Undiscovered Gems in Japan 3 Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

Japan’s stock markets have shown modest gains recently, with the Nikkei 225 Index rising 0.8% and the broader TOPIX Index up 0.2%. Amid this backdrop, small-cap stocks in Japan are attracting attention as potential investment opportunities due to their strong fundamentals and resilience in a fluctuating market. In identifying good stocks, especially within the small-cap segment, key factors include robust financial health, growth potential, and adaptability to changing economic conditions. This article will explore three such Japanese small-cap companies that stand out for their solid fundamentals and promising outlooks.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| QuickLtd | 0.73% | 9.61% | 14.56% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.80% | 6.26% | 4.41% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| Techno Smart | NA | 6.07% | -0.57% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Token (TSE:1766)

Simply Wall St Value Rating: ★★★★★★

Overview: Token Corporation operates as a construction company in Japan with a market cap of ¥155.95 billion.

Operations: Token Corporation generates revenue primarily from its Real Estate Rental Business (¥207.90 billion) and Construction Business (¥131.49 billion).

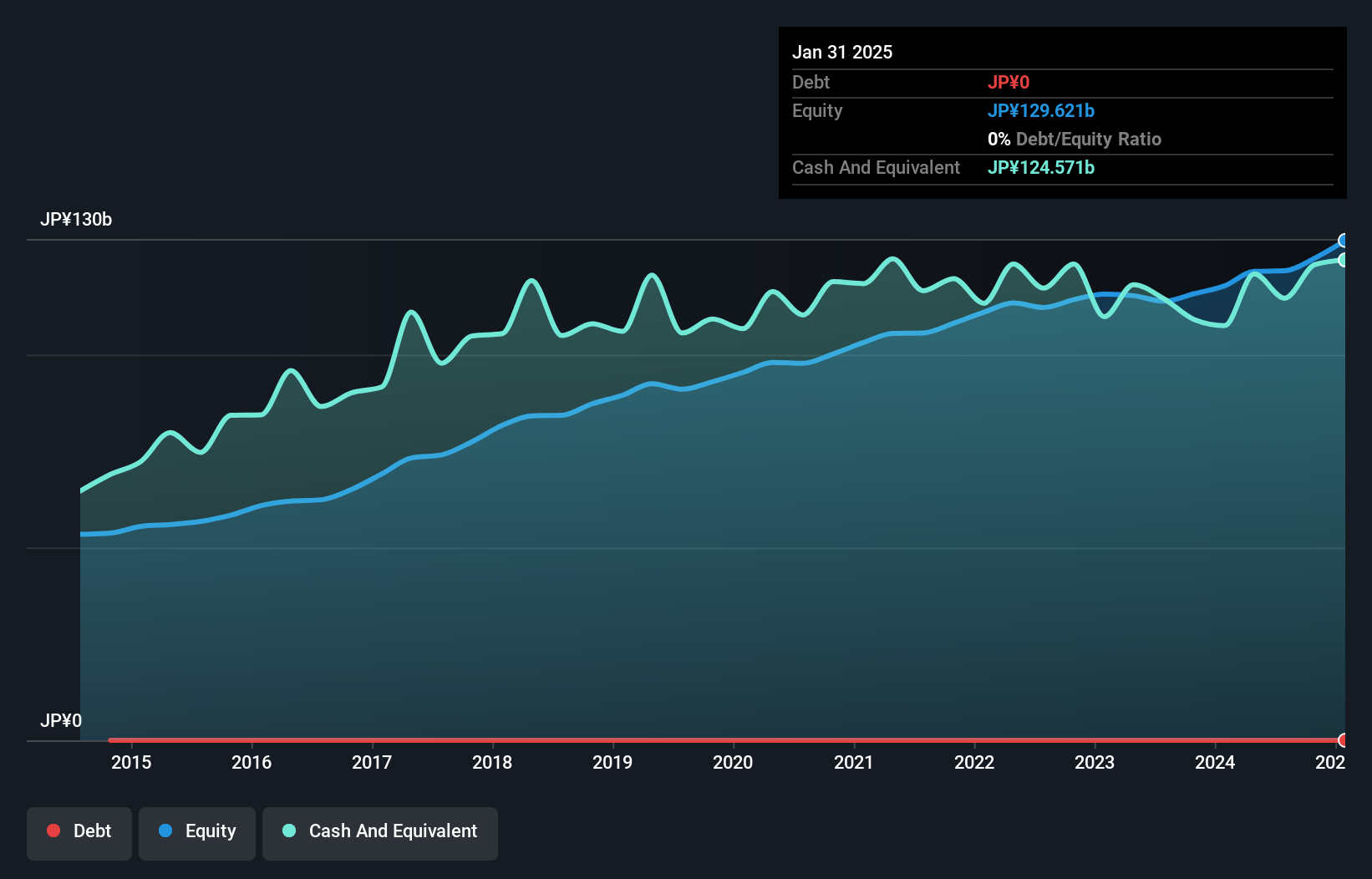

Earnings for Token grew by 70.7% over the past year, outpacing the Consumer Durables industry at -2.8%. With no debt for the last five years and high-quality earnings, Token is in a strong financial position. The company repurchased shares this year, indicating confidence in its future prospects. Earnings are forecast to grow at 9.78% annually, showcasing potential for sustained growth.

- Get an in-depth perspective on Token's performance by reading our health report here.

Assess Token's past performance with our detailed historical performance reports.

Torii Pharmaceutical (TSE:4551)

Simply Wall St Value Rating: ★★★★★★

Overview: Torii Pharmaceutical Co., Ltd. manufactures and markets pharmaceutical products in Japan with a market cap of ¥101.48 billion.

Operations: Torii Pharmaceutical generates revenue primarily from the sale of pharmaceutical products in Japan. The company has a market cap of ¥101.48 billion.

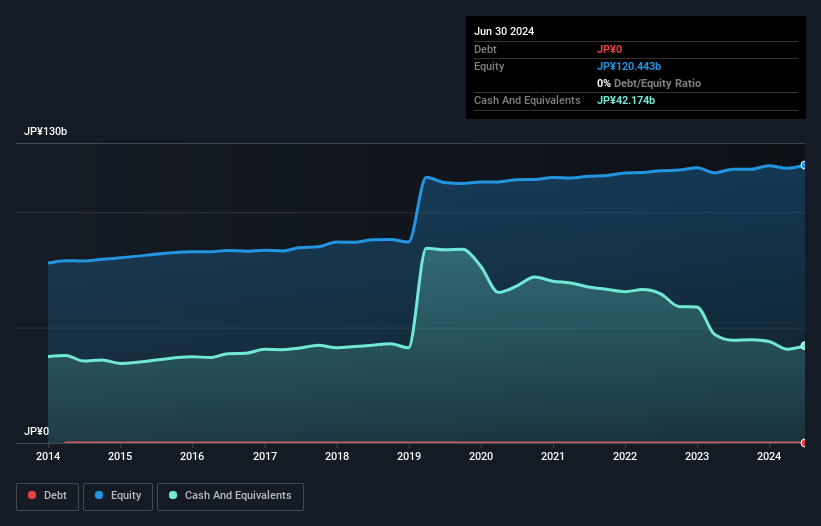

Torii Pharmaceutical, a small but promising player in Japan's pharmaceutical sector, has seen its earnings grow by 65% over the past year, significantly outpacing the industry's 8.6%. The company is debt-free and has maintained this status for five years. Additionally, it boasts high-quality earnings and positive free cash flow. Despite these strengths, future projections indicate a potential average annual decline of 1% in earnings over the next three years.

Nippon Air conditioning Services (TSE:4658)

Simply Wall St Value Rating: ★★★★★★

Overview: Nippon Air Conditioning Services Co., Ltd. (TSE:4658) specializes in providing comprehensive air conditioning maintenance and renewal construction services, with a market cap of ¥36.24 billion.

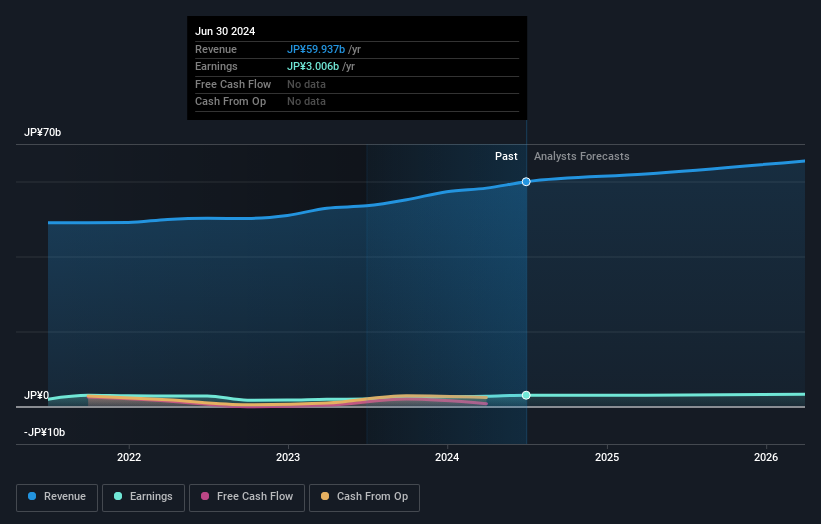

Operations: The company's primary revenue stream comes from maintenance services and renewal construction, generating ¥59.94 billion.

Nippon Air Conditioning Services, a promising small-cap, has shown robust performance with earnings growth of 51.5% over the past year, outpacing the Commercial Services industry’s 5.9%. The company’s debt-to-equity ratio improved from 9.8 to 5.4 over five years, signaling prudent financial management. With a price-to-earnings ratio of 12.1x below the JP market average of 13.5x and expected annual earnings growth of 5.65%, it seems well-positioned for future gains.

Turning Ideas Into Actions

- Explore the 753 names from our Japanese Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Torii Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4551

Torii Pharmaceutical

Manufactures and markets pharmaceutical products in Japan.

Flawless balance sheet with proven track record.