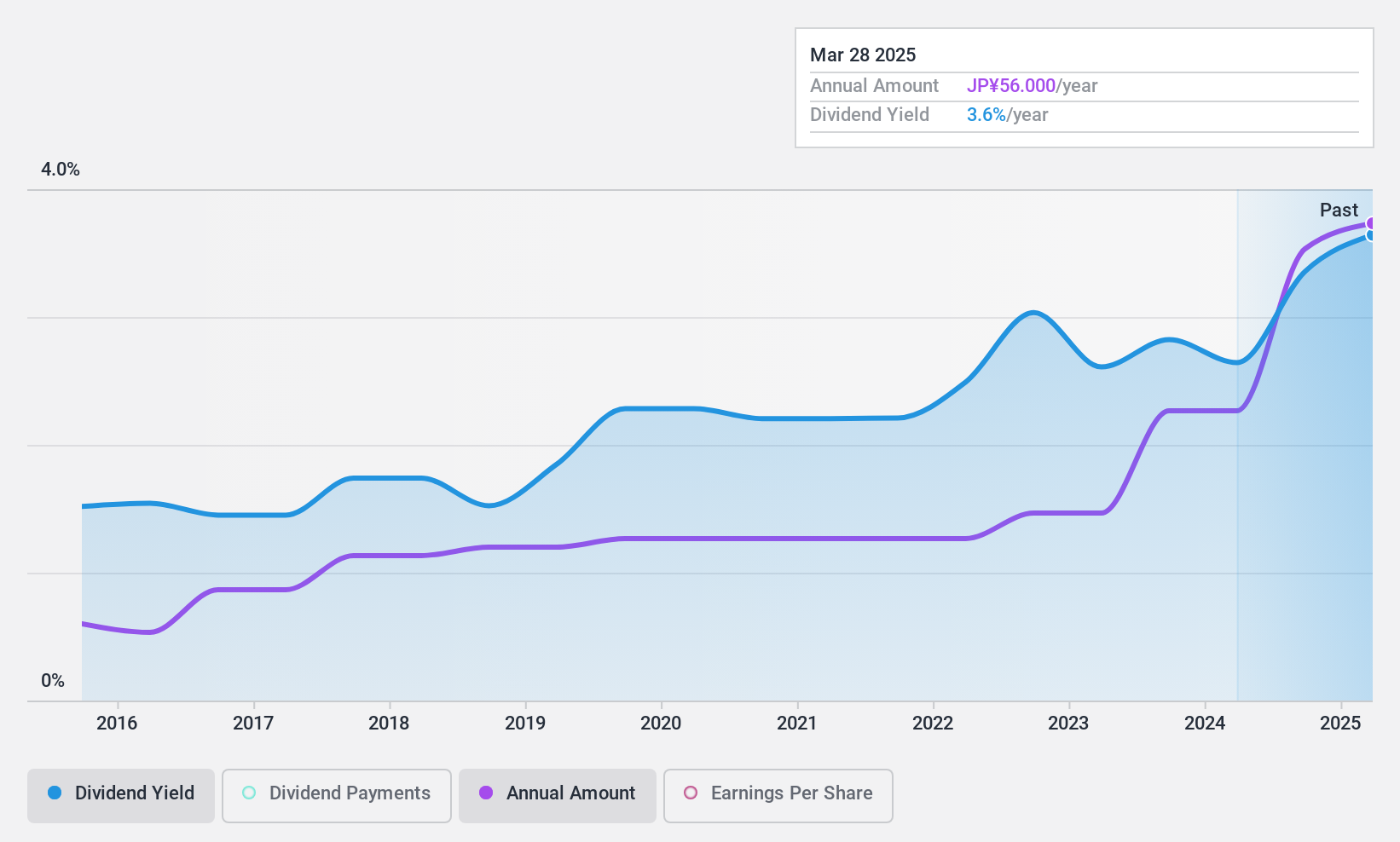

Cube System (TSE:2335)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cube System Inc. provides various technological services in Japan and internationally, with a market cap of ¥16.02 billion.

Operations: Cube System Inc. generates revenue through three primary segments: Software Development at ¥11.23 billion, System Integration at ¥3.45 billion, and Consulting Services at ¥1.89 billion.

Dividend Yield: 3.7%

Cube System's dividends are covered by earnings (Payout Ratio: 53.4%) and cash flows (Cash Payout Ratio: 61.5%). Despite a history of volatility, recent dividend increases suggest potential stability. For the fiscal year ending March 31, 2025, Cube System expects to maintain a dividend of ¥20 per share. Trading at 21.5% below its fair value estimate and with a yield of 3.75%, it ranks in the top quartile of Japanese dividend payers.

- Delve into the full analysis dividend report here for a deeper understanding of Cube System.

- The valuation report we've compiled suggests that Cube System's current price could be quite moderate.

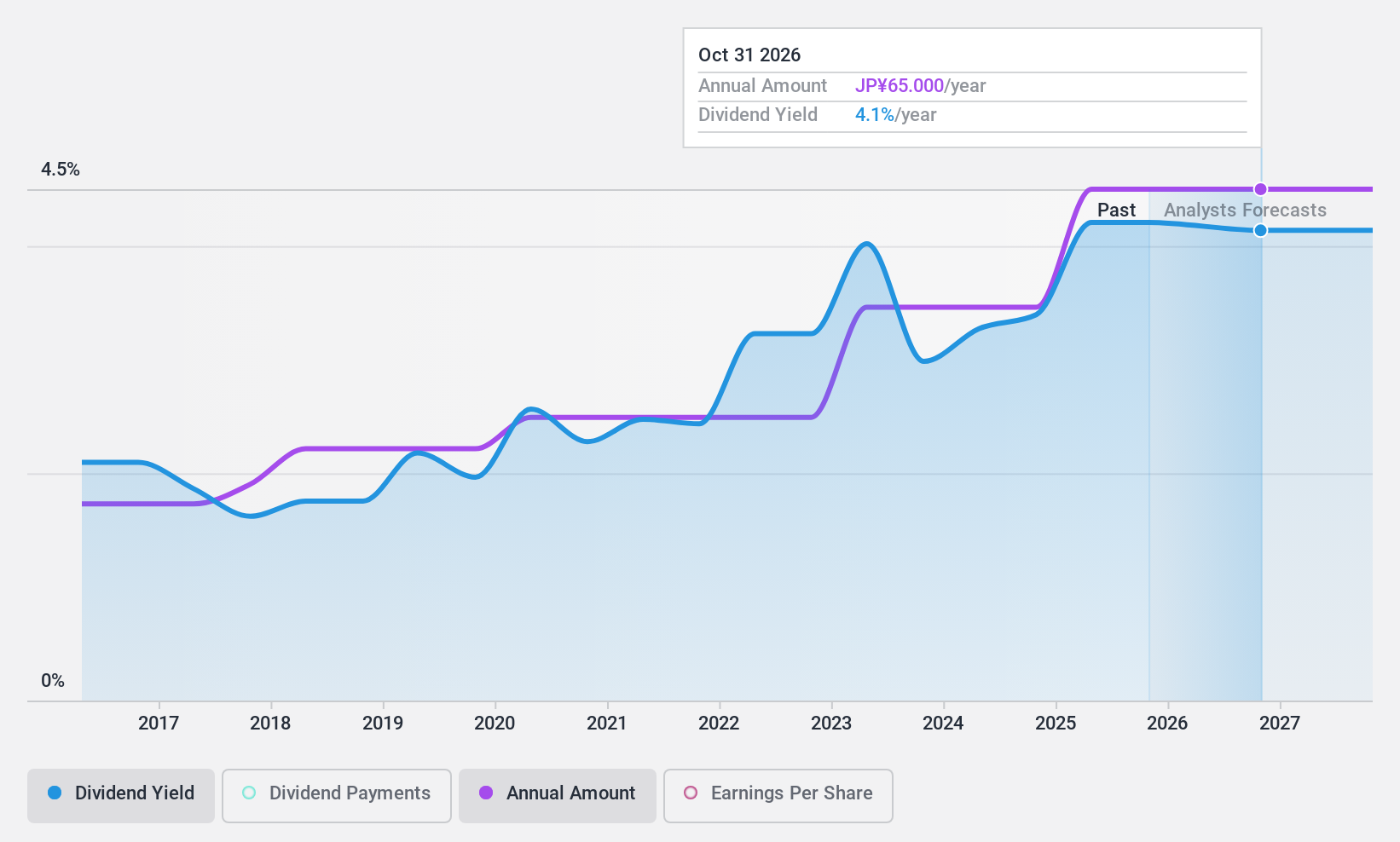

Hagihara Industries (TSE:7856)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hagihara Industries Inc., with a market cap of ¥22.22 billion, manufactures and sells flat yarns in Japan through its subsidiaries.

Operations: Hagihara Industries Inc. generates its revenue primarily through the manufacturing and sale of flat yarns in Japan via its subsidiaries.

Dividend Yield: 3.1%

Hagihara Industries has maintained stable and growing dividend payments over the past decade, though its current 3.09% yield is below the top tier of Japanese dividend payers. Despite a low payout ratio of 18.9%, indicating dividends are well covered by earnings, the company lacks free cash flows to sustain these payments long-term. Its price-to-earnings ratio of 12.1x suggests it is undervalued compared to the JP market average of 13.5x.

- Dive into the specifics of Hagihara Industries here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Hagihara Industries is priced higher than what may be justified by its financials.

Seize The Opportunity

- Investigate our full lineup of 447 Top Japanese Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2335

Cube System

Provides various technological services in Japan and internationally.

Flawless balance sheet established dividend payer.