- Japan

- /

- Auto Components

- /

- TSE:7299

Optimistic Investors Push Fuji Oozx Inc. (TSE:7299) Shares Up 26% But Growth Is Lacking

Fuji Oozx Inc. (TSE:7299) shares have continued their recent momentum with a 26% gain in the last month alone. The annual gain comes to 135% following the latest surge, making investors sit up and take notice.

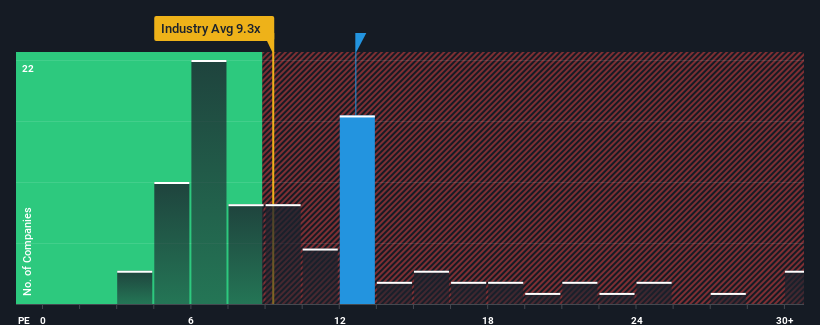

Even after such a large jump in price, there still wouldn't be many who think Fuji Oozx's price-to-earnings (or "P/E") ratio of 12.6x is worth a mention when the median P/E in Japan is similar at about 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's exceedingly strong of late, Fuji Oozx has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Fuji Oozx

Is There Some Growth For Fuji Oozx?

There's an inherent assumption that a company should be matching the market for P/E ratios like Fuji Oozx's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 57% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 11% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Fuji Oozx's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Fuji Oozx's P/E

Fuji Oozx's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Fuji Oozx revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Fuji Oozx that you should be aware of.

If you're unsure about the strength of Fuji Oozx's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7299

Fuji Oozx

Engages in the manufacturing and sale of engine valves and other engine related components in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives