Mitsubishi UFJ Financial Group (TSE:8306): Evaluating Valuation After a 7% Monthly Share Price Gain

Reviewed by Simply Wall St

See our latest analysis for Mitsubishi UFJ Financial Group.

Momentum has clearly been building for Mitsubishi UFJ Financial Group, with a 1-month share price return of nearly 7 percent, adding to a solid run in 2024. Looking wider, long-term shareholders have been rewarded with a standout 1-year total shareholder return of 39 percent and even more impressive gains over the past three and five years. This suggests ongoing confidence in both growth and valuation.

If you’re keeping an eye on market momentum and want to broaden your view, now is the perfect moment to discover fast growing stocks with high insider ownership

But with shares setting fresh highs and future growth already anticipated by many, is Mitsubishi UFJ Financial Group truly undervalued at these levels? Or have markets already priced in all of the upside?

Most Popular Narrative: 10% Undervalued

With shares closing at ¥2,451, the most widely followed narrative places Mitsubishi UFJ Financial Group's fair value at ¥2,453, almost exactly where it trades now. This razor-thin gap heightens the importance of the underlying drivers and assumptions shaping the current valuation story.

The bank's efforts to reduce low-profitability assets and transform into a more profitable entity through strategic asset replacement could enhance their net margins by optimizing the risk-reward ratio. The focus on customer segments and expanded contributions from deposit loan income and fee income indicate enhanced earnings power, potentially leading to robust revenue growth.

Curious about the bold forecasts that power this valuation? The consensus narrative hinges on a dramatic shift in profitability and a surprising financial lever that could change everything. Uncover the crucial quantitative assumptions shaping this fair value. These are details that only the full narrative reveals.

Result: Fair Value of ¥2,453 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected declines in net interest income or volatility from equity sales could quickly change the outlook and shift current valuation assumptions.

Find out about the key risks to this Mitsubishi UFJ Financial Group narrative.

Another View: Valuation via Market Ratios

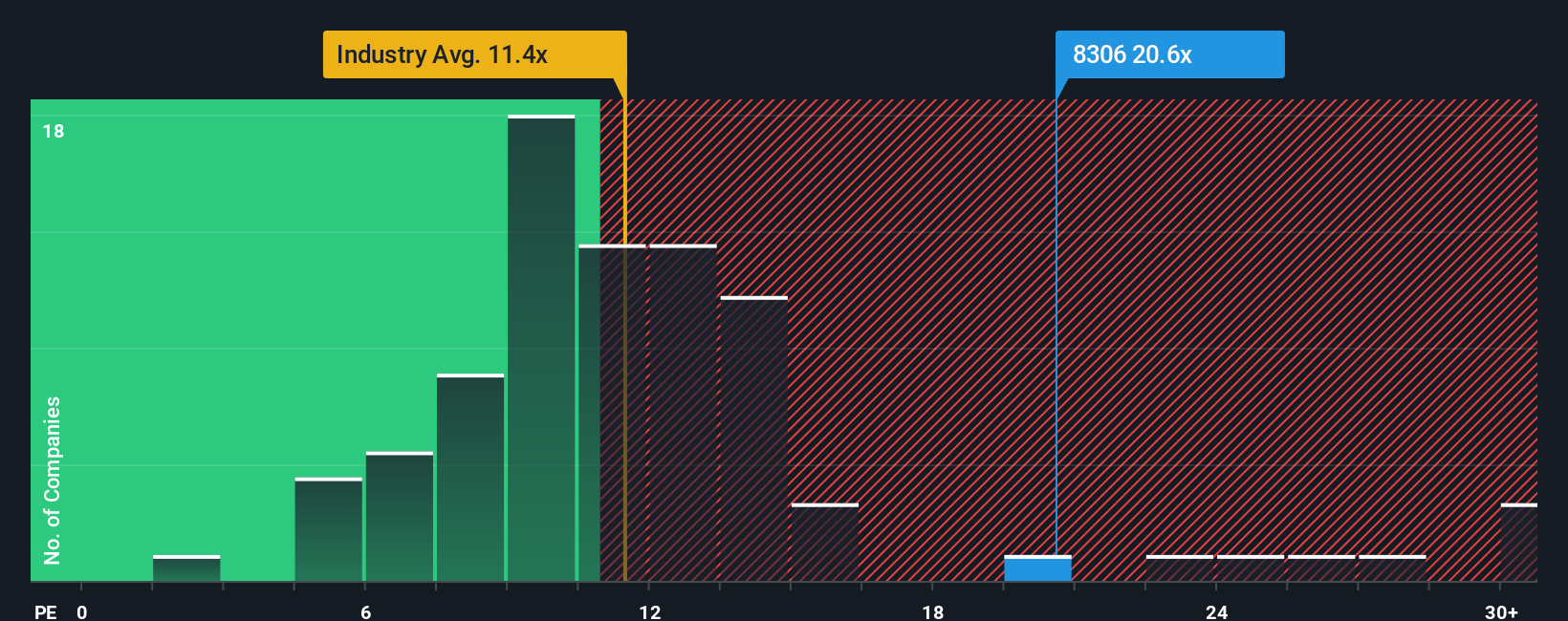

Looking at a market ratio, Mitsubishi UFJ Financial Group currently trades at 22.2x earnings. This is notably higher than the Japanese banks average of 11.3x, the peer average of 18.6x, and even above the fair ratio of 18.1x that the market could revert to. Such a premium suggests investors are paying up for perceived strength, but it also highlights the risk if sentiment or performance wavers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi UFJ Financial Group Narrative

If you have a different perspective or want to dig deeper into the numbers, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your Mitsubishi UFJ Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always searching for the next big opportunity. Give yourself an edge by checking out these handpicked ideas that could energize your portfolio and help you spot the market’s hidden winners before everyone else.

- Unearth potential high-flyers by scanning these 3593 penny stocks with strong financials that are showing real strength on key financials and are ready for critical attention.

- Tap into the power of innovation and growth by checking out these 25 AI penny stocks pioneering advancements in artificial intelligence and disruptive technologies.

- Strengthen your passive income plans by reviewing these 16 dividend stocks with yields > 3% consistently delivering market-beating yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8306

Mitsubishi UFJ Financial Group

Operates as a bank holding company that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives