- Japan

- /

- Construction

- /

- TSE:1730

Is Aso Foam Crete Co., Ltd.'s (TYO:1730) Recent Stock Performance Influenced By Its Financials In Any Way?

Aso Foam Crete's (TYO:1730) stock up by 4.0% over the past month. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to investigate if the company's decent financials had a hand to play in the recent price move. In this article, we decided to focus on Aso Foam Crete's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Aso Foam Crete

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Aso Foam Crete is:

14% = JP¥205m ÷ JP¥1.5b (Based on the trailing twelve months to December 2020).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every ¥1 worth of equity, the company was able to earn ¥0.14 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Aso Foam Crete's Earnings Growth And 14% ROE

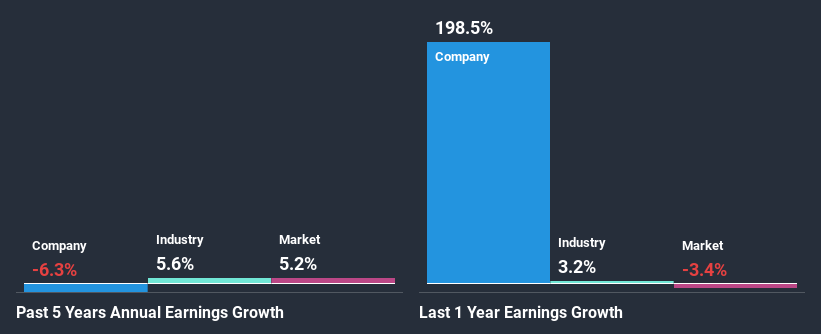

At first glance, Aso Foam Crete seems to have a decent ROE. Further, the company's ROE compares quite favorably to the industry average of 8.6%. Needless to say, we are quite surprised to see that Aso Foam Crete's net income shrunk at a rate of 6.3% over the past five years. Therefore, there might be some other aspects that could explain this. These include low earnings retention or poor allocation of capital.

However, when we compared Aso Foam Crete's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 5.6% in the same period. This is quite worrisome.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Aso Foam Crete is trading on a high P/E or a low P/E, relative to its industry.

Is Aso Foam Crete Using Its Retained Earnings Effectively?

Aso Foam Crete doesn't pay any dividend, meaning that potentially all of its profits are being reinvested in the business, which doesn't explain why the company's earnings have shrunk if it is retaining all of its profits. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Summary

In total, it does look like Aso Foam Crete has some positive aspects to its business. Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return and is reinvesting ma huge portion of its profits. By the looks of it, there could be some other factors, not necessarily in control of the business, that's preventing growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. You can see the 3 risks we have identified for Aso Foam Crete by visiting our risks dashboard for free on our platform here.

If you’re looking to trade Aso Foam Crete, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:1730

Aso Foam Crete

Engages in the civil engineering and construction activities in Japan.

Mediocre balance sheet very low.

Market Insights

Community Narratives