In a week marked by busy earnings reports and mixed economic signals, global markets saw major indices, such as the Nasdaq Composite and S&P MidCap 400 Index, reach record highs before retreating. Amidst this backdrop of cautious optimism and fluctuating market conditions, dividend stocks can offer stability and income potential for investors seeking to enhance their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.69% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.19% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 2033 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

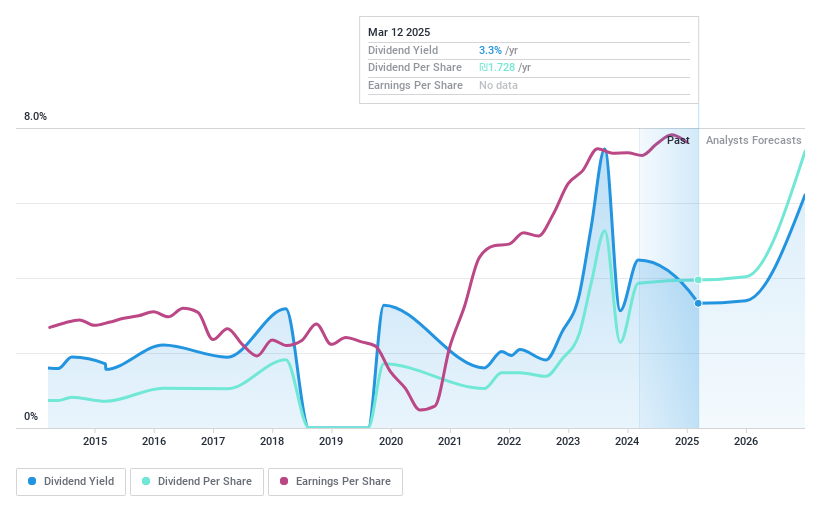

Bank Hapoalim B.M (TASE:POLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Hapoalim B.M., with a market cap of ₪52.74 billion, offers a range of banking and financial products and services in Israel and internationally through its subsidiaries.

Operations: Bank Hapoalim B.M. generates revenue from various segments, including ₪6.52 billion from Israel - Households - Other, ₪1.61 billion from Households - Housing Loans in Israel, ₪0.35 billion from Israel - Households - Credit Cards, and ₪0.85 billion from Overseas - Business Activity, along with revenue contributions of ₪0.36 billion from Israel's Institutional Entities and other activities within the region.

Dividend Yield: 4.3%

Bank Hapoalim B.M. offers a dividend yield of 4.26%, which is below the top tier of Israeli market payers. Despite a volatile and unreliable dividend history over the past decade, dividends are well covered by current earnings with a payout ratio of 27.7%. Recent financials show net income growth, and an ongoing share buyback program worth ILS 1 billion aims to optimize capital management, potentially benefiting shareholders indirectly through increased share value.

- Unlock comprehensive insights into our analysis of Bank Hapoalim B.M stock in this dividend report.

- The valuation report we've compiled suggests that Bank Hapoalim B.M's current price could be quite moderate.

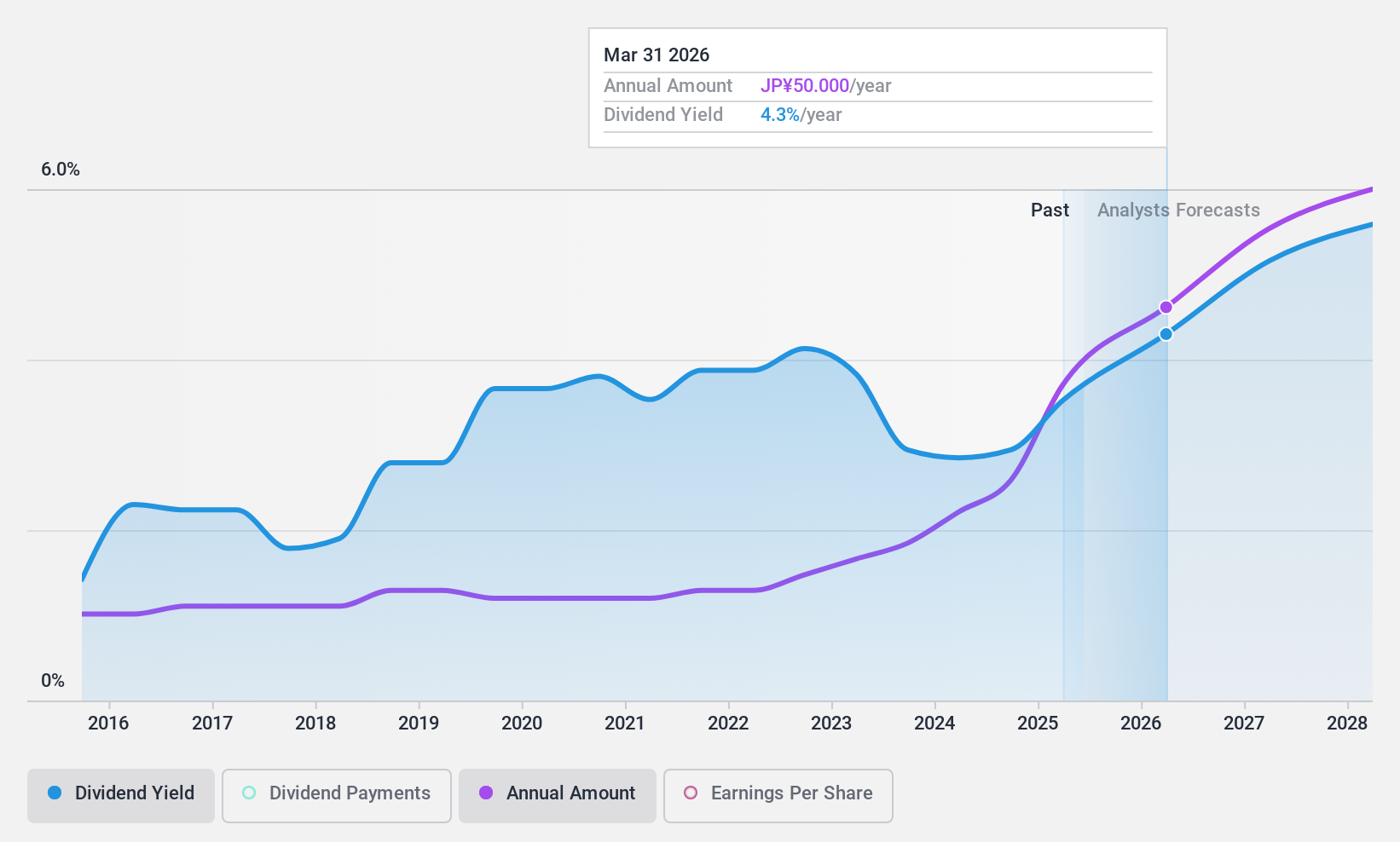

Gunma Bank (TSE:8334)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Gunma Bank, Ltd. offers a range of banking and financial products and services in Japan with a market cap of ¥339.26 billion.

Operations: The Gunma Bank, Ltd. generates revenue primarily from its banking segment at ¥168.72 billion and lease segment at ¥29.70 billion.

Dividend Yield: 3.2%

Gunma Bank offers a stable dividend yield of 3.16%, which is lower than the top 25% of Japanese market payers. The bank's dividends have shown reliability and growth over the past decade, supported by a low payout ratio of 26%. Recent buyback activity, with ¥4.99 billion spent to repurchase shares, reflects efforts to enhance shareholder returns and capital efficiency. However, there is insufficient data on future dividend sustainability relative to earnings or cash flows.

- Navigate through the intricacies of Gunma Bank with our comprehensive dividend report here.

- The analysis detailed in our Gunma Bank valuation report hints at an deflated share price compared to its estimated value.

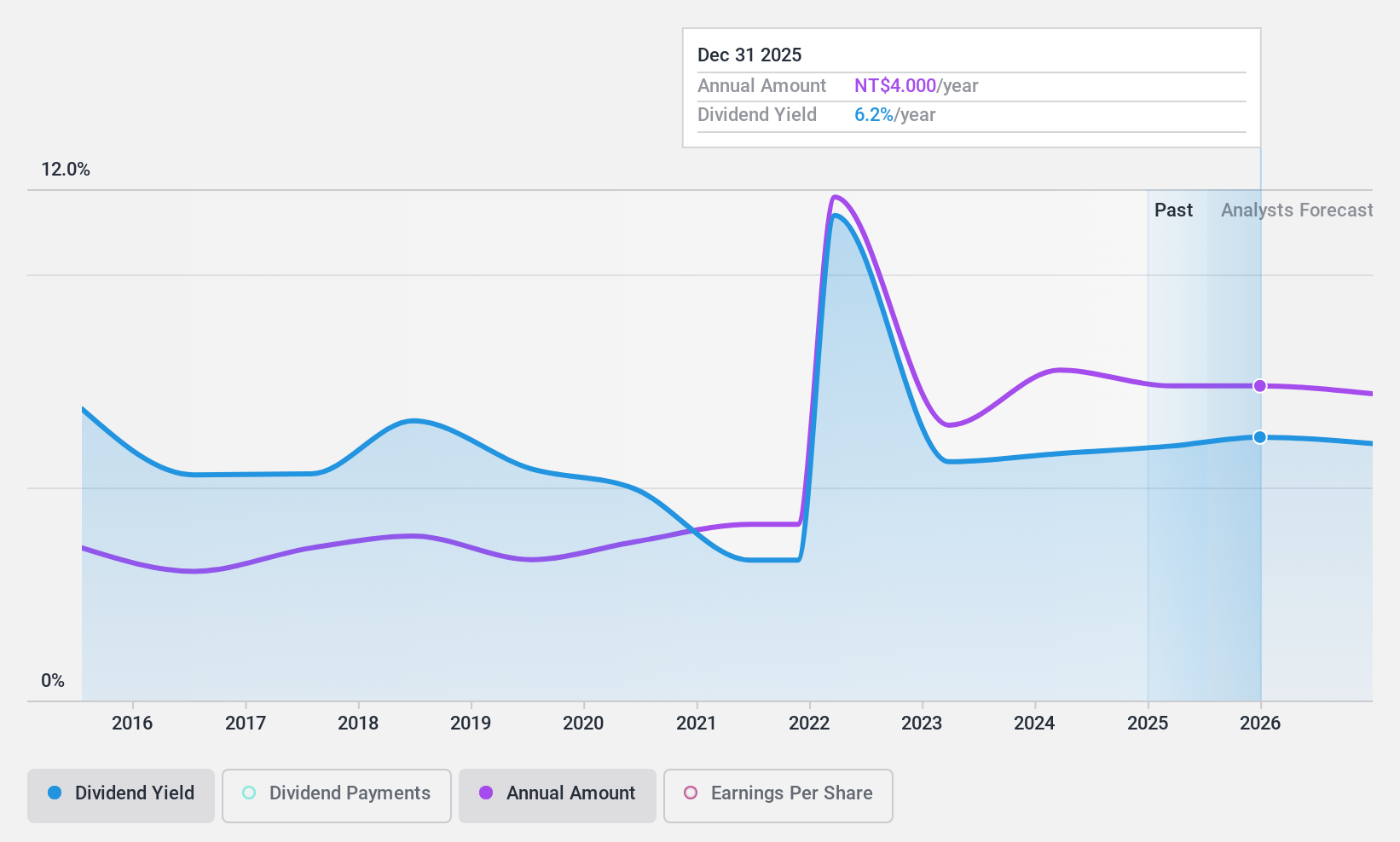

Tung Ho Steel Enterprise (TWSE:2006)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tung Ho Steel Enterprise Corporation, along with its subsidiaries, is engaged in the production and sale of steel products in Taiwan, with a market capitalization of NT$55.79 billion.

Operations: Tung Ho Steel Enterprise Corporation generates revenue primarily from its Steel Department, contributing NT$55.50 billion, and its Steel Structure Department, which adds NT$13.85 billion.

Dividend Yield: 5.5%

Tung Ho Steel Enterprise's dividend yield of 5.5% ranks in the top 25% of Taiwan's market, yet its dividends have been volatile over the past decade. Despite this instability, dividends are well-covered by earnings and cash flows, with payout ratios at 65.4% and 53.6%, respectively. The company trades below estimated fair value and offers good relative value compared to peers, though recent earnings showed a slight decline in net income year-over-year for the third quarter.

- Click to explore a detailed breakdown of our findings in Tung Ho Steel Enterprise's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Tung Ho Steel Enterprise shares in the market.

Key Takeaways

- Click through to start exploring the rest of the 2030 Top Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank Hapoalim B.M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:POLI

Bank Hapoalim B.M

Provides various banking and financial products and services in Israel and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives