- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A101490

Emerging Asian Innovators With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic signals, small-cap stocks have shown resilience, with the Russell 2000 Index outperforming its larger counterparts by advancing 5.52%. This positive momentum highlights the potential for emerging innovators in Asia, where identifying companies with robust growth strategies and adaptability to technological advancements can be key to uncovering promising investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Konishi | 0.13% | 1.57% | 10.10% | ★★★★★★ |

| Korea Ratings | NA | 1.15% | 4.26% | ★★★★★★ |

| Anapass | 8.99% | 20.82% | 58.41% | ★★★★★★ |

| Hangzhou Xili Intelligent TechnologyLtd | NA | 7.65% | 10.10% | ★★★★★★ |

| Shenyang Yuanda Intellectual Industry GroupLtd | NA | 9.86% | 33.52% | ★★★★★★ |

| Taiyo KagakuLtd | 0.66% | 6.12% | 4.54% | ★★★★★☆ |

| Torigoe | 8.08% | 4.54% | 8.78% | ★★★★★☆ |

| Shenzhen China Micro Semicon | 6.54% | 5.94% | -43.71% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 6.10% | 17.97% | 20.67% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

S&S Tech (KOSDAQ:A101490)

Simply Wall St Value Rating: ★★★★★☆

Overview: S&S Tech Corporation is a global manufacturer and seller of blank masks with a market capitalization of approximately ₩1.13 trillion.

Operations: S&S Tech generates revenue primarily from S&S Tech Co., Ltd., contributing ₩220.12 billion, and S&S Lab Co., Ltd., with ₩1.77 billion. The company also sees financial input from S&S Investment Co., Ltd., amounting to ₩1.61 billion.

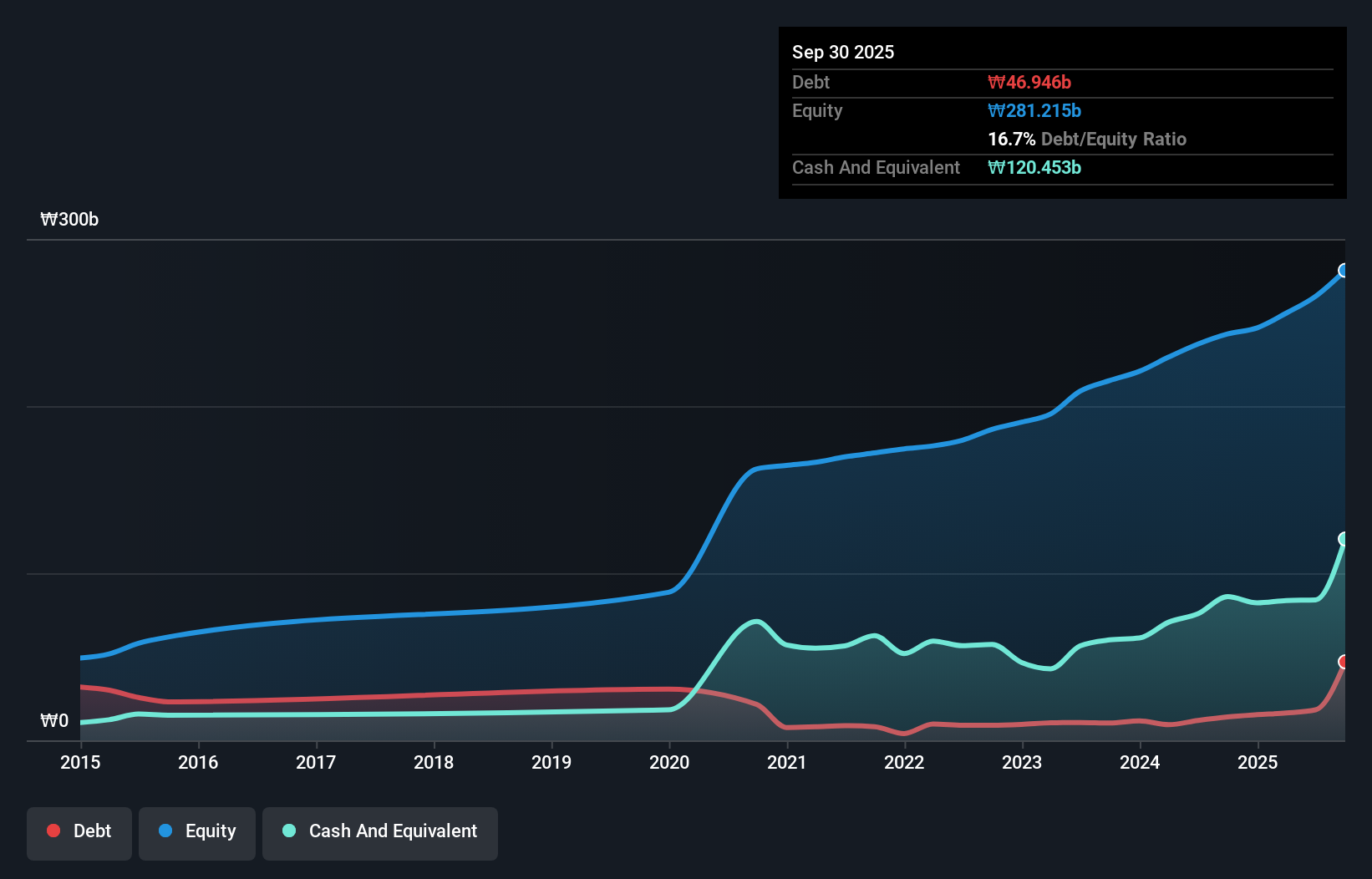

S&S Tech, a dynamic player in the semiconductor industry, has demonstrated impressive growth with earnings rising by 39.9% over the past year, surpassing the industry's 32.4%. The company's debt-to-equity ratio increased from 13.2% to 16.7% over five years, yet it holds more cash than total debt, indicating financial stability. Recent earnings for Q3 showed net income of KRW 12,704 million compared to KRW 8,208 million last year and basic EPS of KRW 610 up from KRW 391. Despite volatility in its share price recently, S&S Tech continues to deliver high-quality earnings and positive free cash flow.

- Navigate through the intricacies of S&S Tech with our comprehensive health report here.

Gain insights into S&S Tech's historical performance by reviewing our past performance report.

Hangzhou XZB Tech (SHSE:603040)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hangzhou XZB Tech Co., Ltd is involved in the research, development, production, and sale of precision parts both in China and internationally, with a market cap of CN¥10.78 billion.

Operations: XZB Tech generates revenue primarily from the sale of precision parts. The company has observed a net profit margin of 12.5%, reflecting its ability to manage costs effectively in relation to its revenue streams.

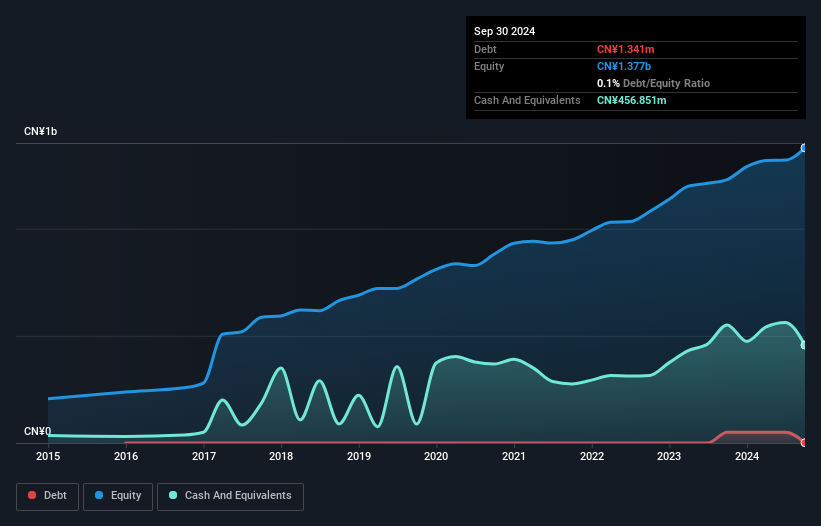

Hangzhou XZB Tech, a smaller player in the tech industry, is showing promising growth. Over the past year, earnings surged by 22.7%, outpacing the Auto Components industry's 7.8% rise. The company has managed to keep its debt under control with a debt-to-equity ratio of just 3.3% over five years and holds more cash than total debt, indicating financial stability. Recent earnings reported for nine months ending September 2025 show sales at CNY 593 million and net income at CNY 209 million compared to last year's figures of CNY 497 million and CNY 162 million respectively, reflecting solid performance improvements.

- Unlock comprehensive insights into our analysis of Hangzhou XZB Tech stock in this health report.

Explore historical data to track Hangzhou XZB Tech's performance over time in our Past section.

Ogaki Kyoritsu Bank (TSE:8361)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Ogaki Kyoritsu Bank, Ltd. is a regional financial institution offering a range of financial products and services both in Japan and internationally, with a market cap of approximately ¥180.48 billion.

Operations: Ogaki Kyoritsu Bank generates revenue through its diverse financial products and services. The bank's net profit margin has shown fluctuations over recent periods, reflecting changes in its cost structure and operational efficiency.

Ogaki Kyoritsu Bank, a lesser-known player in the financial sector, showcases robust earnings growth of 74.8% over the past year, outpacing the industry average of 25.5%. With total assets at ¥6.60 trillion and total equity of ¥349.1 billion, it boasts a strong asset base supported by primarily low-risk funding sources like customer deposits (93% of liabilities). Despite an appropriate level of non-performing loans at 1.3%, its allowance for bad loans is relatively low at 42%. Recent guidance indicates expected profits for fiscal year-end March 2026 with dividends adjusted to JPY 45 per share from JPY 55 last year.

Where To Now?

- Navigate through the entire inventory of 2498 Asian Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A101490

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026