As global markets navigate a landscape marked by fluctuating corporate earnings, AI competition fears, and steady monetary policy from the Federal Reserve, small-cap stocks have experienced mixed fortunes. Amidst this backdrop of volatility and opportunity, identifying undervalued stocks with strong fundamentals and unique market positions becomes crucial for investors seeking potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Powertip Image | 0.57% | 10.95% | 29.26% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Alltek Technology | 166.36% | 7.57% | 13.88% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Petrolimex Insurance | 32.25% | 4.46% | 7.91% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Italian Sea Group (BIT:TISG)

Simply Wall St Value Rating: ★★★★★★

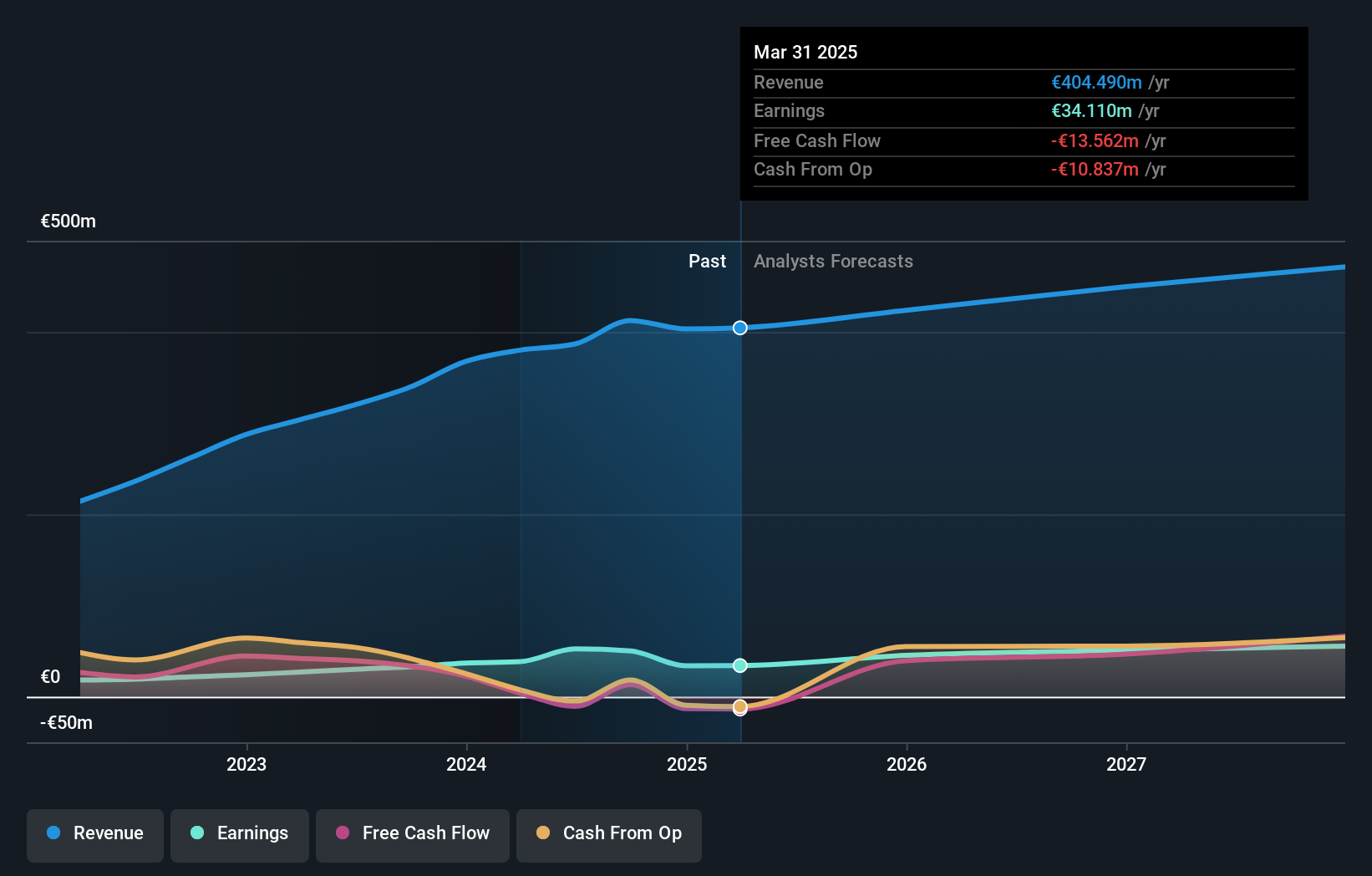

Overview: The Italian Sea Group S.p.A. operates in the luxury yachting industry with a market capitalization of €435.13 million.

Operations: Italian Sea Group generates revenue primarily from shipbuilding (€347.59 million) and refit services (€43.97 million).

Italian Sea Group, a noteworthy player in the leisure industry, has demonstrated impressive financial performance with its earnings growing by 52.9% last year, outpacing the industry’s 11.3%. The company is trading at a significant discount of 52.3% below its estimated fair value, suggesting potential upside for investors. Its debt management is commendable; the debt-to-equity ratio improved from 54.1% to 40.1% over five years and interest payments are well-covered by EBIT at an 8.9x coverage rate. Recent results show revenue climbing to €311M and net income reaching €37M for nine months ending September 2024, indicating robust operational strength.

- Take a closer look at Italian Sea Group's potential here in our health report.

Assess Italian Sea Group's past performance with our detailed historical performance reports.

APG|SGA (SWX:APGN)

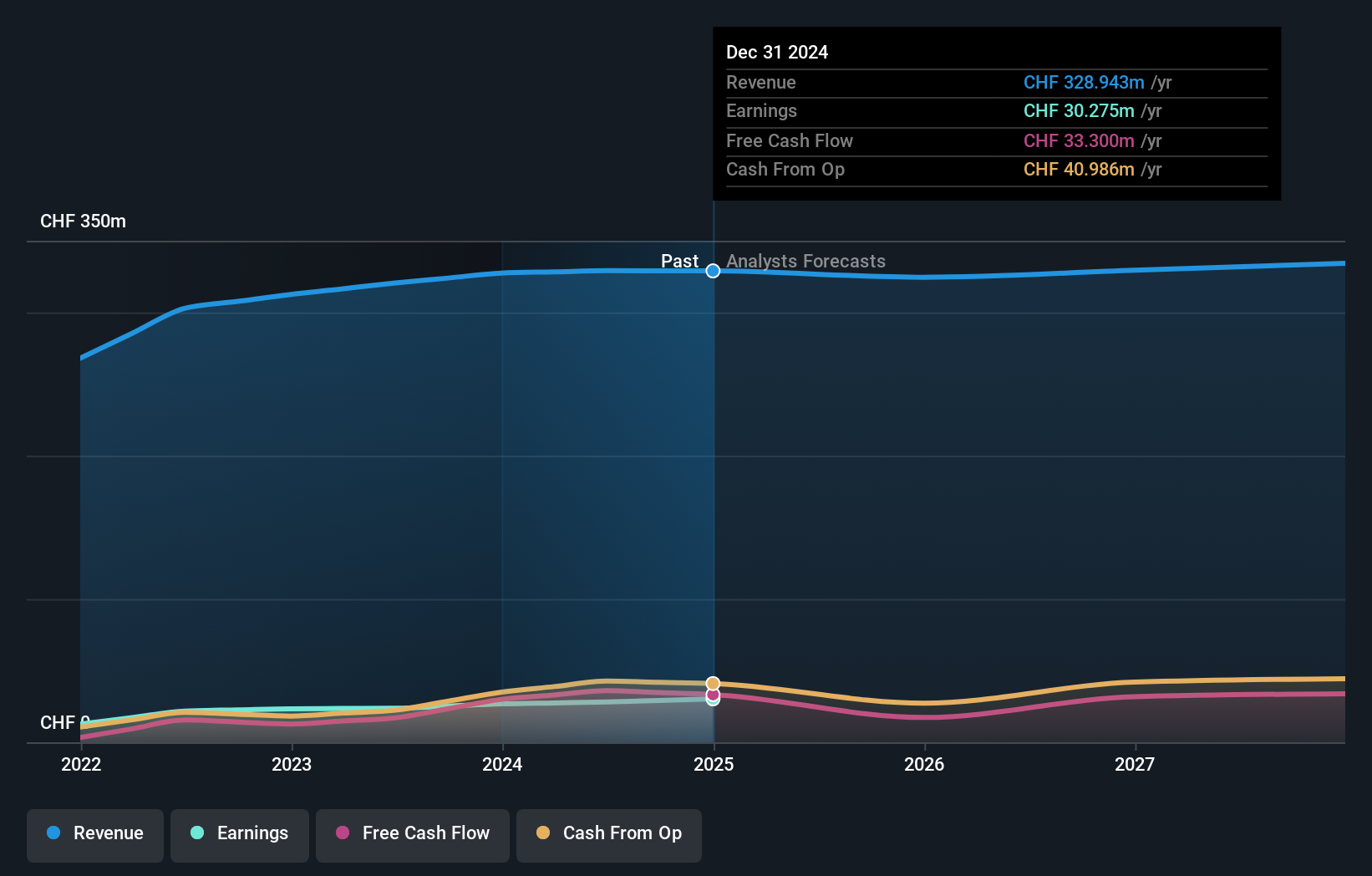

Simply Wall St Value Rating: ★★★★★☆

Overview: APG|SGA SA operates by providing advertising services mainly in Switzerland and Serbia, with a market cap of CHF622.99 million.

Operations: The company generates revenue of CHF329.12 million from the acquisition, sale, and management of advertising spaces.

APG|SGA, a nimble player in the media landscape, stands out with its debt-free balance sheet and high-quality earnings. Over the past five years, earnings have seen a 6.4% drop annually, yet it remains profitable with free cash flow reaching US$36 million as of mid-2024. The company's valuation appears attractive, trading at 35% below its estimated fair value. Despite not keeping pace with the broader media industry’s growth of 23.1%, APG|SGA's solid financial footing and undervaluation suggest potential for investors seeking stability amidst market fluctuations.

- Delve into the full analysis health report here for a deeper understanding of APG|SGA.

Evaluate APG|SGA's historical performance by accessing our past performance report.

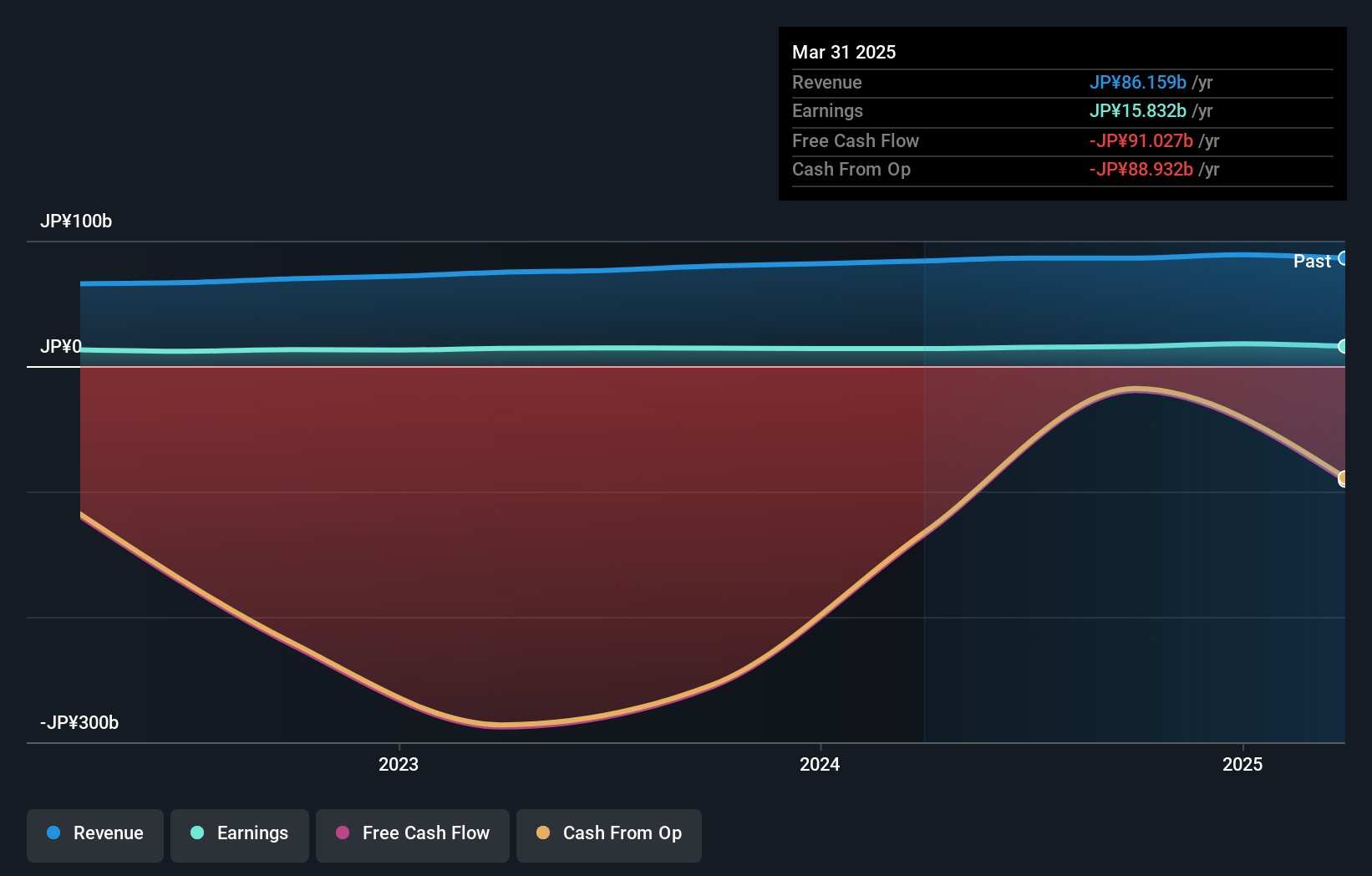

TOMONY Holdings (TSE:8600)

Simply Wall St Value Rating: ★★★★★☆

Overview: TOMONY Holdings, Inc. operates through its subsidiaries to offer a range of banking and financial products and services, with a market capitalization of approximately ¥86.96 billion.

Operations: TOMONY Holdings generates revenue primarily from its banking segment, amounting to ¥86.12 billion. The company's financial performance is also highlighted by its net profit margin trends over recent periods.

TOMONY Holdings, a relatively small player in the banking sector, has total assets of ¥4.97 trillion and equity of ¥285 billion. The bank's deposits stand at ¥4.44 trillion with loans totaling ¥3.59 trillion, reflecting a net interest margin of 1.3%. While its bad loan allowance is insufficient at 32%, non-performing loans are appropriately low at 1.9% of total loans, suggesting prudent risk management practices. Despite trading significantly below fair value by 68%, earnings have grown impressively by 13.8% annually over five years, though last year's growth was slower than the broader industry’s pace.

- Unlock comprehensive insights into our analysis of TOMONY Holdings stock in this health report.

Examine TOMONY Holdings' past performance report to understand how it has performed in the past.

Make It Happen

- Access the full spectrum of 4687 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOMONY Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8600

TOMONY Holdings

Through its subsidiaries, provides various banking and financial products and services.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives