In the midst of a bustling week marked by mixed earnings reports and economic data, global markets have shown varied performance, with U.S. indices experiencing some declines despite reaching record highs mid-week. As investors navigate this complex landscape, dividend stocks remain a compelling choice for those seeking steady income streams amid market volatility. A good dividend stock typically offers reliable payouts and strong fundamentals, providing stability in uncertain times like these.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.83% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.93% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

Click here to see the full list of 2032 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

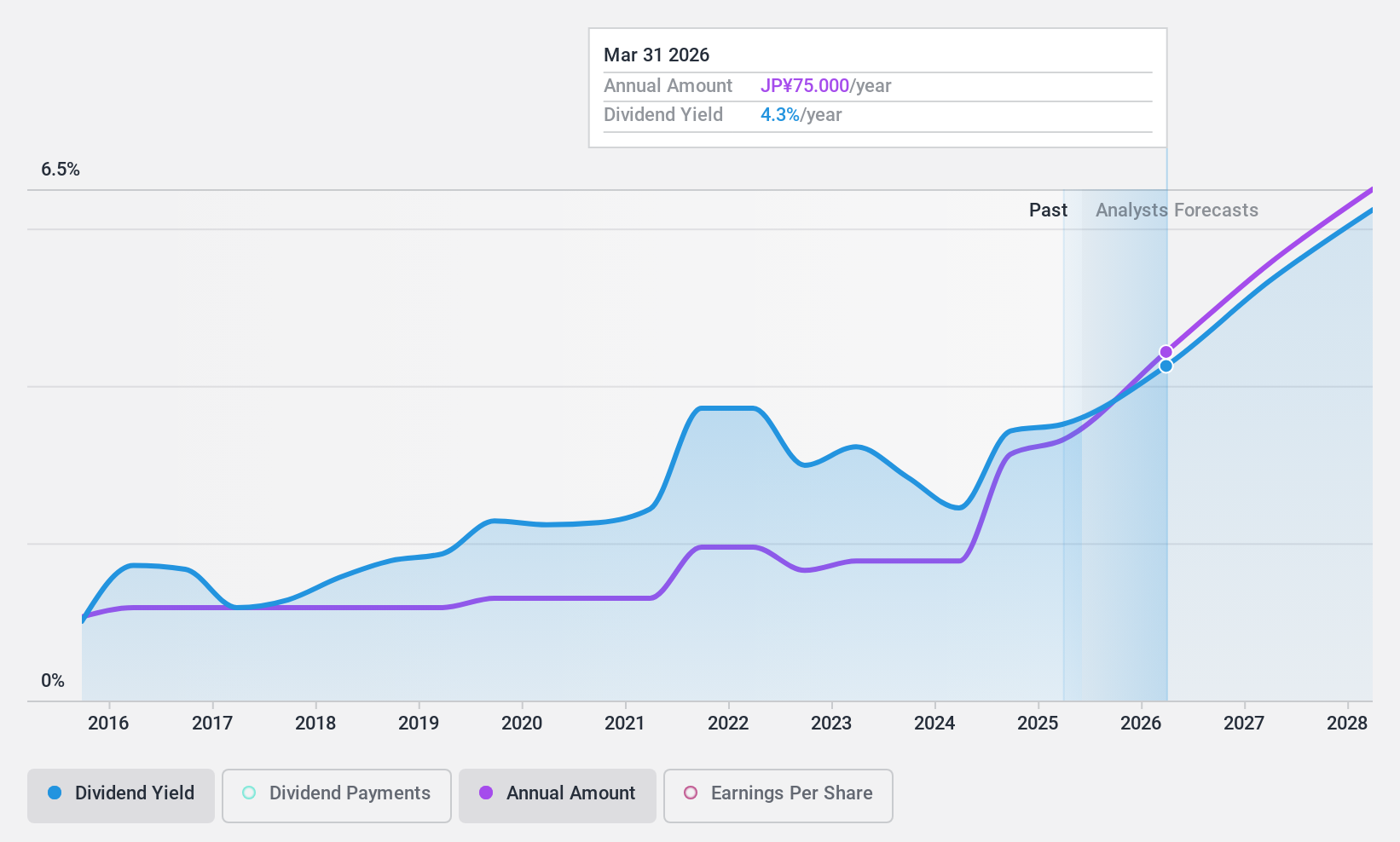

Chugin Financial GroupInc (TSE:5832)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chugin Financial Group, Inc., with a market cap of ¥268.96 billion, operates through its subsidiary The Chugoku Bank, Limited to offer a range of financial services to both corporate and individual customers in Japan.

Operations: Chugin Financial Group, Inc. generates its revenue through The Chugoku Bank, Limited by offering a variety of financial services to corporate and individual clients in Japan.

Dividend Yield: 3.5%

Chugin Financial Group Inc. offers a stable and reliable dividend yield of 3.54%, although slightly below the top tier in Japan's market. Its low payout ratio of 36.3% indicates dividends are well covered by earnings, with consistent growth over the past decade. Recent share buybacks totaling ¥4,999.93 million suggest strong capital management, potentially enhancing shareholder value despite insufficient data to predict future dividend sustainability beyond three years.

- Delve into the full analysis dividend report here for a deeper understanding of Chugin Financial GroupInc.

- Our valuation report here indicates Chugin Financial GroupInc may be overvalued.

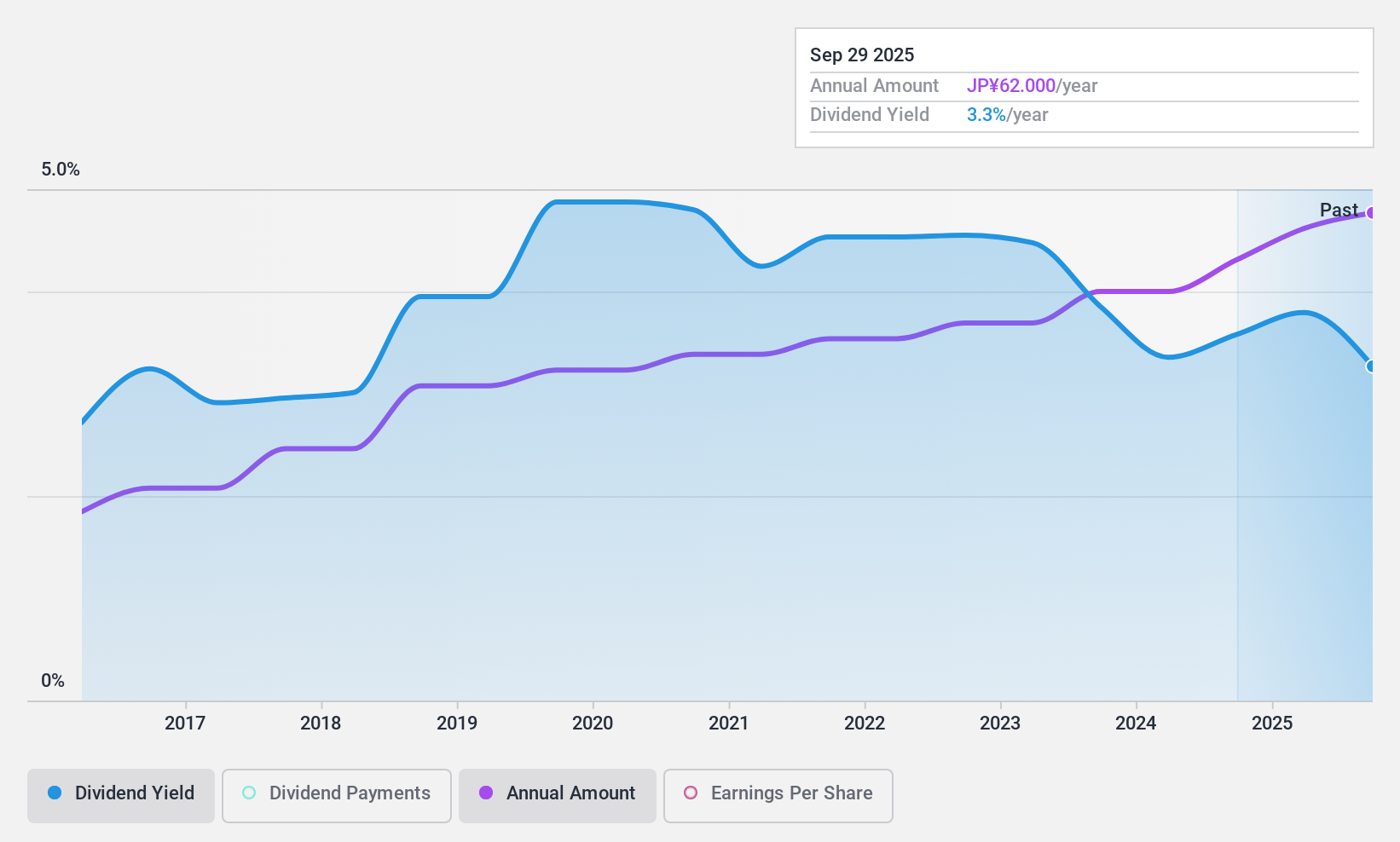

Itochu EnexLtd (TSE:8133)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Itochu Enex Co., Ltd. operates in the sale of petroleum products and liquefied petroleum gas (LPG) both in Japan and internationally, with a market cap of ¥181.08 billion.

Operations: Itochu Enex Co., Ltd. generates revenue through its operations in the sale of petroleum products and liquefied petroleum gas (LPG) across domestic and international markets.

Dividend Yield: 3.5%

Itochu Enex Ltd. provides a stable dividend yield of 3.49%, slightly below Japan's top tier, with dividends reliably growing over the past decade. The company's payout ratio of 47.6% and cash payout ratio of 25.7% indicate strong coverage by earnings and cash flows, supporting dividend sustainability. Despite trading at a significant discount to estimated fair value, recent announcements about upcoming earnings results may influence future performance considerations for investors focusing on dividends.

- Dive into the specifics of Itochu EnexLtd here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Itochu EnexLtd is trading beyond its estimated value.

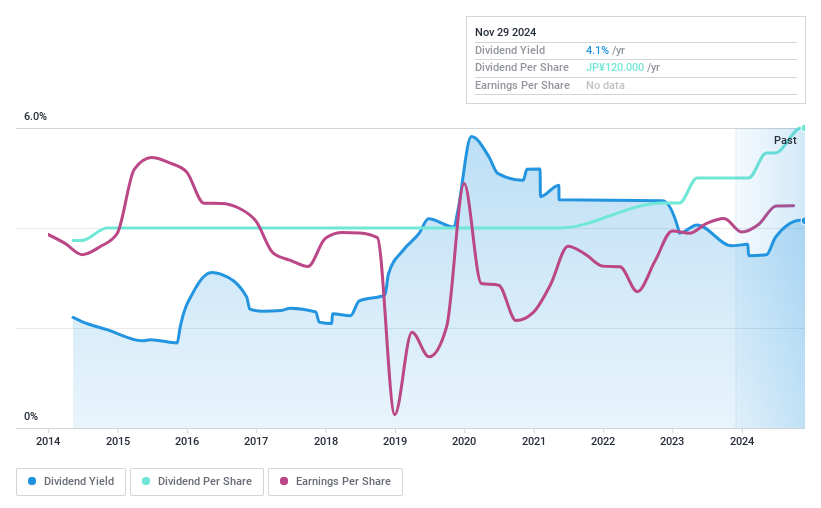

Musashino Bank (TSE:8336)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Musashino Bank, Ltd., along with its subsidiaries, offers banking products and financial services in Japan and has a market cap of ¥90.11 billion.

Operations: Musashino Bank generates its revenue through various segments, including banking products and financial services, with total revenues reported in millions of ¥.

Dividend Yield: 4%

Musashino Bank offers a high dividend yield of 4.04%, ranking in the top 25% of Japanese dividend payers, with stable and growing dividends over the past decade. Its low payout ratio of 28.4% suggests strong earnings coverage, although future sustainability is uncertain due to insufficient data on long-term earnings or cash flow coverage. The stock trades at a significant discount to its estimated fair value, potentially appealing for value-focused dividend investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Musashino Bank.

- Our valuation report here indicates Musashino Bank may be undervalued.

Next Steps

- Click here to access our complete index of 2032 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5832

Chugin Financial GroupInc

Through its subsidiary The Chugoku Bank, Limited, provides various financial services to corporate and individual customers in Japan.

Solid track record with excellent balance sheet and pays a dividend.