Mitsubishi UFJ Financial Group (TSE:8306): Is the Stock Undervalued After Recent Pullback?

Reviewed by Kshitija Bhandaru

Mitsubishi UFJ Financial Group (TSE:8306) shares have moved lower over the past week, slipping 1%. Over the past month, the stock has declined about 2% as investors weigh its recent earnings results and the overall growth outlook.

See our latest analysis for Mitsubishi UFJ Financial Group.

After a strong run earlier this year, Mitsubishi UFJ Financial Group’s share price has cooled a bit as investors digest recent earnings and shifting market sentiment. While short-term price momentum is fading, the company’s impressive 52% total shareholder return over the past year highlights durable long-term gains despite recent pullbacks.

If you’re interested in finding other financial stocks with a track record of strong growth and insider backing, it’s a great moment to discover fast growing stocks with high insider ownership

With shares pulling back but long-term returns still strong, the question for investors now is whether Mitsubishi UFJ Financial Group remains undervalued, or if the market has already factored in the company’s future growth prospects.

Most Popular Narrative: 2.6% Undervalued

With the fair value estimated just above ¥2,345 and shares last closing at ¥2,285, the current narrative suggests limited upside from today’s price. Analyst views emphasize modest undervaluation, setting the stage for a deeper look at the underlying catalysts driving this perspective.

"Ongoing share buybacks and dividend increases demonstrate disciplined capital management, boosting earnings per share and revenue growth potential. However, strong reliance on equity sales and customer segments poses risks to long-term revenue growth in the face of market volatility, as well as interest rate and exchange rate fluctuations."

Want to know what’s fueling this price target? The narrative hinges on a unique mix of earnings power, capital decisions, and bold growth forecasts. What are analysts betting on for the next phase of MUFG’s evolution? Uncover the hidden levers and the key assumptions that could make or break this valuation.

Result: Fair Value of ¥2,345 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any downturn in key customer segments or unexpected volatility in equity sales could quickly undermine these optimistic forecasts for Mitsubishi UFJ Financial Group.

Find out about the key risks to this Mitsubishi UFJ Financial Group narrative.

Another View: The Multiple Tells a Different Story

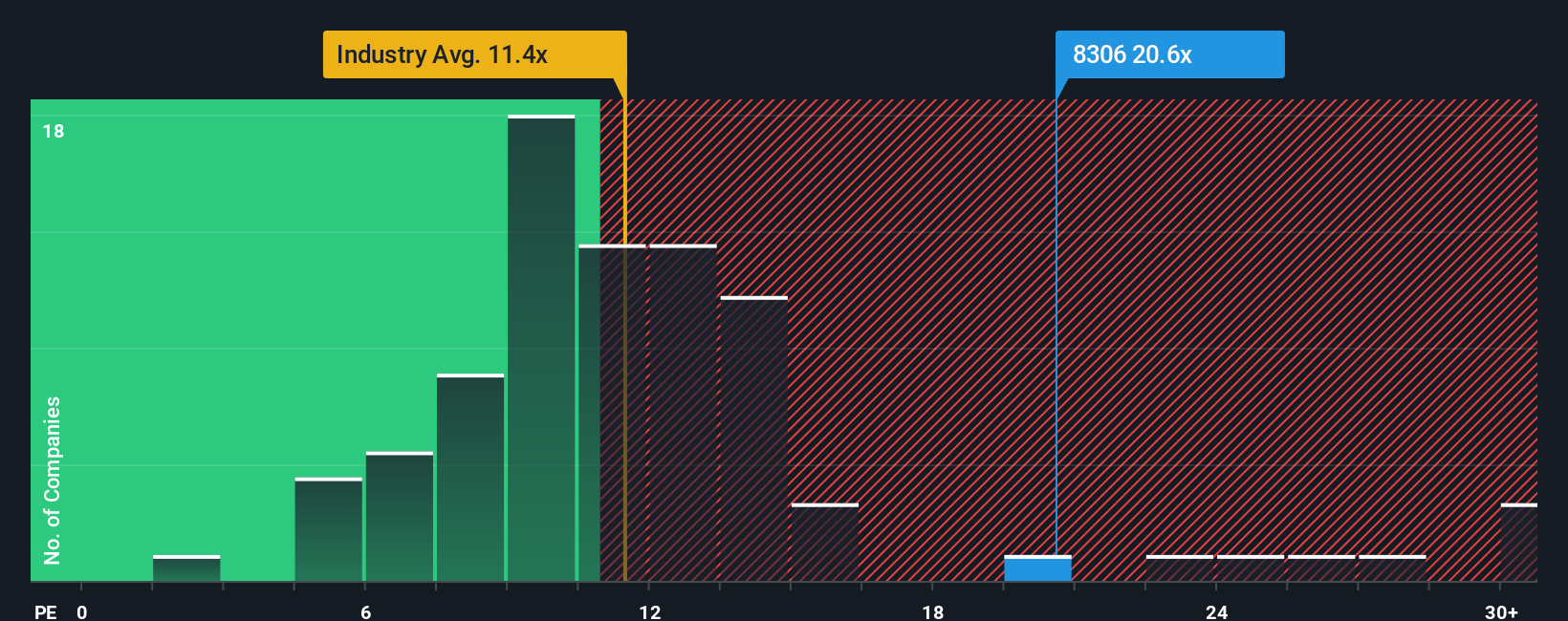

Looking at the company's valuation through its price-to-earnings ratio, a new perspective emerges. Mitsubishi UFJ Financial Group trades at 20.7 times earnings, which is noticeably higher than both peers at 17.5 and the broader Japanese Banks industry at 11.1. Our fair ratio suggests the market could move closer to 18.2. This gap could mean greater valuation risk if the market cools or an opportunity if earnings outpace expectations. Which direction will market sentiment take next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi UFJ Financial Group Narrative

If you see things differently or want to explore the numbers on your own terms, crafting your own view is fast and straightforward. Do it your way

A great starting point for your Mitsubishi UFJ Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next big opportunity slip away. There are three compelling screens delivering investment inspiration you’ll want to act on right now:

- Uncover stocks with consistent returns and strong yields using these 19 dividend stocks with yields > 3% to put reliable income at the core of your strategy.

- Pounce on high-potential companies before the market catches on by checking out these 898 undervalued stocks based on cash flows, which is built on solid cash flow analysis.

- Tap into the future of medicine and AI advancements with these 33 healthcare AI stocks, highlighting innovators transforming healthcare and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8306

Mitsubishi UFJ Financial Group

Operates as a bank holding company that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives