As global markets navigate trade uncertainties and economic shifts, Asian indices have shown resilience with notable gains in regions like Japan and China. In this dynamic environment, dividend stocks offer investors a potential avenue for steady income, particularly as central banks in Asia maintain supportive monetary policies.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.79% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.02% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.00% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.54% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.58% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.47% | ★★★★★★ |

Click here to see the full list of 1177 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

&Do HoldingsLtd (TSE:3457)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: &Do Holdings Co., Ltd. operates in the real estate industry in Japan and has a market capitalization of ¥27.26 billion.

Operations: &Do Holdings Co., Ltd. generates revenue through several segments, including Reform (¥2.37 billion), Finance (¥555 million), Franchise (¥3.24 billion), House Leaseback (¥23.82 billion), Real Estate Distribution (¥1.51 billion), and Real Estate Buying and Selling (¥37.34 billion).

Dividend Yield: 3.2%

&Do Holdings Ltd. offers dividends covered by earnings (38.7% payout ratio) and cash flows (19% cash payout ratio), indicating sustainability despite a volatile dividend history over the past decade. The dividend yield of 3.24% is below Japan's top quartile, and while the price-to-earnings ratio is favorable at 12.3x, debt coverage by operating cash flow needs improvement. Recent share buybacks totaling ¥577.83 million may positively impact future shareholder value.

- Click to explore a detailed breakdown of our findings in &Do HoldingsLtd's dividend report.

- According our valuation report, there's an indication that &Do HoldingsLtd's share price might be on the expensive side.

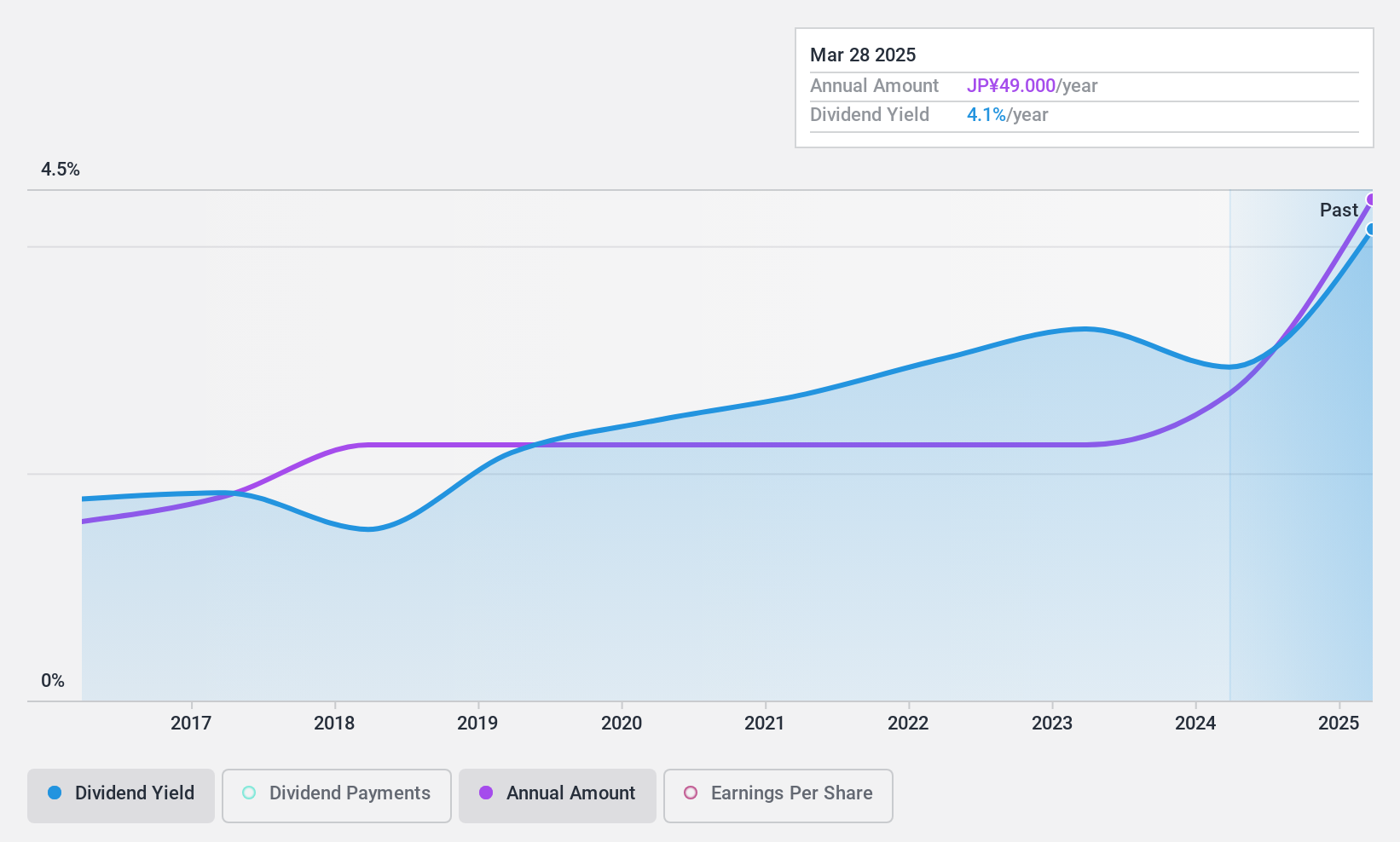

Dai Nippon Toryo Company (TSE:4611)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dai Nippon Toryo Company, Limited, along with its subsidiaries, produces and distributes coatings and jet inks both in Japan and abroad, with a market cap of ¥36.06 billion.

Operations: Dai Nippon Toryo Company's revenue segments include Domestic Coatings at ¥51.80 billion, Overseas Coatings at ¥8.32 billion, Lighting at ¥10.29 billion, and Fluorescent Color Materials at ¥1.22 billion.

Dividend Yield: 3.9%

Dai Nippon Toryo Company has maintained stable and growing dividends over the past decade, though its 3.87% yield is slightly below Japan's top quartile. The low payout ratio of 17.8% suggests dividends are well covered by earnings, yet high cash payout ratio (142.1%) indicates insufficient free cash flow coverage, raising sustainability concerns. A recent board meeting outlined plans to acquire SHINTO PAINT CO., potentially impacting future financials and dividend stability amidst large one-off items affecting results.

- Click here to discover the nuances of Dai Nippon Toryo Company with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Dai Nippon Toryo Company's share price might be too optimistic.

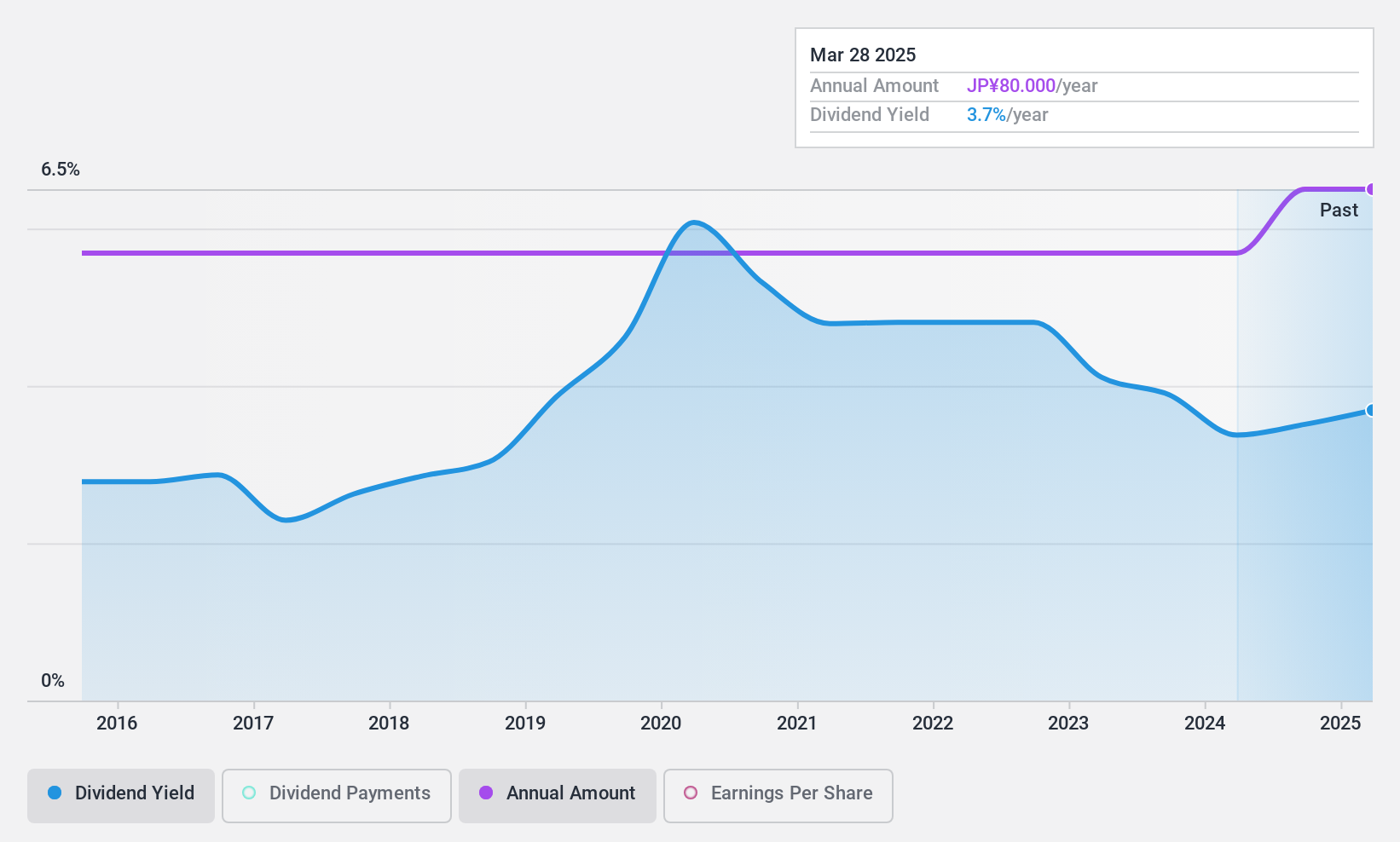

Bank of Saga (TSE:8395)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Bank of Saga Ltd. offers a range of banking products and services in Japan, with a market cap of ¥35.29 billion.

Operations: The Bank of Saga Ltd. generates revenue through its primary segments: Banking at ¥44.06 billion, Leasing at ¥7.62 billion, and Credit Guarantee at ¥753 million.

Dividend Yield: 3.8%

Bank of Saga has consistently delivered stable and growing dividends over the past decade, with a 3.78% yield slightly below Japan's top quartile. The low payout ratio of 18.4% indicates strong earnings coverage, although the allowance for bad loans is low at 31%. Recent revisions increased the year-end dividend forecast to ¥50 per share from ¥40, reflecting confidence in financial performance despite some uncertainties about future dividend sustainability.

- Get an in-depth perspective on Bank of Saga's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Bank of Saga is trading behind its estimated value.

Where To Now?

- Click through to start exploring the rest of the 1174 Top Asian Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4611

Dai Nippon Toryo Company

Manufactures and sells coatings and jet inks in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives