As global markets navigate a landscape of easing trade tensions and mixed economic signals, the Asian markets present both challenges and opportunities for investors seeking stability through dividends. In this context, identifying dividend stocks with solid yields can offer a measure of reliability, particularly when these stocks demonstrate resilience amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.88% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.53% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.14% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.11% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.44% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Nippon Fine Chemical (TSE:4362)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Fine Chemical Co., Ltd. and its subsidiaries manufacture and sell fine chemical, cosmetic, and industrial chemical products both in Japan and internationally, with a market cap of ¥51.75 billion.

Operations: Nippon Fine Chemical Co., Ltd. generates revenue through its fine chemical, cosmetic, and industrial chemical products sold domestically and internationally.

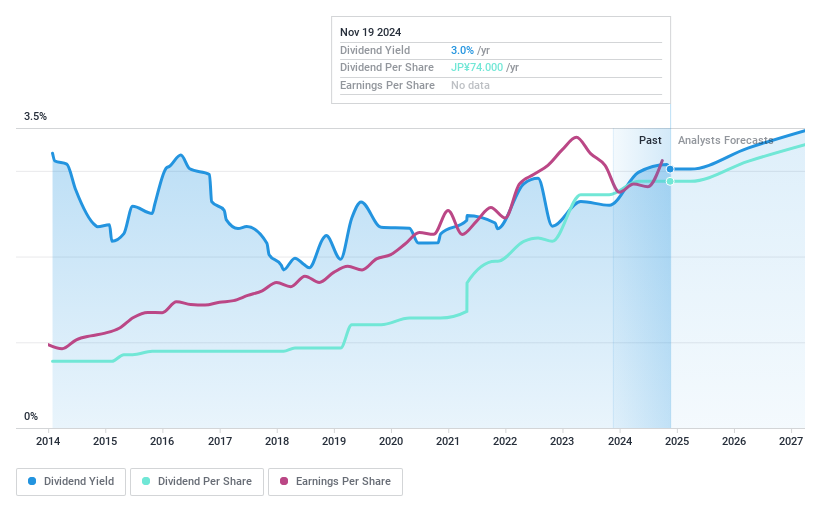

Dividend Yield: 4.1%

Nippon Fine Chemical's dividend payments have been stable and reliable over the past decade, with a current yield of 4.09%, placing it in the top 25% of Japanese dividend payers. Although dividends are well covered by earnings due to a low payout ratio of 43%, they are not supported by cash flows, as indicated by a high cash payout ratio of 119.8%. Recent announcements include an increase in dividends and a share repurchase program worth ¥2 billion to enhance shareholder returns.

- Unlock comprehensive insights into our analysis of Nippon Fine Chemical stock in this dividend report.

- Our valuation report unveils the possibility Nippon Fine Chemical's shares may be trading at a premium.

Hokuriku Electric IndustryLtd (TSE:6989)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hokuriku Electric Industry Co., Ltd. develops, manufactures, and sells electronic components both in Japan and internationally, with a market cap of ¥14.89 billion.

Operations: Hokuriku Electric Industry Co., Ltd. generates its revenue from the development, manufacturing, and sale of electronic components across domestic and international markets.

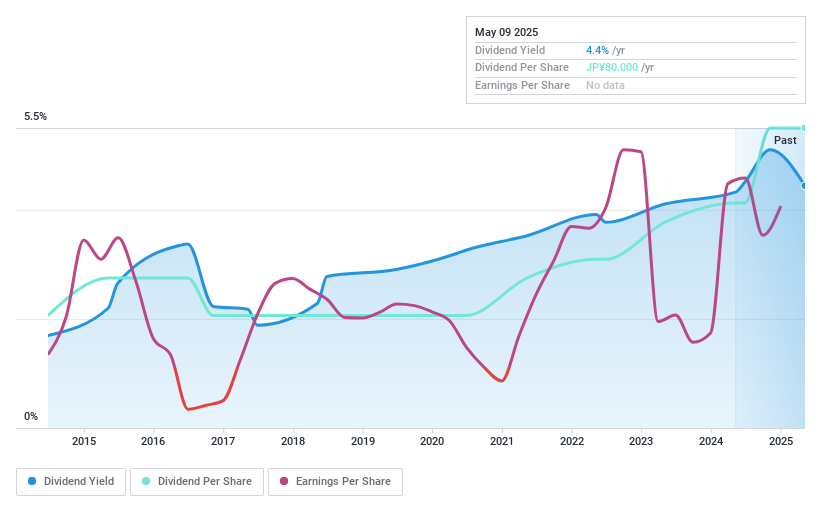

Dividend Yield: 4.3%

Hokuriku Electric Industry Ltd.'s dividend yield of 4.26% ranks it in the top 25% of Japanese dividend payers, though its payments have been volatile over the past decade. The dividends are well covered by earnings and cash flows, with payout ratios of 22.4% and 24.9%, respectively. Recent completion of a share buyback program totaling ¥499.94 million may support shareholder value despite an unstable dividend history.

- Delve into the full analysis dividend report here for a deeper understanding of Hokuriku Electric IndustryLtd.

- Our valuation report unveils the possibility Hokuriku Electric IndustryLtd's shares may be trading at a discount.

Fuji Oozx (TSE:7299)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fuji Oozx Inc. manufactures and sells engine valves and related components both in Japan and internationally, with a market cap of ¥15.20 billion.

Operations: Fuji Oozx Inc. generates revenue from its Automotive Parts Manufacturing Business, amounting to ¥24.16 billion.

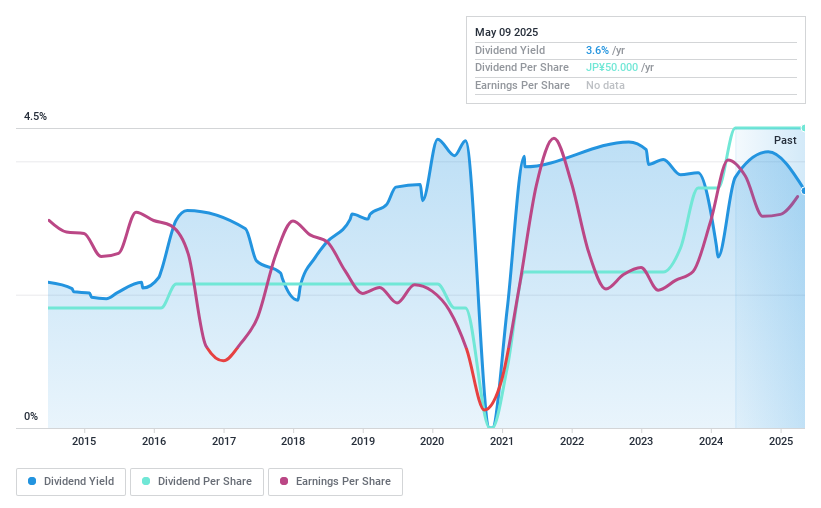

Dividend Yield: 3.4%

Fuji Oozx's dividend yield of 3.38% is below the top quartile of Japanese payers, and its history shows volatility. Despite a low payout ratio of 37.4%, ensuring coverage by earnings, the dividends have been unreliable over the past decade. The company announced a share repurchase program for up to ¥150 million to enhance capital efficiency, though no shares were repurchased as of early May 2025, indicating potential challenges in execution or strategic shifts.

- Click here and access our complete dividend analysis report to understand the dynamics of Fuji Oozx.

- Our valuation report here indicates Fuji Oozx may be undervalued.

Summing It All Up

- Delve into our full catalog of 1231 Top Asian Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Fine Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4362

Nippon Fine Chemical

Manufactures and sells fine chemical, cosmetic, and industrial chemical products in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives