- Japan

- /

- Auto Components

- /

- TSE:7296

Assessing F.C.C (TSE:7296) Valuation as Subtle Share Price Shifts Draw Investor Interest

Reviewed by Simply Wall St

Price-to-Earnings of 9.7x: Is it justified?

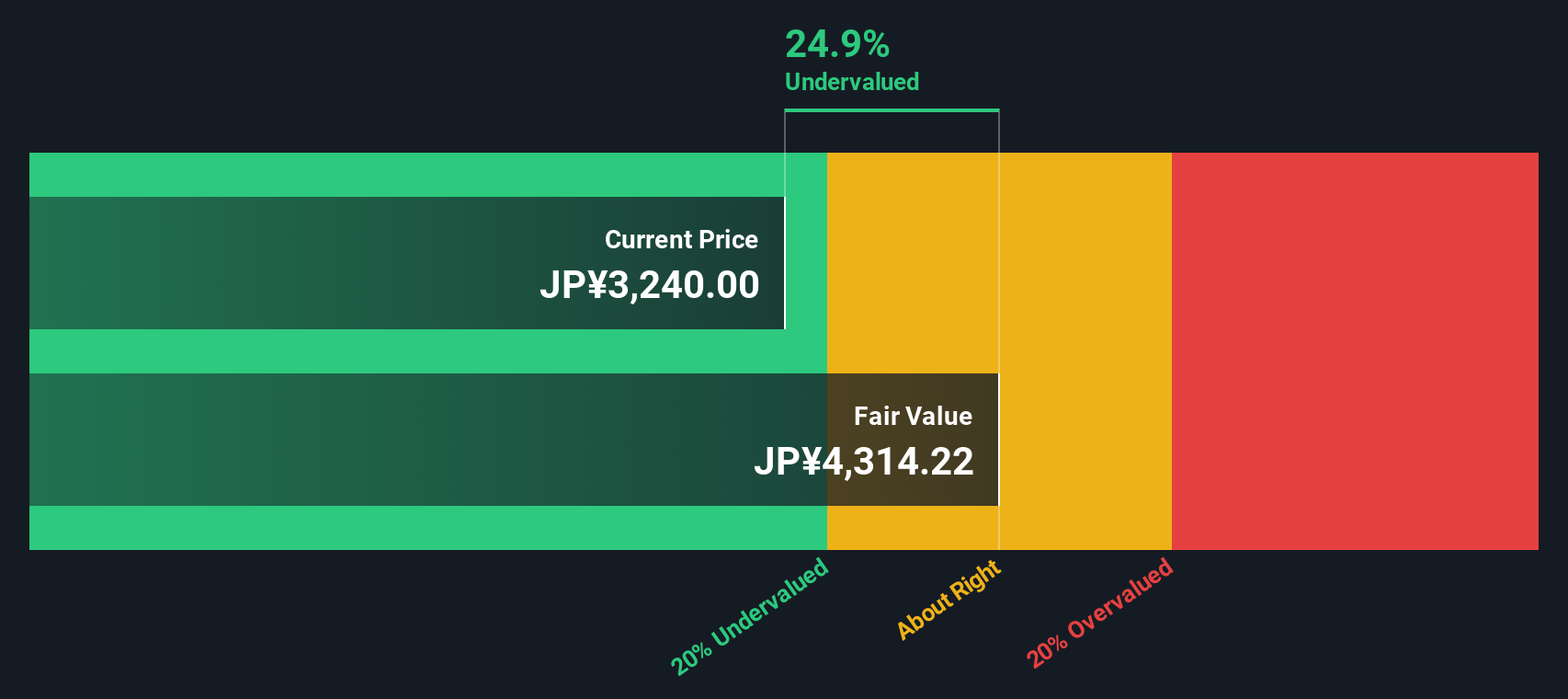

Based on its Price-to-Earnings (P/E) ratio, F.C.C currently appears undervalued relative to its industry peers and the broader market. This lower P/E suggests investors are paying less for each unit of earnings compared with both competitors and the Japanese market at large.

The P/E ratio measures a company’s current share price relative to its per-share earnings, offering a snapshot of how the market values future profit potential. In manufacturing and auto components, this metric provides a critical gauge of perceived growth, profitability, and risk.

With a P/E ratio of 9.7x, below both peer and market averages, the implication is that expectations for earnings growth or quality may be cautious. However, the recent track record shows F.C.C’s earnings growth did outpace sector trends, which raises the possibility that the stock’s value may not fully reflect its improved profitability.

Result: Fair Value of ¥2,971.91 (OVERVALUED)

See our latest analysis for F.C.C.However, persistent declines in annual revenue and net income could signal challenges ahead and may potentially undermine recent share price momentum.

Find out about the key risks to this F.C.C narrative.Another View: Discounted Cash Flow Model

Taking a different approach, the SWS DCF model suggests F.C.C may not be as attractively priced as it first appears. This perspective challenges the earlier outlook and raises the question: which lens should investors trust most?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own F.C.C Narrative

If you think there is a different story to tell, or want to dive deeper into the data yourself, you can build your perspective in just a few minutes. Do it your way

A great starting point for your F.C.C research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Give yourself the edge and take action now. Instead of waiting on the sidelines, use Simply Wall Street's powerful tools to uncover unique opportunities you might be missing.

- Boost your returns by targeting undervalued gems with strong financials. Use our undervalued stocks based on cash flows to find cash flow winners and hidden bargains in the market.

- Unlock reliable income streams by scanning for companies that offer high-yield payouts. Our tool is designed to pinpoint dividend stocks with yields > 3% and strong dividend performers.

- Stay ahead in the tech revolution by finding tomorrow's leaders among AI penny stocks and companies driving artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7296

F.C.C

Manufactures and sells clutches for automobiles, motorcycles, and general-purpose machinery in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion