- Japan

- /

- Trade Distributors

- /

- TSE:1518

A Piece Of The Puzzle Missing From Mitsui Matsushima Holdings Co., Ltd.'s (TSE:1518) 26% Share Price Climb

Mitsui Matsushima Holdings Co., Ltd. (TSE:1518) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 56% in the last year.

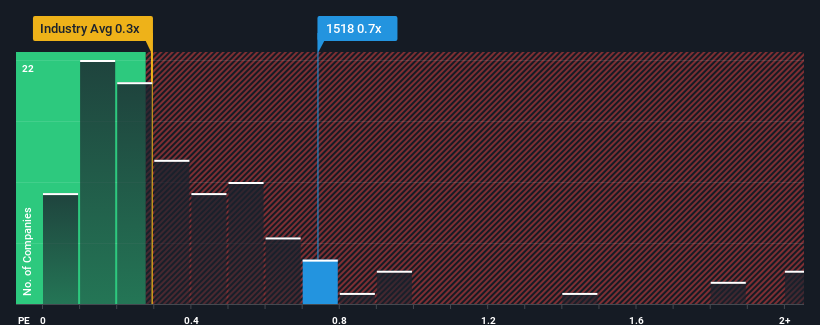

Although its price has surged higher, you could still be forgiven for feeling indifferent about Mitsui Matsushima Holdings' P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Trade Distributors industry in Japan is also close to 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Mitsui Matsushima Holdings

What Does Mitsui Matsushima Holdings' P/S Mean For Shareholders?

For instance, Mitsui Matsushima Holdings' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Mitsui Matsushima Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Mitsui Matsushima Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. Even so, admirably revenue has lifted 35% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to decline by 0.4% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, we find it intriguing that Mitsui Matsushima Holdings' P/S matches its industry peers. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Mitsui Matsushima Holdings' P/S?

Its shares have lifted substantially and now Mitsui Matsushima Holdings' P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As mentioned previously, Mitsui Matsushima Holdings currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Mitsui Matsushima Holdings, and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1518

Mitsui Matsushima Holdings

Through its subsidiaries, engages in the production and sale of coal products in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives