Does the Recent 4% Pullback Signal New Opportunities for MUFG Stock in 2025?

Reviewed by Bailey Pemberton

Trying to figure out your next move with Mitsubishi UFJ Financial Group stock? You are not alone. After all, this is a stock that has left many investors impressed by its jaw-dropping returns over the past five years. The share price is up 542.2% from where it started. If you step back just to a one-year view, the story is still extraordinary, with a 57.6% gain giving it a strong lead over many banking peers worldwide. Even this year, through all the noise about shifting interest rates and changing regulations, the stock has climbed an impressive 23.5% year to date.

That said, stocks rarely move in a straight line. In the last week, traders have seen the price dip by 4.2%, tempering what was otherwise a steady 1.1% gain over the past month. These kinds of short-term swings are not unusual, especially for a large global bank operating in a constantly evolving financial market. While the long-term appreciation reflects optimism about Mitsubishi UFJ’s resilience and opportunities in Asia’s growing economies, near-term volatility can often signal shifts in market perception of risk or simple profit-taking.

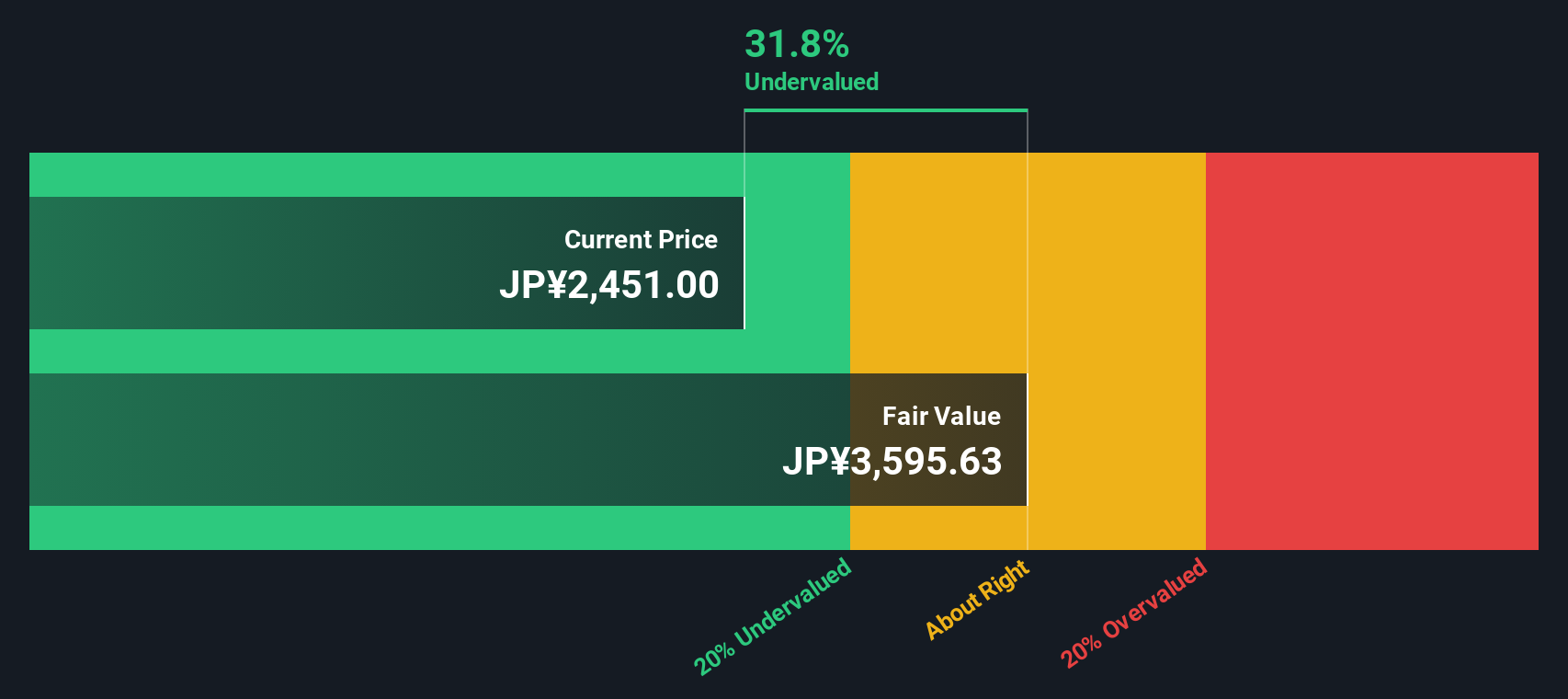

But before you decide whether to take profits, double down, or sit tight, you will want to know: is the stock truly undervalued, fully priced, or just riding a wave of enthusiasm? Based on a range of valuation checks, Mitsubishi UFJ earns a value score of 2 out of 6, meaning it looks undervalued on two standard measures but not across the board. Over the next sections, we will look closer at what those valuation approaches can tell us and why some investors are still watching for even deeper insights that go beyond the usual metrics.

Mitsubishi UFJ Financial Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mitsubishi UFJ Financial Group Excess Returns Analysis

The Excess Returns model takes a practical approach to valuation, focusing on how much profit a company can generate above its cost of equity from the capital invested. For Mitsubishi UFJ Financial Group, this approach measures the return shareholders might enjoy above what could be earned at similar risk elsewhere in the market.

Currently, Mitsubishi UFJ’s Book Value stands at ¥1,752.92 per share, with a Stable EPS of ¥214.14 per share. Both figures are drawn from analyst forecasts. The Cost of Equity is estimated at ¥127.40 per share, meaning the company generates an Excess Return of ¥86.74 per share. Over the next several years, the company is projected to maintain an average Return on Equity of 10.66%. Furthermore, the Stable Book Value is projected to rise to ¥2,009.05 per share, reflecting anticipated growth according to eight analysts' weighted estimates.

Based on these calculations, the Excess Returns model estimates Mitsubishi UFJ’s intrinsic value is about 34.5% higher than its current share price. This indicates the stock is significantly undervalued by this measure, especially considering the robust and sustained profitability reflected in its excess returns methodology.

Result: UNDERVALUED

Our Excess Returns analysis suggests Mitsubishi UFJ Financial Group is undervalued by 34.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

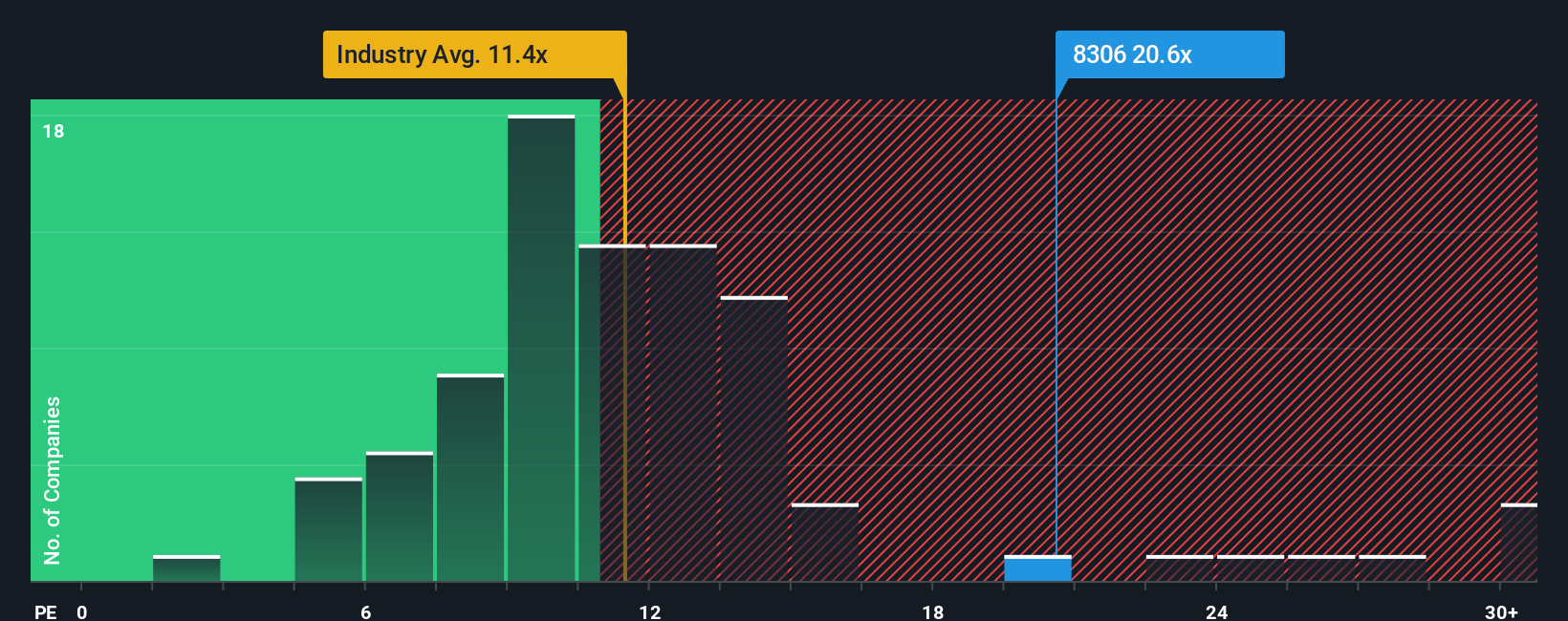

Approach 2: Mitsubishi UFJ Financial Group Price vs Earnings

For companies like Mitsubishi UFJ Financial Group that are consistently profitable, the Price-to-Earnings (PE) ratio remains one of the most reliable ways to benchmark valuation. The PE ratio is widely regarded because it directly connects the company’s earnings power to its current stock price. This helps investors gauge how much they are paying for each yen of profit. When analyzing banks and other financial institutions, a well-chosen PE ratio can signal whether the market is optimistic, cautious, or somewhere in between about future growth and risks.

A "normal" or "fair" PE ratio is significantly influenced by expectations for future growth, perceived stability, and risk factors. Higher growth or lower risks often justify a higher PE, while stagnant growth or elevated uncertainty typically leads to lower PE multiples. For Mitsubishi UFJ, the current PE stands at 20.76x, which is notably above the industry average of 10.96x as well as the average among its peer group at 17.75x. This suggests that investors expect stronger growth or greater stability compared to other banks.

To move beyond simple comparisons, Simply Wall St calculates a "Fair Ratio" in this case, 18.22x which adjusts for factors like Mitsubishi UFJ’s earnings growth, profit margin, risk profile, industry trends, and company size. This metric provides a tailored benchmark that represents what investors should expect to pay, given the company’s unique characteristics. Since the stock’s current PE is only slightly above the Fair Ratio, the difference is minimal, and the stock appears to be valued about right based on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mitsubishi UFJ Financial Group Narrative

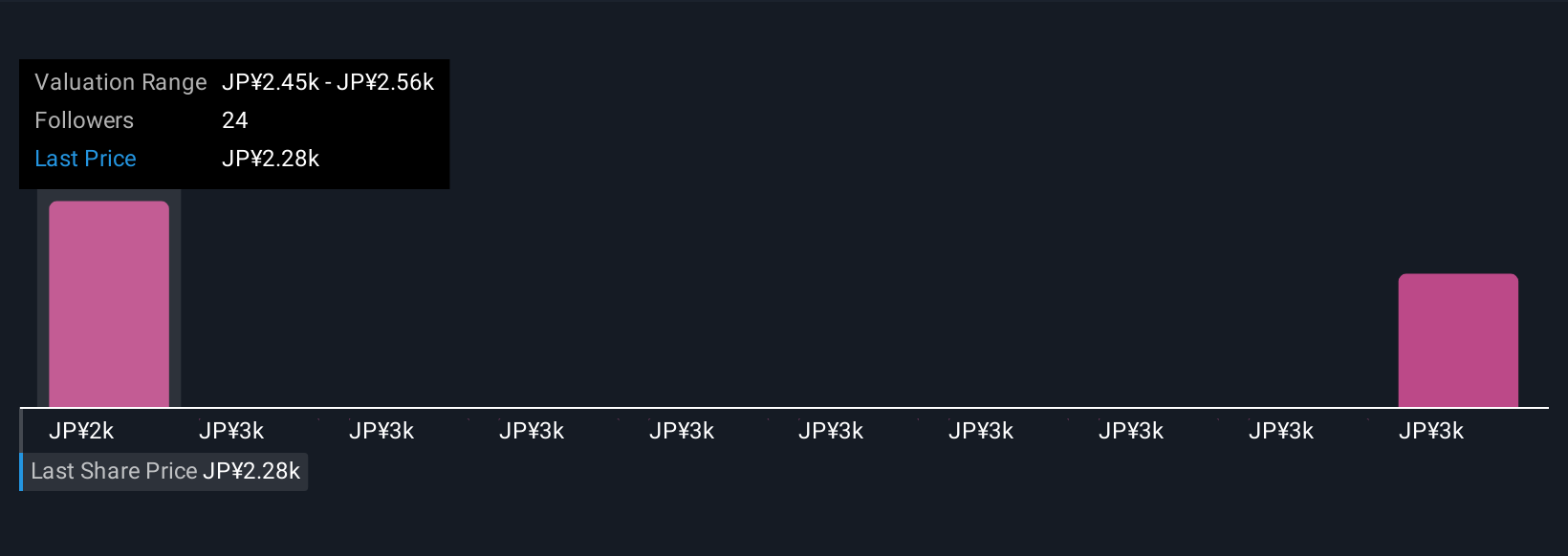

Earlier we mentioned there's an even better way to understand valuation. Let's introduce you to Narratives, which are clear, easy-to-create stories that let you connect your perspective on Mitsubishi UFJ Financial Group with a financial forecast and a resulting fair value. Instead of looking at numbers alone, Narratives empower you to combine what you know about a company, such as its strategies, risks, and opportunities, with assumptions about future revenue, earnings and margins. This approach can make your investment case much more dynamic and personal.

On Simply Wall St's Community page, millions of investors use Narratives to track their reasoning and revisit it as new developments unfold. With Narratives, you can instantly see when your expected fair value differs from the current price, helping you decide whether to buy, sell, or hold. These insights update automatically if earnings or news changes. For example, some investors currently expect MUFG’s fair value as high as ¥2,700 if capital management pays off and market risks subside, while others see it as low as ¥1,830, reflecting more caution about revenue growth and risk from global volatility. Narratives make your investment decision flexible, reasoned, and always up to date.

Do you think there's more to the story for Mitsubishi UFJ Financial Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8306

Mitsubishi UFJ Financial Group

Operates as a bank holding company that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives