- Japan

- /

- Metals and Mining

- /

- TSE:5464

3 Asian Dividend Stocks Yielding Up To 8.3%

Reviewed by Simply Wall St

As global markets face headwinds from trade uncertainties and inflationary pressures, investors are increasingly looking towards Asia for opportunities, particularly in dividend stocks that offer a stable income stream. In this context, selecting dividend stocks with strong fundamentals and consistent payout histories can be a prudent strategy to navigate the current economic landscape.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.69% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.02% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.07% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.79% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 3.94% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.20% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.79% | ★★★★★★ |

Click here to see the full list of 1114 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

China Xinhua Education Group (SEHK:2779)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Xinhua Education Group Limited offers higher and secondary vocational education services in the People's Republic of China with a market cap of HK$1.17 billion.

Operations: China Xinhua Education Group Limited generates revenue of CN¥647.30 million from its educational services in the People's Republic of China.

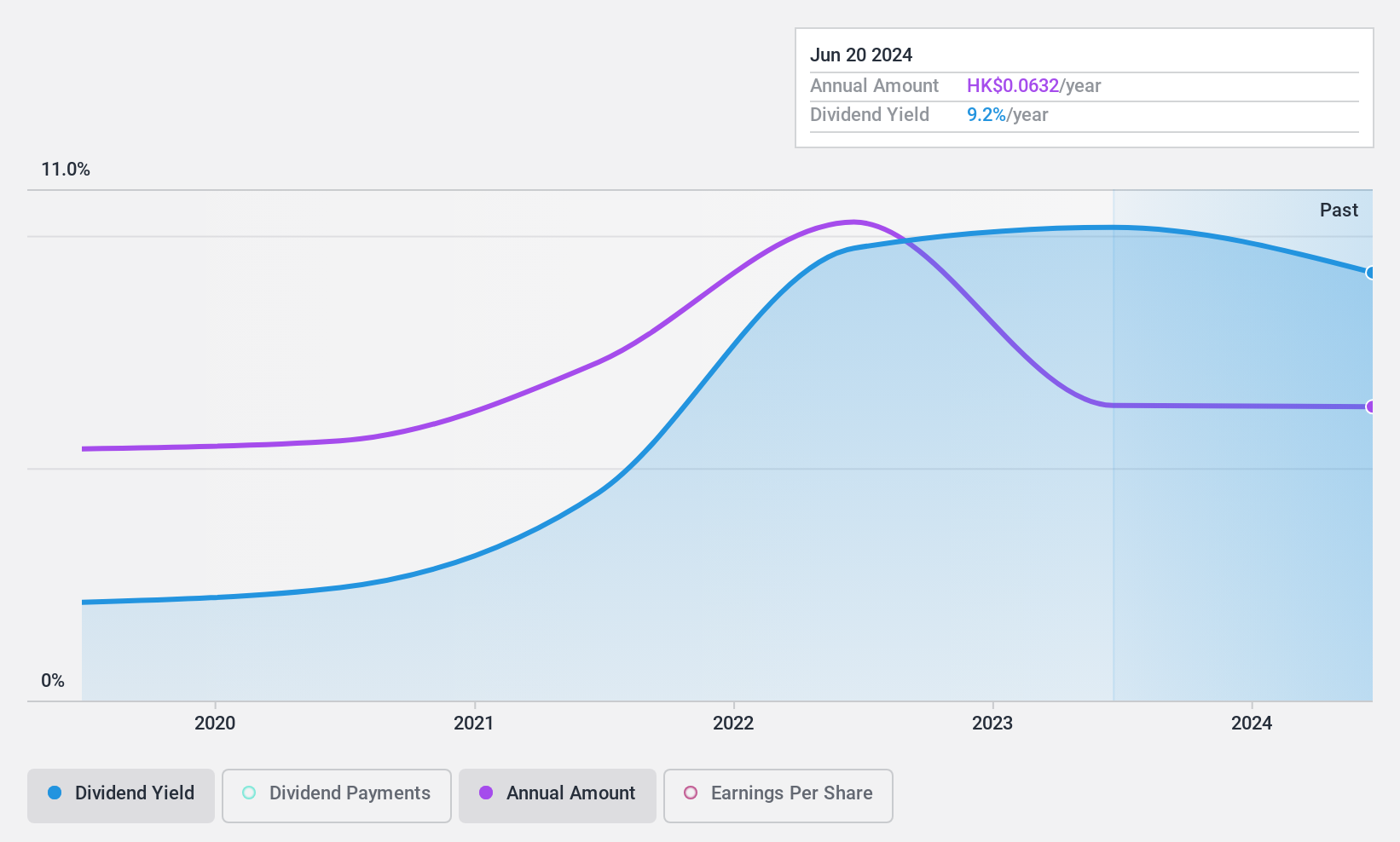

Dividend Yield: 8.4%

China Xinhua Education Group's dividend payments, while covered by earnings and cash flows with low payout ratios of 27.2% and 24.6%, respectively, have been unreliable over its six-year history due to volatility. Despite this instability, the dividend yield is in the top 25% of Hong Kong's market at 8.39%. Recent board changes include Ms. Chen Ming's appointment as an executive director, bringing over two decades of finance experience to potentially strengthen financial oversight.

- Navigate through the intricacies of China Xinhua Education Group with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, China Xinhua Education Group's share price might be too pessimistic.

Mory Industries (TSE:5464)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mory Industries Inc. is a Japanese company that manufactures and sells stainless steel and welded carbon steel products, with a market cap of ¥42.07 billion.

Operations: Mory Industries Inc. generates revenue primarily from its operations in Japan, amounting to ¥44.20 billion, and also derives income from Indonesia with ¥2.21 billion.

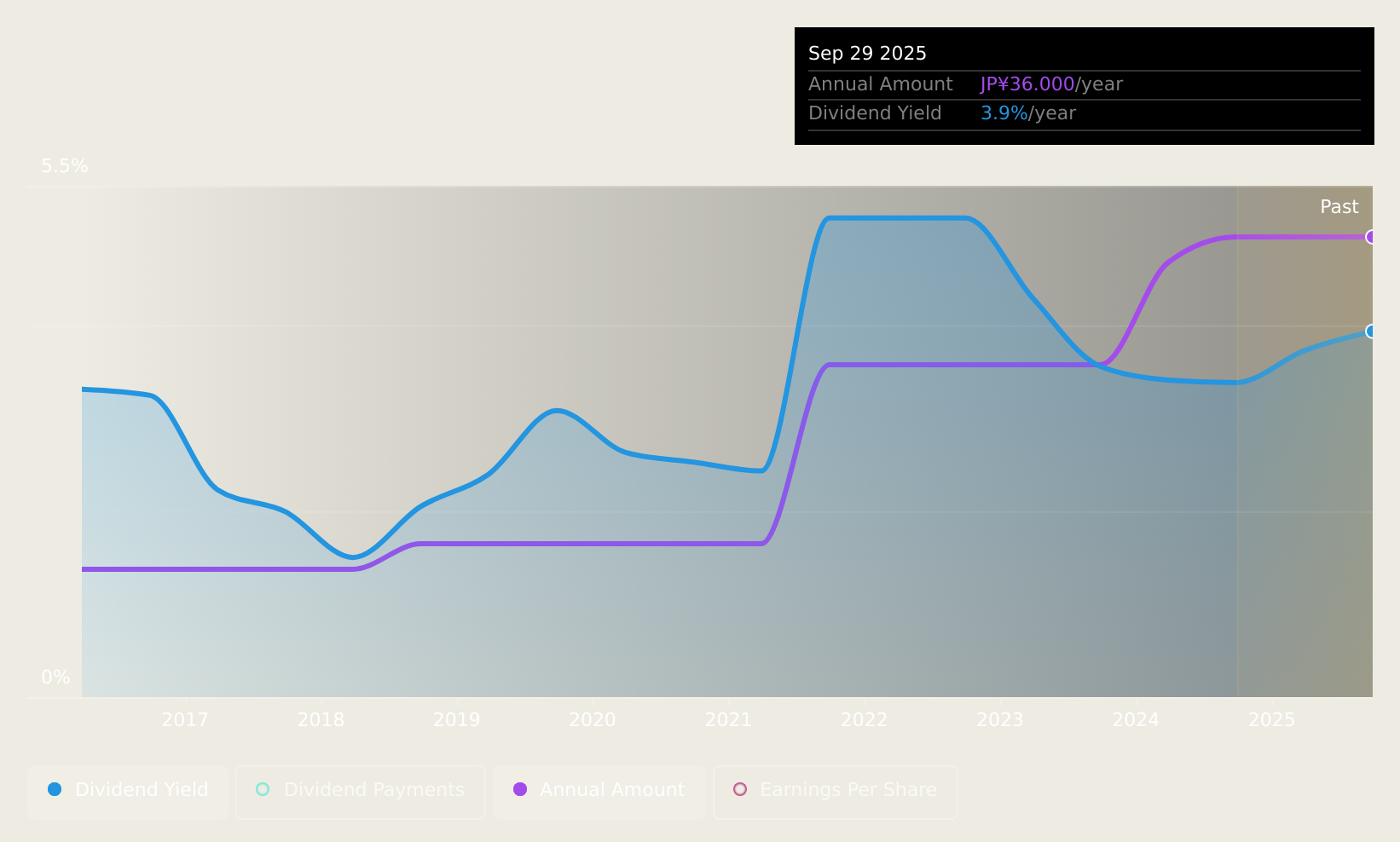

Dividend Yield: 3.2%

Mory Industries' dividend payments have been stable and growing over the past decade, with a payout ratio of 41.9% indicating sustainability. The dividends are well covered by both earnings and cash flows, supported by a low cash payout ratio of 29.8%. Although the current yield of 3.25% is below Japan's top quartile, recent share buybacks totaling ¥574.41 million reflect flexible capital policies aimed at enhancing shareholder returns amidst changing business conditions.

- Take a closer look at Mory Industries' potential here in our dividend report.

- The analysis detailed in our Mory Industries valuation report hints at an deflated share price compared to its estimated value.

Sumitomo Mitsui Financial Group (TSE:8316)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Mitsui Financial Group, Inc. is a global financial services company offering banking, leasing, securities, and consumer finance services across various regions including Japan and other international markets, with a market cap of ¥15.47 trillion.

Operations: Sumitomo Mitsui Financial Group's revenue is primarily derived from its Global Business Unit (¥1.50 billion), Retail Business Unit (¥1.36 billion), Wholesale Business Sector (¥916.30 million), and Market Business Unit (¥662.90 million).

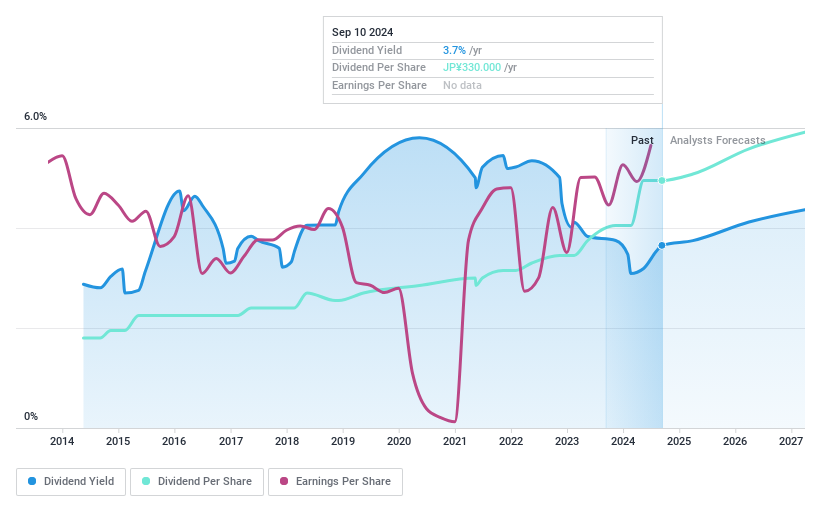

Dividend Yield: 3%

Sumitomo Mitsui Financial Group's dividends have been stable and reliable over the past decade, with a low payout ratio of 33.9%, suggesting sustainability. The current yield of 3.01% is below Japan's top quartile but remains attractive for consistent income seekers. Recent executive changes and debt restructuring, including a $600 million tender offer, indicate strategic efforts to optimize capital structure while maintaining robust earnings growth of 29.6% last year.

- Click here to discover the nuances of Sumitomo Mitsui Financial Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Sumitomo Mitsui Financial Group is trading behind its estimated value.

Next Steps

- Access the full spectrum of 1114 Top Asian Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Mory Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5464

Mory Industries

Manufactures and sells stainless steel and welded carbon steel products in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives