Kyoto Financial Group (TSE:5844) Valuation Check After Unused Share Buyback Authorization

Reviewed by Simply Wall St

Kyoto Financial GroupInc (TSE:5844) just confirmed that, despite board approval for a sizeable share buyback program, it did not repurchase any stock during the late November window on the Tokyo market.

See our latest analysis for Kyoto Financial GroupInc.

The decision not to execute the buyback comes as Kyoto Financial GroupInc’s share price has climbed to ¥3,427, supported by a robust year to date share price return and a powerful multi year total shareholder return that suggest momentum is still very much in its favor.

If this kind of move in a regional bank has caught your eye, it could be a good moment to scan for other potential opportunities via fast growing stocks with high insider ownership.

But with the stock trading above analyst targets and following a strong multi year run, is Kyoto Financial GroupInc still attractively priced for long term investors, or is the market already baking in the next leg of growth?

Price-to-Earnings of 23.1x: Is it justified?

Based on its latest close at ¥3,427, Kyoto Financial GroupInc trades on a rich 23.1x price to earnings multiple versus its banking peers, suggesting an overvalued profile on this measure.

The price to earnings ratio compares what investors are paying today to the company’s current earnings power, a key lens for mature, profitable banks. For Kyoto Financial GroupInc, a 23.1x multiple implies the market is willing to pay a substantial premium for each unit of profit, hinting at elevated expectations around the durability of recent earnings growth and margin improvement.

That premium stands out when set against both the broader Japanese banks industry and closest peers. Kyoto Financial GroupInc’s 23.1x multiple is more than double the JP Banks industry average of 11.3x and well above the peer average of 13.5x. This gap is also stark versus the estimated fair price to earnings ratio of 13.7x that our models suggest the market could ultimately normalize toward for this stock. Explore the SWS fair ratio for Kyoto Financial GroupInc

Result: Price-to-Earnings of 23.1x (OVERVALUED)

However, stretched valuation and modest revenue contraction mean any earnings disappointment or sector wide sentiment shift could quickly unwind Kyoto Financial GroupInc’s recent momentum.

Find out about the key risks to this Kyoto Financial GroupInc narrative.

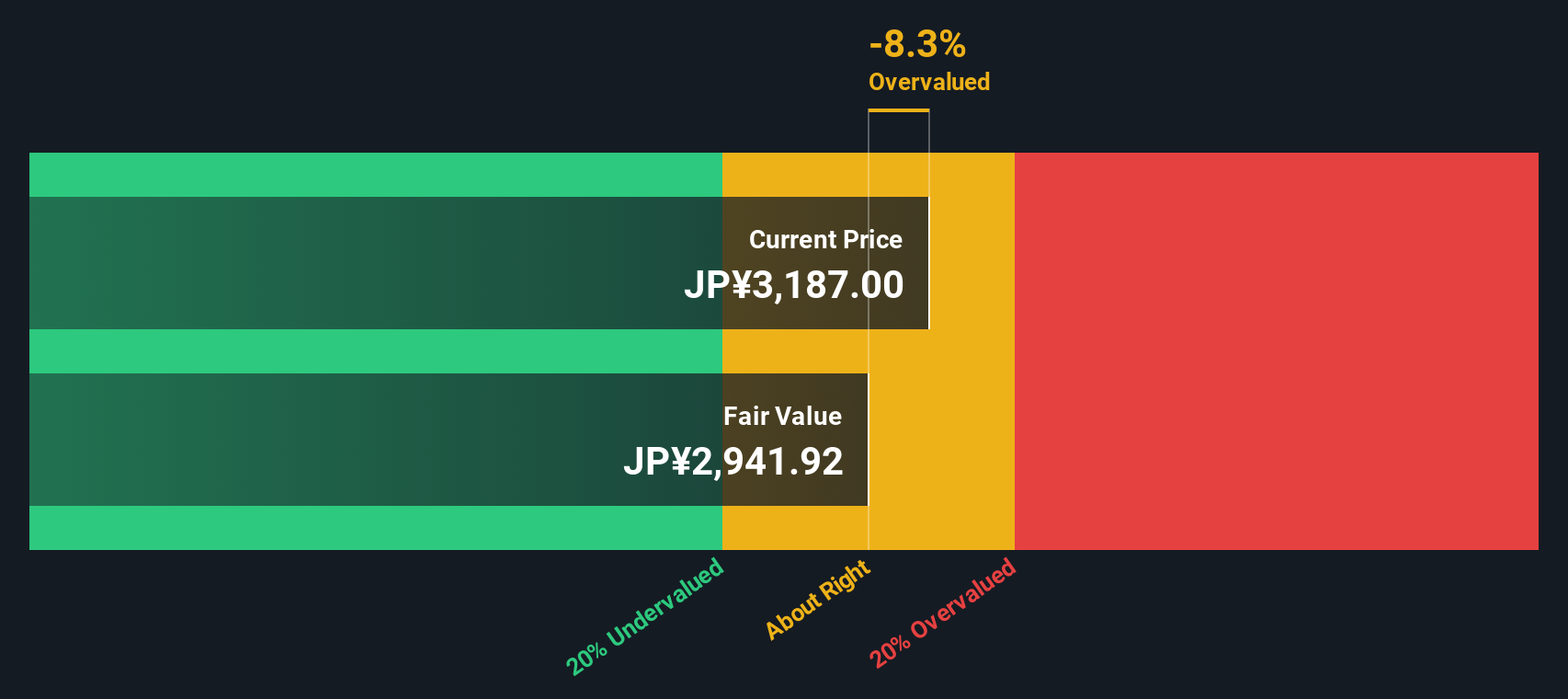

Another View Using Our DCF Model

Our DCF model paints an even starker picture, putting Kyoto Financial GroupInc’s fair value at about ¥1,640.66, well below the current ¥3,427 share price and signaling clear overvaluation on a cash flow basis.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyoto Financial GroupInc for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kyoto Financial GroupInc Narrative

If you prefer to dig into the numbers yourself and challenge these conclusions, you can build a personalized view of Kyoto Financial GroupInc in just a few minutes, Do it your way.

A great starting point for your Kyoto Financial GroupInc research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, equip yourself with fresh opportunities from our most powerful screeners so the next big winner does not slip past your radar.

- Target reliable income streams by reviewing these 15 dividend stocks with yields > 3% that can help anchor your portfolio with steady cash returns.

- Capitalize on disruptive innovation by focusing on these 26 AI penny stocks positioned to benefit from the rapid adoption of artificial intelligence.

- Strengthen your long term strategy by filtering for these 908 undervalued stocks based on cash flows that may offer attractive entry points based on fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyoto Financial GroupInc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5844

Kyoto Financial GroupInc

Through its subsidiary, provides various banking products and services in Japan.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026