Aozora Bank (TSE:8304): Valuation Insights Following Dividend Hike and Upbeat Earnings Outlook

Reviewed by Simply Wall St

Aozora Bank (TSE:8304) has just declared a higher interim dividend of 22 yen per share, following solid first-half financial results and a confident full-year earnings outlook.

See our latest analysis for Aozora Bank.

Following its dividend increase and upbeat earnings results, Aozora Bank’s 7% one-day share price jump stands out and has helped to reverse some of this year’s earlier declines. Still, the latest 12-month total shareholder return is -6.8%, highlighting that recent momentum is building, but the long-term picture remains mixed compared to its robust five-year total return of nearly 65%.

If you’re curious to uncover more opportunities beyond the banking sector, now’s a great time to explore fast growing stocks with high insider ownership.

With investor optimism on the rise after recent results, the question now is whether Aozora Bank’s shares are still undervalued given its outlook, or if the market has already priced in future growth.

Price-to-Earnings of 15.2x: Is it justified?

Aozora Bank is currently valued at a price-to-earnings (P/E) ratio of 15.2x, placing it above both the industry average and its immediate peers. With a last close price of ¥2441 per share, investors are paying more than what is typical for Japanese bank stocks.

The price-to-earnings ratio compares a company's share price to its per-share earnings. It serves as a common gauge of how the market values future profitability. In banking, where earnings can be cyclical and sensitive to credit quality, a higher P/E often signals expectations for superior earnings growth or outsized returns.

However, at 15.2x, Aozora Bank trades at a premium not only to the Japanese Banks industry average of 11.3x, but also to the peer average of 15.1x. This indicates that investors expect stronger results from Aozora Bank than from its sector rivals. Such optimism may not be fully supported by its recent growth trajectory or profitability profile. Relative to the market estimate of a fair P/E ratio of 13.3x, the shares appear expensive. This suggests the valuation could face pressure if earnings growth does not accelerate.

Explore the SWS fair ratio for Aozora Bank

Result: Price-to-Earnings of 15.2x (OVERVALUED)

However, sluggish revenue growth and the shares trading above analyst target price remain important risks that could limit further upside for Aozora Bank.

Find out about the key risks to this Aozora Bank narrative.

Another View: DCF Model Brings a Contrasting Verdict

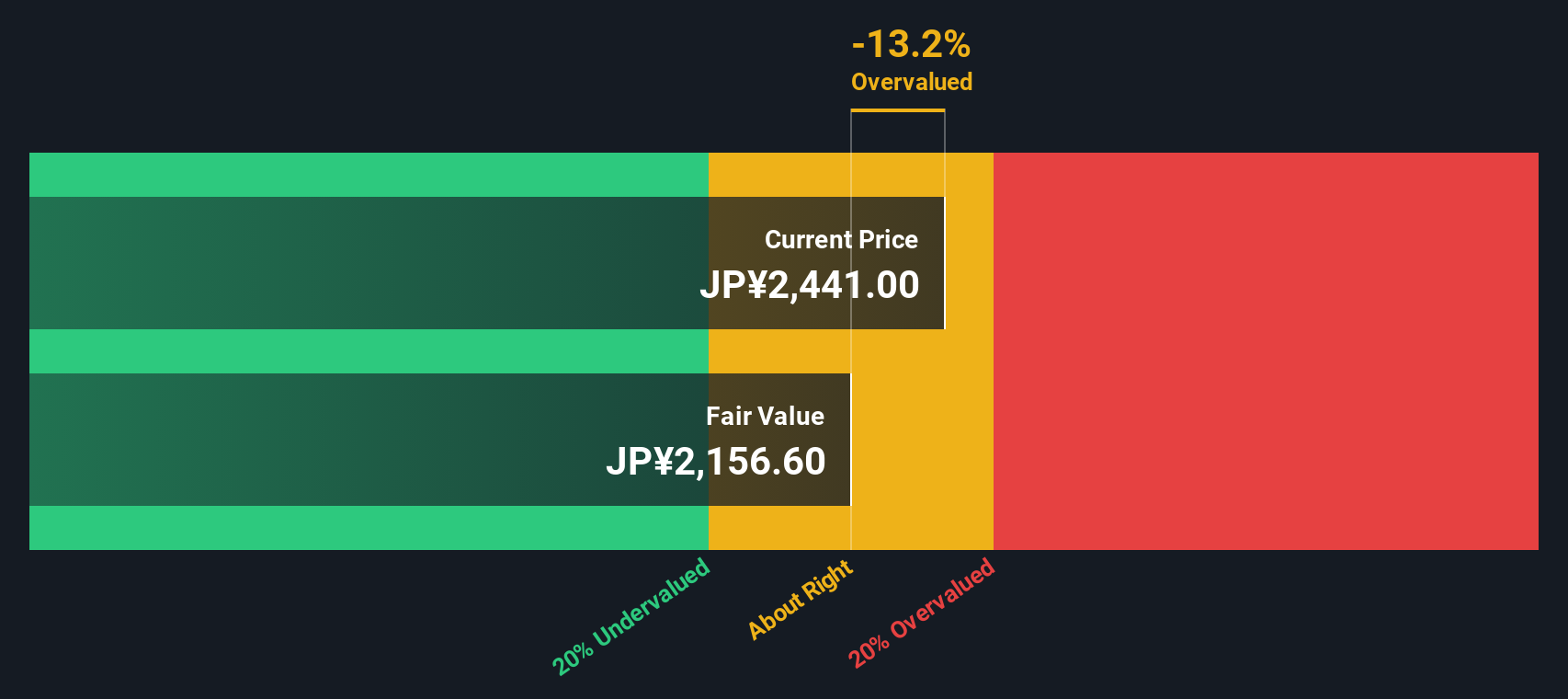

Taking a different approach, our DCF model estimates Aozora Bank’s fair value at ¥2,152.74, which is well below its current share price of ¥2,441. This suggests the stock could be overvalued from a cash flow perspective, not just based on earnings multiples. Which method tells the truer story for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aozora Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aozora Bank Narrative

If you see things differently or want to dig into the numbers yourself, you have the freedom to build your own perspective in just a few minutes. Do it your way.

A great starting point for your Aozora Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let fresh opportunities pass you by. Grab your edge with the Simply Wall Street Screener and spot tomorrow’s potential winners before the crowd.

- Tap into the artificial intelligence boom with these 25 AI penny stocks, which are shaping smarter digital ecosystems and powering automated breakthroughs.

- Secure consistent income streams by reviewing these 16 dividend stocks with yields > 3% offering high yields and a track record of reliable payouts.

- Get ahead of the curve with these 26 quantum computing stocks, pushing boundaries in futuristic computing and unlocking next-level technological growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8304

Aozora Bank

Provides various banking products and services in Japan and internationally.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives