Does MUFG’s Backing of Arizona Renewables Signal a Strategic Shift for TSE:8306’s Growth Narrative?

Reviewed by Sasha Jovanovic

- Recurrent Energy, a subsidiary of Canadian Solar Inc., recently announced the closing of US$825 million in construction financing and tax equity for its Desert Bloom Storage and Papago Solar projects in Arizona, with Mitsubishi UFJ Financial Group (MUFG) among the key financiers.

- This deal highlights MUFG’s growing role in supporting large-scale renewable energy infrastructure, reflecting the group’s alignment with the global energy transition.

- Now, we will consider how MUFG’s participation in major renewable energy financing could influence its investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Mitsubishi UFJ Financial Group Investment Narrative Recap

Shareholders in Mitsubishi UFJ Financial Group generally need to believe in the group’s ability to optimize its asset base, balance risks of volatile net interest income, and grow fee-based and sustainable financing income. The recent financing of Recurrent Energy's Arizona projects underscores MUFG’s push into renewables, but the short term catalyst for earnings, asset optimization and equity sales, appears largely unaffected, while exposure to interest rate swings in global markets remains the key risk.

Of the latest company updates, MUFG reaffirmed its earnings target for the fiscal year ending March 2026, signaling confidence in its revenue streams despite a mixed earnings trend and changing interest rate backdrop. This matters in the context of expanded lending to the renewable sector, which may diversify revenue but does not offset the ongoing sensitivity of net interest income to global interest rates.

Yet, investors should also be mindful that, unlike renewable project wins, risks tied to changes in yen or global interest rates could quickly...

Read the full narrative on Mitsubishi UFJ Financial Group (it's free!)

Mitsubishi UFJ Financial Group's outlook anticipates ¥6,429.1 billion in revenue and ¥2,385.3 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 5.7% and an earnings increase of ¥1,128.2 billion from current earnings of ¥1,257.1 billion.

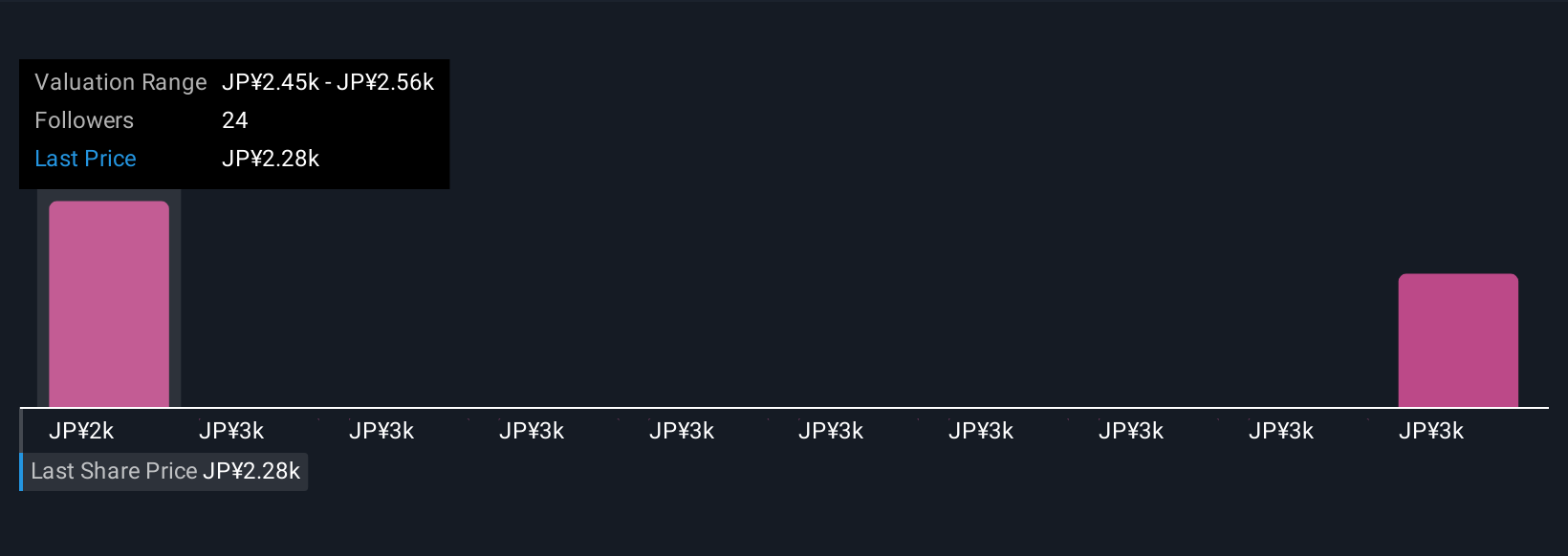

Uncover how Mitsubishi UFJ Financial Group's forecasts yield a ¥2453 fair value, a 10% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for MUFG range from ¥2,452 to ¥3,491 across three independent analyses. Many highlight growth catalysts like the bank’s efforts to optimize net interest income, underscoring why broader market developments can sharply alter investor outlooks.

Explore 3 other fair value estimates on Mitsubishi UFJ Financial Group - why the stock might be worth just ¥2453!

Build Your Own Mitsubishi UFJ Financial Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi UFJ Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mitsubishi UFJ Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi UFJ Financial Group's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8306

Mitsubishi UFJ Financial Group

Operates as a bank holding company that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives