What Seven Bank (TSE:8410)'s 2026 Guidance and Strong ATM Activity Means for Shareholders

Reviewed by Sasha Jovanovic

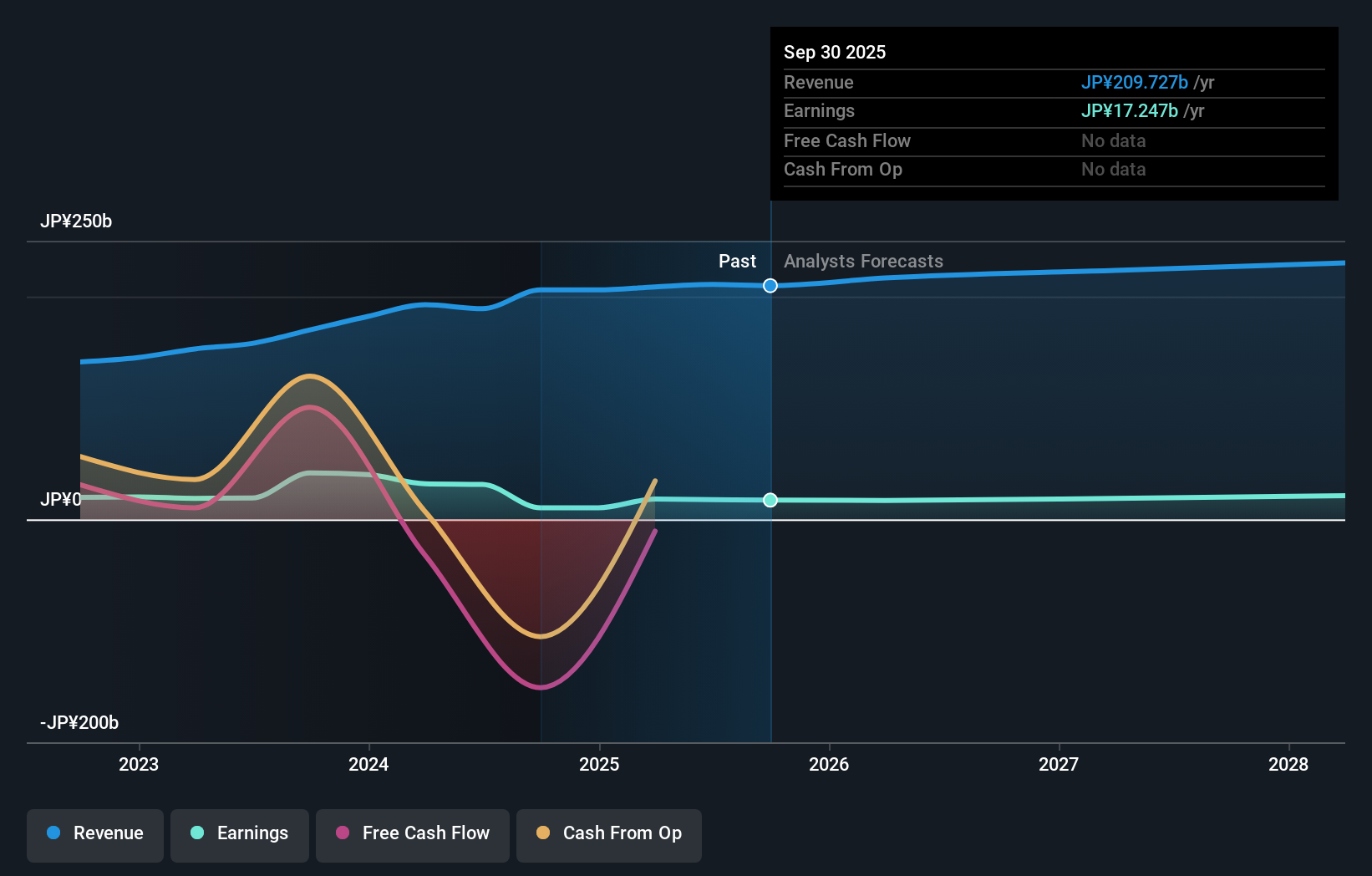

- Seven Bank, Ltd. recently released its consolidated and non-consolidated earnings guidance for the fiscal year ending March 31, 2026, and reported preliminary non-consolidated operating results for October 2025, including 94.4 million total transactions and 28,281 installed ATMs.

- With the company affirming its semi-annual dividend and providing detailed transaction metrics, investors received a comprehensive update on both financial outlook and operational momentum.

- We'll explore what Seven Bank's new fiscal guidance and sustained ATM usage rates may mean for its investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Seven Bank's Investment Narrative?

To own Seven Bank, investors typically need confidence in the durability of Japan’s ATM network, the value of its dividend, and management’s ability to defend transaction volumes as digital payments rise. The company’s fresh earnings guidance and robust October transaction update reinforce the stability of its core business, with over 94 million monthly transactions and more than 28,000 ATMs in operation. The affirmed dividend shows a continued priority on shareholder returns in the short term. The recent news doesn’t appear to change the biggest question marks, particularly around future profit growth and the bank's relatively high valuation compared to its peers. However, these updates provide some reassurance on fundamental performance, at least for now, while the key issues of new digital competition and board inexperience remain unresolved. Investors should continue watching these areas closely.

But, in contrast to the steady dividend, the new management’s short tenure could still weigh on confidence. Seven Bank's shares are on the way up, but they could be overextended by 5%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Seven Bank - why the stock might be worth as much as ¥290!

Build Your Own Seven Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seven Bank research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Seven Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seven Bank's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8410

Seven Bank

Provides various banking products and services to individual and corporate customers in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives