As global markets continue to reach record highs, driven by gains in major indices like the Dow Jones Industrial Average and S&P 500, investors are navigating a landscape influenced by geopolitical factors and domestic policy shifts. Despite tariff concerns and mixed economic signals, the broader market remains resilient, highlighting the importance of identifying reliable dividend stocks that can offer stability and income in such dynamic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.83% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

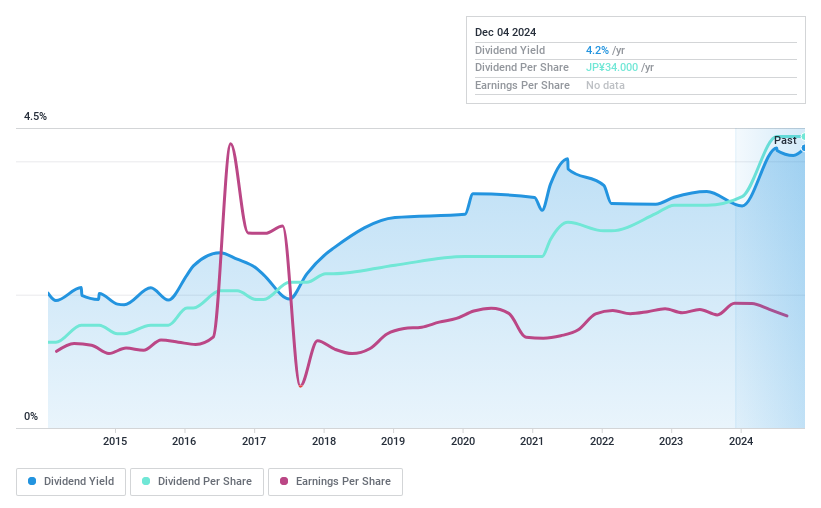

Nitto Fuji Flour MillingLtd (TSE:2003)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nitto Fuji Flour Milling Co., Ltd. manufactures and sells flour products in Japan and has a market cap of ¥59.82 billion.

Operations: Nitto Fuji Flour Milling Co., Ltd.'s revenue segments include the manufacturing and sale of flour products in Japan.

Dividend Yield: 4.1%

Nitto Fuji Flour Milling Ltd. offers a compelling dividend profile with its dividends covered by both earnings and cash flows, boasting a payout ratio of 25.5% and a cash payout ratio of 58.6%. Despite its volatile and unreliable dividend history over the past decade, recent growth in dividend payments suggests improvement. Trading significantly below estimated fair value, it provides an attractive yield of 4.11%, ranking in the top tier among Japanese market payers.

- Dive into the specifics of Nitto Fuji Flour MillingLtd here with our thorough dividend report.

- Our valuation report here indicates Nitto Fuji Flour MillingLtd may be overvalued.

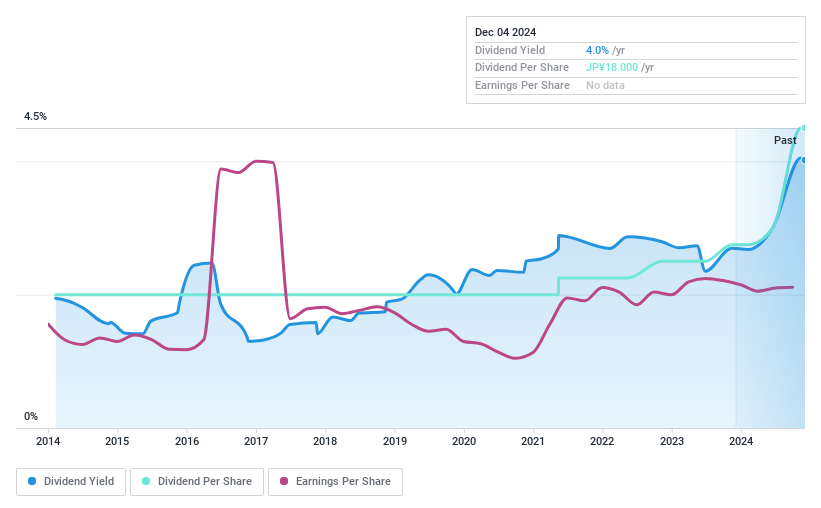

SALA (TSE:2734)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SALA Corporation, with a market cap of ¥51.54 billion, operates in Japan through its subsidiaries focusing on the energy supply and solution business.

Operations: SALA Corporation's revenue is primarily derived from its Energy & Solutions Business at ¥121.37 billion, followed by the Engineering & Maintenance Business at ¥36.38 billion, Animal Healthcare Business at ¥25.46 billion, Housing Business at ¥35.72 billion, Car Life Support Business at ¥16.85 billion, and Property Business at ¥8.08 billion.

Dividend Yield: 4.1%

SALA's dividend payments have grown over the past decade, supported by a low payout ratio of 32.2%, indicating solid coverage by earnings. However, its dividends are not well covered by free cash flows, with a high cash payout ratio of 136.6%. Despite offering an attractive yield of 4.13% in the top quartile of the JP market, its dividend history has been volatile and unreliable due to significant annual drops exceeding 20%.

- Click here to discover the nuances of SALA with our detailed analytical dividend report.

- The valuation report we've compiled suggests that SALA's current price could be inflated.

TOMONY Holdings (TSE:8600)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TOMONY Holdings, Inc. operates through its subsidiaries to offer a range of banking and financial products and services, with a market cap of ¥88.31 billion.

Operations: TOMONY Holdings, Inc.'s revenue segments include a variety of banking and financial products and services.

Dividend Yield: 3.9%

TOMONY Holdings offers a reliable dividend option, with payments growing steadily over the past decade and a low payout ratio of 6.5%, ensuring coverage by earnings. Its yield of 3.89% ranks in the top quartile of the Japanese market, appealing to income-focused investors. Despite past shareholder dilution, TOMONY trades significantly below its estimated fair value, presenting potential for capital appreciation alongside stable dividend returns.

- Click to explore a detailed breakdown of our findings in TOMONY Holdings' dividend report.

- Our valuation report here indicates TOMONY Holdings may be undervalued.

Where To Now?

- Dive into all 1948 of the Top Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOMONY Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8600

TOMONY Holdings

Through its subsidiaries, provides various banking and financial products and services.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives