In recent weeks, global markets have been buoyed by optimism surrounding potential trade deals and advancements in artificial intelligence, with major indices such as the S&P 500 reaching record highs. Despite large-cap stocks generally outperforming their smaller-cap counterparts, the current economic landscape presents opportunities for discerning investors to explore lesser-known small-cap stocks that may offer unique growth potential. In this context, a good stock is often characterized by its ability to capitalize on emerging trends and maintain resilience amid shifting market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tien Phong Plastic | 40.41% | 4.32% | 8.11% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Danang Port | 23.72% | 10.58% | 9.22% | ★★★★★☆ |

| An Phat Bioplastics | 62.46% | 9.85% | 4.38% | ★★★★★☆ |

| Krishana Phoschem | 109.80% | 43.94% | 26.30% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Hazama Ando (TSE:1719)

Simply Wall St Value Rating: ★★★★★★

Overview: Hazama Ando Corporation operates in the construction and construction-related sectors both domestically in Japan and internationally, with a market capitalization of ¥180.88 billion.

Operations: Hazama Ando generates revenue primarily from its Construction Business and Civil Engineering Business, which contribute ¥240.98 billion and ¥126.44 billion respectively. The Group Business adds an additional ¥86.12 billion to the overall revenue stream.

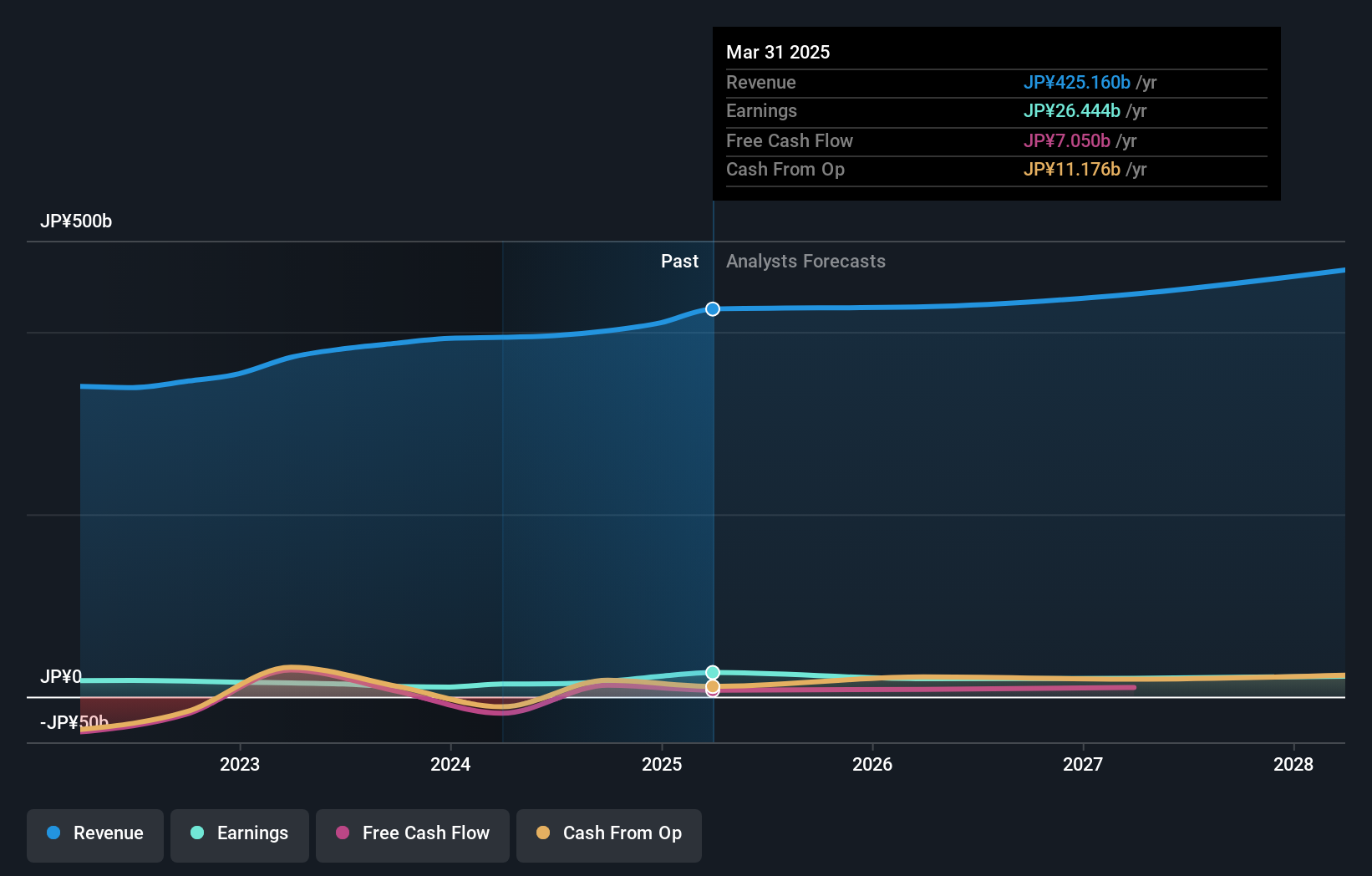

Hazama Ando, a notable player in the construction sector, has shown impressive earnings growth of 49.8% over the past year, outpacing the industry average of 20.7%. The company reported half-year sales of ¥175.50 billion and net income at ¥6.55 billion, with basic earnings per share from continuing operations at ¥41.82. With a price-to-earnings ratio of 10.9x below the JP market average of 13.7x, it appears to offer good value for investors seeking opportunities in this domain. Additionally, Hazama Ando's debt-to-equity ratio has improved from 21.9% to 19% over five years, indicating prudent financial management amidst its growth trajectory.

- Click here and access our complete health analysis report to understand the dynamics of Hazama Ando.

Review our historical performance report to gain insights into Hazama Ando's's past performance.

Vertex (TSE:5290)

Simply Wall St Value Rating: ★★★★★★

Overview: Vertex Corporation manufactures and sells concrete secondary products in Japan with a market capitalization of ¥46.04 billion.

Operations: Vertex Corporation generates revenue primarily through its Concrete Business, which contributes ¥27.34 billion, followed by the Disaster Prevention Business at ¥4.43 billion and the Pile Business at ¥3.31 billion.

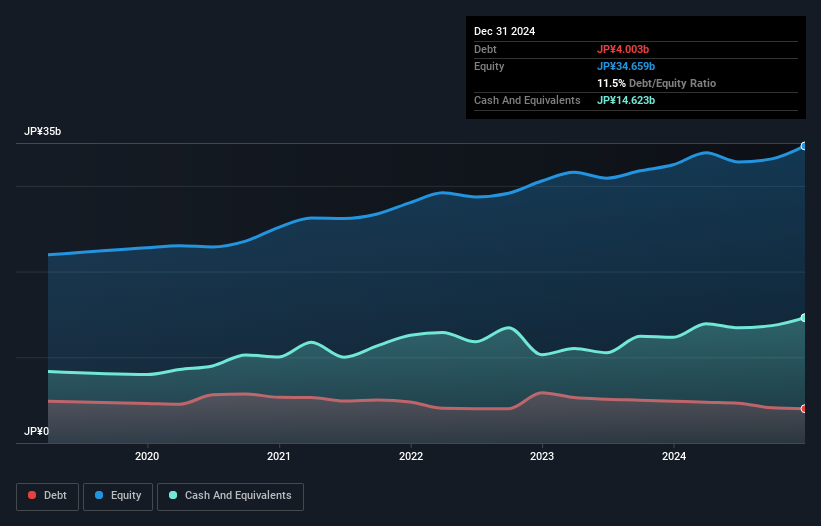

Vertex, a smaller player in its field, offers intriguing potential with its current trading value at 9.8% below fair estimates. Over the past five years, the company has successfully reduced its debt to equity ratio from 20.8% to 12.4%, indicating improved financial health. Earnings have consistently grown by 6% annually during this period, showcasing resilience despite not outpacing industry growth last year. With more cash than total debt and high-quality earnings reported, Vertex seems well-positioned financially. Looking ahead, the upcoming Q2 2025 earnings call scheduled for November may provide further insights into future performance prospects for this promising entity.

- Unlock comprehensive insights into our analysis of Vertex stock in this health report.

Gain insights into Vertex's historical performance by reviewing our past performance report.

Keiyo Bank (TSE:8544)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Keiyo Bank, Ltd. provides a range of banking products and services to individual, corporate, and business customers in Japan with a market cap of ¥97.65 billion.

Operations: Keiyo Bank generates its revenue primarily from its banking segment, amounting to ¥68.80 billion. The company's market capitalization stands at ¥97.65 billion.

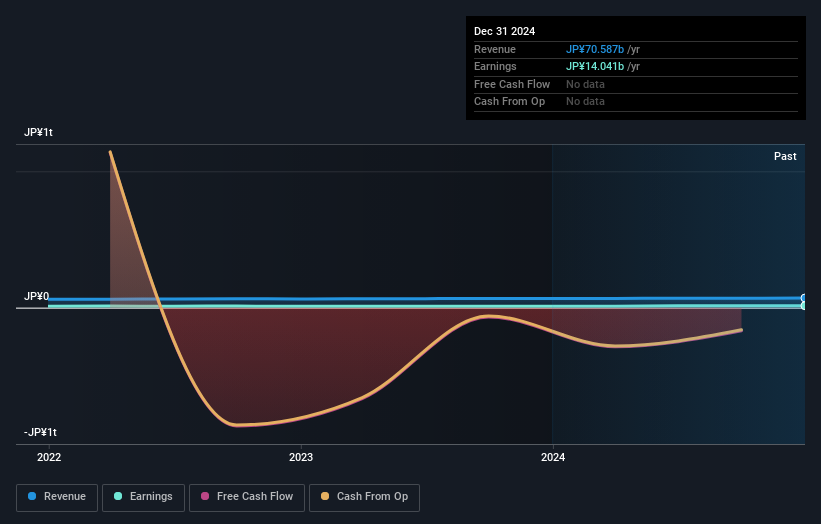

Keiyo Bank, a small player in the financial sector, has been making notable strides with its earnings growing by 34% over the past year, outpacing the industry average of 24%. Despite trading at a significant discount of 41% below its estimated fair value, it faces challenges with an insufficient bad loan allowance at just 1.4% of total loans. With ¥6,639.5 billion in assets and ¥324.2 billion in equity, Keiyo's deposits stand at ¥5,575.3 billion against loans totaling ¥4,239.3 billion. Recently completing a share buyback worth ¥1.6 billion for 2 million shares further highlights its focus on shareholder value enhancement.

Summing It All Up

- Unlock our comprehensive list of 4684 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Keiyo Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8544

Keiyo Bank

Offers various banking products and services to individual, corporate, and business customers in Japan.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion