- Japan

- /

- Construction

- /

- TSE:1802

Obayashi (TSE:1802): Evaluating Valuation After Latest Share Buyback Completion

Reviewed by Kshitija Bhandaru

Obayashi (TSE:1802) has just wrapped up its latest buyback program, purchasing close to 6 million shares between August and September. This move often suggests management is confident about the company’s current valuation and future prospects.

See our latest analysis for Obayashi.

Obayashi’s recent buyback comes on the heels of notable momentum, with a strong 37% total shareholder return over the past year and an impressive 179% gain in three years. The latest ¥2,375.5 share price reflects a period of confidence from both investors and management, supported by sustained growth and recent capital allocation decisions.

If Obayashi’s bullish run has you thinking bigger, now could be a good time to see what else is breaking out in the market and explore fast growing stocks with high insider ownership

With buybacks highlighting management’s optimism and recent returns outpacing the broader market, does Obayashi still have room to climb from here? Or has the market already factored in the company’s future growth potential?

Price-to-Earnings of 12x: Is it justified?

Obayashi shares trade at a price-to-earnings (P/E) ratio of 12x, placing them below both peer and fair ratio benchmarks. At a last close of ¥2,375.5, the stock looks attractively valued on this basis.

The P/E ratio gauges how much investors are willing to pay for a company’s current earnings. For the construction sector, this multiple reflects expectations for steady, not explosive, profit growth.

With Obayashi’s 12x P/E comfortably beneath the peer average of 16.7x and below the estimated fair P/E of 15.7x, the market appears to be pricing in cautious outlooks. However, past-year earnings growth has significantly outpaced the industry. If profitability proves durable, there is a case for the multiple to rise toward the sector’s norm or a higher fair ratio.

Explore the SWS fair ratio for Obayashi

Result: Price-to-Earnings of 12x (UNDERVALUED)

However, slower annual revenue and net income growth of just over 2% and 0.6% could signal challenges in sustaining momentum if these trends persist.

Find out about the key risks to this Obayashi narrative.

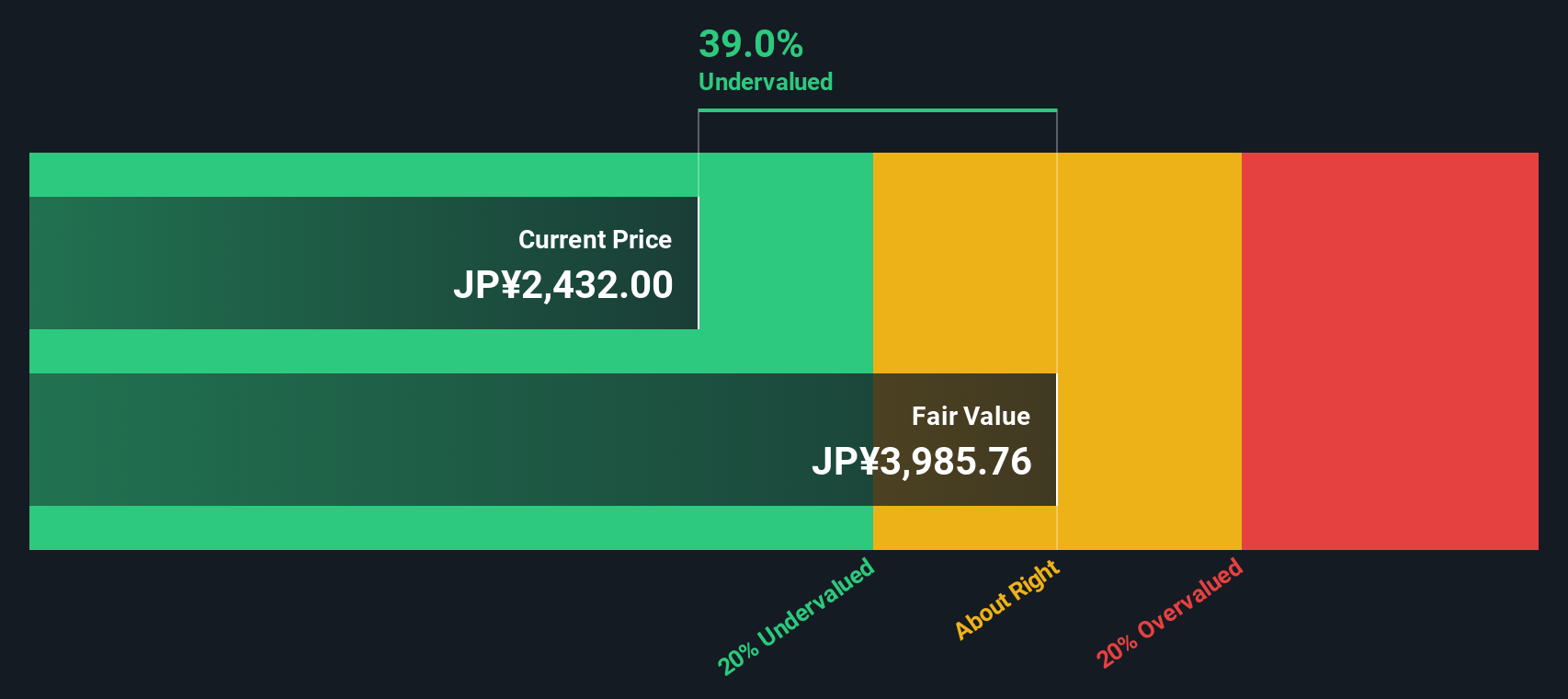

Another View: DCF Model Shows Even Greater Discount

Looking at things from another angle, our DCF model suggests Obayashi is trading at an even steeper discount, with the current share price sitting about 40% below its estimated fair value. This deep gap implies the market could be underpricing Obayashi’s future cash flows. However, does such a large discount stand up to further scrutiny?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Obayashi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Obayashi Narrative

If you have a different perspective or want to dig into the numbers personally, you can shape your own view in just a few minutes. So why not Do it your way.

A great starting point for your Obayashi research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Level up your strategy by tapping into top opportunities the market has to offer. Don’t wait for the crowd—be the one who acts first on fresh ideas.

- Capture attractive income potential with dependable companies. Start by checking out these 19 dividend stocks with yields > 3% offering yields above 3%.

- Spot overlooked gems flying under the radar through these 3585 penny stocks with strong financials featuring strong financials and real growth potential.

- Ride the momentum of technology’s next wave and gain early insights into innovation with these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1802

Obayashi

Engages in the construction business in Japan, North America, Asia and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives