- Japan

- /

- Construction

- /

- TSE:1407

Global Market: 3 Stocks That May Be Trading Below Fair Value Estimates

Reviewed by Simply Wall St

As global markets navigate a complex landscape of steady inflation, geopolitical tensions, and mixed economic signals, investors are increasingly focused on identifying opportunities that may be undervalued. In this environment, stocks trading below their fair value estimates can offer potential for growth as they might benefit from favorable market adjustments or company-specific developments.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.70 | SEK86.05 | 49.2% |

| Trifork Group (CPSE:TRIFOR) | DKK89.90 | DKK175.66 | 48.8% |

| Suzhou Alton Electrical & Mechanical Industry (SZSE:301187) | CN¥29.68 | CN¥59.11 | 49.8% |

| Robosense Technology (SEHK:2498) | HK$37.60 | HK$73.81 | 49.1% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥49.96 | CN¥99.57 | 49.8% |

| Hangzhou Zhongtai Cryogenic Technology (SZSE:300435) | CN¥17.32 | CN¥34.57 | 49.9% |

| cyan (XTRA:CYR) | €2.26 | €4.44 | 49% |

| Camurus (OM:CAMX) | SEK722.50 | SEK1416.78 | 49% |

| BHG Group (OM:BHG) | SEK25.10 | SEK50.06 | 49.9% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥30.31 | CN¥60.04 | 49.5% |

Let's dive into some prime choices out of the screener.

Peijia Medical (SEHK:9996)

Overview: Peijia Medical Limited, with a market cap of HK$5.17 billion, focuses on the research, development, manufacturing, and sales of transcatheter valve therapeutic and neurointerventional procedural medical devices in the People’s Republic of China.

Operations: The company's revenue is derived from its Neurointerventional Business, which generated CN¥376.44 million, and its Transcatheter Valve Therapeutic Business, which contributed CN¥291.23 million.

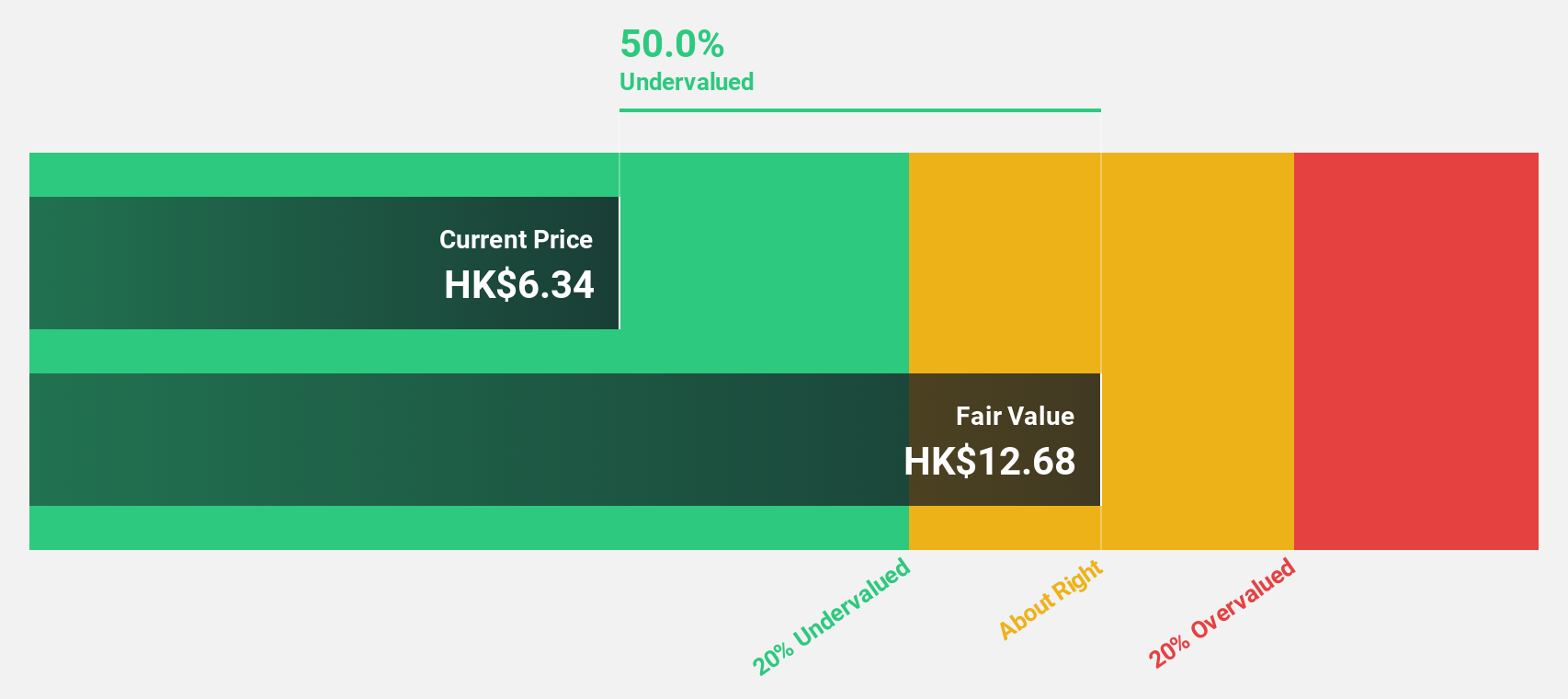

Estimated Discount To Fair Value: 43.2%

Peijia Medical is trading at HK$7.76, significantly below its estimated fair value of HK$13.66, suggesting undervaluation based on cash flows. The company reported a modest revenue increase to CNY 353.38 million for the first half of 2025, with a reduced net loss compared to the previous year. Analysts forecast robust earnings growth and expect profitability within three years, driven by innovative developments like the MonarQ TTVR® system in its pipeline.

- Our expertly prepared growth report on Peijia Medical implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Peijia Medical stock in this financial health report.

West Holdings (TSE:1407)

Overview: West Holdings Corporation, along with its subsidiaries, operates in the renewable energy sector both in Japan and internationally, with a market capitalization of ¥65.95 billion.

Operations: The company generates revenue through its Renewable Energy Business at ¥34.34 billion, Electric Power Business at ¥5.63 billion, Maintenance Business at ¥1.93 billion, and Energy Saving Business at ¥1.27 billion.

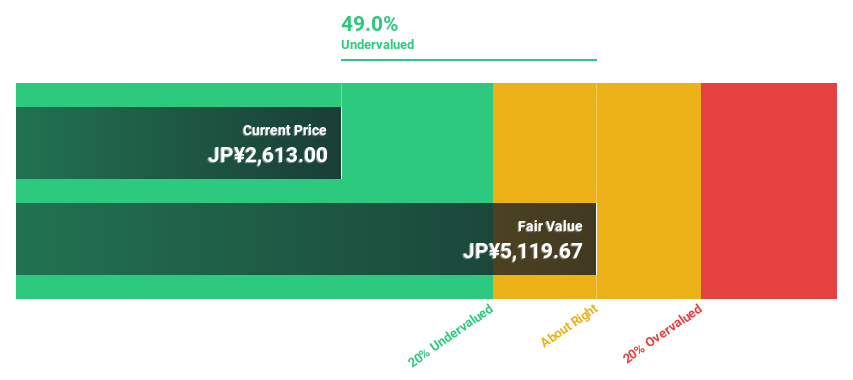

Estimated Discount To Fair Value: 45.2%

West Holdings is trading at ¥1793, significantly below its estimated fair value of ¥3274.74, highlighting potential undervaluation based on cash flows. Despite a high forecasted earnings growth of 24.6% annually over the next three years and revenue growth outpacing the JP market, its operating cash flow does not adequately cover debt obligations. The company's dividend yield of 3.63% is also not well supported by free cash flows, presenting some financial challenges despite strong growth prospects.

- Our earnings growth report unveils the potential for significant increases in West Holdings' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of West Holdings.

TOWA (TSE:6315)

Overview: TOWA Corporation designs, develops, manufactures, and sells semiconductor manufacturing equipment and high-precision molds globally, with a market capitalization of ¥123.47 billion.

Operations: The company generates revenue from its Semiconductor Manufacturing Equipment Business at ¥43.90 billion, Medical Device Business at ¥2.29 billion, and Laser Processing Equipment Business at ¥2.12 billion.

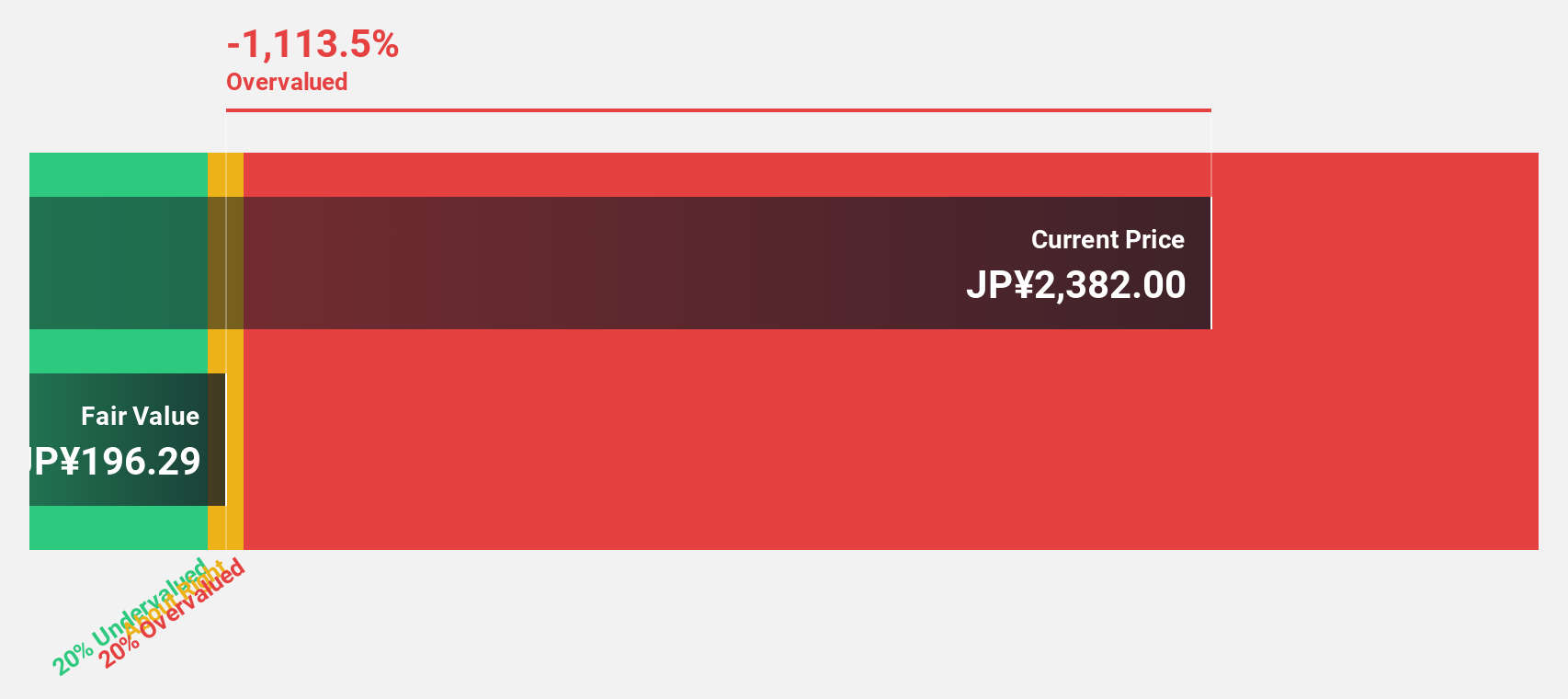

Estimated Discount To Fair Value: 47.5%

TOWA Corporation is trading at ¥1759, significantly below its estimated fair value of ¥3353.03, suggesting potential undervaluation based on cash flows. Despite a volatile share price recently, earnings are projected to grow 20.1% annually, outpacing the JP market's growth rate. However, large one-off items affect earnings quality. Recent involvement in the JOINT3 consortium for semiconductor packaging technology could enhance strategic positioning and long-term growth prospects in this sector.

- The growth report we've compiled suggests that TOWA's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of TOWA.

Taking Advantage

- Access the full spectrum of 516 Undervalued Global Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1407

West Holdings

Engages in the renewable energy business in Japan and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives