Kiyo Bank (TSE:8370): Valuation Perspective on Quiet, Consistent Outperformance

Reviewed by Simply Wall St

Price-to-Earnings of 9.6x: Is it justified?

Kiyo Bank shares are currently trading at a price-to-earnings (P/E) ratio of 9.6, which is lower than both the Japanese banking industry average of 11.2 and the peer group average of 12.1. This suggests the stock could be undervalued by these measures.

The price-to-earnings ratio helps investors compare how much they are paying for each unit of earnings, making it a widely used tool for valuation in the banking sector. A lower P/E can indicate that a stock is priced conservatively relative to its peers and may signal opportunity if earnings quality is high.

For Kiyo Bank, this valuation appears supported by strong recent profit growth, higher-than-peer returns over the last year, and above-industry momentum. This suggests the market may not have fully priced in the bank’s recent operational improvements and earnings strength, which could allow for potential catch-up if positive trends continue.

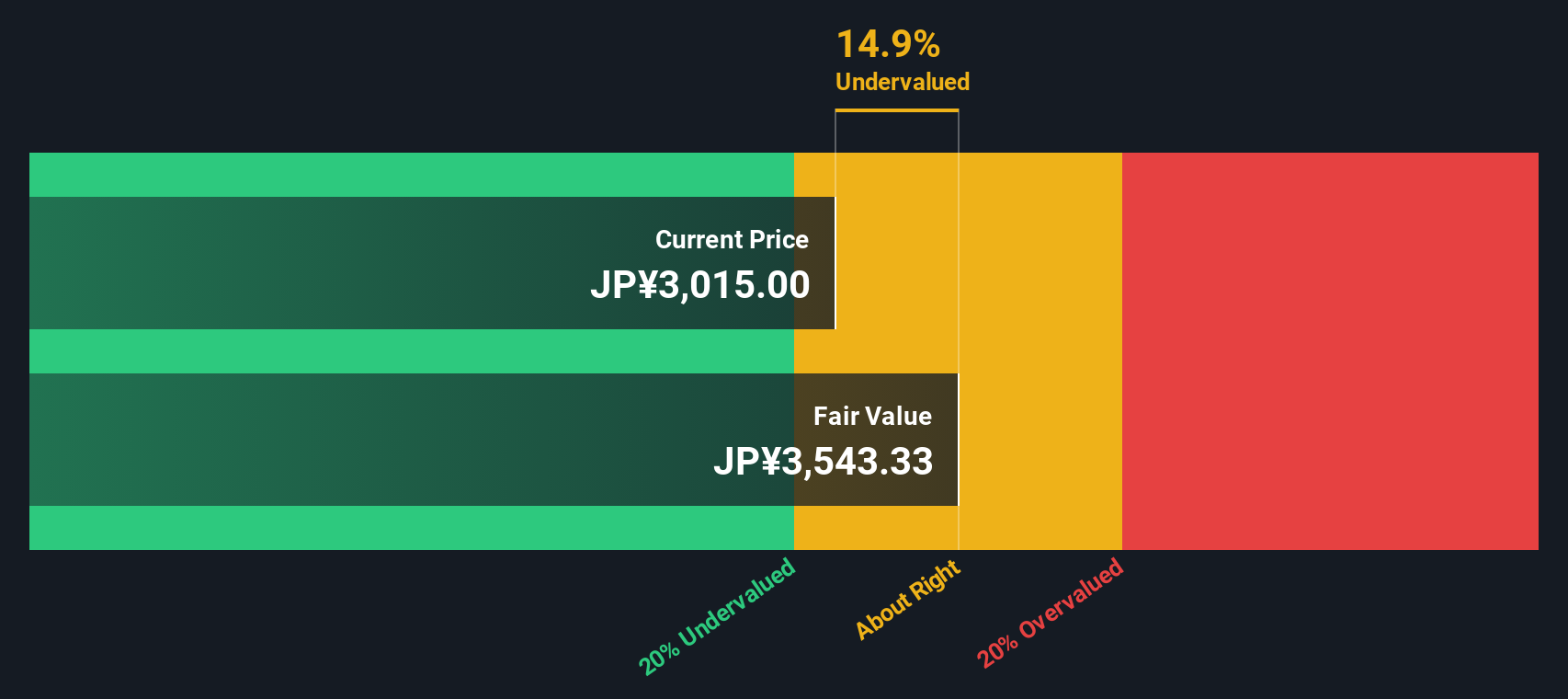

Result: Fair Value of ¥3,545.71 (UNDERVALUED)

See our latest analysis for Kiyo Bank.However, limited visibility into future profit growth and the lack of clear analyst targets could leave investors exposed if market sentiment shifts unexpectedly.

Find out about the key risks to this Kiyo Bank narrative.Another View: What Does a Cash Flow Model Say?

Switching gears from earnings multiples, the SWS DCF model also weighs in on Kiyo Bank’s value and finds the shares undervalued compared to the current market price. But can two valuation methods both be right, or is something being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kiyo Bank Narrative

If you are inclined to dig deeper or want to shape your own perspective, you can quickly craft your own take in just a few minutes. Do it your way

A great starting point for your Kiyo Bank research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep fresh opportunities within reach. If you want to broaden your watchlist, these unique market themes deserve your immediate attention. Don’t let opportunity pass you by:

- Spot companies harnessing artificial intelligence to transform industries, tapping into the next big wave with AI penny stocks.

- Capture growth by targeting fast movers in the penny stock universe with robust financials. Start your search with penny stocks with strong financials.

- Secure reliable returns by finding top picks boasting attractive yields through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kiyo Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8370

Kiyo Bank

Provides various banking products and services to individual and corporate customers in Japan.

Solid track record established dividend payer.

Market Insights

Community Narratives