- Taiwan

- /

- Semiconductors

- /

- TPEX:6138

Undiscovered Gems And 2 Other Promising Stocks With Strong Potential

Reviewed by Simply Wall St

In recent weeks, small-cap stocks have finally joined their larger peers in reaching record highs, with the Russell 2000 Index hitting an intraday peak. This surge comes amid a backdrop of strong consumer spending and geopolitical developments that have buoyed market sentiment despite ongoing manufacturing challenges. In such a dynamic environment, identifying promising stocks involves looking for those with resilient business models and growth potential that can thrive amidst economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

JirFine Intelligent Equipment (SZSE:301603)

Simply Wall St Value Rating: ★★★★☆☆

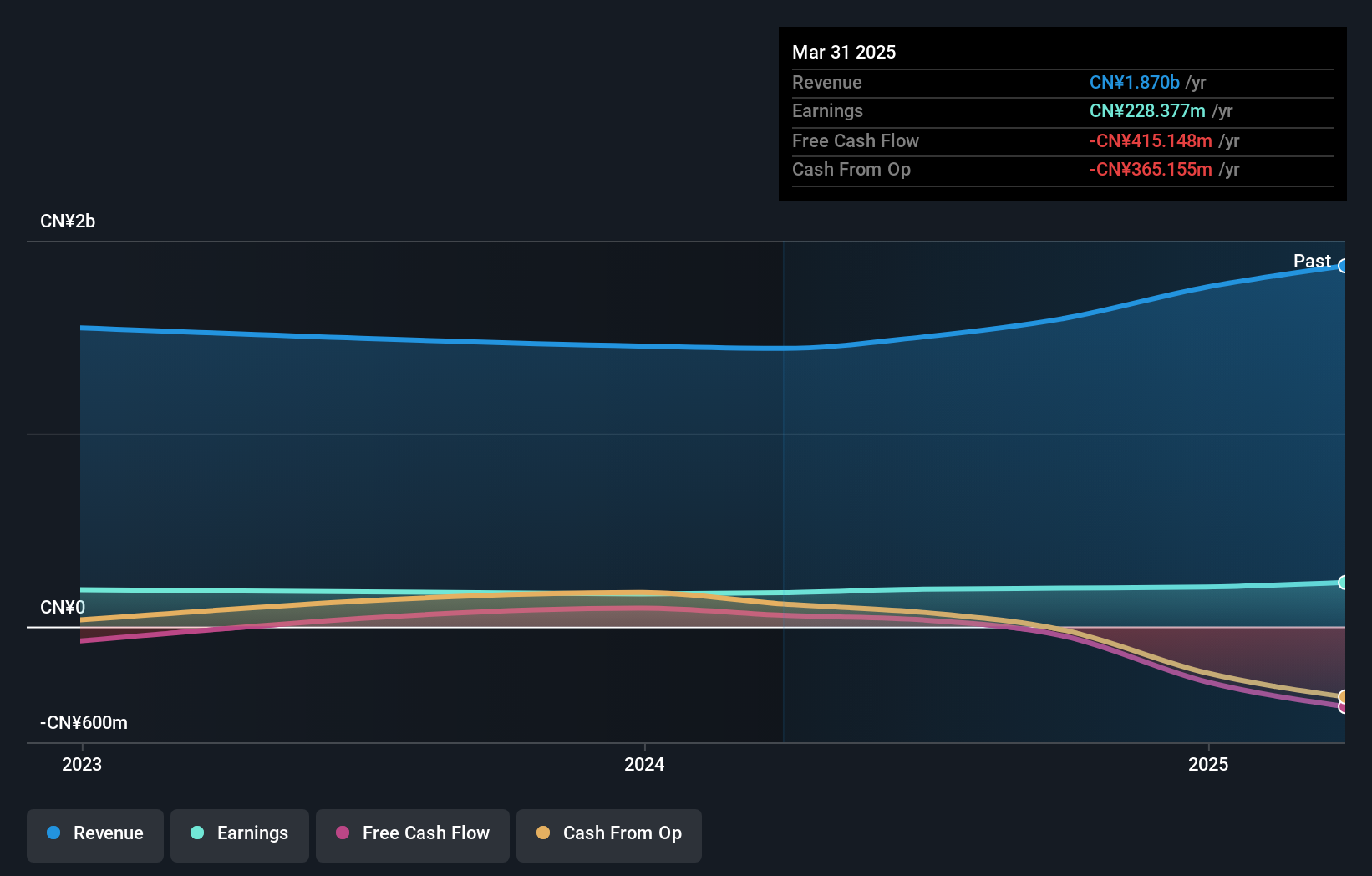

Overview: JirFine Intelligent Equipment Co., Ltd. specializes in the research, development, production, and sale of CNC machine tools with a market cap of CN¥5.39 billion.

Operations: JirFine generates revenue primarily from the sale of CNC machine tools. The company's net profit margin is a key financial indicator, reflecting its profitability after accounting for all expenses.

JirFine Intelligent Equipment, a smaller player in the machinery sector, has shown promising financial performance with earnings growing by 14% over the past year, outpacing the industry's -0.4%. The company reported sales of CNY 1.19 billion for the first nine months of 2024, up from CNY 1.05 billion last year, and net income rose to CNY 150.72 million from CNY 120.61 million. Despite volatile share prices recently and high levels of non-cash earnings impacting quality perceptions, JirFine's price-to-earnings ratio at 27x suggests potential value compared to the broader CN market's average of 36.7x.

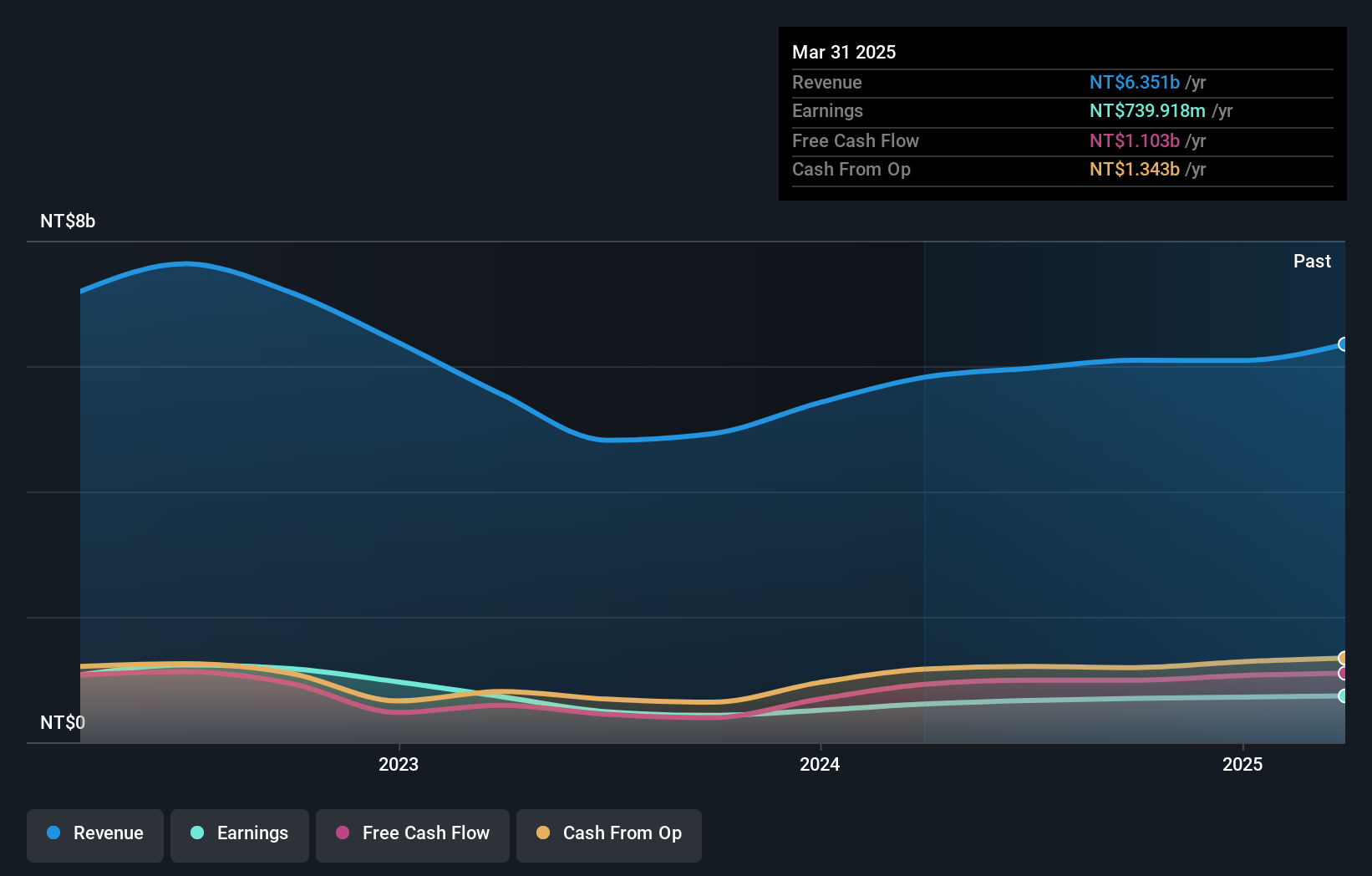

Anpec Electronics (TPEX:6138)

Simply Wall St Value Rating: ★★★★★★

Overview: Anpec Electronics Corporation is involved in the design, testing, production, and marketing of mixed-signal power chips and sensors both in Taiwan and internationally, with a market capitalization of NT$13.69 billion.

Operations: Anpec Electronics generates revenue primarily from its semiconductor segment, amounting to NT$6.09 billion.

Anpec Electronics, a semiconductor player, has shown robust financial health with earnings surging 63.5% in the past year, outpacing the industry’s 5.9% growth. The company reported third-quarter sales of TWD 1.61 billion and net income of TWD 196 million, reflecting solid performance compared to last year's figures. Its debt-to-equity ratio improved significantly from 6.5% to 3.2% over five years, indicating prudent financial management. Despite a volatile share price recently, Anpec trades at about 26% below its estimated fair value and boasts high-quality earnings with more cash than total debt on its books.

- Delve into the full analysis health report here for a deeper understanding of Anpec Electronics.

Evaluate Anpec Electronics' historical performance by accessing our past performance report.

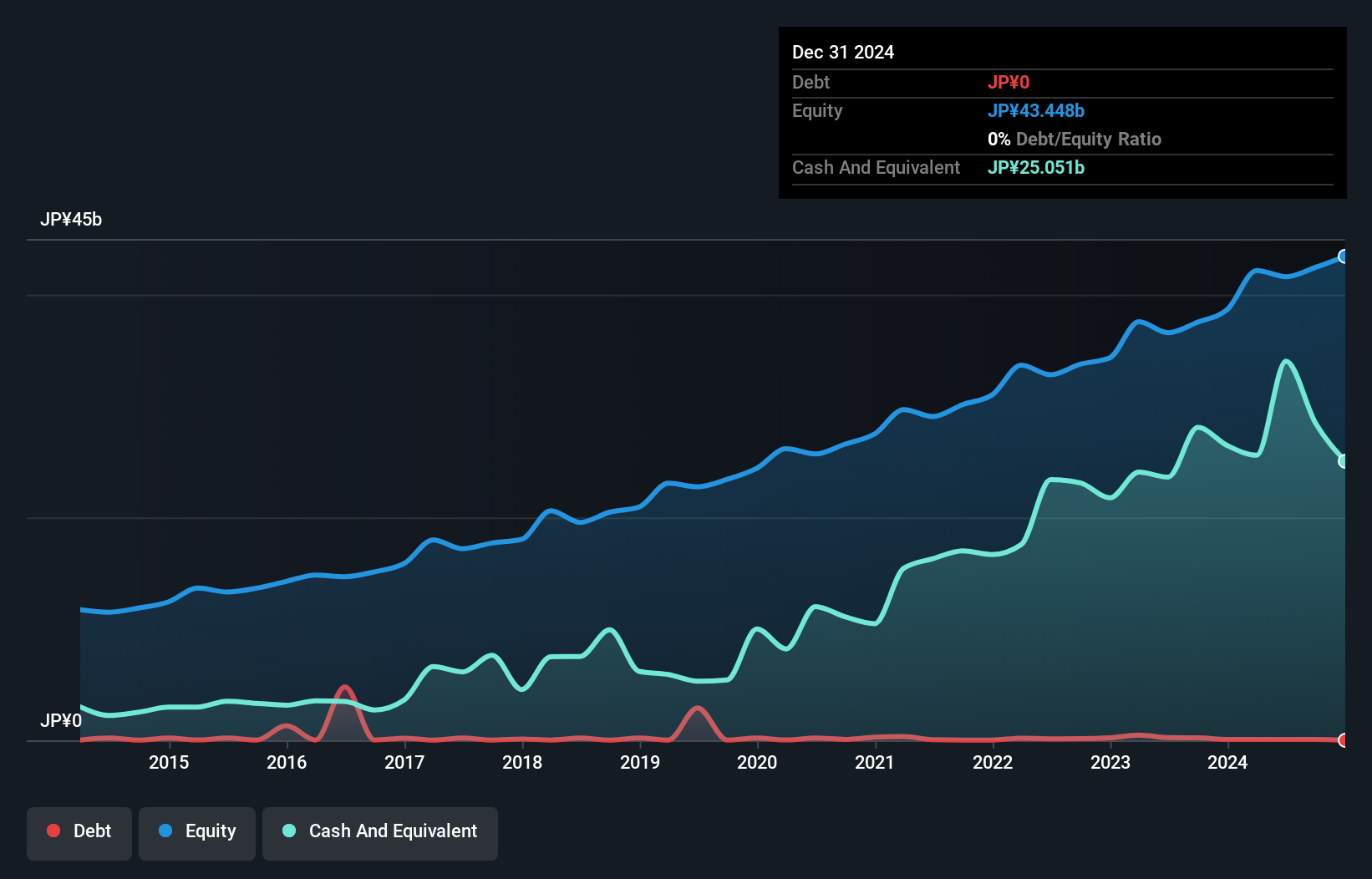

Fuji Furukawa Engineering & ConstructionLtd (TSE:1775)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fuji Furukawa Engineering & Construction Co., Ltd. operates in the engineering and construction sector, with a market cap of ¥74.37 billion.

Operations: The company generates revenue primarily from its engineering and construction services. It has a market capitalization of ¥74.37 billion, reflecting its scale in the industry.

Fuji Furukawa Engineering & Construction, a nimble player in the construction sector, has shown impressive earnings growth of 30% over the past year, outpacing the industry average of 20%. Its price-to-earnings ratio stands at 12x, which is attractive compared to the broader Japanese market's 14x. The company boasts high-quality earnings with substantial non-cash components and maintains a strong financial position with more cash than total debt. However, recent volatility in its share price and an ongoing acquisition by Fuji Electric Co., expected to conclude in February 2025, add layers of complexity to its investment narrative.

- Navigate through the intricacies of Fuji Furukawa Engineering & ConstructionLtd with our comprehensive health report here.

Learn about Fuji Furukawa Engineering & ConstructionLtd's historical performance.

Where To Now?

- Investigate our full lineup of 4641 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6138

Anpec Electronics

Engages in the design, testing, production, and marketing of mixed-signal power chips and sensors in Taiwan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives