Dividend Hike and Earnings Guidance Could Be a Game Changer for Fukuoka Financial Group (TSE:8354)

Reviewed by Sasha Jovanovic

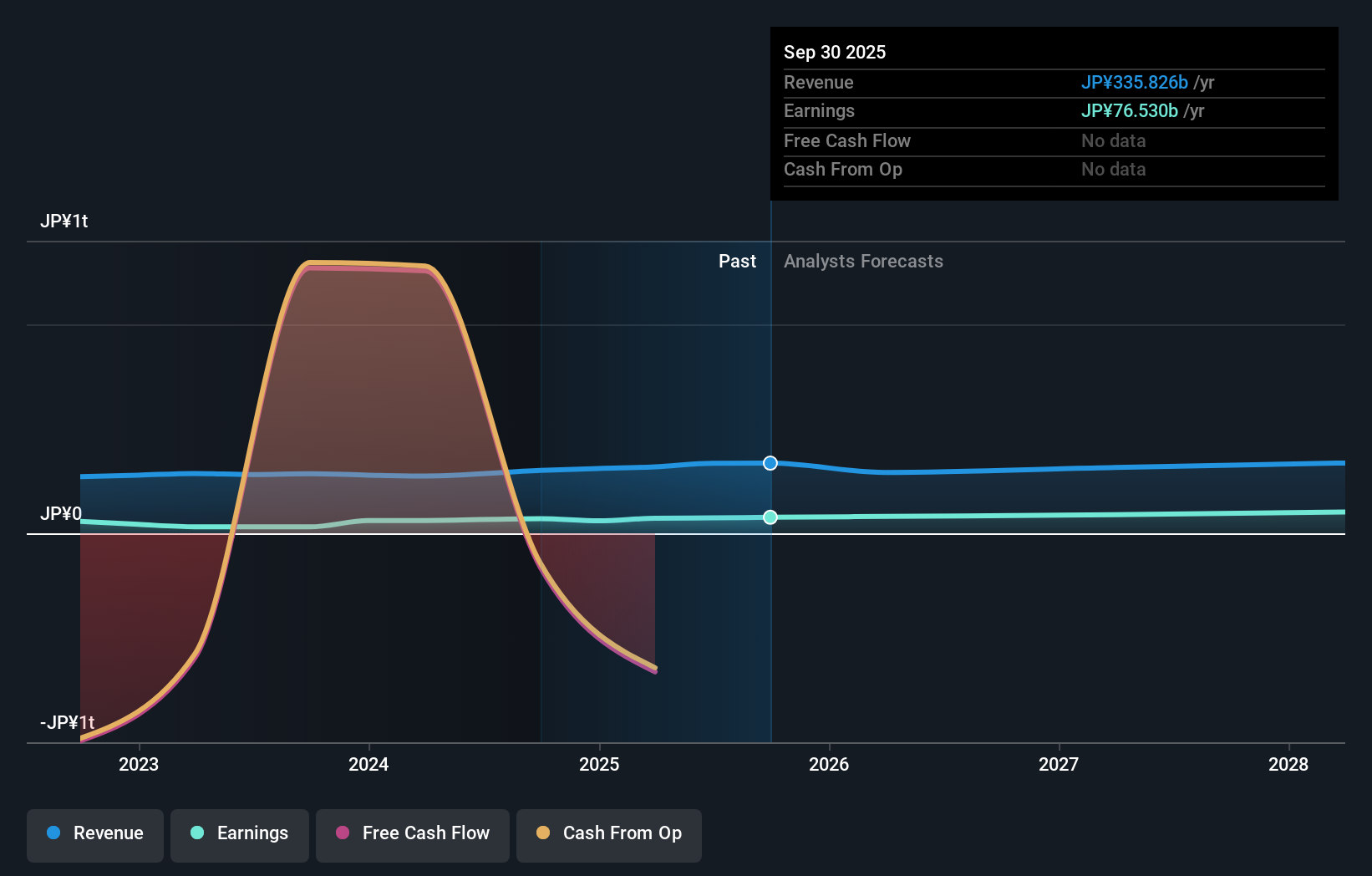

- Fukuoka Financial Group recently announced its earnings and dividend guidance for the fiscal year ending March 31, 2026, projecting net income attributable to owners of the parent company of ¥80 billion and net income per share of ¥423.27, with a second quarter-end dividend of ¥85.00 per share scheduled for December 10, 2025.

- The proposed dividend reflects a marked increase from the previous year's ¥65.00 per share, signaling management's confidence in the company's outlook and financial performance.

- We’ll explore how the increased dividend guidance frames Fukuoka Financial Group’s investment narrative in light of its latest earnings forecast.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Fukuoka Financial Group's Investment Narrative?

To be a shareholder of Fukuoka Financial Group, one typically needs to believe in the resilience and incremental growth of Japan’s regional banking sector, along with the company’s ability to deliver stable earnings and rising dividends despite a competitive environment. The recently announced earnings and dividend guidance, with a sizeable increase in the second quarter payout, reflects management’s efforts to position Fukuoka as a more shareholder-friendly option. While the news helps reinforce investment catalysts like rising profits and a growing payout policy, key risks remain, particularly the bank’s relatively inexperienced board, slower revenue growth than peers, and low return on equity. If these areas aren’t addressed, the boost from higher dividends might not be enough to outweigh lingering concerns. The dividend news is a confidence signal, but it doesn’t fundamentally reshape the most pressing issues already weighing on near-term performance.

Yet, questions about the board’s experience still linger for those watching the stock. Fukuoka Financial Group's shares have been on the rise but are still potentially undervalued by 48%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Fukuoka Financial Group - why the stock might be worth as much as ¥4764!

Build Your Own Fukuoka Financial Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fukuoka Financial Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fukuoka Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fukuoka Financial Group's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8354

Fukuoka Financial Group

Provides various banking services to individual and corporate customers.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives