- Japan

- /

- Construction

- /

- TSE:1861

Is Kumagai Gumi on Solid Ground After Its 49% Jump and Infrastructure Spending Boost?

Reviewed by Simply Wall St

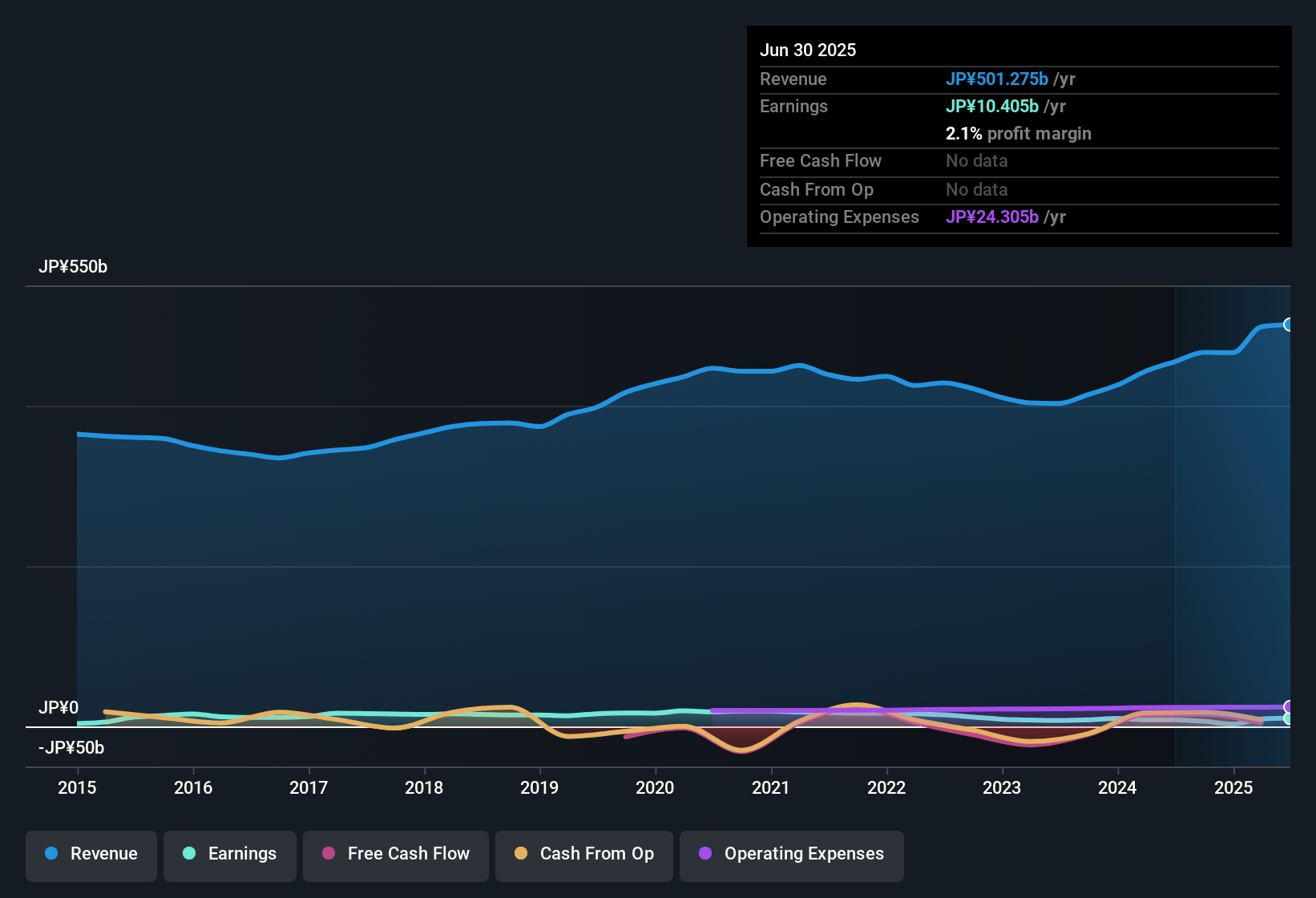

If you have been watching Kumagai GumiLtd lately, you have probably noticed its impressive run in the market. Over the past year, the stock has surged by 49.2%. Looking at a three-year period, the gain more than doubles to a striking 114.6%. Even in the shorter term, the momentum has not let up, with a 2.3% climb this week and a robust 23.4% return year-to-date. These kinds of returns naturally spark questions: is all the easy money gone, or could there be even more upside?

Recently, investor optimism appears to be driven by broader market confidence and sector tailwinds, with Kumagai GumiLtd benefiting from infrastructure spending trends and renewed interest in construction-related companies. This renewed risk appetite has pushed the stock higher, reflecting both growth potential and changing perceptions about the company’s prospects.

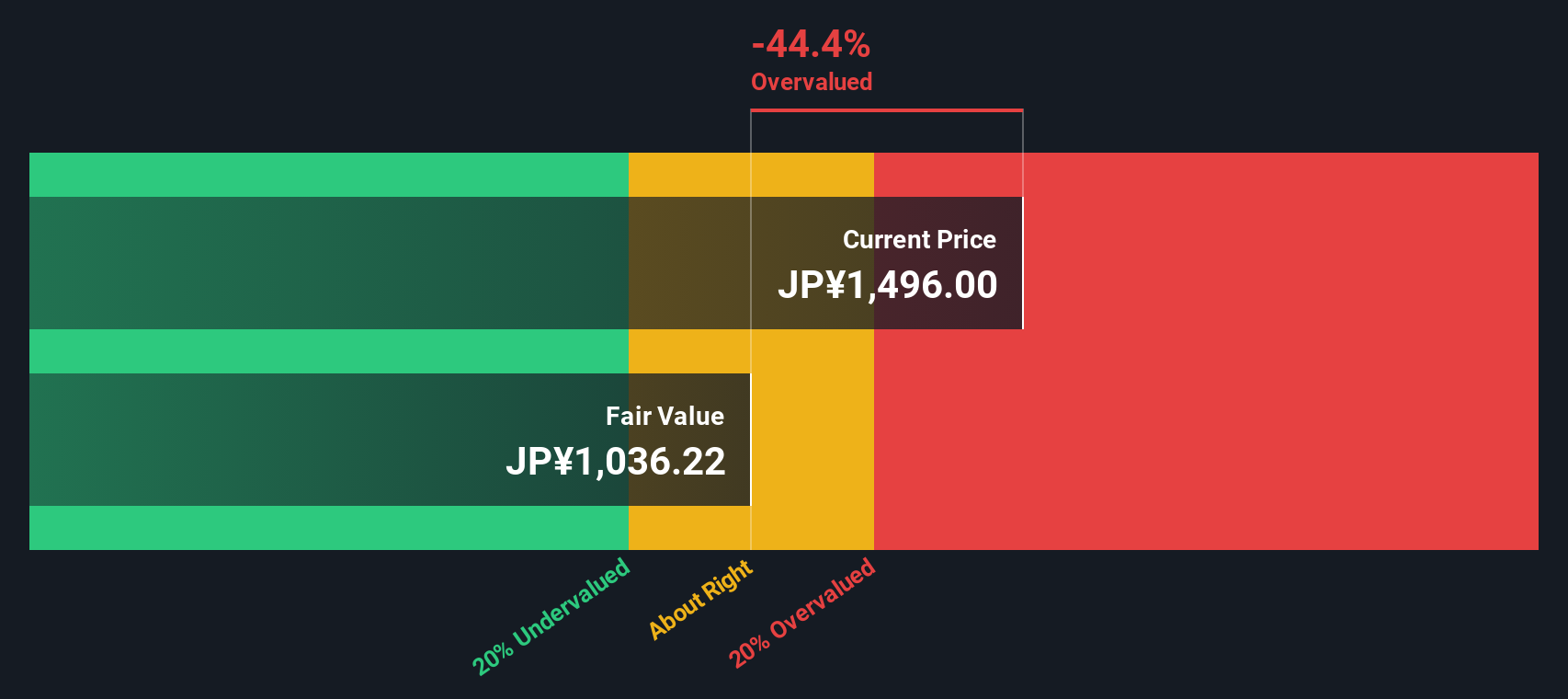

Of course, the real question on every investor’s mind is whether the current price is justified. To give you a concrete starting point, Kumagai GumiLtd recently received a valuation score of 0 out of 6, meaning it is not considered undervalued by any of the standard checks. However, valuation is rarely that simple, and sometimes the numbers miss the nuance.

Next, let’s break down the most commonly used valuation methods and see how Kumagai GumiLtd stacks up on each one. If you are really trying to get ahead, stay tuned for a look at a smarter perspective on valuation at the end of the article.

Kumagai GumiLtd scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Kumagai GumiLtd Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future free cash flows and discounting them back to today's value. This approach reflects what those future amounts are worth in present terms and is favored for its focus on cash generation potential over time.

Currently, Kumagai GumiLtd has trailing twelve-month free cash flow of ¥4.32 billion. Looking ahead, analysts forecast free cash flow growth over the next several years, with the projection for 2028 reaching ¥13.90 billion. Beyond analyst estimates, Simply Wall St extrapolates further, with the model projecting free cash flow in 2035 at around ¥12.23 billion. This emphasizes steady long-term expectations.

The DCF model aggregates these future projected cash flows, factoring in both near-term analyst numbers and longer-term extrapolations, to arrive at an intrinsic value per share of ¥4,437. According to this analysis, Kumagai GumiLtd trades around 11.0% above its calculated intrinsic value, meaning the stock appears somewhat overvalued based on forecast cash flows.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Kumagai GumiLtd.

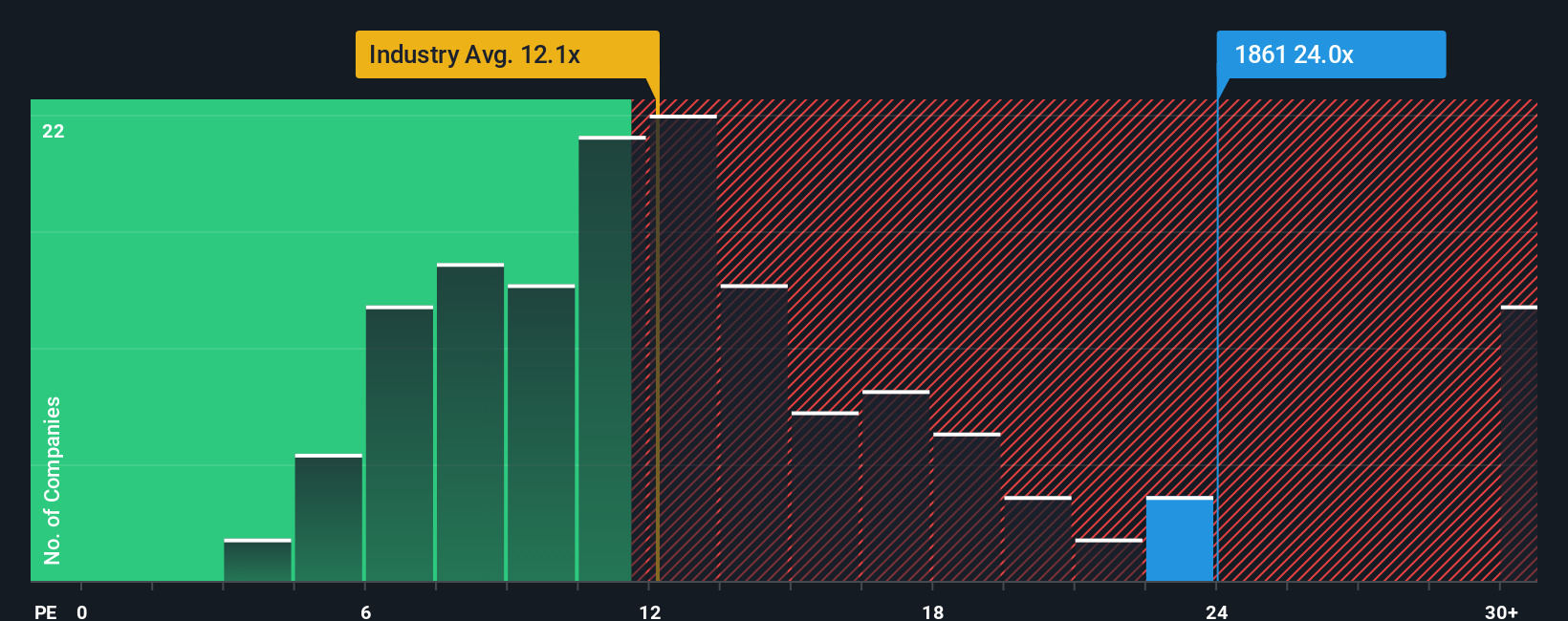

Approach 2: Kumagai GumiLtd Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it relates a company’s share price to its earnings, making it a direct measure of what investors are willing to pay for each unit of profit. For companies like Kumagai GumiLtd that generate significant profits, the PE ratio is particularly relevant in comparing value against peers and broader industry trends.

However, what constitutes a “normal” or “fair” PE ratio can vary based on growth expectations, business risk, and profitability. Companies with higher expected earnings growth, strong profit margins, or lower perceived risk often justify higher PE ratios, while slower-growing or riskier firms typically trade at lower multiples.

Kumagai GumiLtd currently trades at a PE ratio of 20.3x. This stands above the Construction industry average of 12.7x and the average of its closest peers at 14.1x, indicating a premium valuation relative to both. To provide a more nuanced perspective, Simply Wall St calculates a Fair Ratio for the stock. The Fair Ratio considers factors beyond basic earnings, including Kumagai GumiLtd’s earnings growth outlook, risk profile, profitability, market cap, and industry trends. This offers a more tailored benchmark than generic peer or industry comparisons.

In this case, Kumagai GumiLtd’s Fair Ratio is 19.8x, only slightly below its actual multiple. With such a small difference between the stock’s current PE and its Fair Ratio, the valuation appears reasonable rather than significantly stretched or discounted.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Kumagai GumiLtd Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful way for investors to connect their view of a company's story with financial assumptions, such as fair value, projected revenue, earnings, and margins. Rather than just relying on traditional metrics, a Narrative allows you to see the reasoning behind a valuation by linking the company's big picture to a real financial forecast, and ultimately, to a fair value estimate.

Narratives are easily accessible on Simply Wall St's Community page, where millions of investors share their perspectives in clear, story-driven formats. This makes it easy for anyone to compare Fair Value estimates to the current share price, helping you decide when it's time to buy or sell. What sets Narratives apart is that they update automatically whenever new information becomes available, ensuring your view is always current.

For Kumagai GumiLtd, you might notice that one Narrative projects a notably high fair value due to expected infrastructure growth, while another takes a conservative stance based on margin risks. This shows how each investor’s story leads to a different conclusion.

Do you think there's more to the story for Kumagai GumiLtd? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kumagai GumiLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1861

Kumagai GumiLtd

Operates as a construction company in Japan and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives