Senshu Ikeda Holdings (TSE:8714): Valuation Focus as Board Reviews Shareholder Returns and Dividend Policy

Reviewed by Simply Wall St

Senshu Ikeda Holdings (TSE:8714) has called a board meeting to review changes to its shareholder return policy. The agenda includes a possible increase to the dividend of surplus and a revised year-end dividend forecast.

See our latest analysis for Senshu Ikeda Holdings.

Momentum has been unmistakably strong for Senshu Ikeda Holdings, as optimism around dividend and shareholder return policy changes has coincided with a 94.95% year-to-date share price return and a remarkable 111.30% total shareholder return over the past year. This signals sustained market confidence.

If Senshu Ikeda’s rally has you thinking about what’s next, it could be time to broaden your scope and discover fast growing stocks with high insider ownership

With such extraordinary returns already locked in, the key question now is whether Senshu Ikeda Holdings remains undervalued or if the market has already factored in all future growth. This could result in limited opportunities for new buyers.

Price-to-Earnings of 16.2x: Is it justified?

Senshu Ikeda Holdings is currently trading at a price-to-earnings (P/E) ratio of 16.2x, notably higher than both its domestic industry and peer group averages. At the last close of ¥772, investors are paying a premium relative to the average Japanese bank.

The price-to-earnings multiple measures how much investors are willing to pay for each yen of earnings. This makes it a key tool to compare profitability across the banking sector and gauge market optimism for future growth.

While a higher P/E can signal expectations for stronger earnings or higher quality, in Senshu Ikeda’s case, the premium does not reflect above-industry profit growth or market-leading returns. According to the data, 8714’s 16.2x P/E far exceeds the JP Banks industry average of 11.1x and the peer average of 13x, suggesting the current share price may be overextended unless further growth drivers emerge.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.2x (OVERVALUED)

However, risks remain, as any slower-than-expected profit growth or a change in the bank’s shareholder return policy could quickly alter investor sentiment.

Find out about the key risks to this Senshu Ikeda Holdings narrative.

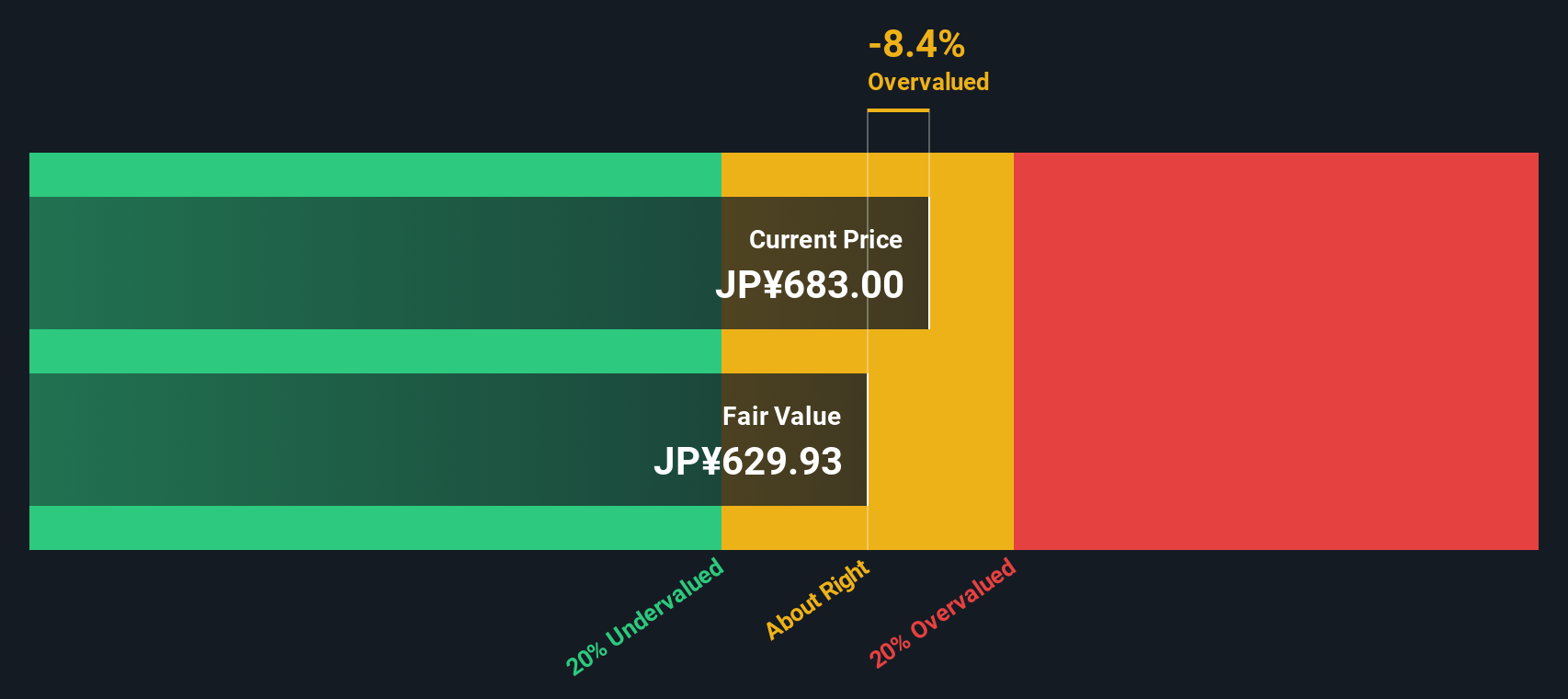

Another View: DCF Model Weighs In

The SWS DCF model offers another take by estimating a fair value of ¥612.41 compared to the current price of ¥772. This suggests Senshu Ikeda Holdings may be overvalued by around 26%. Does this put the rally at risk, or could sentiment keep carrying shares higher from here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Senshu Ikeda Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Senshu Ikeda Holdings Narrative

If you see things differently or want to dig into the numbers yourself, crafting your own perspective takes just a few minutes. Do it your way

A great starting point for your Senshu Ikeda Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seeking your next edge? The Simply Wall Street Screener focuses on unique market opportunities you won’t want to miss. Act now before these trends take off.

- Capture long-term growth potential by reviewing steady, income-generating picks among these 15 dividend stocks with yields > 3% with generous yields.

- Uncover powerful, emerging players as you access these 25 AI penny stocks making waves in artificial intelligence transformations across industries.

- Boost your strategy for future innovation by tracking advancements with these 28 quantum computing stocks in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8714

Senshu Ikeda Holdings

Provides banking products and services to small and medium-sized enterprises, and individuals in Japan.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.